Europe’s alternative finance market has exploded over the last 5 years, now worth an estimated €7.7bn according to the Cambridge Centre for Alternative Finance. The UK alone has grown by over 43% in the last year to £4.6bn, with receivables and invoice finance accounting for around 10-20% of this.

So what’s happened in the last year and what are the key trends in the alternative finance sector? TFG heard some key takeaways of 2018 at the 5th Alternative and Receivables Finance Forum by BCR.

Alternative and Receivables Finance Trends in 2018

The UK has the largest invoice finance market, growing rapidly each year. But looking closely at the numbers, the number of SMEs using invoice finance has been falling by around 1% since 2009, but larger companies accessing higher amounts of receivables finance has driven the growth.

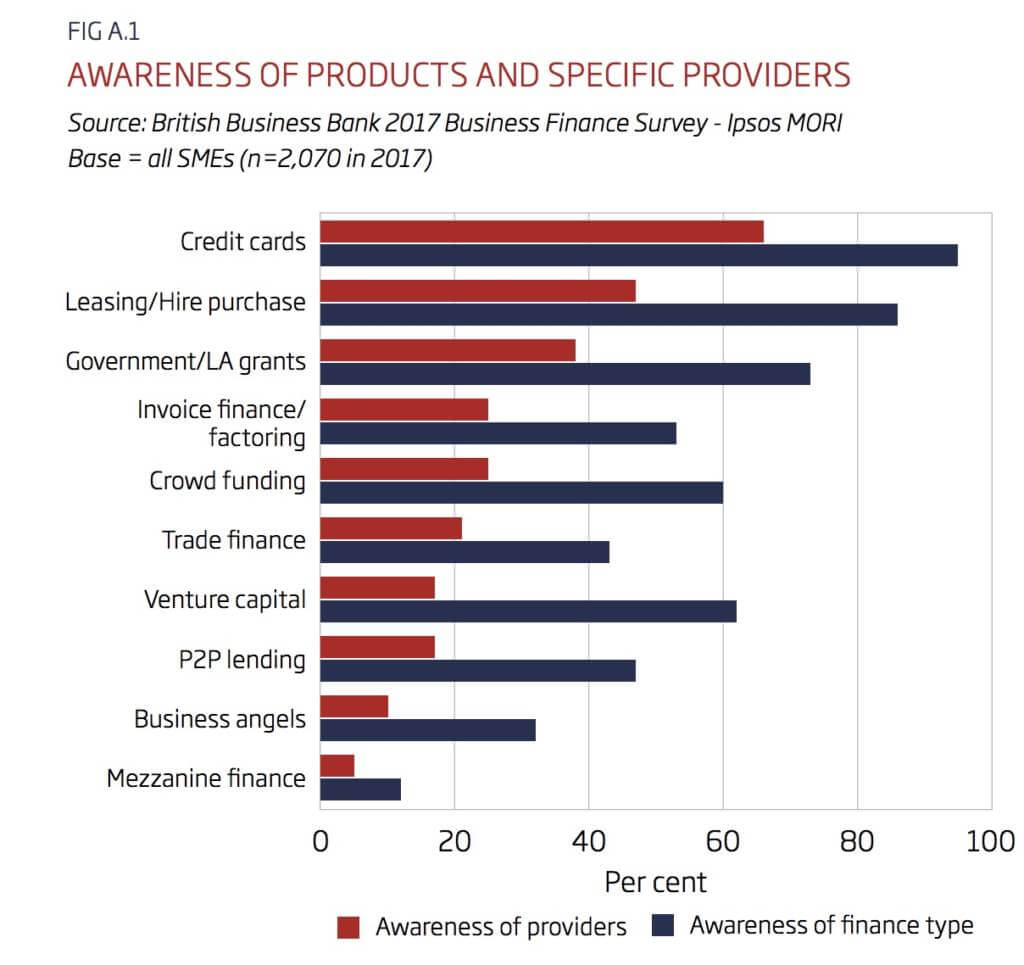

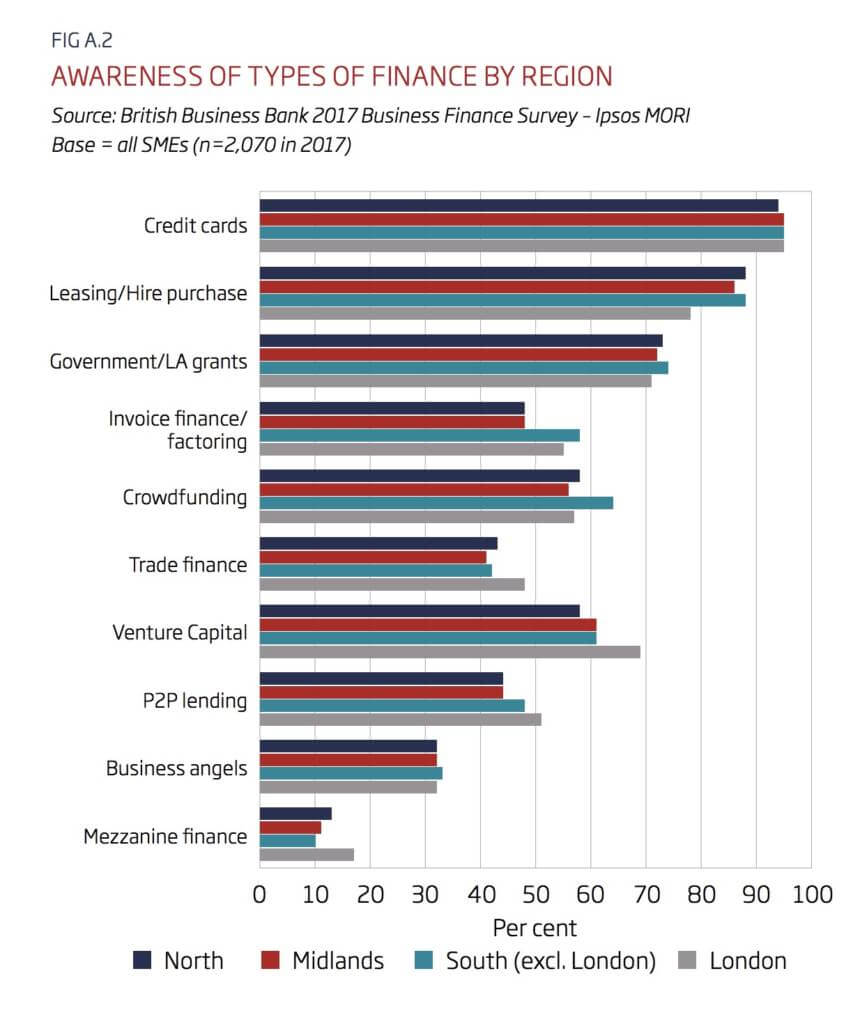

In terms of awareness, even in 2018, access to finance has been a low emotional driver, with businesses often seeing access to finance as a last resort. Only half of SMEs are aware of invoice finance, which has seen no change in the last 6 years, although recognition of peer to peer lending has increased significantly, according to the British Business Banks 2018 Business Finance Survey.

Will we see growth?

The utilisation of invoice finance in comparison to other banking products such as loans and overdrafts is relatively low, largely due to both a lack of awareness and a lack of trust towards individual providers of invoice and receivables finance, according to research by the British Business Bank.

The regulatory environment also has a part to play in increasing awareness in invoice finance forms as trusted providers. UK regulatory regime is a strength for financial services, and position developments can help enhance trust across the marketplace. Finding the balance is critical. On one hand, China’s lenient regulation has led to fraud losers and regulatory pressure, whereas on the other, strict regulation forces marketplace lenders to rely on institutional funding, which is often restrictive for growing businesses and changing economies, as seen a lot in the US.

Twin challenges: reputation and origination

Reputation around hidden fees and clauses is often a hindrance and deterrent towards accessing business finance. However, addressing the trust gap through education, partnership and simplification of fee structure can help build customers, act as a retention tool, and increase awareness of invoice finance as a category.

Graph: SME Awareness of various types of debt finance. Source: British Business Bank 2017 Business Finance Survey – Ipsos MORI. Base = all SMEs (n=2,070 in 2017)

Technology: just ‘cos?

Digitisation can help attract customers as already proven by digital banks and marketplace lenders. technology can help build missing trust through data and clarity, before moving on go other innovation around blockchain. Product innovation such as asset-based lending can help better meet business needs. Factoring may be an ancient invention but customer engagement needs to move on.