Estimated reading time: 7 minutes

Sarah Murrow, CEO of Allianz Trade UK & Ireland, explains how trade credit insurance can help UK companies grow export revenues safely at a time of heightened credit risk.

What is the current outlook for UK exporters?

The UK is in a much better position than many would have us believe. This is an exciting time for the UK, adapting to a new post-Brexit world, reaching out to new markets and relationships, and finding a new role in the global economy.

UK companies have also shown themselves to be surprisingly resilient in maintaining export order books, despite some significant headwinds.

According to our recent Allianz Trade Global Survey 2023, UK exporters remain cautiously optimistic about export revenues, with 83% expecting growth in export turnover in 2023, the highest of all the seven countries covered by the survey.

That said, we‘re in a challenging economic and global trade environment. Over half of respondents to the survey expect a moderate increase in export turnover of between 2% and 5% after two years of double-digit growth.

But as we move into next year, there are fewer clouds on the horizon. Better-than-expected inflation figures for June are hopefully an early sign that inflation is abating, and after muted GDP growth of +0.2% this year and +0.5% in 2024, we expect UK growth to recover to 1.6% in 2025.

Where are UK exporters looking to expand?

The Global Survey revealed that UK companies are more likely to optimise existing export markets, although many are intending to explore new territories. Just over half (51%) of corporates plan to gain further market share in existing markets, while 49% want to diversify and target new countries.

Post-Brexit, UK businesses are taking a more open approach, and are seeking new trade opportunities and relationships. The UK is taking a much more open view, actively looking to support exporters through new trade relationships and reciprocal commitments.

How is the credit risk landscape shaping up?

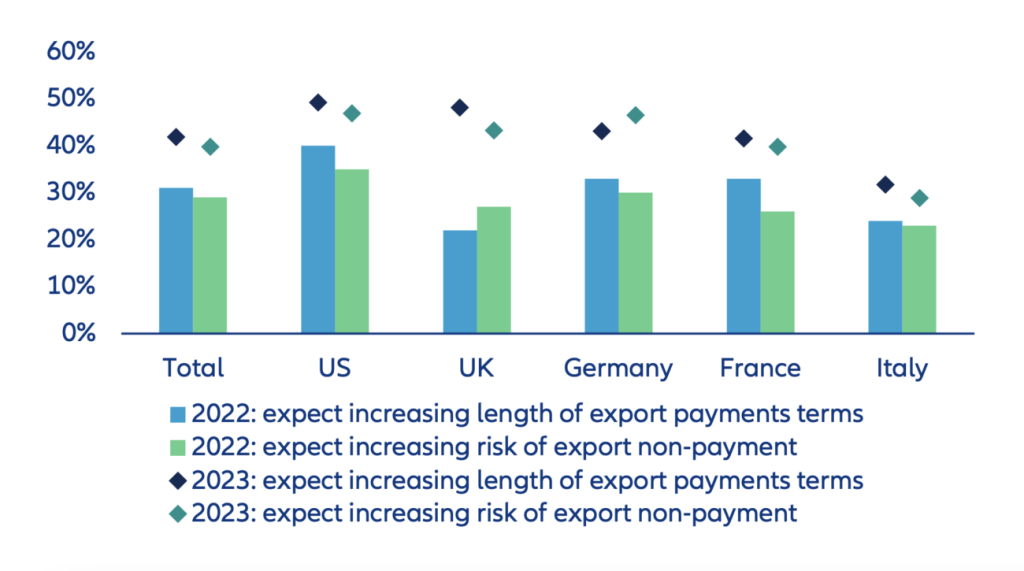

We’re clearly in a period of heightened credit risk. Some 43% of UK exporters expect an increase in the risk of non-payment in 2023, a big jump from 27% last year.

Figure 1: Share of respondents expecting an increase in export payment terms and

non-payment risk, 2023 vs. 2022

Source: Allianz Trade Global Survey 2023

This is in line with our outlook for global insolvencies, which we expect to surge by 21% in 2023 and a further 4% in 2024. In the UK, business insolvencies are expected to increase by 16% this year, falling back to 9% in 2024 as the environment improves.

A looming debt challenge is also on the horizon. The full impact of higher interest rates on the cost of financing has yet to trickle through to the economic environment.

Companies large and small will have significant levels of debt maturing in coming years that’ll need to be refinanced at much higher rates. The impact of higher borrowing costs will hit highly leveraged companies and fragile SMEs the hardest, in particular in countries like Italy and Spain, putting additional pressure on margins and insolvencies.

What challenges do businesses face when exporting in this climate?

Exporting to new markets and sectors can be daunting, even at the best of times. Businesses may be unfamiliar with business partners, payment terms and credit risks, as well as debt collection frameworks and insolvency rights. In many countries, the bankruptcy process is complex, and many businesses don’t have the appetite or expertise to pursue debts in these markets.

Entering new export markets or sectors will also often require companies to extend favourable credit to new customers. However, we’ve seen in the current environment that customers are taking longer to pay.

Half of UK exporters told us that they expect the length of export payment terms to increase, more than double in 2022 and well above average (42%) for all countries in 2023. Allianz Trade’s analysis also found that Day Sales Outstanding (DSO) in 2022 increased by +5 days to 59 days.

With current delays in receiving payments and higher financing costs, many businesses are in effect becoming involuntary banks. But when companies stretch receivables, it can strain cash flow and affect working capital – and this is where trade credit insurance can help. If a customer is late to pay or becomes insolvent, we step in, investigate, and indemnify the loss.

Can trade credit insurance help UK businesses grow exports?

One of the reasons I’ve been in credit insurance for 20 years is because it’s such an incredible product. It’s highly versatile and applicable at every stage of the economic cycle, and it’s of huge value to businesses of all sizes – from micro-SMEs to multinationals.

It gives businesses the confidence to enter into agreements with new customers or enter new markets and sectors. We’ve operated in these countries and sectors for decades and have a network of local partners that can support our customers.

Even where companies are looking to consolidate growth in existing export markets, trade credit insurance can help offset increased levels of credit exposure, especially for SMEs that tend to concentrate on a small number of critical customers.

Many businesses also use trade credit insurance to supplement their credit risk assessment. With over 70,000 clients and monitoring all sectors in 160 plus countries, we also give exporters access to information and insights they wouldn’t otherwise have. For example, if a customer experiences late payment, we can identify potential cash flow problems and alert other customers accordingly.

Can insurance also help with financing?

The other key reason that our customers buy credit insurance is to access financing. By protecting trade receivables with trade credit insurance, exporters can access higher amounts of funding, or potentially access funding at better terms.

In the UK, payment terms are still the preferred option for exporters. Interestingly, we found that more UK companies are turning to Buy Now, Pay Later schemes to finance their exports, which could unlock trade financing for SMEs that were previously shying away from global trade.

Buy Now, Pay Later is particularly relevant for e-commerce, and is a key area of product development for Allianz Trade. For companies pursuing a digital distribution model, we now offer an API-powered plug-in product that can facilitate and ensure transactions on a case-by-case basis.

We also provide a trade credit insurance solution to financial institutions and Buy Now, Pay Later providers working with online retailers. Allianz Trade recently partnered with e-commerce payments platform Two and trade finance bank Santander Corporate & Investment Banking (CIB), to provide the first global B2B Buy Now, Pay Later solution for large multinational corporates: E-Commerce Credit Insurance.

What else is Allianz Trade doing to support UK exporters?

Despite current challenges, there are always opportunities out there for UK exporters – they’ll always find good buyers in good markets and sectors. However, businesses need to be equipped with the right information in order to focus their efforts and mitigate the risks. That’s why we launched Trade Match, an online tool that helps exporters identify countries or sectors offering the best export opportunities.

Our goal is to give UK businesses confidence in tomorrow, despite uncertain economic times. Post-Brexit the UK is re-establishing trade relationships, and we can provide UK businesses with confidence to export through our predictive credit intelligence, our global reach, and boots-on-the-ground resources.