As we enter into a new decade, Finastra and Trade Finance Global spoke to trade experts to give their bets and views for 2020 in terms of trade and supply chain finance. OCR or ML? AI or DLT? Buzzwords and hype or reality?

To this end, TFG has sat down with 7 key leaders in the trade finance space to uncover the biggest predictions for technology in trade finance for the coming year.

To aid in this discussion, we are joined by Iain MacLennan, Head of Trade & Supply Chain Finance, Finastra; Ping Xiao, Head of Transaction Banking at Bank of China; Hans Huber, Trade Finance Innovation Project Manager at Commerzbank; David Bischof, Deputy Director, Finance for Development at the ICC; Ian Sayers, Head, Access to finance at ITC; Sean Edwards, Chairman of the ITFA; and Dani Cotti, Managing Director, Centre of Excellence, Banking & Trade in Sales at TradeIX

Interviewees

IM – Iain MacLennan, Finastra

PX – Ping Xiao, Bank of China

HH – Hans Huber, Commerzbank

DB – David Bischof, ICC

IS – Ian Sayers, ITC

SE – Sean Edwards, ITFA

DC – Dani Cotti, TradeIX

Interviewed by: Carter Hoffman

Top trade technology predictions for 2020

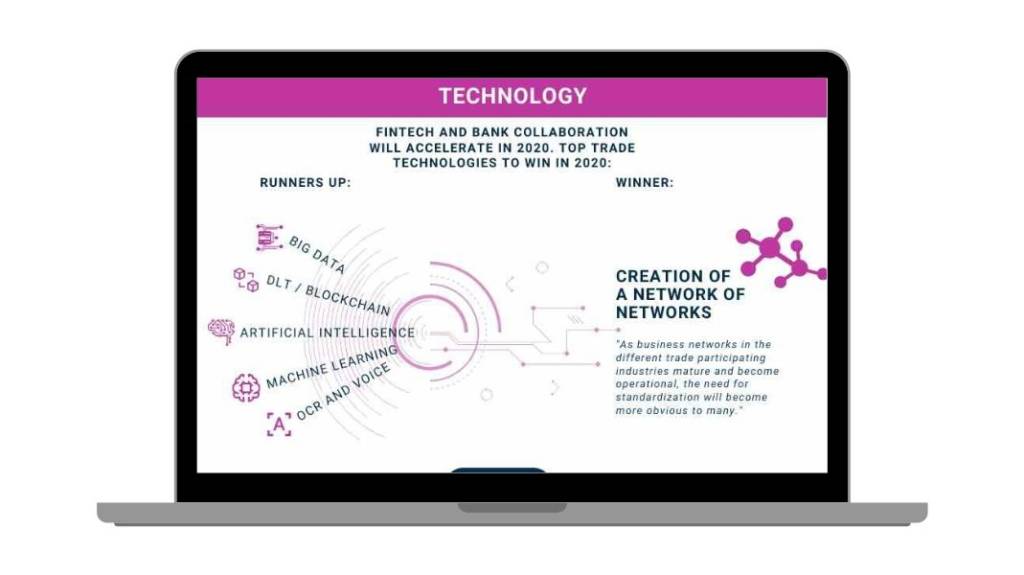

Over the last few years we have seen tremendous innovation across many technologies including DLT and AI. When it comes to technology and innovation, what are your top predictions for trade, supply chain, and receivables in 2020?

PX: As we move into 2020 I have several predictions. I believe that we will see more banks joining various Blockchain consortiums, especially from Asia and possibly Africa as several are already in the product environment. This would be driven by large corporate entities looking to explore this technology to facilitate their trade flows.

In addition, we will experience a significant investment by banks in AI and OCR technology; innovations that will help trade finance banks transition from paper-based to digital formats. This transition will allow for the automation of compliance checks, something also partly fueled from better collaboration between Banks and Fintechs. I believe that in 2020, Fintechs will no longer be seen as competitors but as collaborators to meet the client’s ever changing needs.

And of course we will see more Open Banking. The shape of banking is changing and with the support of PSD2, as I see more third party platforms (3PP) getting access to client’s data. These 3PP facilitating payments for bank’s customers. Examples that come to mind are WeChat, Google Pay, Paypal, Facebook Messenger

IM: We will see much more collaboration with regards to open APIs and selecting services from an end-to-end trade servicing perspective. In addition, we will see new applications of services already available in other sectors within the trade space. To this end I think we’ll see significant adoption of networks that are currently in play, but perhaps not in line with their expected interaction models. There will also be greater integration of multiple technologies to meet the “customer need” whether that is OCR, AI and ML in compliance-checking (i.e. Conpend, Traydstream or others) or another combination of technologies around network of networks and combining multiple previous isolated flows; it’s going to be exciting.

HH: As business networks in the different trade participating industries mature and become operational, the need for standardization will become more obvious to many.

The adoption curve for technologies like IoT, DLT, and AI will further steepen. However, I have to agree that bridge technologies like OCR will also still see considerable investments.

IS: I agree, by this time in 2020, we will be looking back at a year that will be seen as a turning point in the use of distributed ledger, AI, cloud, and machine learning technologies in EDEs. Emerging economies will, by necessity, lead on innovation of practical applications developed to serve urban masses and rural communities making marketing communications and distribution easier and reducing the transaction and administration costs of doing business. Apps will be localized and, at the same time, diminish the impact of borders. Digitally verifiable individual product traceability will become essential for reducing payment and transaction risks.

DB: We expect major changes throughout 2020 as the digitalisation of the trade finance industry continues to develop exponentially. The evolution of blockchain will especially be something to look out for as projects and initiatives move beyond the pilot phase. ICC is currently developing a Digital Trade Standards Initiative (DSI) to promote cross-industry digital trade standards to drive technical interoperability among the numerous blockchain-based networks and technology platforms that have entered the trade and trade finance space over the past two years.

The presence of fintechs in the trade finance industry is also shaping client preferences, and collaboration with traditional trade finance providers is expected to continue growing. We have recognised this trend with the first ever Fintech Showcase set to take place at the Banking Commission Annual Meeting in April.

SE: The network benefits of blockchain will become increasingly apparent but next year will be dominated by the effort to bring corporates on board which will be expensive for banks as they are forced to underwrite some or all the cost. The bigger challenge will be to explore how the technology can allow banks to acquire new business opportunities, clients and penetrate markets. Whilst costs reduction should not be the only, or even the best reason for adopting technology, tech can make a rapid difference in this regard and some “quick wins” will help cultivate internal support. OCR is such a technology as it can help with the review of documents in traditional trade areas

DC: 2020 will offer exciting new tech solutions for Supply Chain and Receivables Finance Program users as a lot of providers will master and leverage the new technologies that will deal with and address the limitations of current programs and solutions. The distributed networks built on blockchain technology will undoubtedly have a big impact as they are radically changing the engagement, onboarding of participants and the deployment of trade finance solutions. AI technology will also have a big impact with new solutions being introduced as a result of intensive data management, with data being the new oil for all supply chains.

You have all mentioned several different technologies that will play a role in the year ahead. If you had to pick one technology that you think will truly kick off or have the most success in 2020 which would it be?

HH: Uhh, that is really hard to predict! Almost impossible! That said, there are several different types of technologies that I think are important to discuss.

Reasoning technologies

I’d say that AI depends on data being available. No data, no intelligence. AI could be seen as a reasoning technology. Pretty much the same applies to Machine Learning.

Data Source technologies

IoT will make a lot of data available, so it’s a source technology, a data creation and input tech. Wearables are a subform to IoT. NLP is also a source technology; it will translate previously unstructured data (and relies on AI to do this).

Connecting technologies

DLT will make data exchangeable and credible, so it’s a connecting (but also infra) technology. This same notion applies to network of networks, however this will take more time to be brought about and consequently spur the use and utility of DLT (and therefore all others). The same again applies to API! No network of networks without APIs and also no data permeability without APIs.

Infrastructure Technologies

Acceptance of cloud computing in business is also an important factor. Cloud is an infrastructure technology. It will gradually replace the privately ran data center.

DLT and API could also be subsumed under Infra-Tech. 5G or ubiquitous broadband networking are in the same boat. Their uptake will contribute to the adoption of other technologies. For instance, it will greatly accelerate the deployability of IoT-devices.

Bottom line:

The general acceptance of cloud computing will maybe be a 2020 turn out. This will make breaking up data silos an order of magnitude more feasible and propel the deployment of more DLT based platforms.

IM: Yes it is hard to predict but I like the “Network of Networks” concept, and I think it truly has a chance to “kick off” or “kick on” in 2020. This could give customers a user experience that they have never had previously, incorporating multiple levels of information into a seamless view, irrespective of its documentation, logistical or another form of information. Talking to a number of banks, there is a belief that the networks will be selected by the corporates and banks will integrate into these. This is a great opportunity for Finastra that we are actively pursuing with a number of our clients.

One other technology which actually links quite strongly into the network of networks is the Internet of Things, again providing a level of information that we have never had to date.

DB: Distributed ledger technology (DLT) does have vast potential – and we can expect further progress next year. Indeed, in the ICC 2018 Global Survey, DLT was highlighted as a priority area of development over the following three to five years for banks.

And in November 2019, ICC partnered with Perlin, DBS Bank, Trafigura, Infocomm Media Development Authority and Enterprise Singapore to pilot ICC TradeFlow, a blockchain platform aimed at simplifying the trade documentation process for all parties, enabling them to visually map out trade flows, issue instructions to partners, and analyse trade actions in real time.

Automation through DLT will help enable wider market access to SMEs, often locked out of the trade finance market due to the high-cost, paper-heavy processes and requirements. DLT could also help improve sustainability tracing in trade finance transactions.

IS: In the countries where ITC works, practical cloud-based applications based on Distributed Ledger Technology will be the real “game changers”. These technologies will take care of cyber threats, poor regulatory and security practices for individuals and enterprises that need to store inimitable transaction records, improve claims authenticity and protect original intellectual property. I think this because it is the only way that start-up and growth enterprises can get financing, be paid and get their creative ideas recognized outside of their own country. This builds hope, adds new value in economies that cannot easily be silenced by self-interests.

SE: I agree that DLT has big potential. Getting blockchain through its current position in the hype cycle is the biggest challenge for this technology. If this can be done, I see that the network effects of this technology as tremendously powerful and transformative.

DC: Agreed, for that I would have to say DLT. We have big hopes for the Marco Polo Network.

PX: While blockchain is still gaining grounds going into 2020, it has lost some momentum at the moment.

Banks have been investing significantly in Artificial Intelligence. Machine Learning, an area of AI where computer systems learn from data and improve this learning over time, will help banks monitor and screen transactions for unusual activity. These technologies have tremendous potential to help reduce the huge cost in the KYC analytical process, helping banks meet regulators compliance requirements. AI will also impact the credit assessment process, helping Credit Analyst carry out more accurate credit scoring and risk assessments with minimal effort.

Another area which is gaining fast traction is the Optical Character Recognition (OCR). This technology is capable of converting documents such as scanned paper, PDF files, and images into a digital format. This would be very good for Trade finance as its traditionally paper-heavy nature. Banks are increasingly using OCR to digitize and interpret trade documents such as purchase orders, packing lists, and bills of lading.

Alexa, Get Me Trade Finance

Trade finance is changing and technology is making it happen. 2020 will be a year of continued technological innovation and advancement. AI, DLT, OCR, IoT, NLP, API, and other assorted acronyms will slowly etch away at the old face of trade finance unveiling a fresh new digital look. Increased levels of digitization in trade are fundamentally changing the customer journey. In the coming months and years we may see this disrupted even further as large brands like Amazon seek to expand their portfolio and offerings to include trade finance. Amidst an uncertain environment there is one thing that can be said for sure: the trade landscape is changing and technology will play a role in determining in which direction the industry will go.