Estimated reading time: 6 minutes

In 1995, Microsoft co-founder Bill Gates was asked to describe the internet in an interview.

His interviewer was skeptical of the value sharing: “I heard you could watch a live baseball game on the internet,” he said, “and I was like: does radio or TV ring a bell?”

Today, Asia accounts for 25% of the global factoring market, compared to only a 12% share 20 years ago.

By any standard, it is fair to say that with the projected growth of Asian economies, there is great promise for the continued growth and impact Asian factoring will have on local, regional, and global businesses.

Unfortunately, however, when we talk about factoring in Asia today, we typically encounter a similar mindset to that of Gates’s interviewer: “Does discounting or working capital loans ring a bell?”

Background: The origins of factoring in Asia

In contrast to the US or EU markets, banks dominate the Asian financial system.

The growth of factoring in Asia has had strong banking attributes from the very beginning.

As a result, it is strongly defined by a conventional lending mindset, and largely misunderstood as a form of lending in the shape of receivables assignment.

When factoring is perceived to be just another form of corporate lending, its value and critical management practices are easily overlooked.

Given this misunderstanding and the absence of proper processes, it was only a matter of time before black swans emerged.

For various financing constraints and arbitrage moves, these gaps in practice allowed some to fabricate transactions and receivables to obtain financing.

Correspondingly, the phrase “de facto lending in the name of factoring” is frequently cited in Chinese jurisprudence.

In this series of Director Interviews, we have asked our directors to answer a few questions so you can get to know them a little better. Discover the first edition with Regional Director for North-East Asia, Mr Lin Hui. https://t.co/xz6rkKMYY5 #FCI #director #interview pic.twitter.com/LXHv34lEmE

— FCI (@fci_factoring) November 3, 2021

Over the past decade, numerous receivables financing fraud cases have erupted throughout Asia, rightly raising concerns, but also adding to the confusion of some Asian bankers, who are not well versed in factoring to begin with.

Many Asian banks and factoring companies have focused on reverse factoring or supply chain financing.

Financing to the suppliers backed by payment commitments of larger corporate “anchor” buyers makes bankers feel more comfortable than factoring to a variety of SMEs.

Also gaining in popularity is a practice called deep-tier financing.

Deep-tier financing is the funding of a supplier’s suppliers through the supply chain, using the digital payment commitment of the anchor buyer as the foundation for the transaction chain.

But the concern remains that related transactions between intra-group companies are largely unrestricted.

When a supply chain finance model lacks the risk management logic of factoring as a foundation, there is a risk of a Greensill-style or other form of fraud.

SMEs in focus

While supply chain financing is a solution to the challenges of SME financing in Asia, the reality is that supply chain finance or reverse factoring alone cannot solve the current problems of financing SMEs.

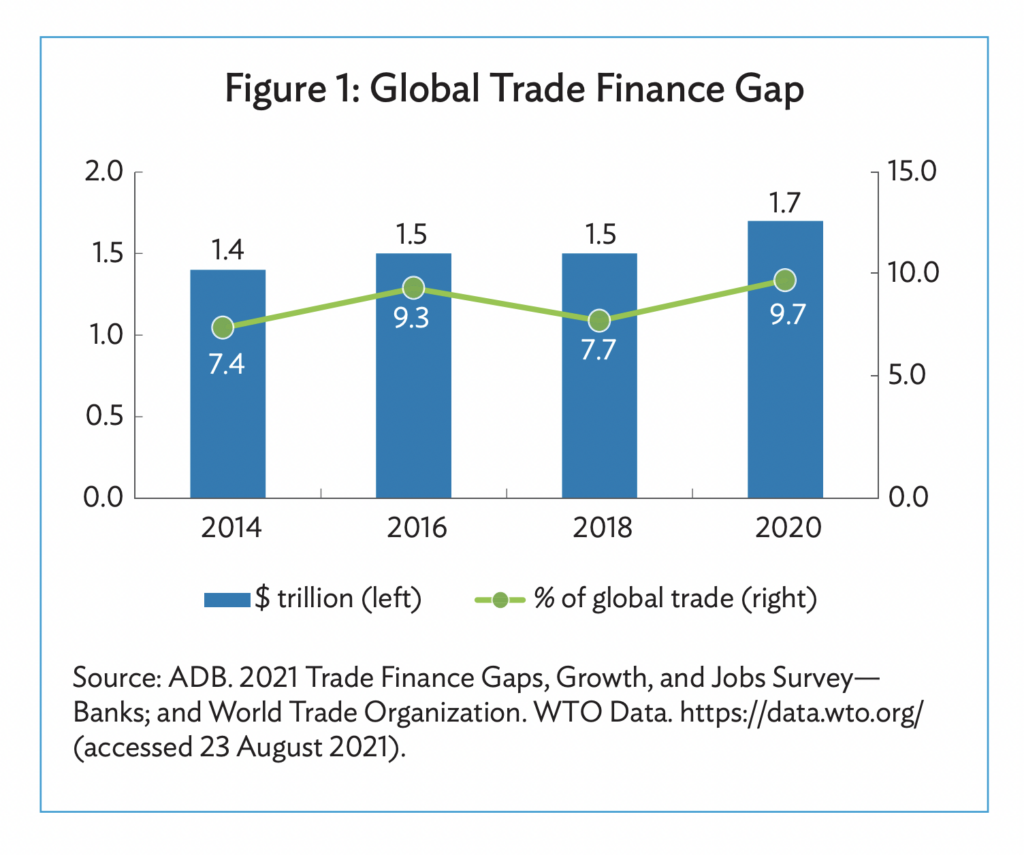

According to the Asian Development Bank (ADB), the global trade finance gap increased in 2020 to a record $1.7 trillion. This shortfall is more acute for SMEs.

Asian banks must truly alter their mindset to embrace the opportunities factoring offers to meet this market need.

A sound understanding of and commitment to the factoring process provides the controls and visibility necessary to effectively manage SME performance risk.

New technologies

The time has come to compare the tools we can use to meet these market demands and challenges.

Traditional lending and bill discounting are the financial services of the radio, TV, and tape recorder era: powerful for the time and scope it was designed for, but lacking the flexibility needed in the internet era.

Factoring is different. It excels in flexibility and is uniquely suited to scale securely through technologies using big data and blockchain.

Its risk management logic and process are easily extended to a much broader range of global trade finance, and it is internet friendly.

Panelists of the webinar of Blockchain Technology in Receivables Finance

— FCI (@fci_factoring) May 5, 2020

Daniel Huszar (Efcom), Enrico Camerinelli (@AiteGroup) and Deepesh Patel (@tradefinglobal ) pic.twitter.com/4LzTSkOd4b

Factoring and the value chain

Let’s recall the intrinsic difference in a small and beautiful factor and how they add value.

A real factor is like a reliable LAN (local area network) providing reliable connections among each client (sellers) and all their related customers (buyers).

All transactions (invoices and payments) are tracked and recorded within the LAN. This visibility allows monitoring to identify problems so that they can be dealt with in a timely, defined manner involving all related parties.

This transparency, a key benefit of factoring, does not exist in the loan and bill discounting business.

As importantly, each factor (LAN) can connect through standardised rules and protocols, creating a dynamic global wide area network (WAN) ready to meet the opportunities coming through the Internet of Things (IOT).

The birth of FCI over 50 years ago was visionary. In a time of radio, TV, and recorders, FCI established a financing concept that was internet-ready.

Through the years it has been refined to optimise transparent, secure, and flexible risk management.

We have seen that global trade finance and technology are evolving in a direction that is perfectly aligned with the concepts and capabilities of factoring.

These advances are demanding that banks in Asia and other regions reinvent their trade finance architecture with factoring logic and process as a cornerstone.

Asian factoring’s breakthrough moment

The Asian factoring market, after 30 years of build-up, is ready for a breakthrough.

Asia holds a dominant position in global trade, with four of the world’s top 10 importers and exporters, and a 55% share of global trade finance.

The Regional Comprehensive Economic Partnership (RCEP), officially launched on January 1, 2022, is the largest free trade area in the world.

And finally, the banks in Asia make up the backbone of the FCI network, and all these banks are reforming their trade finance business.

A huge congrats to one of our members: @dbsbank

— FCI (@fci_factoring) August 4, 2021

Awarded Asia’s best bank for 2021! https://t.co/0aEftganSH #DBS #Euromoney #bestbank #asiafinance #awardsforexcellence #bestbank2021 pic.twitter.com/FdaHdvs9S9

The road ahead

The road ahead for FCI and Asian banks is to follow its original mission: use its vast network to empower the global supply chain and domestic economies, by building a more dynamic, flexible trade finance infrastructure.

The challenges are certainly enormous, but the value of the internet compared to radio, TV, and recorders is clear.

Factoring’s potential is here now to meet the challenges we face today, with the flexibility to adapt for the solutions we will need tomorrow.

Let’s have the insight to move forward with purpose in a way that maximises our potential.