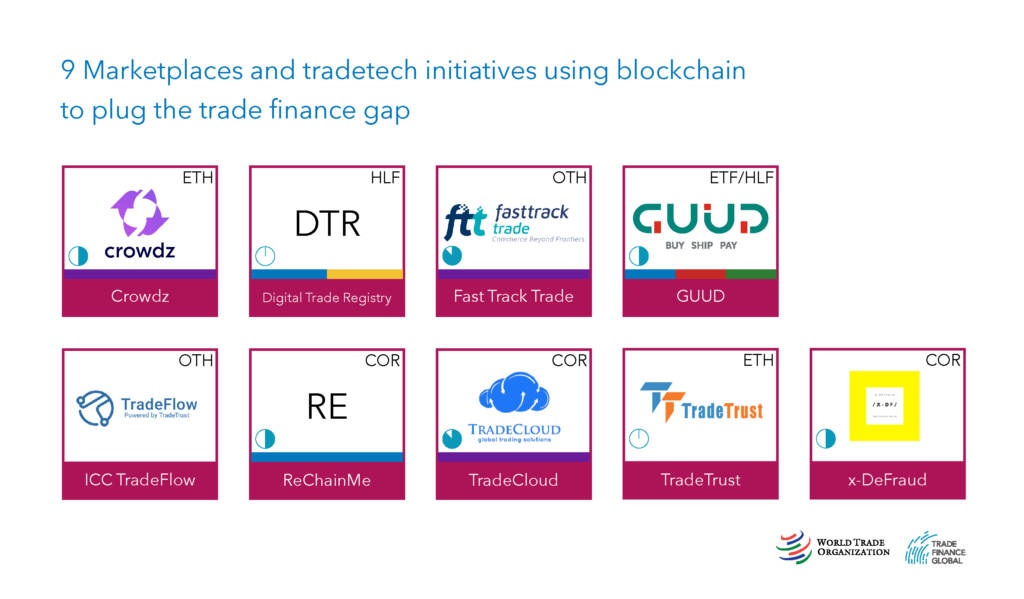

Trade and trade finance remains siloed, age-old and complex. Many are using DLT and blockchain to progress towards their goals of a digitized industry. TFG & WTO recently published their periodic table of DLT projects in trade, and here are 9 marketplaces and other initiatives addressing various opportunities in truly digital trade.

So, here goes…!

1|Crowdz

Crowdz is a FinTech company working to simplify the B2B payments with a platform that makes sending, paying, and selling invoices much easier for MSMEs. They will accomplish this by utilizing Ethereum-based smart contracts to record invoices and supporting documents on the blockchain. By also integrating with smaller accounting platforms, this will help small businesses manage their cash flows in a secure and immutable manner.

The North America, the United Kingdom, and Europe-based platform will generate revenue through subscription fees and finance fees. While not currently live, the platform has already garnered participation from companies like Terraneo International, Rebel Travel, Nursh Dash, Clive Coffee, and Trafalgar Marquee.

2|Digital Trade Registry

The Digital Trade Registry is an initiative led by Singaporean banks who are addressing the issues around duplicate financing frauds, supported by government bodies including Enterprise Singapore, Monetary Authority of Singapore, and The Association of Banks Singapore. The working group is led by Standard Chartered Bank and DBS Bank, and involves ABN Amro Bank, Lloyds Bank, ANZ Bank, ICICI Bank, OCBC Bank, Natixis Bank, UOB Bank, Deutsche Bank, CIMB, and Rabobank.

The Digital Trade Registry, which runs on the dltledgers blockchain platform will provide the ability for each bank to validate whether or not another financial institution has already submitted a particular title instrument for financing purposes, without violating client confidentiality and compliance rules, while still reducing the risk to the finance provider.

It is based on a governance rule book established by the bank-led working group, and allows for real-time matching of title documents including Bills of Lading (BL), Letters of Indemnity (LOI), and Charter Party Bills of Lading (CPBL). The system works by comparing encrypted data points across multiple blockchain nodes using a query-based, runtime search algorithm. In other words, data can be matched across each bank’s ledger, without ever leaving their location. Whenever there is a match, the relevant parties will be alerted. Developed on Hyperledger Fabric and hosted in Microsoft’s cloud service, Azure, the platform can detect fraud in parallel financing, sequential financing, and a number of related scenarios.

3|Fast Track Trade

Fast Track Trade is a trade-centered marketplace providing a blockchain-powered digital trade network for the MSMEs that drives value in any economic market. The platform will automate various corporate workflows including identification, trade documentation, and acknowledgement of payment and financing.

The platform, using the technology developed by the firm Chainzy, operates using transaction fees and financing-based fees as its dominating revenue sources. To date, Fast Track Trade has gained participation from a collection of companies including WorldFirst, NinjaVan, Get Go Global, and Circles.Life as well as more than ten other trade financing companies. The permissioned platform will operate primarily in Asean, Africa, and Europe.

4|GUUD

GUUD is a technology platform aiming to simplify the inherent complexities in global trade processes and to reimagine them to drive greater efficiency and inclusivity in the digital world. Their launch in late September 2020 was supported by a series of local partners and government agencies including Enterprise Singapore, Infocomm and Media Development Authority (IMDA), Singapore Customs (NTP Office), and Singapore Cooperation Enterprise (SCE). GUUD is managed by vCargo Cloud Pte Ltd.

Following the UN/ CEFACT Buy-Ship-Pay model, the GUUD platform aims to empower MSMEs to become players in global trade by connecting them to Customs departments for import or export permits processing, shipping and logistics providers for arranging transportation of goods, and financial institutions like banks for trade finance.

With steering influence coming from the UN’s Sustainable Development Goals, the permissioned platform underpinned by Ethereum and Hyperledger Fabric is determined to deliver on its vision of “Trade for Good”. To finance this vision and generate revenue, they will make use of license and transaction fees.

5|ICC TradeFlow

ICC Tradeflow is a blockchain solution designed to allow enterprises to move away from cumbersome and inefficient manual systems and towards a powerful new interoperable digital framework. The project is a collaborative effort between the ICC, blockchain provider Perlin, DBS Bank, Trafigura, Infocomm Media Development Authority (IMDA), and Enterprise Singapore.

The platform will work by allowing businesses to visually map out trade flows, issue instructions to partners, and analyse trade actions in real time. On the platform, businesses can upload, verify, and modify trade documents, as well as act upon instructions from trading partners. Other components of the platform include a trade clock to keep progress of a particular transaction, as well as anti-fraud protections for shipping and documentation.

6|ReChainMe

ReChainME is a permissioned blockchain platform initiated by Landmark Group, a multinational conglomerate based in the UAE. It ensures seamless connection amongst key participants involved in the supply chain, resulting in greater transparency, speed and accountability. The aim of the project is to create a single truth and trusted view across all members to optimize the supply chain process. The platform generates revenue through subscription and transaction fees.

In June 2019, Landmark Group and HSBC completed a first-of-its-kind transaction that connected ReChainME and Voltron (now Contour), two independently built blockchain platforms powered by Corda, proving their interoperability and showing how collaborative technologies can further accelerate international trade in the future. The transaction involved a shipment from Hong Kong, China for Babyshop, Landmark Group’s family retail brand in the United Arab Emirates (UAE). All the key participants along the logistical supply chain could view documents and track progress of the shipment in real-time, thereby reducing the overall time to complete the transaction by up to 12 days. It also helped reduce the need for paper, as retail supply chains typically involve large numbers of paper documents that are screened and updated at multiple touch points.

7|TradeCloud

TradeCloud is a web-based portal, underpinned by R3 Corda’s DLT infrastructure, where producers, consumers and traders can meet to exchange information, negotiate contracts and conclude business. By building a community and connecting the industry, TradeCloud aspires to reduce costs and improve margins for the commodity industry. The permissioned platform charges subscription fees to buyers and sellers while leaving all other services free of charge to other stakeholders.

Through its vision for a commodities-web, TradeCloud provides users the ability to automatically generate proposals and contracts, monitor replies to bids, securely share documents with external parties, and search for deals in the market.

8|TradeTrust

TradeTrust describes itself as a digital utility comprising a set of globally-accepted standards and frameworks that connect governments and businesses to a public blockchain to enable trusted interoperability and exchanges of electronic trade documents across digital platforms. It provides open-source software to enable the digital verification of documents. Currently it makes use of Model Law on Electronic Transferable Records (MLETR)-compliant title transfer, document authentication, document provenance, and selective disclosure, with plans to soon unveil an identity resolution service.

The international, permissionless project built on the public Ethereum network is used by Trafigura, DBS, Standard Chartered Bank, United Overseas Bank, PSA International, BlockLab, Port of Rotterdam, DLTLedgers, Hashkey Group, JEDTrade, Trade Window, Tramés, Veritag, and Pacific International Line.

9|x-DeFraud

x-Defraud, by Kratos Innovation Labs, is a permissioned blockchain-based platform built on the Corda blockchain framework designed to help mitigate the ever-present risk of fraud in the industry. It accomplishes this aim by storing all the supporting documents in a trading cycle on a distributed ledger system, using predefined algorithms all flowing into the system are cross-checked to flag any attempts at duplicate financing or other fraudulent activities.

While currently in the Minimum Viable Product (MVP) stage, the geographically unrestricted platform aims to use DLT extensively for food supply chain management and trade finance. They intend to generate revenue following a pay per access model, where users pay a marginal fee to look up invoices on the network.

![KYC[DLT] - The hottest KYC projects in trade finance (yes, they use blockchain!)](https://www.tradefinanceglobal.com/wp-content/uploads/2020/10/KYCDLT-The-hottest-KYC-projects-in-trade-finance-yes-they-use-blockchain-150x150.jpg)