Estimated reading time: 7 minutes

Shortly after joining as a member of ITFA in 2019, Trade Finance Global (TFG) heard from 6 interesting fintech startups in the trade and receivables ecosystem, participating in the ITFA Fintech Discovery Day in Helsinki.

The ICC estimates around $9 trillion of global trade finance is done each year, yet non-banks and institutions only provide $250 billion of this.

Amongst banks, there is often a lack of resources and internal knowledge to finance smaller ticket deals, such as the provision of liquidity to trading SMEs.

In addition, the regulatory landscape around Basel iii and iv capital requirements have hindered banks’ ability to finance and service smaller companies.

Fintechs are trying to make it easier for banks to do lower-value ticket deals by making the process easier to extend payment terms and create efficiencies in doing the paperwork for SMEs, as well as managing exposures and documenting transactions.

This also makes the pooling of trade finance books, securitisation, and bringing in non-bank investors easier and more feasible for investors.

It is often difficult for banks to onboard SMEs due to the high opportunity cost (relative to reward size) so fintechs are tending to focus on an agile customer on-boarding and the automation of KYC compliance checks.

Fintechs in the cross-border trade finance space are addressing three opportunities for banks, corporates, and businesses: KYC and the provision of quality information about the customer, onboarding journey time, and integration with bank systems.

How can banks and their clients and risk/ liquidity partners benefit from these fintechs?

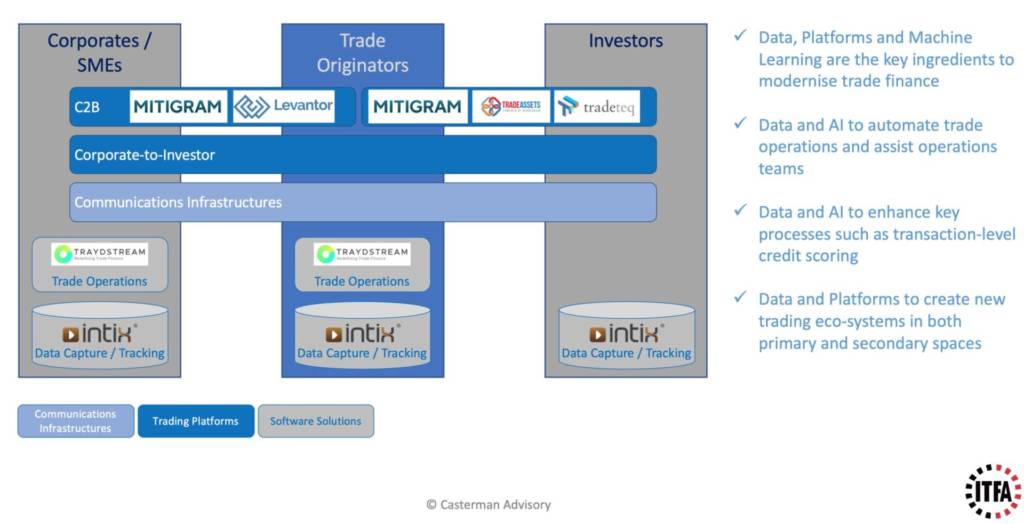

Source: Casterman Advisory

André Casterman, chair of the Fintech Committee of the International Trade and Forfaiting Association (ITFA) and fintech consultant, put together a helicopter view of the fintech ecosystem, a map was developed in 2018 to help the ITFA membership take a view and to position fintechs in the appropriate segments and functions of the trade space:

#1 – Mitigram

Founded in 2014 and based in Stockholm, Mitigram is a networking and communications tool aimed at helping corporates facilitate trade finance by finding out confirmation prices for letters of credit, guarantees, receivables, and performance bonds.

Mitigram is the world’s first global trade finance collaborative platform for corporates, commodity traders, and risk takers/ liquidity providers to access counterparties in funding and hedging risk of trade transactions.

By capturing and centralising trade flow data in a structured format, Mitigram’s dashboards can then show additional information around the share of wallet in certain markets, reasons for rejecting trade or receivables applications, potential revenue lost based on risk/market, and the bank’s efficiency metrics.

Mitigram claims to have facilitated over $70 billion of financing flows since launch.

#2 – Tradeteq

Tradeteq is a London-based fintech that allows bank and non-bank investors to connect, interact, and transact.

Trade finance is deemed a reliable asset class, known to achieve consistent yields even during macroeconomic events.

Tradeteq transforms trade finance into an investable asset for traditional credit investors such as pension funds and insurance companies.

This process creates greater capacity within banks, subsequently generating more financing for SMEs.

Tradeteq uses various machine learning and artificial intelligence specialists to deploy tools for non-standard data.

Rather than using outdated statistics methodology to determine risk and credit score (such as the Altman Z-score), Tradeteq uses network data and real-time payment behaviours to form a more accurate representation of credit scoring and tools to monitor investments.

#3 – Levantor

Levantor is a London-based fintech focused on helping enable sales.

Supply chain finance programmes have proven very successful amongst corporates and their suppliers when it comes to managing working capital and providing some level of payment terms to suppliers.

However, on the sales side, sometimes a supplier’s standard payment terms (e.g., 30 days) aren’t sufficient to cover inventory and debtor time scales.

In contrast to supply chain finance, Levantor focuses on sellers. The credit is not on the large corporate buyer, instead, on a diverse portfolio of buyers.

Levantor helps simplify credit terms between the seller and the buyer, by providing extended payment terms. There is no recourse to the seller, and banks can access this pool of assets.

For sellers and corporates, they can enable sales with no recourse back to them.

#4 – Traydstream

Traydstream is designed to speed up and make trade finance processing more efficient by looking at the process of document checking, compliance, and scrutiny.

According to Traydstream, currently, physically checking an LC takes around 2 hours but with Traydstream’s technology, this can be reduced to 45 seconds.

Using an optical character recognition (OCR) engine that extracts data from the letter of credit, Traydstream conducts the document scrutiny – which includes resolving issues around missing fields, ensuring consistency and compliance regarding ISBP and UCP rules.

Traydstream is also integrated with various vessel and journey checks, as well as risk / sanction checks.

With around 250k algorithms on the platform, Traydstream is a SaaS-based ecosystem designed to ingest and make trade processing data more efficient.

#5 – Tradeassets

Tradeassets focuses on financial inclusion.

The risk of financial exclusion at the corporate and bank level can have huge implications for trading businesses in emerging markets, but the effect of financial exclusion at the institutional level can have an impact and disconnect at a level that is much greater for entire nations.

Tradeassets is a Dubai-based digital ecosystem that looks to address and enable financial inclusion, focussing on digitalisation within the secondary trade finance market.

#6 – INTIX

INTIX is a data-centric fintech providing data capture functionality at all levels of a trade transaction.

By transforming data into a new economic asset, capturing data points from many areas of a transaction banking business can enhance processes such as credit scoring at a transactional level, trade distribution, liquidity monitoring, and trade finance automation.

Competition vs collaboration

So, who owns the customer relationship and to what extent are fintechs disrupting here?

It’s often easy to have the impression that fintechs are taking away market share, however, the idea of partnership and collaboration, cross-selling and offering a broader suite of products, as well as fintechs powering the backend (rather than the front-end) systems for banks is much more plausible.

Financial institutions and banks are however looking at addressing the market through open banking and platform initiatives where they offer finance through newer players, the key challenges remain, however, in terms of KYC and money laundering.

Ecosystems between fintechs and banks, banks and customers, and fintechs and fintechs continue to develop in the trade finance space.