Estimated reading time: 5 minutes

There are a number of different types of finance which can facilitate the trading of goods and services both globally and domestically. The trade finance industry also supports and accommodates transactions that facilitate international payments, mitigate currency risk and exposure, and both debt and equity fundraising.

Trade finance – Explained

Trade finance is a broad term that encompasses a variety of instruments and techniques that are used to finance global trade.

The trade finance industry as a whole has experienced significant changes over the past decade with rapid advancements in technology, mounting geopolitical tensions, and worldwide economic shutdowns.

Despite all this, the capital requirement of a business or the accessibility of an individual’s cash flow can still be determined by pre-export and post-export trade finance.

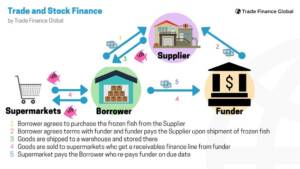

Suppliers and supply chain management is crucial to trade finance; the different actors in any global supply chain may use financing products to help fund the production of goods, exporting of services or perhaps the shipment of trade using a mixture of pre-export or post-export financing.

Trade finance is a broad term that encompasses a variety of instruments and techniques that are used to finance global trade.

The trade finance industry as a whole has experienced significant changes over the past decade with rapid advancements in technology, mounting geopolitical tensions, and worldwide economic shutdowns.

Despite all this, the capital requirement of a business or the accessibility of an individual’s cash flow can still be determined by pre-export and post-export trade finance.

Suppliers and supply chain management is crucial to trade finance; the different actors in any global supply chain may use financing products to help fund the production of goods, exporting of services or perhaps the shipment of trade using a mixture of pre-export or post-export financing.

1. Payment-in-advance

Payment-in-advance is a pre-export trade finance type that involves an advance payment or even full payment from the buyer before the goods or services get delivered.

This is risky, and although it can help the supplier in terms of cash flow constraints, it is risky for the buyer in case the goods are not delivered.

Advance payment is a popular option, but substantially increases non-payment or credit risk for the supplier.

2. Working capital loans

Working capital loans (or business loans) can be used to finance the upfront cost of doing business and can cover anything from the cost of raw materials to the cost of labour.

These short-term loans are normally issued on a 6-month tenor.

With secured working capital loans, banks use the company’s assets as a form of security against non-payment.

Banks may also issue unsecured business loans for a higher cost. Since this type of loan does not have any assets as collateral is inherently riskier for the bank requiring them to pay a higher fee.

3. Overdrafts

An overdraft is an easy-to-use facility – often already available on business bank accounts – that enables a company to go ‘overdrawn’ to a certain predefined amount.

Overdrafts are simple to use and flexible but can come with much higher interest rates if businesses do not monitor them carefully.

4. Factoring

Factoring is a type of post-export finance based on receivables.

Suppliers that sell internationally often do so on account, using payment terms that don’t require the buyer to actually pay for the goods they buy for multiple months.

Many cash-strapped suppliers, however, cannot afford to wait 3+ months to receive payment for their products – they have bills to pay today.

This is where factoring comes in.

Factoring involves a funder or financial institution – referred to as a factor – buying the accounts receivables of the supplier for a discount (they generally will generally pay 95% of the face value of the receivable in total, 80% of which is paid upfront, with the balance being paid once the buyer makes payment).

Once the invoice comes due, rather than paying the original supplier, the buyer is now asked to pay the factor.

For example, SupplyCo sells $10,000 worth of semiconductors to BuyCo using 30-day payment terms.

SupplyCo produces and ships the semiconductors, knowing that it will not receive payment for them until a month down the road.

To help liquidate this account receivable on its balance sheet before the end of the term, SupplyCo approaches FactorCo.

FactorCo agrees to purchase the account receivable from SupplyCo for $9,500 in total – $500 less than the original amount.

FactorCo will pay SupplyCo $7,600 in cash (80% of $9,500) today.

In one month when the original invoice comes due, BuyCo will pay its required $10,000 to FactorCo.

Now that FactorCo has received payment, it will pay the remaining 20% balance ($1,900) to SupplyCo.

At the end of this transaction, BuyCo has received its semiconductors, SupplyCo has received $9,500 in payment, and FactorCo has generated $500 in factoring revenue.

Factoring is often used by suppliers that are seeking to optimise their balance sheets and free up working capital within the business.

In factoring, there can be some degree of recourse available, unlike forfaiting.

5. Forfaiting

Forfaiting is another trade finance tool based on receivables.

Forfaiting and factoring are can be distinguished by the duration of financing.

Although both are types of post-export finance, the supplier does not have any recourse with forfaiting.

This means that once it has sold the receivable to the forfaiter, the supplier is no longer liable in the event of non-payment from the buyer.

Generally, forfaiting is only used for medium- and long-term receivables and tends to come with a larger price tag than factoring for the supplier selling the receivables.

The forfaiter requires extra costs because they are absorbing a host of additional risks associated with the transaction.

These risks can include political risk, non-payment risk, transport risk, and currency risk, among others.

While these risks are certainly tangible, they can be mitigated by the appropriate trade instrument.

TFG has put together a guide on mitigating trade risk through credit insurance, FX products, and insurance.