- 2024 ICC Trade Register report reaffirms low risk nature of trade finance assets, despite a slowdown of global trade volumes in 2023.

- Receivables finance is outpacing traditional documentary trade products, marking a shift towards open account trade and flexible working capital solutions.

- The report highlights a notable shift towards trade in regional blocs, particularly growth in non-USD settlements.

The annual Trade Register from the International Chamber of Commerce (ICC) in collaboration with Boston Consulting Group (BCG) and Global Credit Data (GCD) has been released, analysing the landscape for trade, supply chain finance, credit risk, and proprietary trade finance risks for 2023.

The report surveys partner banks of the ICC Banking Commission, representing 5% of global trade flows and 18% of financed trade flows. The conclusions are indicative of the industry’s trajectory and highlight opportunities down the road.

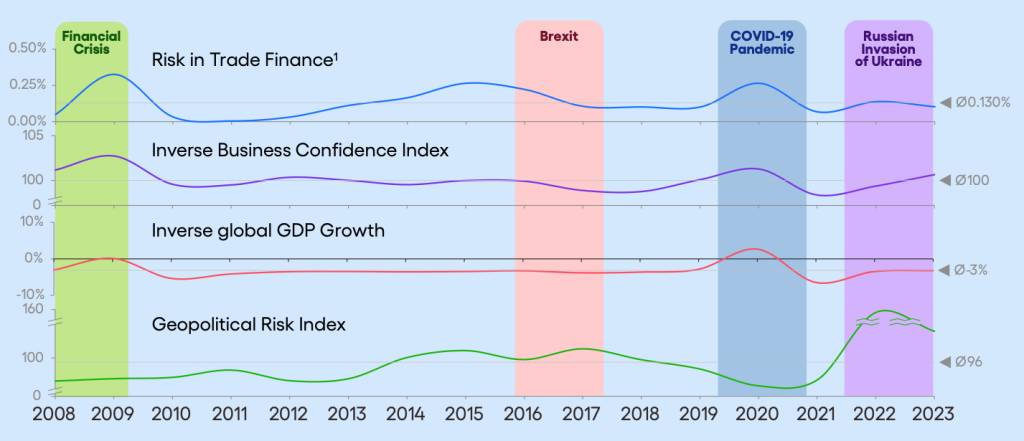

2023 was mired by ongoing geopolitical tension, stilted market demand, corporate deleveraging, and high interest rates, transforming the industry. Overall, though, indicators for 2024 are positive, while the low-risk nature of trade finance remains a pillar of stability.

Trade: 2023, 2024 forecast, beyond

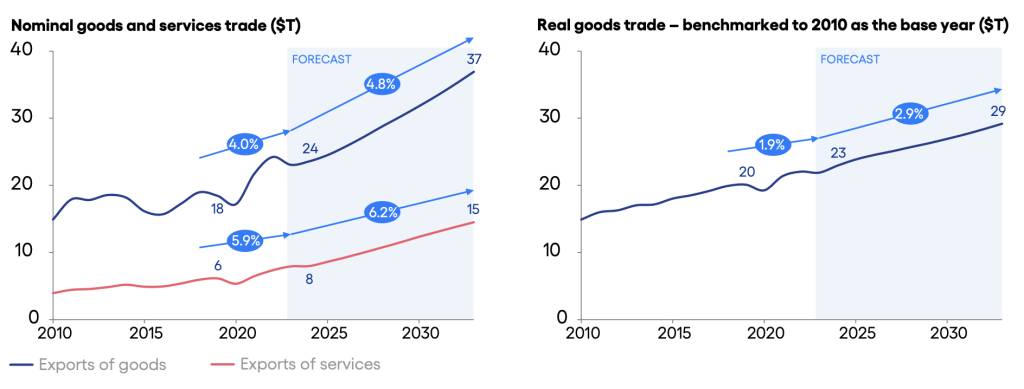

Global goods trade saw a year-on-year decrease in both real terms (-0.7%) and nominal terms (-4.8%): a slowdown from growth post-pandemic in 2021 and 2022.

Source: ICC Trade Register report. BCG Global Trade Model 2024, UN Comtrade, IHS, WTO, Oxford Economics, BCG analysis. FX rates are floating .

The variance of this by sector is interesting in defining the future of commodity demand. The energy sector fell by 19% in nominal terms (while demand remained steady, increasing by 1% in real terms). Modest downturns were seen in metals and mining (-7% and -9%), semifinished intermediate good such as chemicals (-10%), semiconductors (-10%), and agribusiness (-4%).

On the other hand, automotive trade increased by 12% in nominal terms while the aerospace sector saw a 16% increase.

This was offset by an 8% increase in services trade, now making up one-third of all trade. In nominal terms, this constituted $7.9 trillion, with Middle-Eastern countries (Saudi Arabia, UAE, Qatar), India, and Ireland witnessing the fastest growth.

Sectorally within services, the travel industry rebounded strongly, returning to approximately 25% of the global services trade. Financial services and information and communications technology (ICT) also saw steady annual growth. Conversely, construction services reported slower growth.

Global inflation fell from 8.0% in 2022 to 6.5% in 2023. But despite the moderation of inflation, consumers continued to suffer expensive essentials like energy bills.

In terms of trade currency, while the US dollar is likely to retain its dominance in the short term, non-US dollar trade is on the rise. This is driven by increased use of Chinese currency in cross-border payments; and by US foreign policy affecting specific sectors, with around 20% of the global oil trade settled in non-USD currencies.

Source: ICC Trade Register 2024. BCG Global Trade Model 2024, UN Comtrade, IHS, WTO, Oxford Economics, BCG analysis.

Having said this, the USD’s dominance is still decisive, with 55% of international payments and 83% of trade finance market payments made in the American currency.

Looking forward, as central banks have reduced interest rates in response to waning inflation, 2024 should theoretically be reviewed as a year of relative normalisation. Yet the year has been defined by shifting geopolitics, the result of elections for more than half the world’s population and conflict.

Supply chains have seen monumental rerouting. The drop in trade between the US and China has pushed both parties closer to their allies. Similarly, the EU has been seeking to diversify from Russia and China.

But surprisingly, the strongest growth has come from the ‘Global South’, which largely consists of emerging economies. India’s trade growth is expected only to accelerate, at 9% CAGR over the next decade. The benefits of campaigns like ‘Make in India’, as well as continued growth in projected trade with China, reinforce India as a rapidly emerging platform.

Trade and supply chain finance

Slowing trade volumes, compounded by higher interest rates, posed challenges for trade and supply chain finance. Banks reported the following as the greatest threats to their businesses:

- Disrupted trade flows from ongoing geopolitical conflict (40% responded this to be a high or severe threat)

- Margin erosion (36%)0

- New regulation on capital treatment (30%)

- Increased competition amongst financial institutions (25%)

- Increased fraud risk (21%)

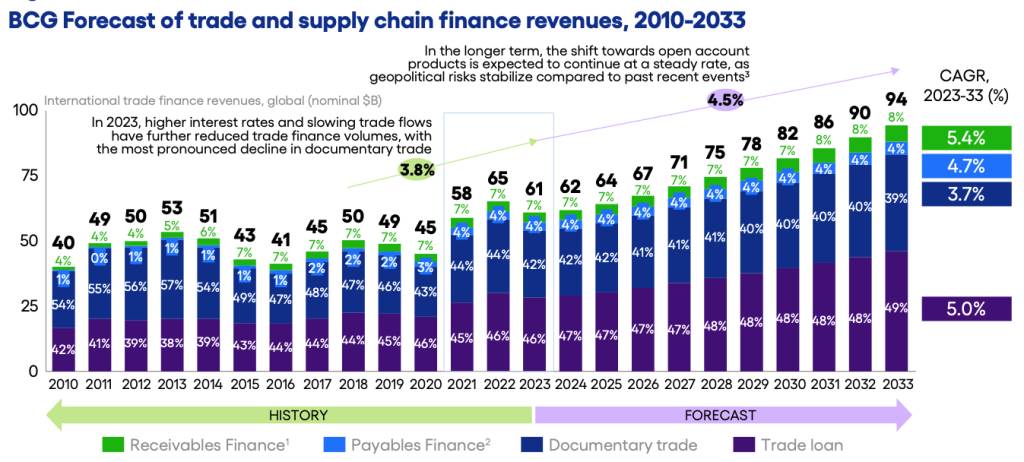

Source: ICC Trade Register 2024. BCG Global Trade Model 2024, UN Comtrade, IHS, WTO, Oxford Economics, BCG analysis.

Trade and SCF revenues declined overall, with the most notable contraction in the Asia-Pacific region. But the only modest reduction in the EU, which accounts for one-fifth of global trade finance revenues, lessened the severity of this decline.

While some expect receivables finance and payables finance to accelerate faster than the growth of documentary trade and trade loans, the proportions within overall trade and SCF revenue growth remain steady.

In fact, documentary trade products are projected to have a below-average growth at 3.7% CAGR, and reduced demand for payables finance comes as a result of disclosure rules and Basel III capital treatment regulation.

Nonetheless, the wider picture is positive for trade finance. Much optimism comes from the modernisation of platforms, the result of the rapid evolution of technological solutions. As many as 90% of banks are investing in digital customer experience initiatives to meet client expectations.

Artificial intelligence (AI) and generative-AI have huge potential regarding data extraction, fraud prevention, document checking, and creating data model language universality. This technology can also improve accessibility for smaller, less technologically-literate parties by providing validation and assistance in contracts, and by using chatbots to simplify customer service.

In this regard, momentum picking up around digital trade and related regulation, such as the Model Law on Electronic Transferable Records (MLETR), is likely to have informed positive projections. However, 80% of survey respondents believe the digitalisation of trade is dependent on collaboration throughout the ecosystem – corporates, shipping companies, banks, insurance brokers, as well as regulatory bodies.

Climate and sustainability remain important, with a notable change from banks. Over 90% of those already engaging in sustainable finance report positive growth. In Western Europe, regulations like the EU’s Carbon Border Adjustment Mechanism mandate this transition, but creating profit incentives around sustainability mean its significance will only grow.

Credit risk, proprietary trade finance risk

The report proposes that trade finance, SCF, and export finance have proven resilient from a credit risk perspective because they involve low-risk transactions, which constitute the bulk of global trade.

Source: OECD, World Bank, Geopolitical Risk Index, ICC Trade Register 2024

These instruments represent a low-risk asset class, even during times of uncertainty: as elucidated by Figure 4. On an exposure-weighted basis:

- Global default rates for import letters of credit (LoCs) decreased from 2022 to 2023.

- Default rates for export LoCs are significantly lower than for other trade finance products, and defaults increased negligibly between 2022 and 2023.

- For loans for import/export, 2022 to 2023 saw a slight decrease.

- Default rates for performance guarantees decreased in 2023 (this was on an obligor-weighted basis too).

For export finance, most transactions are guaranteed by export credit agencies at up to 100% of their value. In the sample surveyed, the average was 94%. This grants banks the capacity to be indemnified by an export credit agency (ECA) up to the level specified, meaning export finance has a particularly low loss given default (LGD) levels.

—

The findings of the 2024 ICC Trade Register Report are consistent with commentary throughout the year, regarding the significant disruptions posed by geopolitical uncertainty as well as the opportunity provided by technology. It is in this opportunity that positive forecasts seem to stem.

Importantly, however, the findings in this year’s report align with previous reports: that trade finance, SCF, and export finance present a low risk for banks. These trade finance instruments appear, in their nature, to be insulated from inevitable disruptions.