Cross-Border Payments

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

How do cross-border payments work?

Cross-border payments involve transferring money or other forms of value from a party in one country to a party in another. These payments can take many forms, depending on the needs of the parties involved and the regulatory requirements of the countries in question.

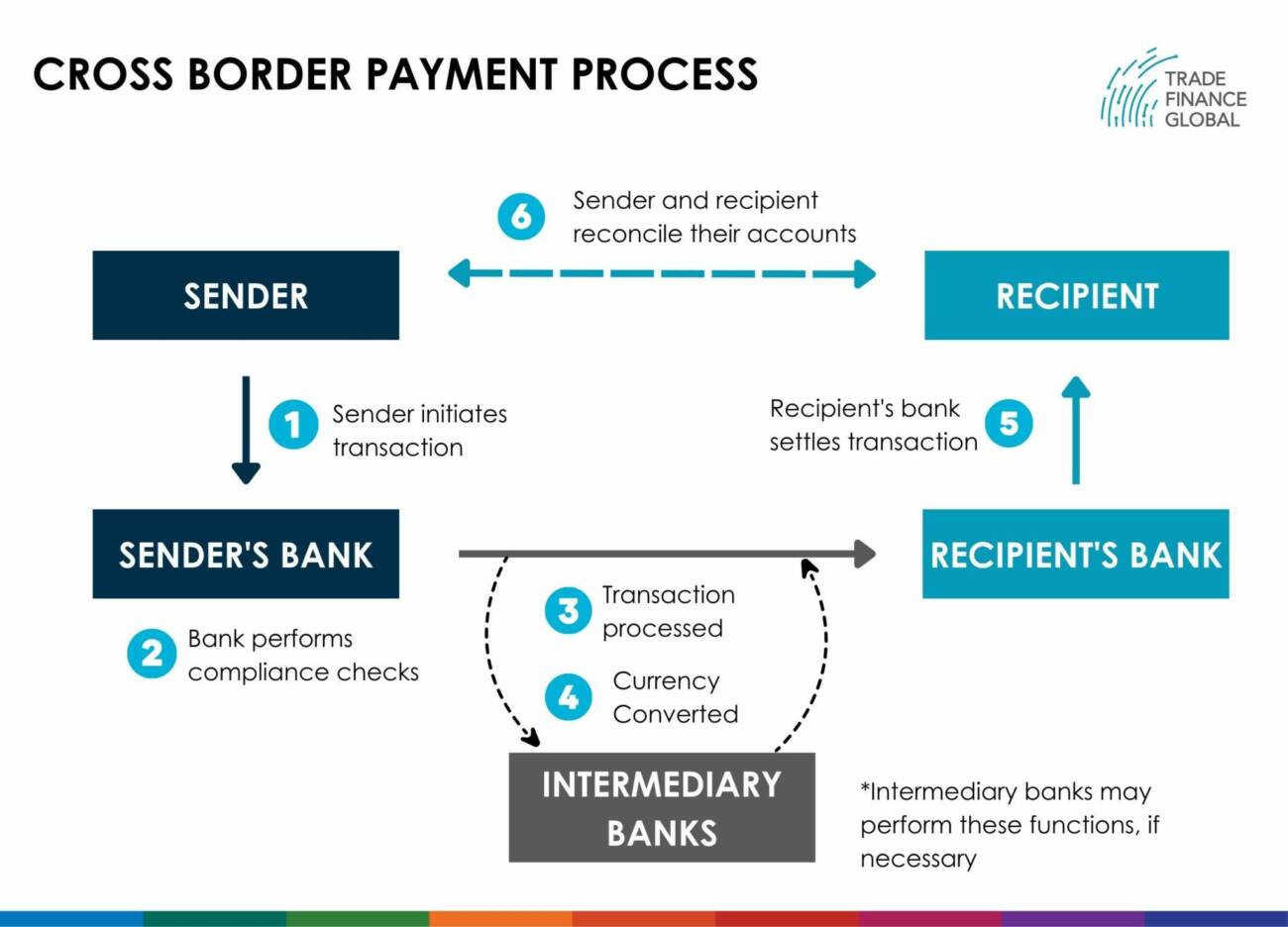

Generally, any cross-border transaction will pass through some variation of the following steps, beginning with initiation and progressing to receipt and reconciliation.

- Initiation: The payment process begins when the sender (or payer) initiates the payment. This may involve filling out a payment form, providing the relevant details to their bank or payment service provider (PSP), or using a digital payment platform or app such as PayPal.

- Compliance checks: The bank or PSP will perform regulatory compliance checks. Exactly what they need to do will vary based on the regulations in the jurisdictions relevant to the transaction but will generally include KYC, AML, CFT and other checks to ensure that the transaction aligns with the regulatory requirements.

- Processing: Once the payment is initiated, it must be processed and cleared through various intermediaries, such as correspondent banks, payment processors, and clearinghouses. While these intermediaries generally charge fees for their services, they are often necessary to ensure the payment is authorised, validated, and settled.

- Currency conversion: If necessary, the bank will convert the payment into the relevant currency at the current exchange rate. In some instances, this may involve a direct conversion from the home currency of the sender to the home currency of the receiver, while in other instances, it can involve the use of a third currency like the US dollar. The exchange rate used can impact the overall cost of the payment. This may involve using foreign exchange (FX) brokers, banks, or other intermediaries.

- Settlement: Once the payment has been processed and converted (if necessary), it must be settled (or transferred) to the recipient’s account. The recipient’s bank receives the payment and credits it to the recipient’s account. This may involve using various payment rails, such as SWIFT, ACH, SEPA, or other payment systems, depending on the countries and currencies involved. The payment is considered settled once the recipient’s bank confirms that the payment has been credited.

- Receipt and reconciliation: The recipient (or payee) receives the payment in their account and can use the funds as needed. The sender and recipient may receive a payment confirmation and can reconcile their records accordingly.

The cross-border payment process is naturally more complex than a domestic transaction as it can involve multiple intermediaries and result in longer processing times and higher fees.

The entire process of cross-border payments can take several days or more to complete, depending on factors such as the countries involved, the currencies used, the payment amount, and the regulatory requirements of the relevant authorities. The costs will also vary depending on the fees charged by intermediaries and the exchange rates used.

While it can still be a cumbersome process overall, technological advancements and regulatory changes are helping to make cross-border payments faster, more transparent, and more affordable.

Cross Border Payment Process Diagram

What are the challenges of cross-border payments?

As with any international business activity, cross-border payments come with their own set of challenges.

For one, the sender and receiver may have different currencies, necessitating currency conversion. Currency conversion can be time-consuming and expensive, and the exchange rate used can affect the overall cost of the payment. These costs are further compounded when one of the currencies is less popular and thus less readily available or particularly volatile.

In some instances, the uncertainty surrounding FX fluctuations – particularly when payment on a transaction is not due for several months – means that firms must use financial instruments like futures contracts to ensure that a major price swing does not eliminate their profit. While this can be done relatively easily with the help of a bank, it is yet another cost that must be considered.

Another inherent challenge is that cross-border payments involve multiple intermediaries, such as correspondent banks, clearinghouses, and payment processors, which can complicate the payment process and increase the cost, as each intermediary will likely charge separate fees for their services.

Beyond the cost pressures, multiple intermediaries can make it difficult for the sender and receiver to track the payment’s progress and understand the fees involved. This lack of transparency can lead to confusion and occasionally disputes.

These payments can take several days or more to complete, which can be inconvenient for the sender and receiver. In some cases, the delay may be due to regulatory requirements or the need for additional payment verification, in others, it may simply be due to the nature of completing a transaction across time zones.

And those are just the challenges involved in dealing with an honest counterparty.

The risk of fraud can increase when dealing with unfamiliar parties or using unfamiliar payment methods, and remedying a fraudulent situation can be exponentially more difficult when multiple legal jurisdictions are involved.

Despite the challenges, transacting internationally introduces (quite literally) a whole world of opportunity.

What are the benefits of cross-border payments?

Any organisation afraid to make a cross-border payment effectively excludes itself from global business opportunities and the chance to increase its revenue and grow its customer base.

These systems also allow businesses to access foreign currencies, which can be useful as a financial hedging mechanism or for pursuing investment opportunities abroad.

However, more than just businesses benefit from these services. Many individuals across the developing world benefit from their economy’s inclusion in the global financial system, which can bring increased goods and services from abroad and increase the efficiency of domestic firms now facing international competitive pressures.

Furthermore, many migrant workers leverage cross-border payment systems to send remittances back home to support their families, which is often far faster, cheaper, more convenient, and, in some cases, even physically safer than using traditional methods like carrying cash or mailing a check.

Overall, cross-border payments can facilitate global trade and commerce, support financial inclusion, and provide new opportunities for businesses and individuals.

Publishing Partners

- Payments Resources

- All Payments Topics

- Podcasts

- Videos

- Conferences