UCP 600 – Ultimate 2025 Guide ✔️

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get Started

ADVERTISEMENT

Contents

What is UCP?

The Uniform Customs and Practice for Documentary Credits (“UCP”) is the rule governing the Documentary credits. It was established by the international chamber of commerce (ICC) to mitigate the doubts caused by individual countries promoting their own national rules on documentary credit practice. The objective, since attained, was to create a set of contractual rules that would establish uniformity in that practice, obtain global understanding, a common interpretation and application of documentary credit, so that practitioners would not have to cope with plenty of conflicting national regulations. UCP is the most successful set of private rules for trade ever developed.

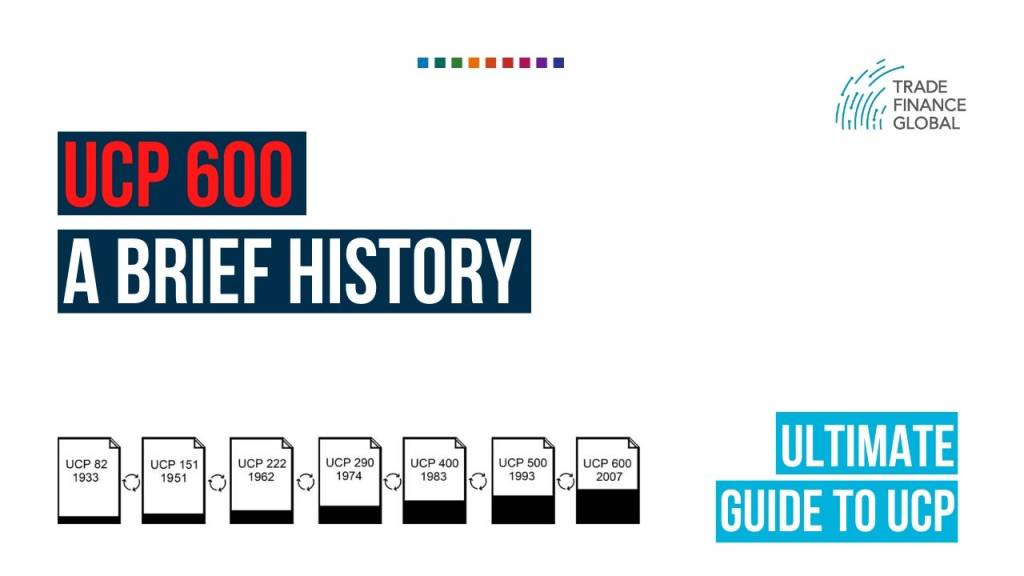

UCP 500 versus UCP 600 – A brief history

The first version of the rules published by ICC in 1933 known as (UCP 82), it has been revised six times to keep pace with market needs and practices, in 1951 (UCP 151), 1962 (UCP 222), 1974 (UCP 290), 1983 (UCP 400), 1993 (UCP 500) and the latest version in 2007 known as (UCP 600). First published in December 2006 and implemented on 1 July 2007.

The origin of UCP 600 and its purpose

UCP 600 is the fruit of more than three years of work by the International Chamber of Commerce’s (ICC) Commission on Banking Technique and Practice. One of the most important objectives of the UCP 600 is providing easier language and addressing the progress in various industries to unify the interpretation and application of documentary credits.

The main issues that considered in shaping UCP 600

- Addressing developments in banking, transport and insurance industries.

- Easier language and style to remove wordings that could lead to inconsistent application and interpretation.

- Reviewing ICC Opinions, DOCDEX Decisions.

- Considering the incorporation of or relationship with, ISBP 645, URR 525, ISP 98 and eUCP.

Key Sections and Articles for the UCP 600

it comprises of 39 articles to cover the following:

- Scope and application of the rules (article 1)

- Definitions and interpretations (articles 2 and 3)

- Obligations and liabilities (from article 4 to 13)

- Examination and dealing with documents (from article 14 to 17)

- Documents including commercial invoice, transport documents and insurance document (from article 18 to 28)

- Miscellaneous Provisions (from article 19 to 33)

- Disclaimers (from article 34 to 37)

- Transfer and assignments (articles 38 and 39)

UCP 600 commentary

The publication provides the text of each article, the changes from UCP 500, the commentary explaining and analysing each article and sub-article of UCP 600 and cross-reference to other articles.

The commentary reflects the view of the drafting group, users of the commentary should also be aware that the decision to accept or reject documents depends on the terms and conditions of the credit, the applicable provisions of UCP 600 not the commentary and international standard banking practice.

The introduction to the commentary on UCP 600 states: ‘the writing of the Commentary proved to be more difficult than drafting the rules themselves.’

With around 5000 comments received by the Drafting Group during the revision process, it was impossible for them to provide feedback on every issue that did or did not make it into the text of UCP 600.

These issues included, amongst others, the following items:

- Should the words “on its face” remain within the UCP?

- What was the value of the concept of “reasonable time” when there was no common standard for determining reasonableness globally?

- Should the UCP now reflect the growing practice of documentary credits being issued by non-banks, by substituting “issuer”, “confirmer”, etc., for the terms “issuing bank”, “confirming bank”, etc., that had been used in past UCPs?

- Was a majority of the Banking Commission in favour of including a rule covering the ability of a nominated bank to prepay or purchase a draft it accepted or a deferred payment it incurred?

- Was there a need for an equivalent of UCP 500 article 30 when the UCP transport document articles do not mention who is actually to “issue” the respective transport document?

All of the points were debated at some length by national committees tasked with providing input, so that the Drafting Group could gauge where their representatives on the Banking Commission wished an article to be positioned.

The objective of the commentary to enlighten practitioners about the processes behind the changes in each article and to explain why a change was introduced, why no change was made, why some issues may appear new but are not, i.e., a clarification rather than a change, and to suggest the way the wording in UCP 600 should be understood and applied.

After UCP 600

After UCP 600

URR 725

As a result of the huge growth in the volume of inter-bank currency reimbursements remained largely subject to locally accepted practice in the major financial centres, with the one exception of the U.S.A, where banks had formulated their own operating rules, moreover, the practices around bank-to-bank reimbursements under documentary credits developed into more complicated procedures followed by banks not a party to the documentary credits providing the beneficiary with reimbursement promptly. To meet the need for international standards and to assist trade facilitation, the ICC banking commission authorized a working party to draft the Uniform Rules for Bank-to-Bank Reimbursements (URR 525) in 1993 and implemented on 1 July 1996.

The update to URR 525 was necessary to bring the URR rules into conformity with the UCP 600, in April 2008 URR 725 was approved by the ICC national committees and implemented in October 2008. URR 725 should not be seen as a revision of URR 525. It is an updating process that has followed the same manner as the eUCP, i.e. to change the style to match that of UCP 600.

Banks that are requested or authorized to add their confirmation often require from an issuing bank before adding their confirmation to specify a reimbursing bank instead of reimbursed directly by an issuing bank. UCP 600 article 13, covers basic principles for bank-to-bank reimbursements. URR 725 covers these principles in more details and clarification, such as general provisions and definitions, liabilities and responsibilities, form and notification of authorizations, amendments and claims and miscellaneous provisions.

The contents of URR 725

It comprises of 17 articles as the following:

- Application of URR

- Definitions

- Reimbursement Authorizations Versus Credits

- Honour of a Reimbursement Claim

- Responsibility of the Issuing Bank

- Issuance and Receipt of a Reimbursement Authorization or Reimbursement Amendment

- Expiry of a Reimbursement Authorization

- Amendment or Cancellation of a Reimbursement Authorization

- Reimbursement Undertaking

- Standards for a Reimbursement Claim

- Processing a Reimbursement Claim

- Duplication of a Reimbursement Authorization

- Foreign Laws and Usages

- Disclaimer on the Transmission of Messages

- Force Majeure

- Charges

- Interest Claims/Loss of Value

What is ISBP 745?

With the approval of UCP 600 in October 2006, it has become necessary to provide an updated version of the International Standard Banking Practice for the Examination of Documents under Documentary Credits (ISBP 645). The first version was Issued in 2003, it was felt appropriate, paragraphs that appeared in Publication 645 and that have been covered in effectively the same text in UCP 600 have been removed from the updated version of ISBP, publication 681 is the first revision of ISBP 645. The introduction to UCP 600, states: ‘During the revision process, notice was taken of the considerable work that had been completed in creating the International Standard Banking Practice for the Examination of Documents under Documentary Credits (ISBP), ICC Publication 645’.

A fully revised version of ISBP 681 was undertaken, in July 2013 ISBP 745 was published. It filled a gap between the general rules of the UCP 600 and the daily job of the documentary credit practitioners and provides coverage of documents which are not specifically mentioned in UCP 600, as well as, it serves as a valuable tool for parties to correctly apply the principles of UCP 600 and accurately interpret and clarify conditions appearing within documentary credits, it covers a range of practices outlined by ICC Opinions issued since 2007, decisions of the ICC Banking Commission, and has been extended to cover documents including non-negotiable sea waybill, beneficiary certificate, packing list, weight list, beneficiary certificates, analysis, inspection, health, phytosanitary, quantity and quality certificates.

It should be noted ISBP 745 doesn’t modify or exclude UCP 600 articles and both should be read in their entirety and not in isolation. To emphasize this point, paragraph i. of Preliminary Considerations reads “This publication is to be read in conjunction with UCP 600 and not in isolation.”

Thierry Senechal, ICC Senior Policy Manager and Banking Commission Executive Secretary said: “This guide has developed into an invaluable aid to banks, corporates, logistics specialists and insurance companies alike, on a global basis, when creating documents for presentation, or for the examination of documents presented under, a documentary credit.”

Gary Collyer, Chair of the Drafting Group for the revision of ISBP, said: “Rejection rates have decreased since the original launch of the ISBP guide in 2002 and it is acknowledged that a major contributing factor to this is the application of the practices detailed in ISBP.”

Key Sections of ISBP 745

Each section begins with an alphabetical letter as the following:

- Key Sections Of Isbp 745

- Each Section Begins With An Alphabetical Letter As The Following:

- (I-vii) Preliminary Considerations

- A) General Principles

- B) Drafts And Calculation Of Maturity Date

- C) Invoices

- D) Transport Document Covering At Least Two Different Modes Of Transport (“multimodal Or Combined Transport Document”

- E) Bill Of Lading

- F) Non-negotiable Sea Waybill

- G) Charter Party Bill Of Lading

- H) Air Transport Document

- J) Road, Rail Or Inland Waterway Transport Documents

- K) Insurance Document And Coverage

- L) Certificate Of Origin

- M) Packing List, Note Or Slip (“packing List”)

- N) Weight List, Note Or Slip (“weight List”)

- P) Beneficiary’s Certificate

- Q) Analysis, Inspection, Health, Phytosanitary, Quantity, Quality And Other Certificates (“certificate”)

ICC guidelines and guidance papers

The ICC recommendation and guidance papers do not amend the UCP rules or International Standard Banking Practice (ISBP), the papers act as a response from the ICC when various banks are applying unilateral and incorrect interpretations to certain articles and clarifying the proper interpretation and application when it determines that there is a need to do so, furthermore, to share practical views and guidance from experts in the management of trade finance transactions when exceptional events and issues arise for example this exceptional period because of the novel coronavirus (“COVID-19”).

Some of the ICC guidelines and guidance papers

- The requirements for an on-board notation

- The use of sanction clauses in trade finance-related instruments subject to ICC rules

- Notes on the principle of strict compliance

- Decision of the ICC in respect of a revision of UCP 600

- The use of drafts (bills of exchange) under documentary credits

- Notes for Documentary Credit Formats

- The impact of COVID-19 on trade finance transactions issued subject to ICC rules

- Addendum to guidance paper on the use of sanctions clauses 2014

- The correct interpretation of the first paragraph of UCP 600 article 35

UCP 600 revision

Which is the latest version of UCP?

UCP rules revised six times since the first publication in 1933, the period between each revision range from 9 to 14 years, on 15th June 2017 ICC Executive Committee released a document NO.470/1272 to announce their decision after the voting that held with National Committee Forum in Rome on 8th November 2016 and on 23rd November 2016 in Paris in respect of a revision of UCP 600, the results were that the majority of National Committees preferred not to proceed with a revision, despite there were a few counter-views and comments were given supporting a UCP revision.

Summary of the ICC decision in respect of a revision of UCP 600

It is not considered, at this stage, to be appropriate to revise UCP 600 as the most of the problems lay not with the rules themselves, but with the application, i.e. practice of the rules (“international standard banking practice”).

50% of the problems apply to the presented documents: it is a justifiable assumption that a greater understanding of ISBP 745 would help alleviate these problems and greatly reduce this percentage, the remaining 50%, it is difficult to see how a revision of UCP would make much of a material difference as many of these causes are outside the scope of correction by the beneficiary.

The majority of problems are caused by:

- poor drafting of the credit

- Lack of understanding of documentary credit workflows and the principles of UCP 600

- Lack of attention to detail and management of the production, shipment and document collation processes

- Excessive and unnecessary data being added to documents

- Restricted access to ISBP 745

Only seven items were identified for possible inclusion in a revision of UCP and most of these were already an integral part of ISBP 745. No new problems were raised which would prove that existing rules are wrong or that there is a gap.

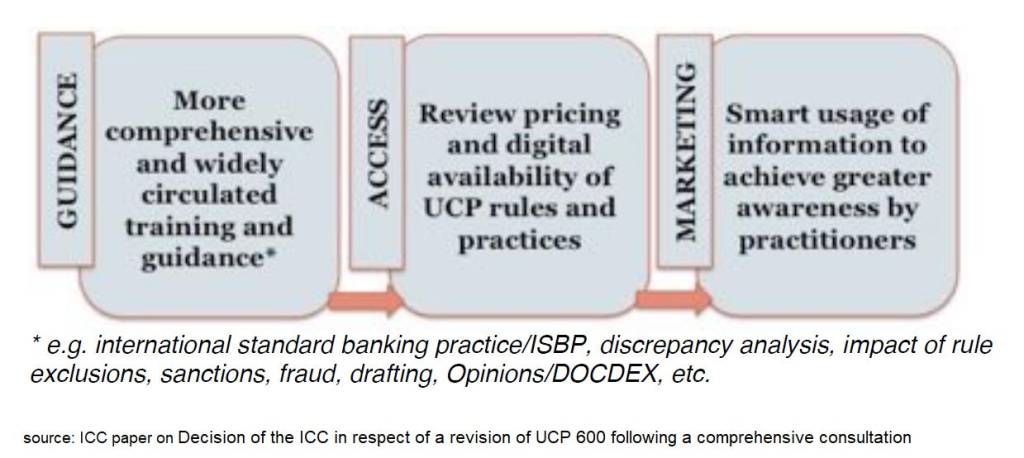

The ICC Executive Committee Decision is greater understanding of practices should be the way forward, rather than a revision of the rules and this will be achieved by the implementation of a three-prong facilitation approach:

Overcoming the above problems

The following recommendations should be considered which could potentially reduce discrepancy ratios under documentary credits, as the rates of non-compliance are quite high, specifically on the first presentation.

- As stated in ISBP 745 Preliminary Considerations (iv), ‘many of the problems that arise at the document examination stage could be avoided or resolved by the respective parties through careful attention to detail in the credit or amendment application and issuance of the credit or any amendment thereto’.

- An issuing bank should ensure that any credit or amendment it issues is not ambiguous or its wording subject to more than one interpretation and conflicting in its terms and conditions as most of the difficulties and complications that arise from poorly or badly drafted credits.

- Avoid inserting excessive details and including terms which only belong to an underlying agreement/contract that cause unintended consequences and payment delays.

- The applicant and beneficiary should carefully consider the documents required for presentation, by whom they are to be issued, their data content and the time frame in which they are to be presented.

- Documentary credits must not include conditions for which fulfilment cannot be ascertained from the face of a document.

- Avoiding as much as possible to exclude or modify specific articles or sub-articles of UCP 600 unless that is necessary.

- Only necessary documents should be required by the credit and ensure the document descriptions are as simple as possible at the same time to meet any contractual requirements.

- Avoid adding generic requirements that are to apply to all presented documents.

UCP 700 wish list

UCP 700 wish list

As mentioned above the ICC executive committee stated they won’t revise UCP 600 anytime soon, on the other hand, it also states there are issues identified for possible inclusion in a revision of UCP. Several issues highlighted by trade finance experts for example:

- Kim Sindberg in his blog ‘UCP 700 – on the table?’ He outlined the framework and the issues that needed to be addressed and indicated what should/could be changed under UCP 600 articles and why.

- David Meynell and Gary Collyer in their blogs ‘UCP 700’ & ‘UCP gaps’ They addressed a number of issues that seem rational for a new version of UCP 600.

A few of these issues outlined below:

- The removal of the reference to standby letter of credit.

- The removal of the reference to ‘draft’.

- The removal of ‘negotiation’ as a form of availability.

- Should a sanctions article be added, or perhaps be included as a sub-article of article 36 ‘Force Majeure’?

- Transport, UCP should provide a correct reflection of market conditions, including transport and logistics.

- Inoperative credits, a clarification as to how and when the credit becomes operative.

- Some paragraphs from ISBP 745 that are more appropriate to be a rule rather than a practice.

- Suggestions for specific articles to be removed, reworked, reshaped or merged with ISBP.

eUCP

The Uniform Customs and Practice for Documentary Credits (UCP) Supplement for Electronic Presentations (“eUCP”) first published in 2002 as version 1.0 supplemented UCP 500, later updated as version 1.1 in 2007 to accompany the publication of UCP 600 and to bring it in line with the changes in terminology in UCP 600 and recently as version 2.0 in 2019 in order to accommodate current practice, technological developments and the continuing evolution toward electronic presentation. The rules were intentionally developed with version numbers in order to be updated regularly when required according to future technological developments that emerge in trade finance and without impacting upon other existing ICC rules.

Olivier Paul, ICC Director for Finance Development said: “The digitalisation of trade is becoming more and more a reality. By releasing the new eRules, ICC is taking another step in the right direction to ensure that our rules are adapted to new realities,”

David Meynell, Co-Chair of the Working Group and Owner, TradeLC Advisory said: “Extending the mitigation of risk from a paper environment to the electronic milieu safeguards the applicability of ICC rules whilst guaranteeing relevance in a constantly evolving digital trade world.”

By acknowledging the importance of the eRules, the ICC has made the full text of the eUCP available online for the use of trade finance practitioners everywhere. ICC has also published an article-by-article analysis of eUCP V2.0 and eURC V1.0 to guide banks on the new rules.

It is worth mentioning that, the eUCP doesn’t address or define the method that is necessary to facilitate electronic presentation, these are left to the parties to agree on the platform or the system to be used.

The contents of eUCP V2.0

It comprises of 14 articles, in order to avoid confusion between the articles of UCP and the eUCP the articles are numbered with an ‘e’ preceding each article number as the following:

- e1 Scope of the Uniform Customs and Practice for Documentary Credits (UCP 600) Supplement for Electronic Presentations (“eUCP”)

- e2 Relationship of the eUCP to the UCP

- e3 Definitions

- e4 Electronic Records and Paper Documents V. Goods, Services or Performance (new article)

- e5 Format

- e6 Presentation

- e7 Examination

- e8 Notice of Refusal

- e9 Originals and Copies

- e10 Date of Issuance

- e11 Transport

- e12 Data Corruption of an Electronic Record

- e13 Additional Disclaimer of Liability for Presentation of Electronic Records under eUCP

- e14 Force Majeure (new article)

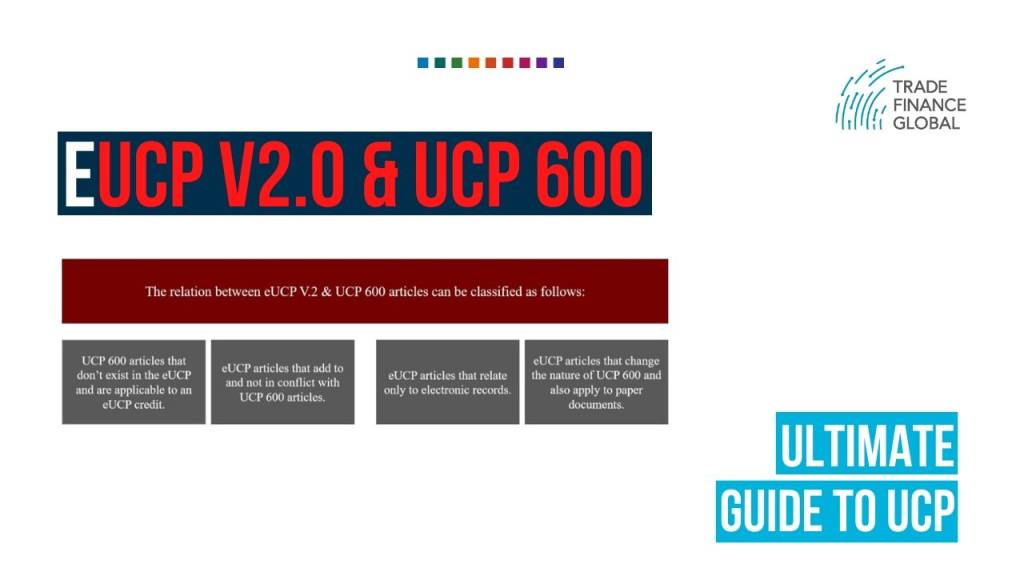

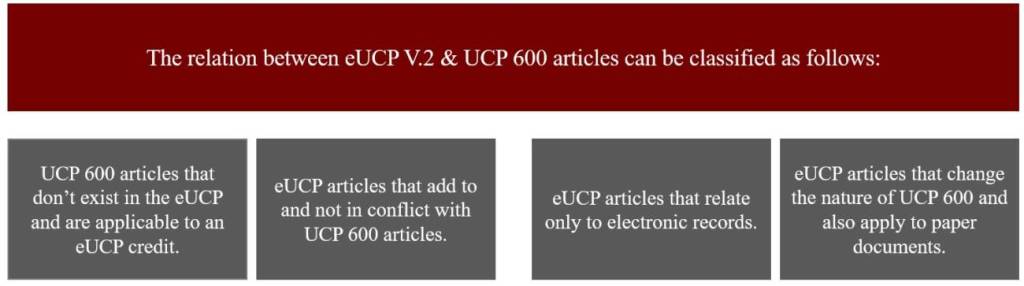

The relation between eUCP V2.0 & UCP 600 articles

- The eUCP V2.0 is a supplement to UCP 600 and to be used in conjunction with UCP 600.

- It shall apply where the credit indicates that is subject to eUCP V2.0.

- Credits issued subject to eUCP V2.0 are automatically subject to UCP 600 without specific reference.

- An eUCP credit must indicate the applicable version of the eUCP. If not indicated, it is subject to the latest version in effect on the date the eUCP credit is issued or, if made subject to the eUCP by an amendment accepted by the beneficiary, the date of that amendment.

- The Presentation can be all electronic records or a mixture of some paper documents and some electronic records.

- The provisions of eUCP shall prevail to the extent that they would produce a result different from the application of the UCP.

- It comprises of a number of terminologies used in the eUCP V2.0, some also appear in UCP 600, whilst others appear solely in the eUCP V2.0

- The requirement for presentation of one or more originals or copies of an electronic record is satisfied by the presentation of one electronic record.

- It provides a method by which corrupted data may be represented.

- Banks are liable for their own data processing systems.

- Force majeure article, as the previous versions did not include one.

Case study for ePresentation

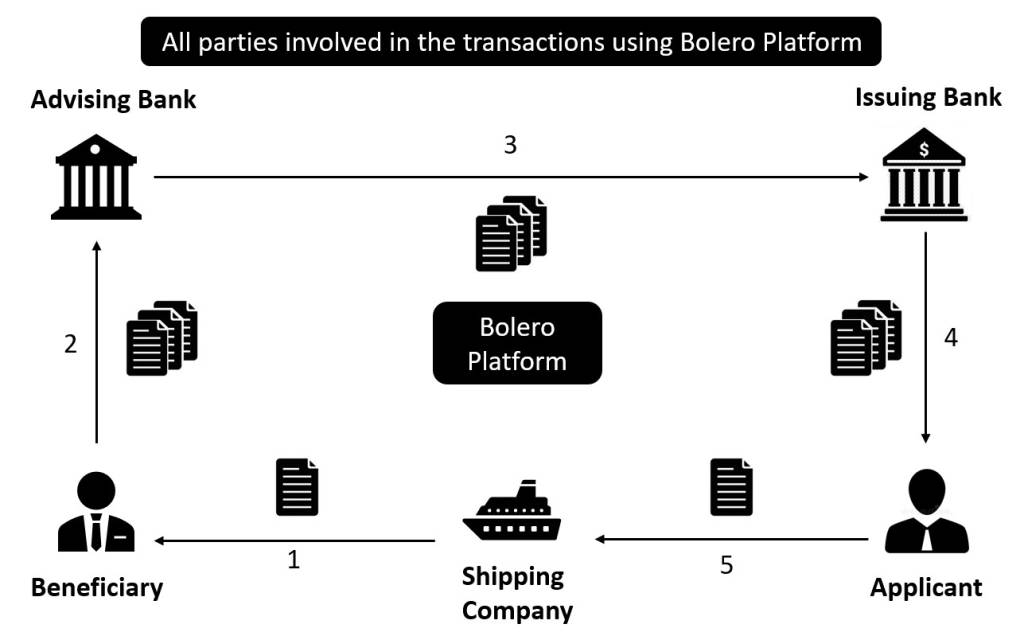

First ePresentation under eUCP using Bolero

At the end of 2010 Bolero announced the first electronic presentation using the Bolero platform to perform fully electronic presentation of documents under a documentary Credit issued subject to eUCP.

The parties involved in the transaction:

- The beneficiary BHP Australian mining company, formerly known as (BHP Billiton)

- The applicant Tae Kyung Ind. Co. Ltd. in South Korea

- The issuing bank Korea Exchange Bank (KEB)

- The advising and negotiating bank, The Royal Bank of Scotland (RBS)

- The shipping company “K” Line Pte Ltd.

The electronic documents sent via Bolero platform by the beneficiary to RBS for pre-checking then as a formal ePresentation, after approval the documents forwarded to KEB and promptly honoured.

Arthur Vonchek, CEO of Bolero said: “We are very excited about the success of the live pilot which demonstrates both the reality as well as the substantial opportunities associated with straight through document presentation.”

Mr. Yutaka Kuge, General Manager, from “K” Line Pte Ltd. said: “Electronic BOL’s provide significant benefits to all parties in the supply chain. For ship-owners specifically, the most notable advantages are a fully traceable audit trail of BOL ownership and faster turnaround of administrative processes around BOL’s by elimination of physical BOL’s getting delayed or even lost during the transfer between the various parties.”

The ePresentation replaces the need for paper documentation, thereby saving the time for all parties involved, while accelerating the working capital cycle through faster and secure payment.

Summary

- Since its origin, more than 85 years, UCP, has governed documentary credits and is considered to be a fundamental component of international trade, as well as, addressing developments in banking, transport and insurance industries and providing great support, comprehensive and practical working assistance to bankers, lawyers, importers, exporters, transporters, academics and all the parties involved in international and domestic trade, so that revision for UCP 600 is a vital matter and will not fade away in order to keep pace with market needs and practices.

- URR provides a framework of rules to facilitate the business of documentary credits and the bank-to-bank reimbursement, thereby saving time and costs.

- ISBP serves as an aid to a beneficiary of a documentary credit in its creation and presentation of documents to banks, also it works as a checklist for document checkers to follow in the examination process under documentary credits.

- eUCP provides a framework of rules when dealing in electronic documents under documentary credits and accommodates the technological developments.

- The ICC always makes every effort to keep trade finance flowing smoothly around the world by creating standards and guidelines to avoid the confusion and conflicts between parties and continually adjust and overhaul the rules to reflect the changing nature of banking in trade.

Speak to our trade finance team

Our trade finance partners

- Letters of Credit / Documentary Credit Resources

- All Letters of Credit Topics

- Podcasts

- Videos

- Conferences