What is Receivables Discounting?

The above Supply Chain Finance techniques have been defined by the Global Supply Chain Finance Forum (BAFT, EBA, FCI, ICC and ITFA)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

What is Receivables Discounting?

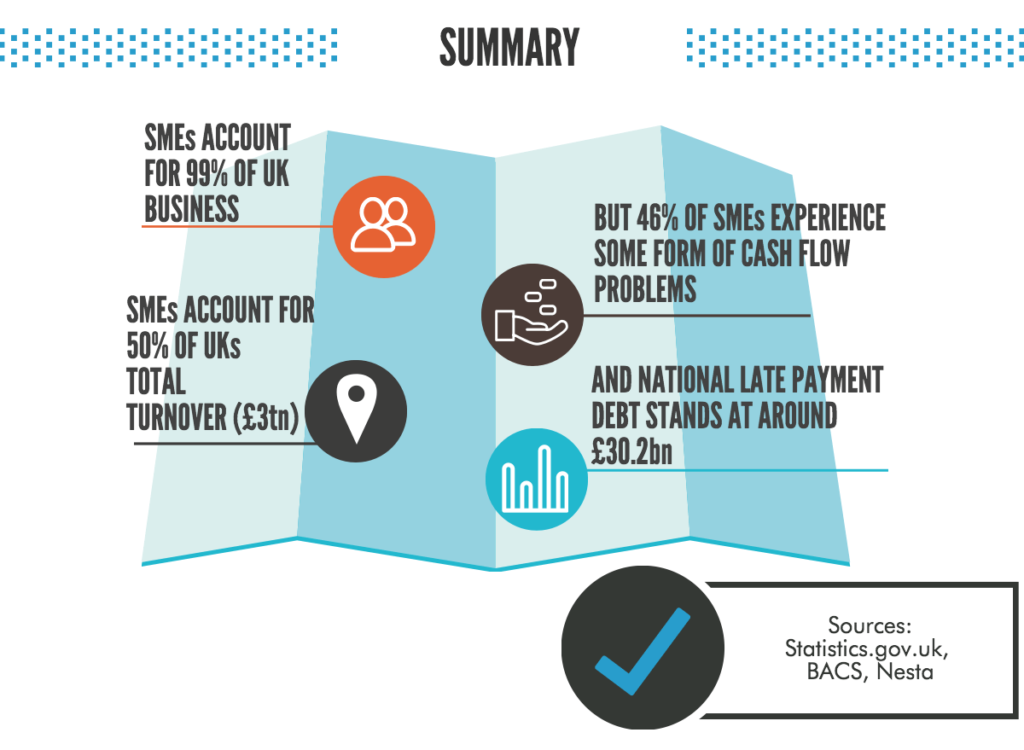

Receivables discounting is a type of asset financing which involves obtaining a short term loan against accounts receivable. It is first important to understand what a receivable looks like and the reason that this type of funding is subsequently used.

Receivables discounting can be used for many reasons. This type of financing is frequently used to help growing businesses access capital secured against invoices. Receivables discounting can help prevent companies running into working capital complications.

What is a receivable and what is receivables discounting?

A receivable is a promise of future incoming value into a company. This may be monetary worth or something else of capital worth. It is important to note that it is a future defined value flowing to the business and is not received at the point that a transaction is made. At its most basic form, this will be an invoice that is submitted to an end buyer when a product is purchased. The reason that the goods are not paid for on purchase is due to the end buyer being provided with credit days from the supplier. This attracts buyers to work with sellers, as they will have a period of time in which to provide payment. The reasons for these ‘credit terms’ may be varied; it will assist with the cash flow of the ultimate buyer, will allow an element of sell through of the stock prior to payment and will permit flexibility of the purchaser. This may also be a deciding factor for the purchaser; of who the supplier will be.

The concept of having credit terms is used to attract the end buyer. In the event that no credit terms are provided; payment is received at the point of delivery or pick up of the product.

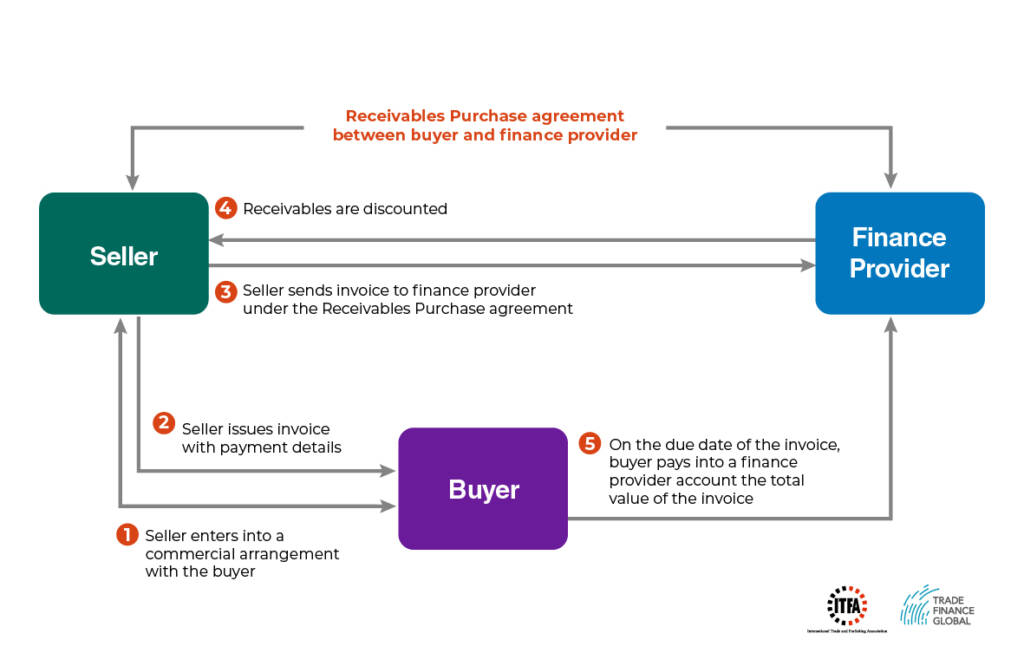

Diagram – Receivables Discounting

Why is providing credit terms a problem?

The cash flow of a business is of central importance, as it allows expansion and forward momentum. In order to grow, there is always a need for finance and so providing long term credit days can make expansion a difficult process. In effect, providing credit terms may starve the business of finance.

How can receivables discounting work to provide credit terms to a business?

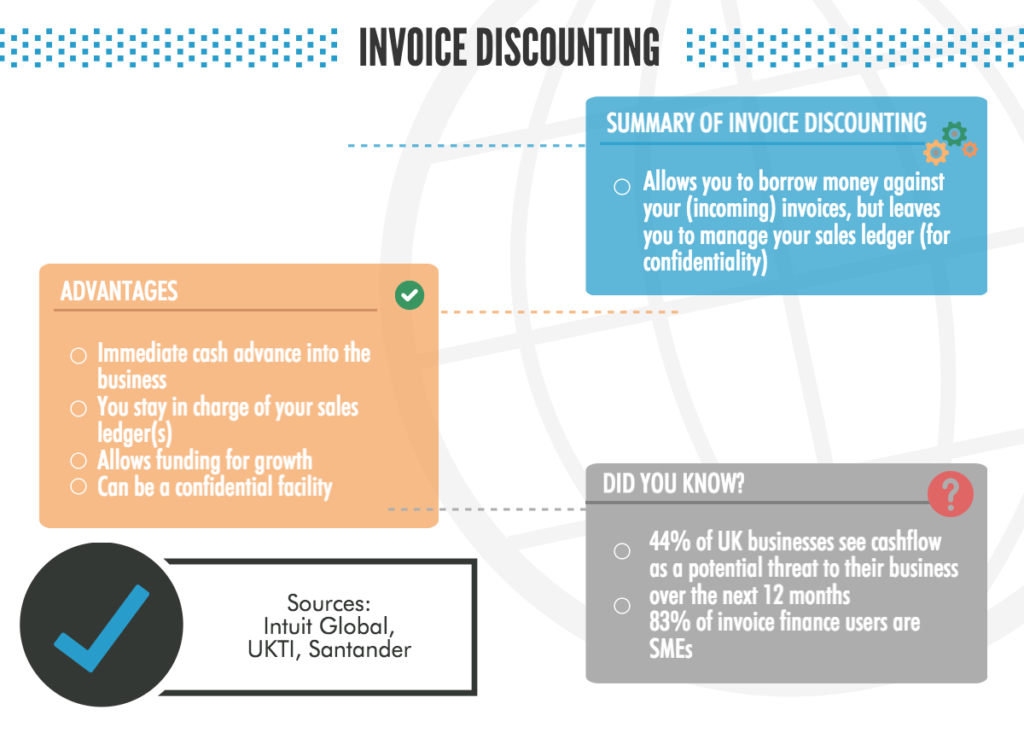

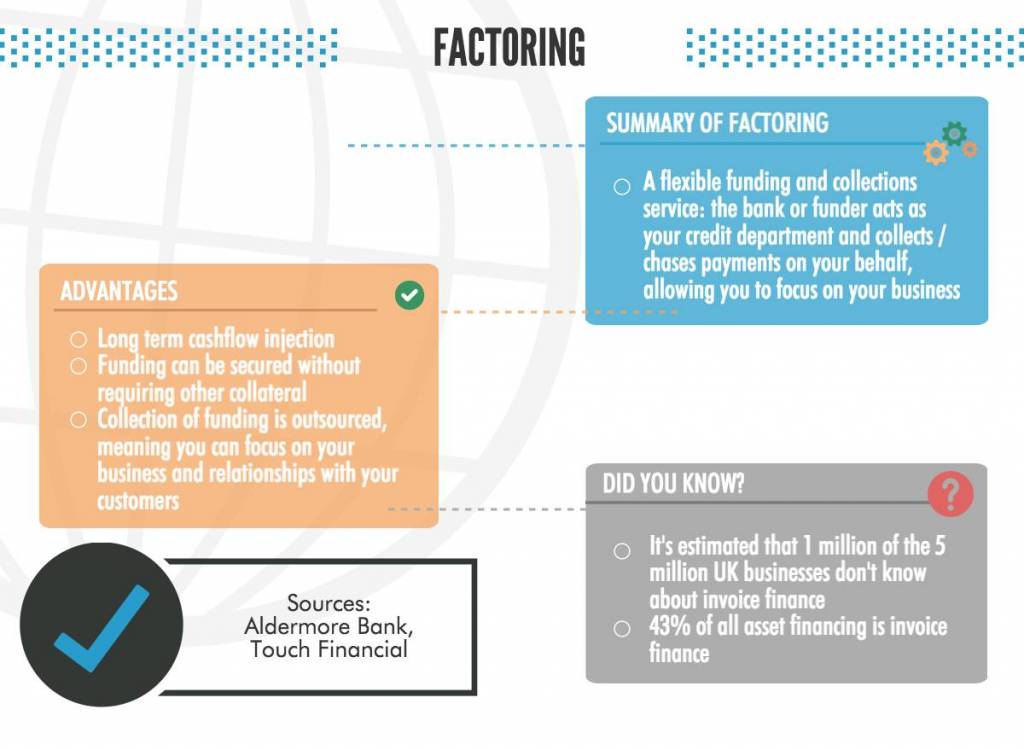

Receivables discounting (also known as receivables factoring) is a mechanism in which finance is provided against receivables; such as invoices. The typical way this will happen is for 75-90% of funding to be provided against the invoice value. In terms of chronology, at its most basic form an invoice is sent out to the end buyer; this is acknowledged and assigned in favour of the funder and a percentage of funding is advanced against it. When payment is made to the lender at the defined time; usually within 30, 60 or 90 days, the funder will deduct their fees and the amount lent or advanced. Any remaining funds are paid back to the borrower.

The process above is called receivables discounting or invoice finance. There are many other terms for it but at its most basic; funds are provided towards against an incoming receivable or invoice.

Download our receivables discounting infographic

Case Study

Wholesaler of soybean produce

Company X is exporting soybeans to the UK from Peru. The soybeans are stored in a warehouse in the UK until the customer wishes to buy the produce. A receivables discounting agreement would be used to enable Company X to receive funds once the end customer is sent an invoice and a funder agrees to discount the invoice (paying Company X on 30-90 day terms).

Our trade finance partners

- Supply Chain and Payables Finance Resources

- All Payables Finance Topics

- Podcasts

- Videos

- Conferences