What is Invoice Discounting?

The above Supply Chain Finance techniques have been defined by the Global Supply Chain Finance Forum (BAFT, EBA, FCI, ICC and ITFA)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Invoice discounting allows a company to receive funds soon after sending out an invoice and can be done on a batch or single invoice basis. This allows capital to be used in the business for general cash flow or expansion purposes. It also removes pressure from the company in looking for alternative types of funding and having additional assets to offer as security for these facilities.

What is invoice discounting?

Invoice discounting can be used for many reasons. It is usually the chosen form of financing where an established business is growing and has a specific customer or a number of invoices that they would like to raise finance against. However, this may not be on all their customer accounts and could not be on all invoices in relation to one specific customer.

Invoice discounting is relevant where a business has a number of customers and invoices are raised to those customers. Typical businesses have payment terms of 30, 60, 90 or 120 days; based on what is agreed. The customer will then have a certain amount of time to pay a company for an invoice that is issued. In the event that a master invoice discounting facility is entered into (this governs the process), then it allows the company to discount invoices with specific customers and up to the maximum value levels that are agreed.

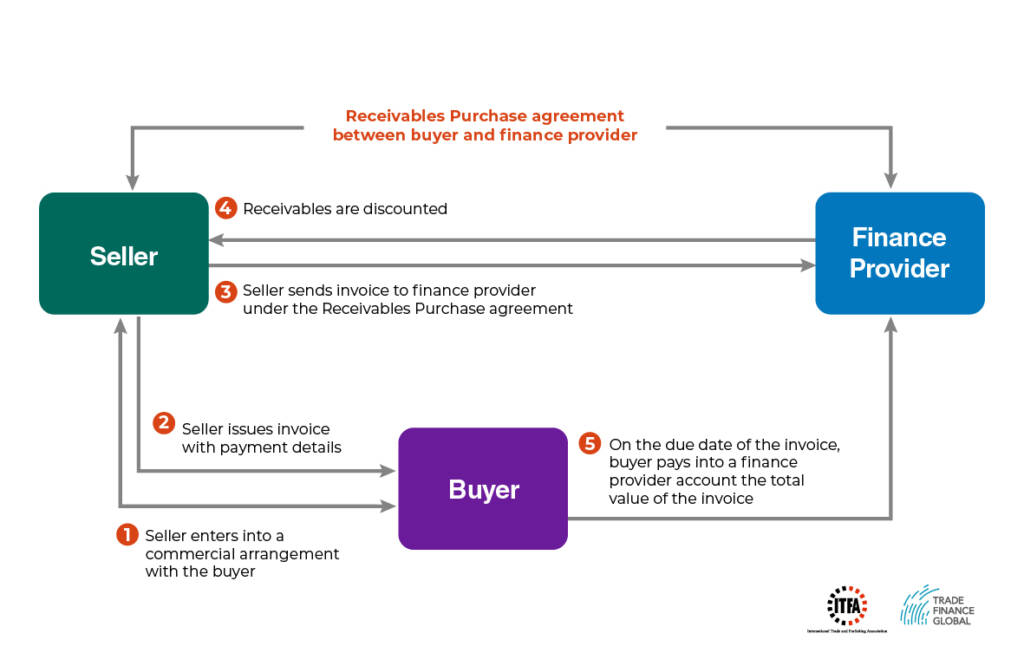

Diagram – How does invoice discounting work?

Benefits of invoice discounting

It is much simpler than a standard business loan, in terms of process and security offered. A business loan may require assets and other elements as security, but an invoice discounting facility will concentrate on the value of the invoice and sometimes the insurance backing of that facility. Invoices can also be discounted on a confidential basis, depending on what is agreed with funder. Therefore, the customer would not know that there is a third party funder who is involved. A business will also have the flexibility of deciding when they discount invoices, which can match up with their funding requirements.

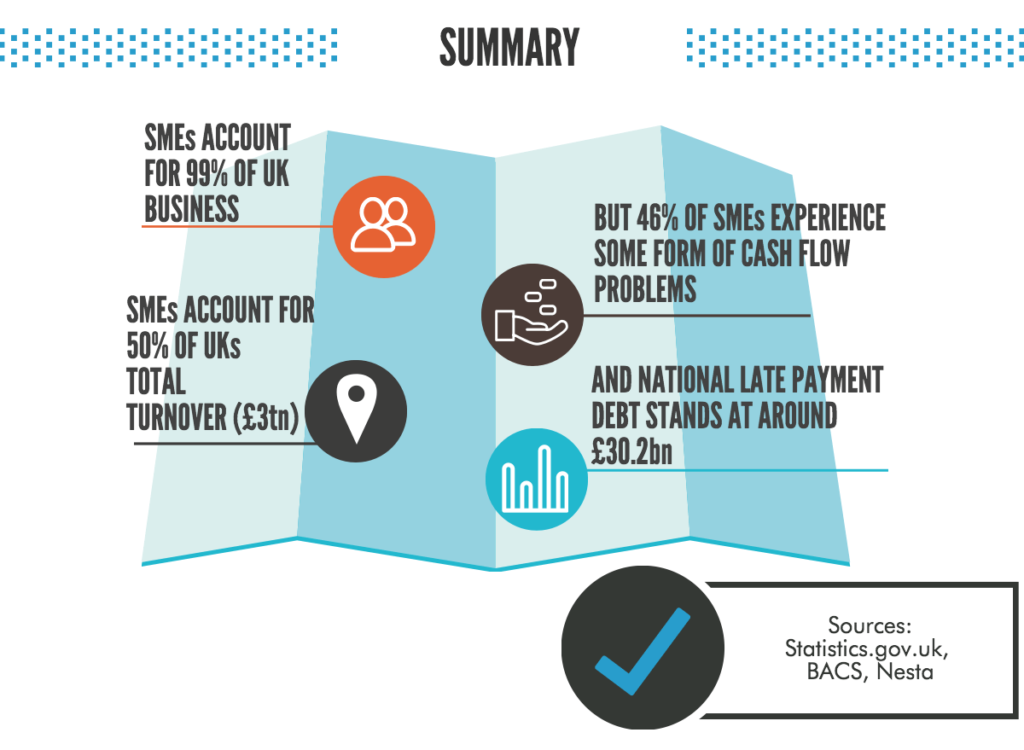

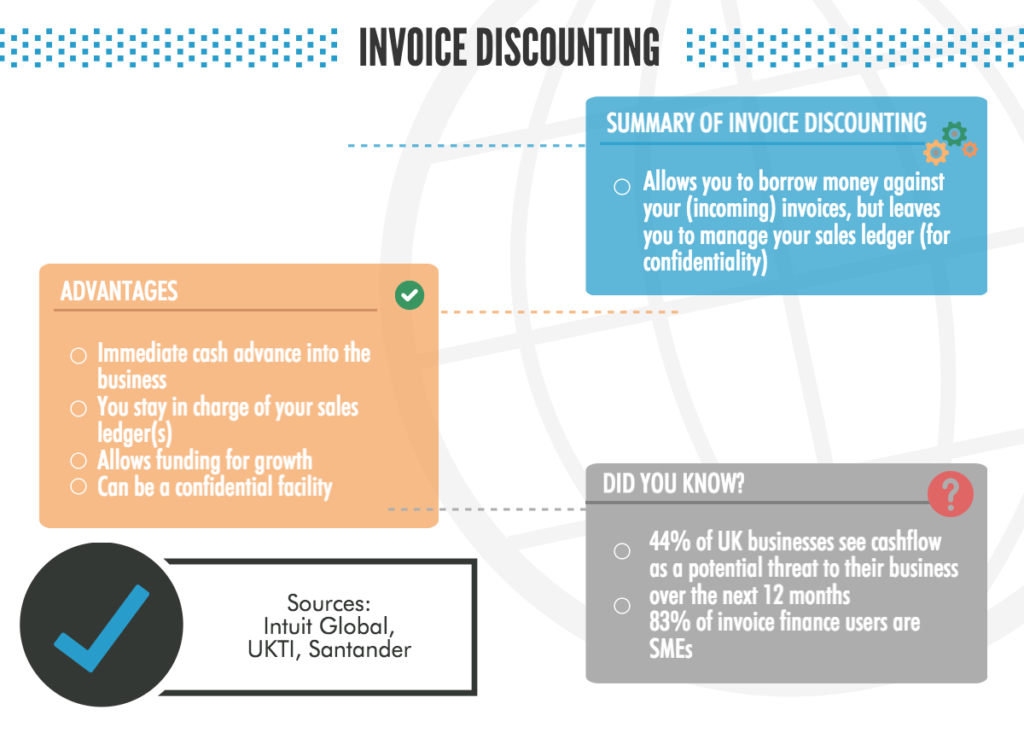

Download our invoice discounting infographic

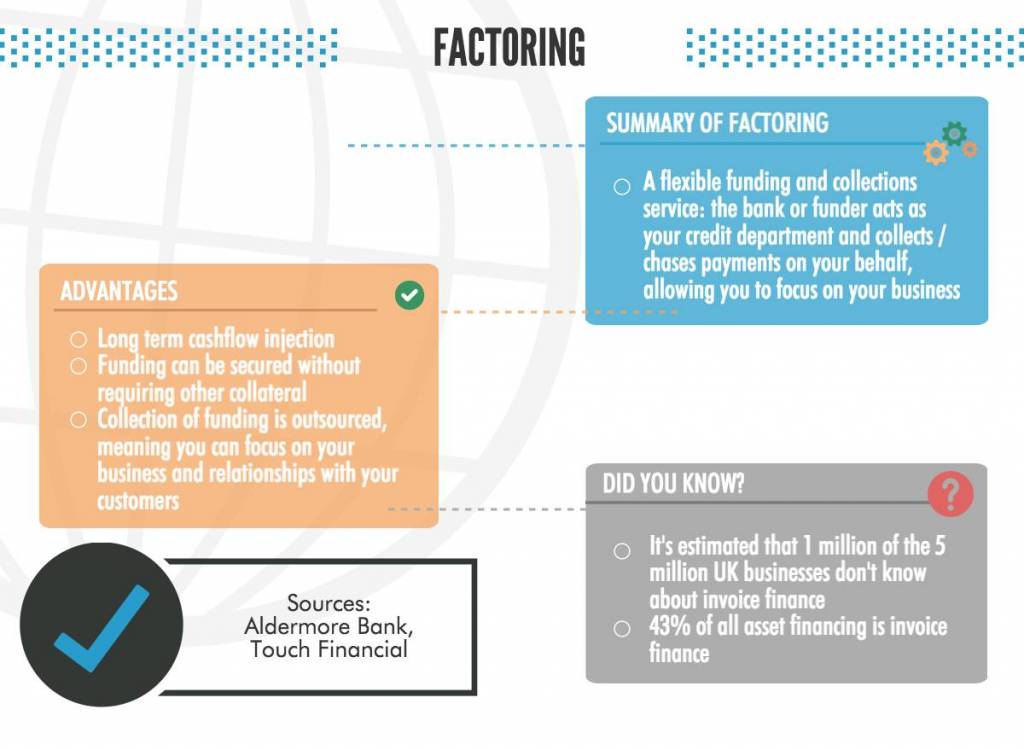

Want to find out more about invoice finance? Check out our handy infographic – a comprehensive guide which defines invoice discounting, factoring, as well as the differences between the two!

Case Study

Wholesaler of furnished goods

A furniture wholesaler sells to high street chain stores every month and sends out their invoices monthly. A couple of their customers have negotiated longer payment terms of 90 days. The company decides that they would like to receive finance against these invoices, so that they can re-invest the money into employing more sales people and stock in order to bring on new accounts. The funder agrees that they will advance 85% of the value of these invoices to the company. When payment is received, the funder will be paid their fees and the customer receives the remaining funds.

Our trade finance partners

- Invoice Finance Resources

- All Invoice Finance Topics

- Podcasts

- Videos

- Conferences