What is Invoice Factoring?

Content

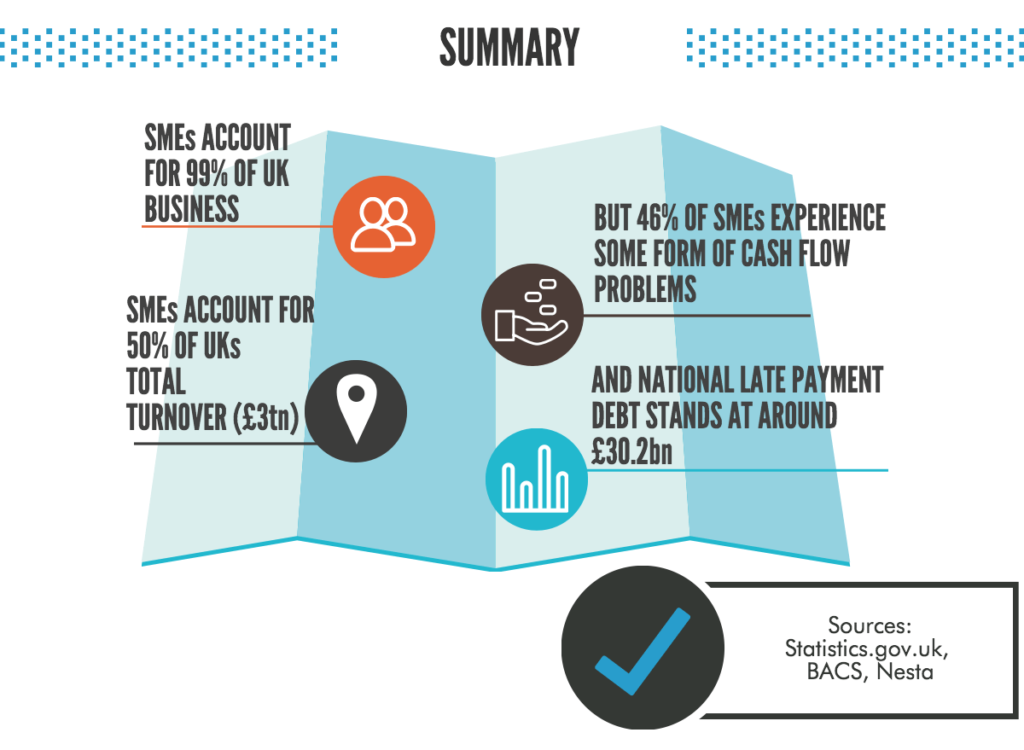

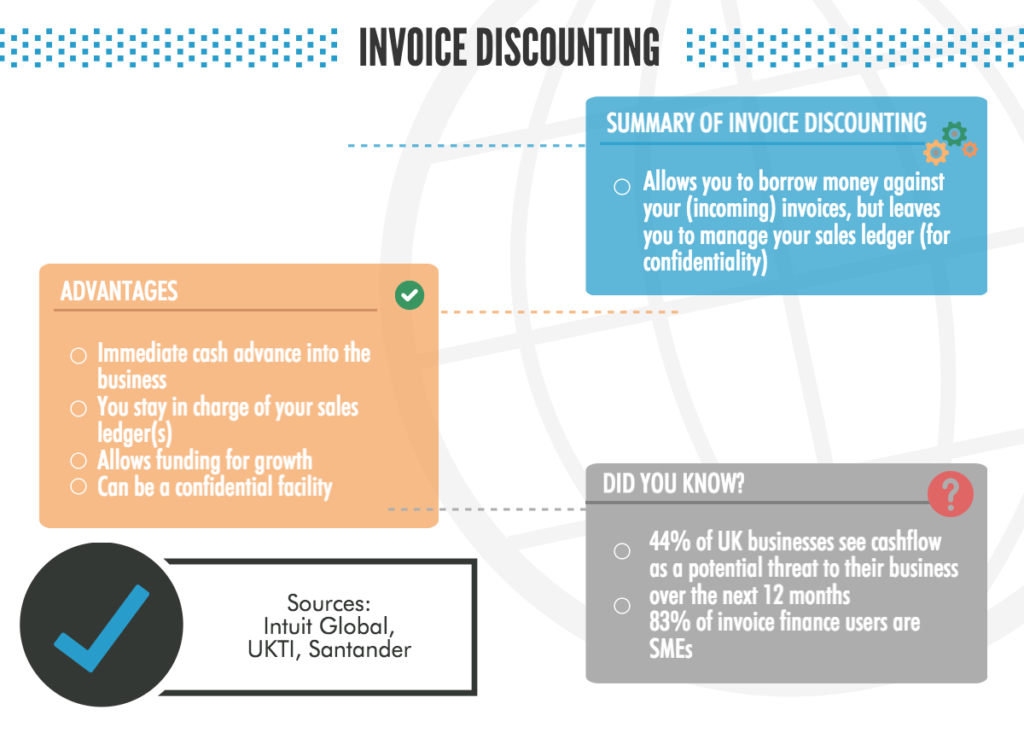

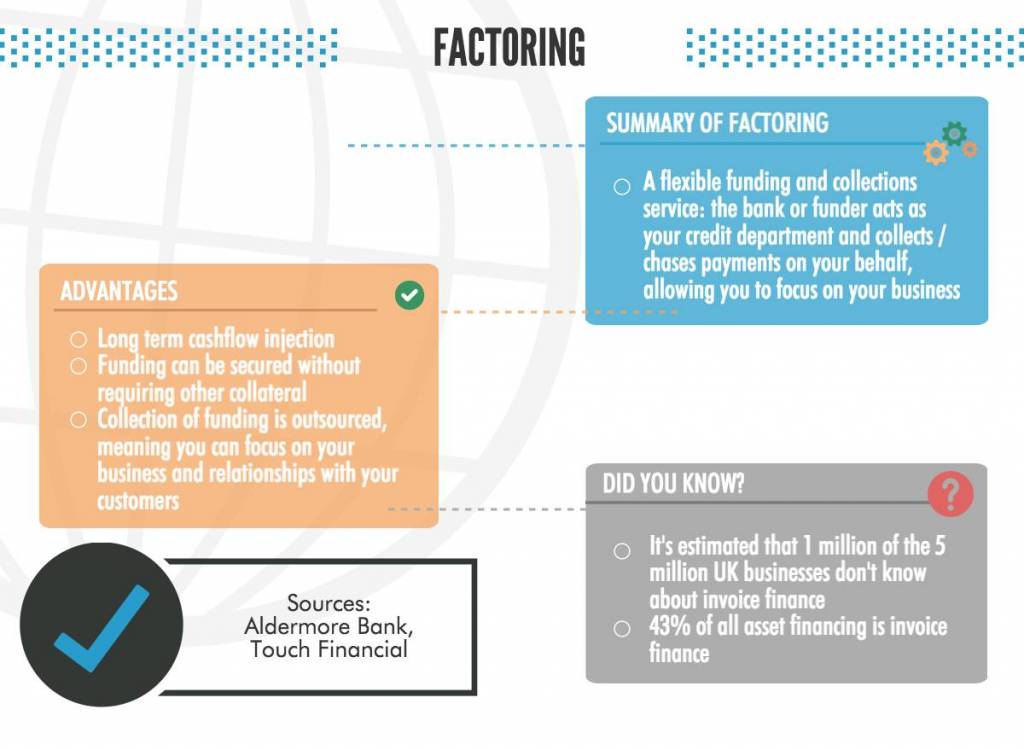

Invoice factoring allows a business to grow and unlock cash that is tied up in future income, so that it can re-invest that capital and time is not spent collecting payments. Thus, there is a removal of the unpredictable nature of waiting for payment so that revenue can be booked and capital is then available to spend.

Invoice Factoring – Overview

Invoice factoring is most typically used where the funder manages the customer collections and ledgers of the business. This allows them to have more control and most invoices are discounted when they are sent out. It is typically used with smaller businesses who have little or no credit control. However, the industry, size and growth trajectory of the business will all be looked at.

In simple terms, a company will send out an invoice to a customer, who will have pre-agreed payment terms. These are usually 30, 60, 90 and 120 day payment terms. A finance company (the factor) will look at the strength of the customers, the borrower and further possible security offered. Depending on the business, they may take over an element of the finance function from the business and advance a proportion of the funds (in relation to the invoice value) to the company soon after invoices are sent out. Usually, the factor will then work with the end customers to collect payments, remove their fees and send the remaining income onto the company.

How does it work?

As invoices are raised, the factoring company will provide a percentage of the face value of the invoice to the company e.g. 80%. Depending on the set up, the factoring company will then collect the debt from the customer, remove their fees and send the remaining funds onto the company.

The company raises an invoice which is sent out to the client, and a copy to the funder.

We can help your business look for the most appropriate and well placed funder, who will then arrange for payment, normally within 24 hours.

As part of the factoring arrangement, the funder collects the payment off the customer on your behalf.

You receive the rest of the invoice balance once the invoice is paid, less fees that the funder takes.

We’re 100% independent: working only for our businesses

Unlike some of our competitors, we are not tied to any lenders, we arrange a wealth of funding options for you in order to choose the most appropriate options for you.

Download our invoice factoring infographic

Benefits of invoice factoring

- Depending on the level of control that the funder takes, they will take some management over the ledger of the business and more generally, the credit control.

- The funder will also remove the difficulty and associated disadvantages of chasing customers for collection.

- Invoice factoring allows for a more stable income and confidence of growth in the company, as it allows payment and expansion as soon as invoices are raised.

Case Study

Toy Manufacturer

A toy company sells toys to a large superstore. They sell £100,000 worth of stock every month and get paid on 90-day payment terms. Thus, every time an invoice is sent out, the superstore pays 90 days later. A factoring company will assess the quality of the customer, amongst other things and a factoring facility will be set up. The factoring company will provide a pre-agreed percentage of the £100,000 to the borrower and may assist in managing the credit control of the business. They will then collect payment from the customer.

Our trade finance partners

- Supply Chain and Payables Finance Resources

- All Payables Finance Topics

- Podcasts

- Videos

- Conferences