Delivered at Place Unloaded (DPU) Incoterms® 2020 Rule

Contents

What is DPU?

DPU is an Incoterms® 2020 rule that stands for Delivered at Place Unloaded.

Under DPU the seller is generally responsible for export packing, loading charges, delivery, export duties and taxes, origin terminal charges, loading on carriage, carriage charges, and destination terminal charges.

The buyer then, is generally responsible for the delivery to the destination and import duties and taxes.

DPU is a new Incoterms rule for 2020.

While it is often considered as simply being a change of name from the previous DAT (Delivered At Terminal), it is in fact, just that little bit more.

Difference between Delivered at Place Unloaded (DPU) and Delivered At Terminal (DAT)

Delivered at Terminal (DAT) itself was introduced in 2010 as an expansion of DEQ (Delivered Ex Quay) to cover any mode of transport.

The implication in DAT was that the seller delivered the goods, unloaded, into a terminal, whether that be an open area of land such as a container yard or a covered warehouse such as at an airport.

Regrettably, that explanation was not clear in the wording of DAT, though its location before Delivered at Place (DAP) in the order of the 2010 rules tends to reinforce that.

The difference now between DPU and DAP is that it means any place, including the buyer’s premises and therefore is shown now after DAP.

This rule started out life in 1953 as EXQ (Ex Quay) and was renamed in Incoterms® 1990 as DEQ (Delivered Ex Quay), requiring the seller to deliver the goods unloaded from the vessel onto the quay (wharf).

Clearly, this referred only to goods directly loaded onto the vessel, such as bulk and break-bulk cargo.

In Incoterms® 2010, this rule was replaced by an expanded one to cover any mode of transport, DAT (Delivered at Terminal) where a “terminal” was described in the Guidance Note (as “information that is particularly helpful” according to the Introduction in that book) but not in the rule itself, as including “any place, whether covered or not, such as a quay, warehouse, container yard or road, rail or air cargo terminal.”

Clearly, it was envisaged that it referred to delivery into some form of transport terminal for the buyer to collect them after any import clearance formalities had been completed.

Fairly late in discussions for the Incoterms® 2020 rules, there were representations from a very small number of national committees to expand this rule to cover delivery to the destination outside a terminal and where the seller arranged unloading.

This could occur, for example, with specialised capital machinery being delivered to a site where the seller was also responsible for assembly and installation.

Thus, at almost the last minute, was borne DPU (Delivered at Place Unloaded). When the Drafting Committee revised DAT to DPU, it received support from an increased number of National Committees.

This rule differs from DAP in only one point: in DAP the seller delivers the goods at the nominated place not unloaded, while in DPU, they are unloaded.

In hindsight, a very good question would be, should this rule exist at all?

Why was A2 not split into two delivery options, as occurs with FCA?

Then there would have only been 10 Incoterms® 2020 rules.

Delivered at Place Unloaded Incoterms 2020 Rule – will it work?

Certainly, for land transport within the European and Central Asian land mass it is feasible. It represents what typically happens in common courier parcel deliveries, as the driver takes the parcel from the truck and hands it to the buyer.

It is even feasible for smaller airfreight parcels that the truck driver can lift.

How it will turn out in practice for heavier packages by airfreight and cross-ocean container shipments is yet to be seen.

Not only must the seller’s carrier obtain from the buyer the appropriate paperwork to take possession of the goods from the airline or shipping line but now it must also provide the means of unloading the truck at the destination place.

For a container, this could mean providing additional labour and a forklift plus a pallet jack for moving the goods within the container.

Add to that potential insurance and workplace safety issues when labour and machinery not employed or contracted by the buyer operate within the buyer’s premises.

Delivered at Place Unloaded (DPU) podcast

Delivered At Place Unloaded seller and buyer obligations

DPU A1 / B1 general obligations

A1 (General Obligations)

In each of the eleven rules, the seller must provide the goods and their commercial invoice as required by the contract of sale and any other evidence of conformity, such as an analysis certificate that might be relevant and specified in the contract.

Each of the rules also provides that any document can be in paper or electronic form as agreed in the contract, or if the contract makes no mention of this, then the rules default to what is customary.

The rules do not explicitly define what “electronic form” is. This ambiguity means that it can be anything from a .pdf file to a blockchain record or another format yet to be developed.

B1 (General obligations)

In each of the rules, the buyer must pay the price for the goods as stated in the contract of sale.

The rules do not refer to when the payment is to be made (e.g., before shipment, immediately after shipment, thirty days after shipment, etc.) or how it is to be paid (e.g., prepayment, against an email of copy documents, on presentation of documents to a bank under a letter of credit, etc.).

These matters should be specified in the contract.

DPU A2 / B2: delivery

A2 (Delivery)

The DAP and DPU rules require the seller to take on almost the maximum responsibility of placing the goods at the disposal of the buyer at the agreed destination place (or point within that place), but DAP does not require the goods to be unloaded from the arriving means of transport. This usually would be a truck but could be a train, barge, ship or even sometimes a chartered aircraft.

The DPU rule goes one step further, requiring the seller to unload the goods from the arriving means of transport.

DPU is the old DAT rule but expanded to mean any place to avoid the misunderstanding of the 2010 rule where many took it literally from its title to just mean a terminal, even though it meant anywhere from an open field to a covered warehouse including the buyer’s warehouse.

A common mistake with DAP and DPU is the belief that the destination will always be the buyer’s premises. This does not need not be the case, as the buyer could nominate anywhere it chooses. This could be the site of a new factory they are building for their client, it could be the container terminal in the destination country, or it could be somewhere else entirely.

Some shipments are specialised and require the seller to provide the necessary equipment to unload them. If this is the case, then the DPU rule should be used over DAP.

If the destination is a terminal, then the seller’s carrier would usually need to unload the means of transport or arrange for that unloading (such as the container from the truck delivering it from the quay or the goods from the chartered aircraft), again making it DPU not DAP.

The delivery must be made on the agreed date or within the agreed period.

B2 (Delivery)

The buyer’s obligation is to take delivery when the goods have been delivered, as described in A2.

DPU A3 / B3: transfer of risk

A3 (Transfer of risk)

In all the rules, the seller bears all risks of loss or damage to the goods until they have been “delivered” in accordance with A2 described above.

The exception is loss or damage in circumstances described in B3 below, which varies depending on the buyer’s role in B2.

B3 (Transfer of risk)

The buyer bears all risks of loss or damage to the goods once the seller has “delivered” them as described in A2.

If the buyer fails to inform the seller exactly where they need to deliver the goods, or if the buyer fails to import-clear the goods, then they bear the risk of loss or damage to the goods from the agreed date or agreed period for delivery.

For example, if the seller despatches the goods to the buyer and they are held indefinitely by the importing country’s authorities because the buyer failed to obtain the necessary import permit, then it is the buyer who bears the risk.

DPU A4 / B4: carriage

A4 (Carriage)

Under DPU, the seller must arrange, or contract for, and bear the cost of carriage to the named place of destination. If there is an agreed point within that destination, then to that point.

As the seller has to arrange the carriage, it needs to know from the buyer if there is a specific point in the place of delivery to which the goods must be transported.

For example, if the destination is shown as simply “Budapest, Hungary”, where in that large metropolis is the seller’s carrier to leave the goods? It could be that it is to be the buyer’s premises or a particular location, say in an empty building site, the carrier’s premises, the airport, the container yard, or a particular quay on the river… the exact point should be agreed upon.

If the exact location is not specified, then the seller can select the point that best suits its purpose, which will usually be the cheapest option, such as a cargo terminal.

For both DAP and DPU, if the delivery at the destination is to occur after the buyer completes any necessary import formalities, then the buyer must bear the cost of storage due to delays in those formalities being completed (assuming the seller has provided the buyer with necessary documents in time).

Under DPU, it is the seller who bears the cost of any storage due to delays in import clearance.

B4 (Carriage)

Under DPU, the buyer has no obligation to the seller to arrange a contract of carriage.

DPU A5 / B5: insurance

A5 (Insurance)

Despite the seller having the risk of loss or damage to the goods up to the delivery point, the seller does not have an obligation to the buyer to insure the goods.

B5 (Insurance)

Since the seller has the risk of loss or damage to the goods up to the delivery point, the buyer does not have an obligation to the seller to insure the goods.

DPU A6 / B6: delivery / transport document

A6 (Delivery / Transport document)

The seller (at its own cost) must provide the buyer with any document the buyer needs to take over the goods.

The specific form of this documentation will depend on the agreement in the contract and could be as simple as a receipt that the buyer is to sign. With DPU, it may be the case that the buyer must import-clear the goods, so a copy of the seller’s transport document might be needed as evidence of the export and the date of shipment.

B6 (Delivery / Transport document)

Under DPU, the buyer is obligated to accept the documentation provided in A6, since it actually takes no part in the transport process.

DPU A7 / B7: export / import clearance

A7 (Export / Import clearance)

Where applicable, the seller must (at its own risk and cost) carry out all export clearance formalities required by the country of export, such as licences or permits, security clearance for export, or pre-shipment inspection.

Additionally, as the point of delivery under DPU is in the importing country, the seller must also carry out and pay for any formalities required by any country of transit before that delivery occurs.

The seller has no obligation to arrange any import clearances.

However, if the buyer requests it (at its own risk and cost), the seller must assist in obtaining any documents or information which relate to formalities required by the country of import, such as permits or licences, security clearance, or pre-shipment inspection required by the authorities.

B7 (Export / Import clearance)

When using DPU, the buyer must assist the seller (at the seller’s request, risk, and cost) in obtaining any documents or information needed for all export-related formalities required by the country of export and any country of transit.

Where applicable, the buyer must carry out and pay for all formalities required by the country of import.

These include:

- licences and permits required for import,

- import clearance,

- security clearance for import,

- pre-shipment inspection, and

- any other official authorisations and approvals.

DPU A8 / B8: checking / packaging / marking

A8 (Checking / Packaging / Marking)

In all rules, the seller must pay the costs of any checking operations which are necessary for delivering the goods, such as checking quality, and measuring, packaging, weighing, or counting the goods.

The seller must also package the goods (at its own cost) unless it is usual for this particular good to be sold unpackaged, such as in the case of bulk goods.

The seller must also take into account the transport of the goods and package them appropriately unless the parties have agreed in their contract that the goods be packaged or marked in a specific manner.

B8 (Checking / Packaging / Marking)

In all rules there is no obligation from the buyer to the seller as regards packaging and marking. There can, in practice, however, be agreed exceptions, such as when the buyer provides the seller with labels, logos, or similar.

DPU A9 / B9: allocation of costs

A9 (Allocation of costs)

Under DPU, the seller must pay all costs until the goods have been delivered under A2, except any costs the buyer must pay as stated in B9. The only difference between DAP and DPU is that the seller pays for the unloading of the goods.

This means that under DPU, the seller must pay:

- any transport costs resulting from the contract of carriage, including costs of loading the goods and any transport-related security,

- unloading costs,

- the cost of providing the buyer with proof that the goods have been delivered,

- any costs, export duties, and taxes (where applicable) related to export clearance and any transit clearance

Further, if the seller requests that the buyer provide any information or documents in relation to export clearance, then the seller must pay the buyer for these costs.

B9 (Allocation of costs)

Under DPU, the buyer must pay:

- any duties, taxes, and other costs for import clearance, where applicable, and

- all costs relating to the goods from when they have been delivered (other than those that are payable by the seller).

Further, if the buyer requests the seller to assist in obtaining information or documents needed for the buyer to effect import formalities, then the buyer must reimburse the seller’s costs.

Additionally, if the seller has advised that the goods have been clearly identified as the goods under the contract, the buyer must pay any additional costs that arise from the buyer failing to give notice in accordance with B10.

DPU A10 / B10: notices

A10 (Notices)

The seller must give the buyer any notice the buyer needs to receive the goods.

B10 (Notices)

If the parties agree in the contract, the buyer must give the seller sufficient notice of when and the point within the place of destination where they require delivery.

The contract will usually detail how much notice the buyer must give, as this is likely to vary with the modes of transport used.

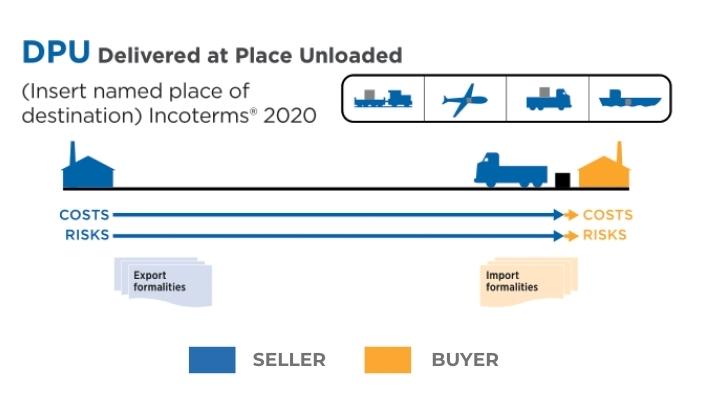

Delivered at Place Unloaded (DPU) diagram 2024

Diagram: DPU – obligations from the seller and buyer, and where the transfer of risk between each party is transferred. Source: ICC

Delivered at Place Unloaded and letters of credit

DPU transactions are largely incompatible with payment by the typical letter of credit (LC).

With delivery only occurring at the very end of the transport chain, an LC calling for the presentation of, say, a bill of lading consigned to order and blank endorsed would be a contradiction to DPU.

The situation becomes even more complex if the issuing bank routinely demands bills of lading to be consigned to its order, which is then endorsed over to the applicant (the buyer) to enable the buyer to take possession of the goods.

In such cases, the seller’s security is at risk if the buyer fails to take delivery of the goods. This risk is heightened by the fact that the seller’s truck may be left waiting at the buyer’s specified delivery location for unloading, all the while depending on the issuing bank to fulfil its obligations under the LC before the transfer of goods can be completed.

Imagine how strange it would be for the seller to arrive at the buyer’s receiving dock, obtain some form of delivery receipt from the buyer, send it back to their office overseas, and present it to their bank, which sends it to the issuing bank who hopefully honours the presentation.

Meanwhile, the truck is sitting blocking the receiving dock for a couple of weeks, with the driver having set up camp in the truck’s cabin until the office back home sends word that they have received payment and can now unload!

DPU Video – What is the importance of the new Incoterms® 2020 rules in light of Brexit?

“Incoterms” is a registered trademark of the International Chamber of Commerce.

Refer to ICC publication no. 723E for the text.

Publishing Partners

- Incoterms Resources

- All Incoterms Topics

- Podcasts

- Videos

- Conferences