Carriage and Insurance Paid To (CIP) Incoterms® 2020 Rule

Contents

Carriage and Insurance Paid To (CIP) – Incoterms® 2020 Rules [UPDATED 2024]

Carriage and Insurance Paid To (CIP) is an Incoterms® 2020 rule that requires the seller to take out maximum insurance cover for the buyer’s risk.

Aside from this insurance requirement, CIP is similar to CPT.

Introduction to Carriage and Insurance Paid To (CIP)

Carriage and Insurance Paid To (CIP) is an Incoterm where the seller is responsible for the delivery of goods to an agreed destination in the buyer’s country, must pay for the cost of this carriage, and must take out maximum insurance cover for the buyer’s risk.

The seller’s risk, however, ends once they have placed the goods on the ship at the origin destination. The risk is passed when the first carrier receives the goods.

Carriage and Insurance Paid to is eligible for any form of transportion.

Carriage and Insurance Paid To (CIP) Incoterms 2020 Rule – key difference to CPT

CIP dates back to the early days of international shipping and has been largely unchanged since.

Carriage Insurance Paid To (CIP) and Carriage Paid To (CPT) may be similar Incoterms rules, but they have one key difference: insurance.

Under CPT, the seller is responsible for:

- export packing,

- loading charges,

- delivery to port/place,

- export duties and taxes,

- origin terminal charges,

- loading on carriage,

- carriage charges, and

- destination terminal charges.

and the buyer is responsible for:

- Delivery to destination and

- import duties and taxes.

Responsibility for insurance is not explicitly delineated in CPT.

CIP follows this same structure, except that it adds insurance to the seller’s list of responsibilities. CIP is one of only two Incoterms rules explicitly laying out the responsibility for insurance (the other being Cost, Insurance, and Freight (CIF)).

This typically will be an original insurance policy covering just that transaction or a certificate issued by the insurer under the seller’s existing open marine policy.

Both of these will normally show the seller as the “insured” or “assured” and will require the seller to endorse the document on the reverse such that the buyer or any bona fides holder with an insurable interest in the goods at the time of loss or damage occurred can claim.

At a minimum, the insurance must cover the price provided in the contract plus 10 per cent (i.e. 110 per cent) and must be in the currency of the contract.

Carriage and Insurance Paid To (CIP) podcast

Carriage and Insurance Paid To (CIP) seller and buyer obligations – rule by rule

CIP A1 / B1 general obligations

A1 (General Obligations)

In each of the eleven rules, the seller must provide the goods and their commercial invoice as required by the contract of sale and any other evidence of conformity, such as an analysis certificate that might be relevant and specified in the contract.

Each of the rules also provides that any document can be in paper or electronic form as agreed in the contract, or if the contract makes no mention of this, then the rules default to what is customary.

The rules do not explicitly define what “electronic form” is. This ambiguity means that it can be anything from a .pdf file to a blockchain record or another format yet to be developed.

B1 (General obligations)

In each of the rules, the buyer must pay the price for the goods as stated in the contract of sale.

The rules do not refer to when the payment is to be made (e.g., before shipment, immediately after shipment, thirty days after shipment, etc.) or how it is to be paid (e.g., prepayment, against an email of copy documents, on presentation of documents to a bank under a letter of credit, etc.).

These matters should be specified in the contract.

CIP A2 / B2: delivery

A2 (Delivery)

Under CIP, the seller “delivers” the goods by handing them over to its contracted carrier on the agreed date or within the agreed period (not when the goods reach the final destination).

There has in the past been some confusion because Incoterms® 2000 referred to “the first carrier” if there were subsequent carriers.

In practice, there may well be several carriers contracted in turn by the seller’s contracted carrier, such as the truck collecting the goods and taking them to the airport terminal, the cargo handler contracted by the airline to move the goods to the aircraft and load them onto it, the airline itself, and the repeat of these at the other end. But the only carrier of concern is the carrier contracted to move the goods from the point of delivery to the destination.

Most importantly, delivery occurs when the seller passes the goods to their carrier to transport them, not when the goods reach the destination.

B2 (Delivery)

The buyer must take delivery when they have been handed to the seller’s carrier and physically receive the goods at the named place, or point within that place, of destination.

CIP A3 / B3: transfer of risk

A3 (Transfer of risk)

In all the rules, the seller bears all risks of loss or damage to the goods until they have been “delivered” in accordance with A2 described above.

The exception is loss or damage in circumstances described in B3 below, which varies depending on the buyer’s role in B2.

B3 (Transfer of risk)

The buyer bears all risks of loss or damage to the goods once the seller has “delivered” them as described in A2.

If the contract requires the buyer to inform the seller of the time for dispatching the goods or the point of receiving the goods within the destination place, and the buyer fails to do so, then the buyer bears the risk of loss or damage to the goods from the agreed date or the end of the agreed period.

For example, if the buyer does not inform the seller where they are to send the goods, how can the seller dispatch them?

If the seller has clearly identified the goods, then the risk transfers to the buyer either on the agreed date or at the end of the agreed period.

CIP A4 / B4: carriage

A4 (Carriage)

Under CIP, the seller must contract for the carriage of the goods or procure such a contract if this is one leg of a “string” sale.

The contract must be from the place of delivery and maybe an agreed point within that place. It must be made on “usual terms” and for the “usual route in a customary manner of the type used by the carriage of the type of goods sold.” If the seller and buyer agree on specific matters regarding the contract of carriage, that is well and good, but if they don’t, then the seller must arrange it in the usual manner for those goods.

As the seller has to arrange the carriage it needs to know from the buyer if there is a specific point in the place of destination to which the goods must be transported.

For example, if the destination is shown as simply “New Delhi, India”, where in that large metropolis is the seller’s carrier to leave the goods?

It could be that it is to be the buyer’s premises, or a particular location, say in a green-fields building site, or the carrier’s premises, or the airport, or the container yard… the exact point should be agreed upon. If it is not, then it is the seller’s choice to select the point that best suits its purpose, which will usually be the cheapest option, such as a cargo terminal.

If the delivery at the destination is to occur after the buyer completes any necessary import formalities, then the cost of storage due to delays in those formalities being completed is for the buyer, always assuming the seller has provided the buyer with necessary documents in time.

The seller must comply with any transport-related security requirements for the whole of the transport to the destination.

B4 (Carriage)

Under CIP, the buyer has no obligation to the seller to arrange a contract of carriage.

CIP A5 / B5: insurance

A5 (Insurance)

Under CIP, the seller must arrange a contract of insurance at its own cost to cover the buyer’s risks. This cover must be of the level provided by LMA/IUA Institute Cargo Clauses (A) or similar, dependent on the mode of transport used, often referred to generally as “all risks” as it covers all manner of risks with specific exclusions.

If the buyer requests, the seller must also arrange (at the buyer’s cost) additional cover under the LMA/IUA Institute War Clauses (Cargo) and Institute Strikes Clauses (Cargo) or similar dependent on the mode of transport unless such cover is already included, as it usually is, with the “all risks” insurance.

The amount of the insurance must be at least 110 per cent of the invoice value and in the currency of that invoice and contract. It must cover the goods for at least the duration from the point of delivery (as described in A2 above) to the named place of destination. Often, in contracts of sale and letters of credit, the stipulation is the unnecessary wording “warehouse to warehouse”.

The seller must provide the buyer with a separate contract or a certificate under an existing policy giving the details of the shipment to enable the buyer, or anyone else having an insurable interest in the goods, to claim from the insurer. This document usually shows the seller as the insured and is then endorsed by the seller on the back of the original in blank or with a specific endorsement.

If the buyer requests it, the seller must also provide them (at the buyer’s expense) with information that the buyer needs to arrange any additional insurance.

B5 (Insurance)

Despite the buyer having the risk of loss or damage to the goods from the delivery point, the buyer does not have an obligation to the seller to insure the goods.

However, the buyer must provide the seller, if requested, with any information it needs to arrange any additional insurance requested by the buyer under A5.

For example, the seller might need to know the location of the destination warehouse so its insurer can assess the risk and levy an appropriate premium.

CIP A6 / B6: delivery / transport / document

A6 (Delivery / Transport document)

When using CIP, the seller must provide the buyer (at the seller’s cost) with the usual transport documents for the transport agreed under A4, if it is customary or the buyer requests it.

As CPT and CIP cover any mode of transport, the specific form of the transport documentation will depend on the specific mode (or modes) used.

If the modes include carriage by sea (such as in full container load (FCL) or less than container load (LCL) transactions) then the seller is usually responsible for obtaining a sea waybill or bill of lading.

If the latter is issued in a negotiable form and in several originals, then a full set of those originals must be presented to the buyer, sometimes through the seller’s bank to the buyer’s bank under a letter of credit.

If the mode includes the goods going by air then typically an air waybill will be issued and if requested the seller will be given one “original for shipper” but this is not a negotiable transport document.

Shipment by truck might involve the issue of a CMR in Europe (which stands for “Convention on the Contract for the International Carriage of Goods Wholly or Partly by Road“) or simply some form of consignment note or truck waybill. These, too, are not negotiable.

Shipment by rail similarly will usually be covered by some form of rail consignment note that is not negotiable.

The transport document must cover the movement of the contracted goods within the agreed period for shipment. If it is agreed, then this document must enable the buyer to claim the goods from the carrier at the named destination and, subsequently, enable the buyer to sell the goods in transit to a secondary buyer by transferring that document. This would usually be in the form of a negotiable bill of lading.

B6 (Delivery / Transport document)

Under CIP, the buyer must accept the transport document provided by the seller so long as it is in conformity with the contract.

CIP A7 / B7: export / import clearance

A7 (Export / Import clearance)

CIP, like all the multimodal rules, is suitable for both domestic and international transactions.

Where applicable, the seller must (at its own risk and cost) carry out all export clearance formalities required by the country of export, such as licences or permits, security clearance for export, or pre-shipment inspection.

The seller has no obligation to arrange any transit or import clearances.

However, if the buyer requests it (at its own risk and cost), the seller must assist in obtaining any documents or information which relate to formalities required by the country of transit or import, such as permits or licences, security clearance, or pre-shipment inspection required by the authorities.

B7 (Export / Import clearance)

Where applicable, the buyer must assist the seller (at the seller’s request, risk, and cost) in obtaining any documents or information needed for all export-related formalities required by the country of export.

Where applicable, the buyer must carry out and pay for all formalities required by any country of transit and the country of import.

These include:

- licences and permits required for transit,

- import licences and permits required for import,

- import clearance,

- security clearance for transit and import,

- pre-shipment inspection, and

- any other official authorisations and approvals.

Under CIP, these are the buyer’s responsibility because they occur after “delivery” by the seller.

At first glance it might seem strange that both seller and buyer have responsibility for pre-shipment inspections. To clarify, the seller is responsible if it is a requirement of the country of export, and the buyer is responsible if it is a requirement of the country of transit or import.

CIP A8 / B8: checking / packaging / marking

A8 (Checking / Packaging / Marking)

In all rules, the seller must pay the costs of any checking operations which are necessary for delivering the goods, such as checking quality, and measuring, packaging, weighing, or counting the goods.

The seller must also package the goods (at its own cost) unless it is usual for this particular good to be sold unpackaged, such as in the case of bulk goods.

The seller must also take into account the transport of the goods and package them appropriately unless the parties have agreed in their contract that the goods be packaged or marked in a specific manner.

B8 (Checking / Packaging / Marking)

In all rules there is no obligation from the buyer to the seller as regards packaging and marking. There can, in practice, however, be agreed exceptions, such as when the buyer provides the seller with labels, logos, or similar.

CIP A9 / B9: allocation of costs

A9 (Allocation of costs)

The seller must pay all costs until the goods have been delivered under A2, except any costs the buyer must pay as stated in B9.

This means that under CIP, the seller must pay:

- the costs of insurance,

- any transport costs resulting from the contract of carriage, including costs of loading the goods and any transport-related security,

- the cost of providing the buyer with proof that the goods have been delivered,

- unloading costs at the agreed destination (if this is included in the contract of carriage, which it typically is for most shipments),

- any costs of transit included in the contract of carriage, and

- any costs, export duties and taxes, where applicable, related to export clearance.

Further, if the seller requests that the buyer provide any information or documents in relation to export clearance, then the seller must pay the buyer for these costs.

B9 (Allocation of costs)

Under CIP, the buyer must pay:

- unloading costs (unless the seller paid them under the contract of carriage),

- any costs of the country of transit (unless they have been paid by the seller under the contract of carriage),

- any duties, taxes, and other costs for import clearance, where applicable, and

- all costs relating to the goods from when they have been delivered (other than those that are payable by the seller).

Further, if the buyer requests the seller to assist in obtaining information or documents needed for the buyer to effect insurance and import formalities, then the buyer must reimburse the seller’s costs.

CIP A10 / B10: notices

A10 (Notices)

The “C” Incoterms rules (i.e., CFR, CIF, CPT, CIP), as we have seen before, involve two distinct points:

- The seller must give the buyer notice that the goods have been “delivered” (per the conditions in A2).

- The seller must give the buyer any notice that the buyer will need to enable them to receive the goods.

The manner in which this will be done is usually detailed in the contract. It could be as simple as an email or might require copies of shipping documents being delivered.

B10 (Notices)

If the parties agree in the contract that the buyer is entitled to determine the time for the seller to deliver the goods, and possibly more importantly, the point within the named place of destination where it will receive the goods, the buyer must give the seller sufficient notice.

The contract will usually detail how much notice is to be given, and this might vary with the modes of transport.

Carriage and Insurance Paid To (CIP) advantages and disadvantages

CIP first appeared in Incoterms® 1980 as standing for Freight Carriage and Insurance Paid To but was shortened in the 1990 rules.

The only difference between CPT and CIP is that the CIP seller must contract for insurance against the buyer’s risk. The level of cover has been changed in Incoterms® 2020 to be the maximum of Institute Cargo Clauses (A), (Air) or similar, for 110% of the CIP value, or similar — what is sometimes referred to as an “all risks” cover.

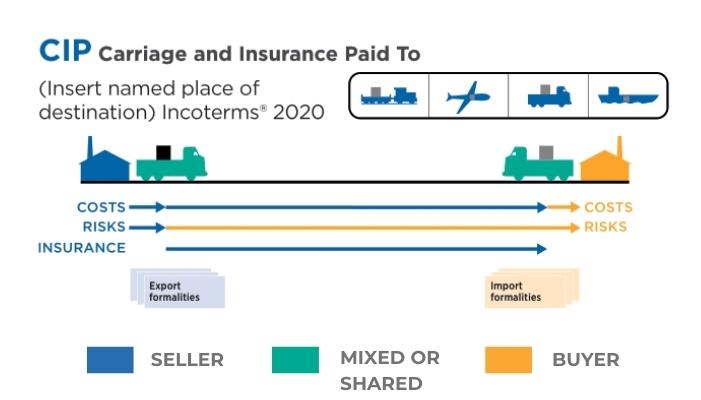

Carriage and Insurance Paid To (CPT) diagram 2024

Diagram: CIP – obligations from the seller and buyer, and where the transfer of risk lies when shipping goods from the seller’s factory to the destination place of the buyer. Source: ICC

Carriage and Insurance Paid To (CIP) and letters of credit (LC)

If payment is by LC, the seller should be careful about the wording as some issuing banks have either not progressed beyond the 1970s or simply make up their own clauses.

The LC should ideally call for “One original of insurance policy or certificate for 110 per cent of full CIP value of the goods shipped covering Institute Cargo Clauses (A) or (Air), Institute War Clauses (Cargo) or (Air Cargo) and Institute Strikes Clauses (Cargo) or (Air Cargo)”.

Banks love to add nonsense clauses like “claims payable in X country”, which in the 21st century is outdated thinking as insurers no longer hand over cheques. They pay electronically, usually from wherever their head office is.

Any wording such as “in the currency of the draft” is equally nonsense as the insurer has no idea of what the draft is, and the LC rules require the insurance to be in the LC currency anyway, so it need not be said in the LC itself.

Another favourite of bankers who have never read the Institute Cargo Clauses (A) wording is to include in the LC a requirement for the insurance document to state “from seller’s warehouse to buyer’s warehouse” or words to that effect.

ICC(A) article 8.1 is already clear as to the duration of coverage, and such words on the document either would not make a scrap of difference or could possibly lead to a problem.

Nothing more is needed than the above words. Anything more is usually redundant or dangerous and could lead to a discrepancy.

CIP video – Why have Incoterms® 2020 been updated and what are the key tips for buyers and sellers?

“Incoterms” is a registered trademark of the International Chamber of Commerce.

Refer to ICC publication no. 723E for the text.

Publishing Partners

- Incoterms Resources

- All Incoterms Topics

- Podcasts

- Videos

- Conferences