Cost, Insurance and Freight (CIF) Incoterms® 2020 Rule

Contents

Cost, Insurance and Freight (CIF) – Incoterms® 2020 Rules [UPDATED 2024]

Cost, Insurance and Freight (CIF) is an Incoterm rule that is identical to the CFR Incoterm rule except in one aspect: insurance.

Even though the risk transfers to the seller upon loading the goods on board the vessel, in CIF, the seller is obliged to take out insurance cover for the buyer’s risk.

Introduction to Cost, Insurance and Freight (CIF)

As with CFR, under CIF, the seller is responsible for packaging the goods for transport, clearing the goods for export, arranging for transport to the named port of destination, and loading the goods at the port of shipment. The bill of lading usually indicates “freight prepaid.”

The buyer is responsible for the costs of unloading the goods at the port of destination, the duties, tariffs, and taxes for import customs and any additional transportation costs to the final destination.

Under CIF, the seller must purchase cargo insurance, although they are only required to obtain minimum coverage. This will be at Institute Cargo Clauses (C) or similar.

The insurance needs to be in the currency of the contract, protect the buyer against the risk of loss, and cover the price provided in the contract plus at least 10 percent. It must cover the goods from the point of delivery to at least the named port of destination. The seller must give the buyer the insurance policy or a certificate under a policy — this document usually evidences the seller as the party being insured so it must then blank endorse the document on the back to allow the buyer to claim should it so require.

This is one of only two terms that place a compulsory responsibility for insurance on the seller, the other being CIP.

Cost, Insurance and Freight (CIF) Incoterms 2020 Rule – key changes and updates

CIF also has its origins in the early days of international shipping and has remained largely unchanged since.

The difference between CIF and CFR is that while the risk of loss or damage at delivery becomes the buyer’s, the seller is obliged to take out insurance for that risk and provide the buyer with a document which allows the buyer to claim against that insurance.

This typically will be an original insurance policy covering just that transaction or a certificate issued by the insurer under the seller’s existing open marine policy.

Both of these will normally show the seller as the “insured” or “assured” and will require the seller to endorse the document on the reverse such that the buyer or any bona fide holder with an insurable interest in the goods at the time of loss or damage occurred can claim.

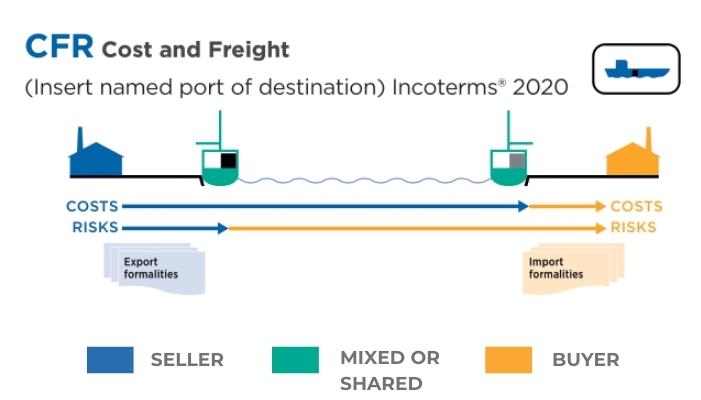

Cost, Insurance and Freight (CIF) diagram 2024

Diagram: CIF – Even though the risk transfers to the seller upon loading the goods on board the vessel, in CIF, the seller is obliged to take out the minimum level of insurance cover for the buyer’s risk. Source: ICC

Cost, Insurance and Freight (CIF) podcast

CIF seller and buyer obligations – rule by rule

CIF A1 / B1 general obligations

A1 (General Obligations)

In each of the eleven rules, the seller must provide the goods and their commercial invoice as required by the contract of sale and any other evidence of conformity, such as an analysis certificate that might be relevant and specified in the contract.

Each of the rules also provides that any document can be in paper or electronic form as agreed in the contract, or if the contract makes no mention of this, then the rules default to what is customary.

The rules do not explicitly define what “electronic form” is. This ambiguity means that it can be anything from a .pdf file to a blockchain record or another format yet to be developed.

B1 (General obligations)

In each of the rules, the buyer must pay the price for the goods as stated in the contract of sale.

The rules do not refer to when the payment is to be made (e.g., before shipment, immediately after shipment, thirty days after shipment, etc.) or how it is to be paid (e.g., prepayment, against an email of copy documents, on presentation of documents to a bank under a letter of credit, etc.).

These matters should be specified in the contract.

CIF A2 / B2: delivery

A2 (Delivery)

Under CIF, the seller “delivers” by placing the goods on board the vessel on the agreed date or within the agreed period (if there is no such time notified then at the end of that period) and in the manner customary at the port.

Most importantly, delivery occurs when the seller loads the goods onto the vessel, not when the vessel reaches the destination port.

B2 (Delivery)

Under CIF, the buyer must:

- take delivery of the goods when the seller has delivered them on board the vessel and

- receive them from the carrier at the named destination port.

Most importantly, delivery occurs when the goods are released from the seller’s direct control, not when the goods reach the destination.

The main difference in wording to FOB is simply that with CFR and CIF, reference to the vessel being nominated by the buyer is absent, as is a reference to the buyer nominating a loading point within the load port.

The contract for carriage and cost implications are dealt with in other articles.

CIF A3 / B3: transfer of risk

A3 (Transfer of risk)

In all the rules, the seller bears all risks of loss or damage to the goods until they have been “delivered” in accordance with A2 described above.

The exception is loss or damage in circumstances described in B3 below, which varies depending on the buyer’s role in B2.

B3 (Transfer of risk)

The buyer bears all risks of loss or damage to the goods once the seller has delivered them as described in A2.

If the buyer fails to inform the seller about the destination port (or the point within that destination port), then the seller will be unable to deliver under A2, and the buyer bears the risk of loss or damage to the goods from the agreed date or at the end of the agreed period.

CIF A4 / B4: carriage

A4 (Carriage)

Under CIF, the seller must arrange (or procure in the case of a string-sale) a contract for the carriage of the goods from the agreed point of delivery in A2 to the named port of destination or, if agreed, to any point (quay or wharf) in that port.

The contract of carriage must be made on usual terms that are appropriate to the type of goods and by a vessel normally used for transporting the type of goods by the usual route (often agreed on in the contract of sale) at the seller’s cost.

B4 (Carriage)

The buyer has no obligation to the seller to arrange a contract of carriage.

CIF A5 / B5: insurance

A5 (Insurance)

Under CIF, the seller must arrange a contract of insurance (at its own cost) to cover the buyer’s risks. This cover must be of the level provided by LMA/IUA Institute Cargo Clauses (C) or similar clauses under other insurance regimes. This type of cover is the minimum available for defined risks only. Anything which is not defined is not covered.

If the buyer requests, the seller must also arrange (at the buyer’s cost) additional cover under the LMA/IUA Institute War Clauses (Cargo) and Institute Strikes Clauses (Cargo) or similar unless such cover is already included.

The amount of the insurance must be at least 110 per cent of the invoice value and in the currency of that invoice and contract. It must cover the goods for at least the duration from the point of delivery (as described in A2 above) to the named port of destination.

The seller must provide the buyer with a separate contract or a certificate under an existing policy giving the details of the shipment to enable the buyer, or anyone else having an insurable interest in the goods, to claim from the insurer. This document usually shows the seller as the insured and is then endorsed by the seller on the back of the original in blank or with a specific endorsement.

The seller must also provide the buyer (at the buyer’s request, risk, and expense) with information that the buyer needs to arrange any additional insurance.

B5 (Insurance)

Despite the buyer having the risk of loss or damage to the goods from the delivery point, the buyer does not have an obligation to the seller to insure the goods.

However, the buyer must provide the seller, if requested, with any information it needs to arrange any additional insurance requested by the buyer under A5.

CIF A6 / B6: delivery / transport document

A6 (Delivery / Transport document)

Under CIF, the seller (at its own cost) must provide the buyer with the usual transport document covering transport to the agreed port of destination.

The transport document must cover the contracted goods within the agreed period for shipment.

If it is agreed, then this document must enable the buyer to claim the goods from the carrier at the named place of destination (and in a string sale, enable the buyer to sell the goods in transit to a subsequent buyer by transferring that document).

B6 (Delivery / Transport Document)

The buyer must accept the transport document provided by the seller if it conforms with the contract between them.

CIF A7 / B7: export / import clearance

A7 (Export / Import clearance)

Under CFR, the seller must (at its own risk and expense) carry out all export clearance formalities required by the country of export, where applicable, such as:

- licences or permits,

- security clearance for export,

- pre-shipment inspection, and

- any other authorisations or approvals.

The seller has no obligation to arrange any transit/import clearances.

However, if the buyer requests (at its own risk and cost), the seller must assist in obtaining any documents or information that relate to formalities required by the country of transit or import, such as:

- permits or licences,

- security clearance for transit/import,

- pre-shipment inspection required by the transit/import authorities, and

- any other official authorisations or approvals.

B7 (Export / Import clearance)

Where applicable, the buyer must assist the seller (at the seller’s request, risk, and cost) in obtaining any documents or information needed for all export-related formalities required by the country of export.

Where applicable, the buyer must carry out and pay for all formalities required by any country of transit and the country of import. These include:

- licences and permits required for transit,

- import licences and permits required for import,

- import clearance,

- security clearance for transit and import,

- pre-shipment inspection, and

- any other official authorisations and approvals.

These are the buyer’s responsibility because they occur after “delivery” by the seller.

At first glance, it might seem strange that both seller and buyer are responsible for pre-shipment inspections. To clarify, the seller is responsible if it is a requirement of the country of export, and the buyer is responsible if it is a requirement of the country of transit/import.

CIF A8 / B8: checking / packaging / marking

A8 (Checking / Packaging / Marking)

In all rules, the seller must pay the costs of any checking operations which are necessary for delivering the goods, such as checking quality, and measuring, packaging, weighing, or counting the goods.

The seller must also package the goods (at its own cost) unless it is usual for this particular good to be sold unpackaged, such as in the case of bulk goods.

The seller must also take into account the transport of the goods and package them appropriately unless the parties have agreed in their contract that the goods be packaged or marked in a specific manner.

B8 (Checking / Packaging / Marking)

In all rules, there is no obligation from the buyer to the seller regarding packaging and marking. There can, in practice, however, be agreed exceptions, such as when the buyer provides the seller with labels, logos, or similar.

CIF A9 / B9: allocation of costs

A9 (Allocation of costs)

The seller must pay all costs until the goods have been delivered under A2 (meaning loaded on board the vessel for CIF) except any costs the buyer must pay as stated in B9.

Under CIF, the seller must pay:

- the costs of loading the goods on board the vessel,

- the freight costs,

- any transport-related security costs,

- transit costs or unloading at the discharge port, if these are included in the contract of carriage,

- any costs involved in providing the usual proof that the goods have been delivered, so if the contract between the parties states that proof is a bill of lading, then the seller pays any document fee,

- any costs, export duties, and taxes, where applicable, related to export clearance, and.

- the cost of insurance covering the buyer’s risk

Further, if the seller requests that the buyer provide any information or documents in relation to customs clearance, then the seller must pay the buyer for these costs.

B9 (Allocation of costs)

Under CIF, the buyer must pay:

- all costs relating to the goods from when they have been “delivered” (meaning loaded on board the vessel for CIF), other than those payable by the seller, and

- any duties, taxes and other costs for transit or import clearance, where applicable.

If the buyer has requested the seller to provide assistance in obtaining information or documents needed for the buyer to effect transit and import clearance, then the buyer must reimburse the seller’s costs.

Additionally, if the seller has advised that the goods have been clearly identified as the goods under the contract, the buyer pays any additional costs incurred if:

- the buyer fails to give notice,

- the parties have agreed in the contract that the buyer is entitled to determine the time for shipping the goods or the point of receiving the goods in the port of destination.

CIF A10 / B10: notices

A10 (Notices)

The seller must give the buyer sufficient notice that the goods have been delivered (meaning loaded on board in the case of CIF).

The seller must also give the buyer any notice required by the buyer so that the buyer can receive the goods.

What that notice is will be agreed in the sales contract and might well also refer to conditions contained in a charter party contract of carriage if relevant.

B10 (Notices)

If the parties agree in the contract that the buyer is entitled to determine the time for the seller to ship the goods and, possibly more importantly, the point within the named port of destination where it will receive the goods, the buyer must give the seller sufficient notice.

The contract will usually detail how much notice is to be given.

Cost, Insurance and Freight (CIF): advantages and disadvantages

Cost, Insurance and Freight (CIF) is a trade term used to describe a shipping agreement between the buyer and seller. This agreement provides advantages and disadvantages for both parties involved.

Advantages for the seller

Under CIF the seller has the advantage of being able to secure additional profit by securing insurance at a low cost and then including a higher charge for it in the selling price. This approach lets sellers leverage their market knowledge or bulk purchasing to obtain cheaper premiums, thus increasing their profit margin by adding a markup on the insurance cost charged to the buyer.

This method provides financial benefits to the seller while covering the transportation risks up to the destination port.

From the buyer’s perspective

CIF simplifies the buying process for the buyer by eliminating the need to arrange for shipment insurance, as the seller takes on this responsibility. This convenience means the buyer does not have to deal with declaring shipments to their insurance providers, reducing their administrative burden.

However, this benefit may be offset by potential challenges in claiming insurance.

Since the seller selects the insurer, often prioritising cost savings, the insurance coverage may not be as robust or responsive. Buyers might encounter difficulties with claims, facing reluctance from the insurer to settle claims promptly or fairly, leading to possible financial losses and complications in securing compensation for any damages or losses during shipment.

It is also important to note that some countries do not permit CIF imports, requiring the buyer to insure with an insurer in its own country.

Cost, Insurance and Freight and letters of credit

With letters of credit, just as for FOB and CFR, the banks seem to have no problem, except they sometimes make a complete mess of the insurance clause.

Examples include:

- requiring the presentation of a policy but not a certificate of marine insurance and

- inserting nonsense words and requirements because “that is how they have always done it”.

A seller would be prudent to not just state in the contract that they will provide an insurance document.

Sellers need to use specific wording such as “One original insurance policy or certificate of marine insurance, for 110 per cent of the invoice value, blank endorsed, covering Institute Cargo Clauses (C), Institute War Clauses (Cargo) and Institute Strikes Clauses (Cargo)”.

Anything more than that in an LC is just superfluous and often meaningless.

CIF Video – What is the importance of the new Incoterms® 2020 rules in light of Brexit?

“Incoterms” is a registered trademark of the International Chamber of Commerce.

Refer to ICC publication no. 723E for the text.

Publishing Partners

- Incoterms Resources

- All Incoterms Topics

- Podcasts

- Videos

- Conferences