Importing from Singapore

Singapore Country Profile

Official Name (Local Language) Republic of Singapore

Capital Singapore

Population 5,781,728

Currency Singapore Dollar

GDP $296.6 billion

Languages Chinese; English

Telephone Dial In 65

Singapore Exports Profile

Exports ($m USD) 373,255

Number of Export Products 4,278

Number of Export Partners 218

Singapore Economic Statistics

| Government Website | https://www.gov.sg/ |

| Sovereign Ratings | https://countryeconomy.com/ratings/singapore |

| Central Bank | Monetary Authority of Singapore |

| Currency USD Exchange Rate | 1.379 |

| Unemployment Rate | 2.1% |

| Population below poverty line | NA |

| Inflation Rate | -0.8% |

| Prime Lending Rate | 1.17% |

| GDP | $296,6 billion |

| GDP Pro Capita (PPP) | $87,100 |

| Currency Name | Singapore Dollar |

| Currency Code | SGD |

| World Bank Classification | High Income |

| Competitive Industrial Performance | 2/138 |

| Corruption Perceptions Index | 6/180 |

| Ease of Doing Business | 2/190 |

| Enabling Trade Index | 1/136 |

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedImporting from Singapore

Singapore is one of the most significant hubs for global trade, housing the world’s second-busiest container port and an economy that is highly reliant on both imports and exports. Singapore’s main exports include semiconductors and integrated circuits, oil, gold, and machines. It primarily exports to Asia, with China, Hong Kong, and Malaysia as the top destinations, but the US and Australia are also important destinations. Singapore has a thriving export market, primarily based on manufacturing semiconductors and around its port industry; however, services exports are also a growing sector, with transport, financial services, and business management as the most significant. International tourism is an especially important industry that has seen sustained growth after the pandemic and could expand further in coming years, even as other exports might slump due to decreased foreign demand.

Singapore is a long-standing hub of stability in the region, with a democratic government and almost no internal unrest or regional tensions. The government has been led by one party since Singapore’s independence, which makes its policy consistent and predictable, especially in economy and trade. Its economic growth has been unprecedented, with real GDP doubling in only 20 years; the economy has been hailed for its resilience and diversification as well as its impressive growth. Because of its varied trading partners and sectors, Singapore has not been significantly impacted by global events such as the war in Ukraine; a competent and strong government deals with internal issues efficiently, leading to one of the most impressive managements and recoveries from the Covid-19 pandemic in the region.

As an important exporter for both the US and China, there have been fears that Singapore may be caught in a trade war between the two countries. US restrictions on Chinese chip makers have not applied to Singaporean producers yet, but if these were widened, the Singaporean semiconductor industry would bear much of the brunt.

Importing from Singapore: What is trade finance?

Owing to its stable government and effective systems, Singapore has been considered as the easiest place to start and do business by the World Bank.

Due to its open trade policy, more than 99% of all imports entering Singapore are duty-free. However due to certain social and environmental regulations, high taxes are charged on beer, liquor, tobacco products and motor vehicles. Resources are scarce in Singapore that is why it follows a concept of intermediary trade and imports refined petroleum ($69 billion), integrated circuits ($54 billion), crude petroleum ($33 billion), computers ($7.5 billion) and gas turbines ($6.7 billion). These materials are obtained from China ($42 billion), Malaysia ($40 billion), and the United States ($31 billion) to name a few. Singapore imports these items to manufacture and refine them for re-exporting.

Chart Showing GDP Growth Compared to rest of world

GDP Composition for Singapore

Agriculture

0%

Orchids, vegetables; poultry, eggs; fish, ornamental fish

Industry

26.6%

Electronics, chemicals, financial services, oil drilling equipment, petroleum refining, rubber processing and rubber products, processed food and beverages, ship repair, offshore platform construction, life sciences, entrepot trade

Services

73.4%

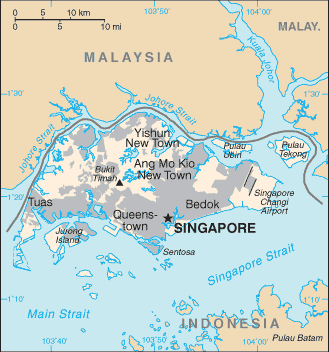

Map

Top 5 Export Partners

| Country | Trade | % Partner Share |

| China | 54,039 | 14.48 |

| Hong Kong, China | 46,011 | 12.33 |

| Malaysia | 39,580 | 10.60 |

| Indonesia | 27,952 | 7.49 |

| United States | 24,183 | 6.48 |

Top 5 Export Products

| Export Product | Number |

| Monolithic integrated circuits, nes | 18.1% |

| Petroleum oils, etc, (excl. crude); preparation | 14.3% |

| Gold in oth semi-manufactured forms,non-monetar | 6.5% |

| Aircraft parts nes | 4.0% |

| Transmission apparatus, for radioteleph incorpo | 2.7% |

Local Authors

Local Partners

- All Topics

- Singapore Trade Resources

- Export Finance & ECA Topics

- Local Conferences