What is IGST, CGST and SGST?

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

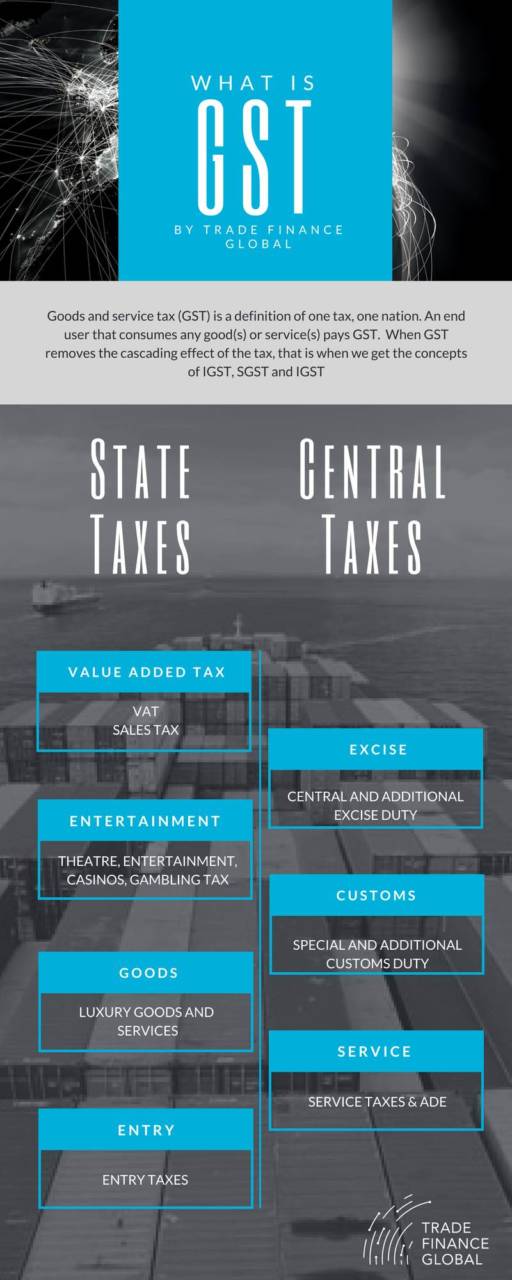

The Goods and Service Tax (GST) is a term signifying one tax, one nation policy. An end-user that consumes any good(s) or service(s) pays the GST. We get the concepts of IGST, SGST and CGST when we observe the ways in which GST removes the cascading effect of taxes.

These terms have the following meanings:

IGST

Integrated goods and service tax

SGST

State goods and services tax

CGST

Central goods and services tax.

GST replaces which taxes?

Before the introduction of GST, there were multiple taxes, such as the service tax, central excise, and state value-added tax (VAT). However, GST is just one tax with three categories—IGST, SGST, and CGST—that depend on whether the performed transaction is intrastate or interstate.

What determines which category of GST is applicable?

We need to understand whether the transaction is an intrastate or an interstate supply of goods and services to determine which category of GST is applicable.

- Intrastate supply (SGST and CGST)

This arises when the place of supply (buyer), as well as the location of the supplier (seller), happen to be in the same state. In this case, a seller must collect both State Goods and Services Tax (SGST) and Central Goods and Services Tax (CGST) from the buyer —here, the SGST gets deposited with the state government, and CGST gets deposited with the central government.

- Interstate supply (IGST)

This arises when the place of the supply (buyer), as well as the location of the supplier (seller), are in different states. Another scenario that counts as interstate supply is in cases of the import or export of goods and services, or when the goods and services are supplied to—or by—the SEZ unit. If the transaction is inter-state, then the seller collects Integrated Goods and Services Tax (IGST) from the buyer.

Now that we know where each category of GST is applicable, let’s explain them.

What is the Integrated Goods and Services Tax (IGST)?

IGST is the category of GST that involves taxes levied on all interstate supplies of goods and services. The tax is shared between the central and state governments, and the exports are zero-rated.

The GST act governs Integrated Goods and Services Tax levies.

Under the GST regime, an Integrated GST (IGST) is levied and collected by the Centre on Inter-State supply of goods and services. Under Article 269A of the Constitution, the GST on supplies in the course of interstate trade or commerce shall be levied and collected by the Indian Government, and such tax shall be apportioned between the union and the states in the manner as may be provided by Parliament by law on the recommendations of the Goods and Services Tax Council.

What is the State Goods and Services Tax (SGST)?

SGST is the other category of GST that is levied on intrastate supplies of goods and services by the state government. The SGST Act of each country governs levies of this tax.

For the State Goods and Services Tax to be introduced, some taxes must be subsumed into it. Some of them include VAT, state sales tax, entertained tax (only when the local bodies do not levy it), luxury tax, entry tax (not in lieu of Octroi), taxes on lottery, gambling, and betting, and state cesses and surcharges (if they relate to supply of goods and services).

Under SGST, if there is any tax liability, it can only be set off against SGST or IGST input tax credits.

What is the Central Goods and Services Tax (CGST)?

CGST is the final category of GST. It’s a tax levied on intrastate supplies of goods and services by the central government, and it is governed by the CGST Act. Since SGST falls under intrastate supply, it is levied in the same way, but it is now regulated by the state government.

For the Central Goods and Services Tax to be introduced, some taxes must be subsumed. They include central sales tax (CST), additional customs duty—countervailing duty (CAD), central excise duty, service tax, special additional duty of customs (SAD), and surcharges and cesses.

So, what does this mean? It means that both the central and state governments will come to an agreement that sees them combine their levies in an appropriate proportion aimed at revenue sharing between them.

Section 8 of the GST Act mentions that taxes are levied on all intrastate supplies of goods and/or services. However, the rate should not surpass 14% each.

Why does the split of GST to IGST, SGST and CGST arise?

The split of GST to IGST, SGST and CGST arise when both the central and state governments have the power to levy and collect taxes. It happens mostly when a country has a federal structure, and so both central and state governments have responsibilities to perform and need to raise taxes to carry out these duties. To ensure the one nation, one tax policy, the central and state governments must levy GST.

Get in touch with our Freight Forwarding networking team here

Testimonials

A business owner Dipesh from Rajastan had sold his finished goods to Jyoti from Gujarat worth a total value of Rs. 10,00,000. The GST rate is 18%, which is split into a total of 18% of IGST. In this case, the dealer must charge Rs. 180,000 as IGST, which will go to the Centre.

– Dipesh B, Goods Manufacturer

Case Study

Goods Distributor

Trade Finance Global along with their partner freight forwarders and tax assistants helped us file our returns, arrange transportation and sort out our duties in India.

- All Topics

- Key Terms

- Incoterms Resources

- Podcasts

- Videos

- Conferences