Forward Contracts (FEC) – What is a forward exchange rate contract?

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

Forward contracts are ‘buy now, pay later’ products, which enable you to essentially ‘fix’ an exchange rate at a set date in the future (often 12 – 24 months ahead).

Forward contracts involve two parties; one party agrees to ‘buy’ currency at the agreed future date (known as taking the long position), and the other party agrees to ‘sell’ currency at the same time (takes the short position).

A forward contract is between a partner of Trade Finance Global and your company. A forward contract is also known as a forward foreign exchange contract (FEC).

At Trade Finance Global, our team can not only assess and advise your business on currency solutions, but also suggest the most appropriate financing mechanism, working with expert currency experts and financiers to help bridge the gap in your supply chain, and help you exchange money in different currencies.

Pricing – How Forward Contracts are calculated

- The system will adjust the market spot rate for what’s known as a ‘forward point’ when calculating the forward rate.

- The difference between interest rates between the currency pair and time to maturity is then calculated when forming the FEC.

- There is a standard formula for calculating forward points which is recognised across the industry. Our experts in currency at Trade Finance Global adhere to this.

- After the currencies are paired, the total amount the business wishes to trade, and the agreed exchange rate has been agreed, a binding contract is automatically agreed.

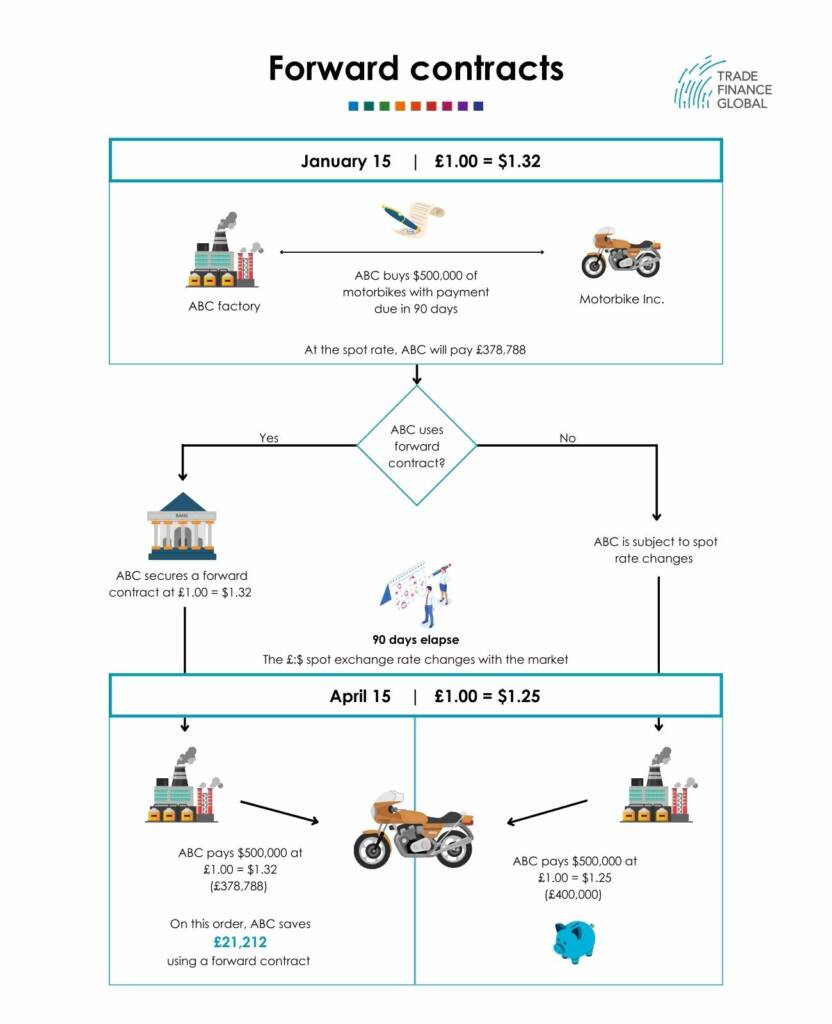

How could a forward contract work? Forward Contract Example

Example of How a Forward Contract Works

ABC Factory in Edinburgh is looking to buy motorbikes from Taiwan. The business meets with the supplier, and agrees to pay USD $500,000 in 3 months from now.

The current GBP / USD exchange rate at the time of the deal is GBP £1.00 = USD $1.32. ABC Factory therefore expects to pay GBP £378,788 for the equipment.

In 3 months’ time, GBP £1.00 = USD $1.25.

Here is what could happen;

Scenario 1: If ABC Factory doesn’t use a Forward contract

In 3 months’ time, when the business is ready to pay for the goods from Taiwan, the exchange rate has moved adversely for ABC Factory, GBP £1.00 = USD $1.25. This means that the goods would cost £400,000.

ABC Factory would pay £21,212 more than anticipated originally.

Scenario 2: ABC Factory does use a Forward contract

After 3 months, ABC Factory is ready to purchase the equipment from Taiwan. The exchange rate has moved adversely, however, as GBP £1.00 = USD $1.25, ABC Factory negotiated a forward contract with a currency provider.

The result is that ABC Factory saves £21,212 by thinking ahead and protecting itself with a forward currency contract.

Pros

- Allows the business to lock in an exchange rate for a trade that will occur at a future pre-agreed rate.

- Choose a rate which suits the business that will allow you to buy and sell in the future at a known rate.

- Manage and budget cash flow without worrying about FX volatility. Forward exchange contracts can be used as hedging mechanisms for a business

Cons

- High Risk. If the rate moves unfavourably in the future, a forward contract could be loss making. There is a contractual obligation to fulfil a forward exchange rate contract.

- A deposit is often required on the commencement of the transaction.

- The forward rate that is quoted is often given as a premium to the spot rate. The availability of a forward contract is also based on demand.

Case Study

Equipment Distributor

The Warwickshire based company supplies equipment to many manufacturers and merchants around the country, and were required to purchase equipment from their suppliers in advance. The forward options provided helped the company lock in a specific exchange rate which helped with future cash flow planning and mitigating currency risk.

Our trade finance partners

- Business Currency and FX Resources

- All Topics

- Podcasts

- Videos

- Resources

- Conferences