Foreign Exchange Options – What are FX Options?

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

An FX option provides you with the right to but not the obligation to buy or sell currency at a specified rate on a specific future date. A vanilla option combines 100% protection provided by a forward foreign exchange contract with the flexibility of benefitting for improvements in the FX market.

This works like an insurance contract. In exchange for such a right (without the obligation), the holder usually pays a cost which is known as the Premium for the FX Option.

Currency market fluctuations can have a lasting impact on cash flow whether it is buying a property, paying salaries, making an investment or settling invoices. By utilising FX Options, business can protect themselves against adverse movements in exchange rates.

This feature of FX Options makes them extremely useful for hedging FX risk when the direction of movements in exchange rates is uncertain.

FX Options are also useful tools which can be easily combined with Spot and Forward contracts to create bespoke hedging strategies. FX options can be used to create bespoke solutions and work to remove the upfront cost of a premium – this involves certain caveats around the structure of the option product.

Basic terminology for FX Options

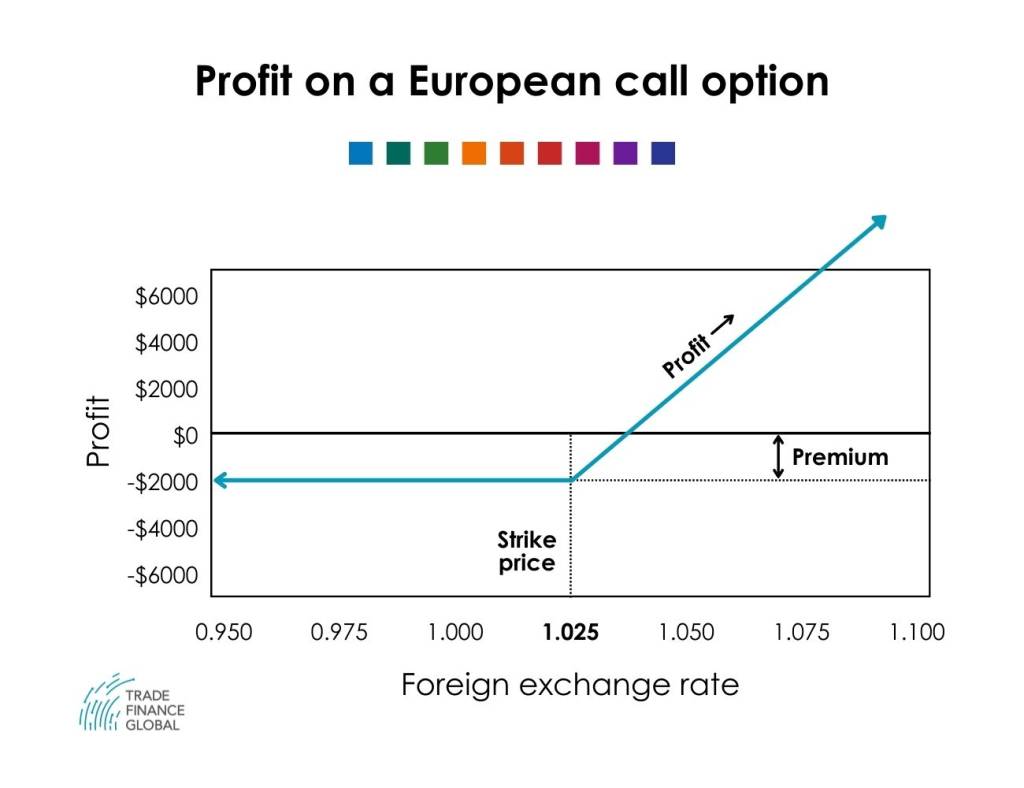

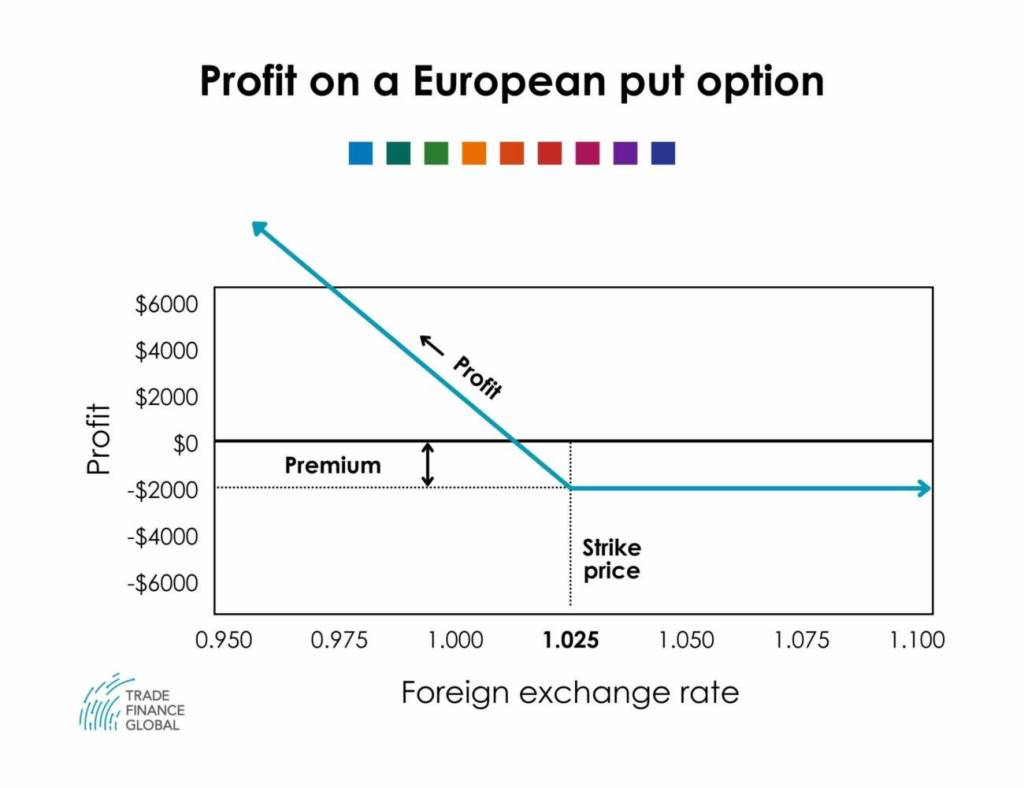

Premium

The upfront cost of purchasing a currency exchange option.

Strike Price

The strike (or exercise price) is the price at which the option holder has the right to buy or sell a currency.

Expiry Date

The trade’s expiry date is the last date on which the rights attached to an option may be exercised.

Exercise

The act of the option buyer notifying the seller that they intend to deliver on the option contract.

Delivery Date

The date when the currency exchange will take place, if the option is exercised.

Types of Currency Exchange Options Contracts

FX options can be classified based on the timing for exercise:

European Option

European options can only be exercised at the end of the agreed tenor (at maturity).

American Options

American Options can be exercised any time during the life of the contract.

Depending on the underlying transaction, FX options may be classified as:

Call Option

This gives the holder the right but not the obligation to purchase a specified currency at a pre-arranged rate up to the expiration date.

Put Option – This gives the holder the right but not the obligation to sell the specified currency at a pre-arranged rate up to the expiration date.

Example of a Vanilla Option Currency Exchange Contract

For example, a UK based company imports materials from the US, and needs to pay a supplier $500,000 in six months’ time.

The forward rate for six months is 1.3300 and looking to protect 1.3250

The UK based company would like to benefit from favourable exchange rate whilst having 100% protection against adverse market movements and is willing to pay a premium for this.

Here are the possible scenarios:

Scenario 1: GBP/USD weakens, at maturity the exchange rate is 1.2500. You are entitled to buy your full $500,000 at 1.3250.

Scenario 2: GBP/USD strengthens, at maturity the exchange rate is 1.4575. You let your currency option expire and simply buy $500,000 at the market rate of 1.4575, thus benefiting from the 10% improvement in the FX rate.

Pros

- Provides protection on 100 per cent of your exposure

- Allows you to benefit in full from favourable currency moves

Cons

- A premium is payable

Example of a Participating Forward Contract (Non Premium based)

Participating Forward

A Participating Forward provides a guaranteed protected rate for 100% of your exposure while allowing you to benefit from a favourable moves on a predetermined portion of your currency exposure.

How the structure works:-

For example, a UK based company imports materials from the US, and needs to pay a supplier $500,000 in six months’ time.

The forward rate for six months is 1.3400

The UK based company would like to benefit from favourable exchange rate moves but are reluctant to pay a premium for this.

They are prepared to accept a worst rate of 1.3200. We then calculate the participation level to be 50 per cent.

Here are the possible scenarios:

Scenario 1: GBP/USD weakens, at maturity the exchange rate is 1.2900. You are entitled to buy your full $500,000 at 1.3200.

Scenario 2: GBP/USD strengthens, at maturity the exchange rate is 1.4200. You are obligated to buy $250,000 at 1.3200. However, the remaining $250,000 can be purchased in the spot market at 1.4200. This will give an effective rate of 1.3700.

Pros

- Provides protection on 100 per cent of your exposure

- Allows you to benefit from favourable currency moves on a pre-determined portion of your total exposure

- No premium payable

Cons

- The protected rate will always be less favourable than the forward rate

Case Study

E-Commerce Supplier

The Gloucestershire based company is the biggest supplier of electronic appliances for households. Trade Finance Global and their currency partners worked with the company to come up with an options FX strategy to mitigate risk whilst the company grew, competing with their previous FX provider.

Read more here

Our trade finance partners

- Business Currency and FX Resources

- All Topics

- Podcasts

- Videos

- Resources

- Conferences