Stock Finance for Importers and Exporters

Trade Finance without Barriers

Informing Today’s Market, Financing tomorrow’s Trade.

Get Trade FinanceContent

What is stock finance?

Stock finance is a mechanism which releases working capital from stock such as finished goods or raw materials, which works by lenders purchasing stock from a seller on behalf of the buyer. Stock finance is different from invoice finance, and tends to be used as a 30-90 day revolving facility to enable access to cash as and when a business needs it.

It is important to note that stock finance differs from straight funding of working capital as it relates to the movement, purchase and/or sale of goods, and services both domestically and international.

Stock finance is a type of lending used by many cross border and domestically trading companies. It is important to note that there is a difference to trade finance and other supply chain or invoice finance types.

Stock finance is a type of funding whereby the borrower uses a lender’s funds in order to purchase product to sell. This is usually stock that will sit in warehouse to sell on. A reason that this may be used instead of trade finance is that as there will not be confirmed purchase orders, buffer stock is needed or stock will be sold to customers where trade finance is not applicable. An example of this is selling to individual consumers online.

What does Stock Finance Include?

Stock finance covers a variety of financial services designed to make cross-border and domestic trade easier. Due to the number of products available and variety of industries and goods covered, there are a wide range of tools used. These include import bills for collection, LCs, pre-shipment export, shipping guarantees and invoice factoring and discounting.

Stock Finance includes

- Lending

- Issuing LCs

- Factoring

- Export Credit

- Insurance

Products that could be purchased using a stock finance facility include:

- Electronics products

- Watches

- Furniture

- Lighting

- Commodities

- Hardware

- Wood

- Cars

Who’s involved in stock finance?

- Importers

- Exporters

- Export Credit Agencies

- Insurers

- Financiers

- Banks

- Other Service Providers

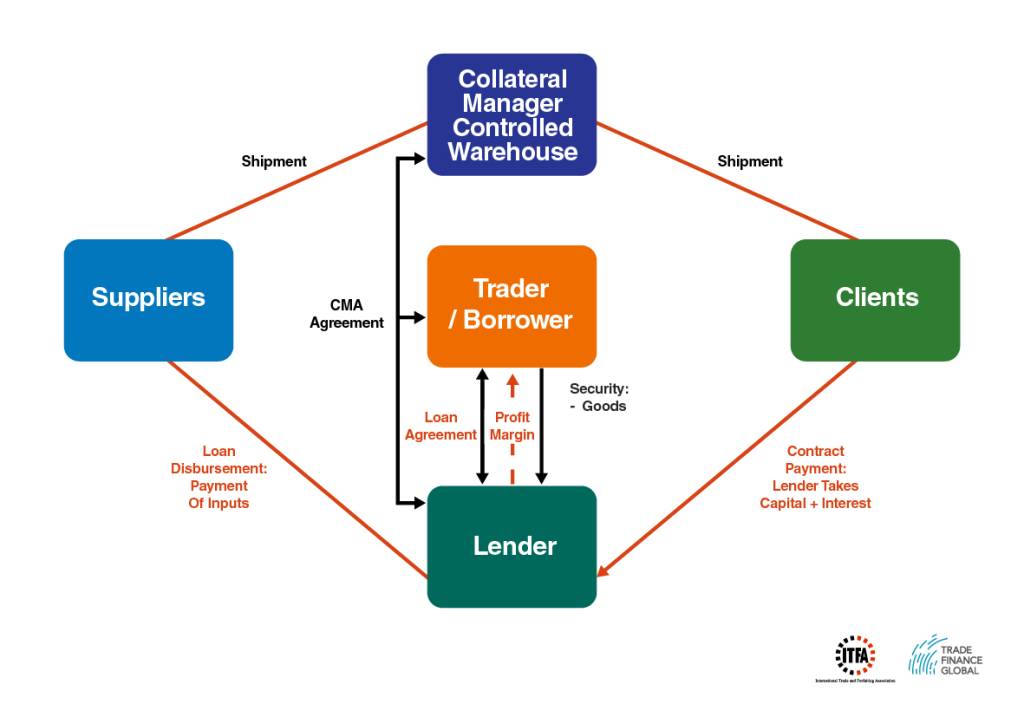

Diagram: how does stock finance work?

Why use a stock financing facility?

Many businesses are not able to work on the basis of a normal trade finance facility; where there is a buyer and seller. In effect, they will need to purchase and store stock. This will be for many reasons some of which are outlined below:

- Protect reputation by not being under-stocked

- Hedge out risk

- Having stock to provide for seasonal fluctuations

- Demand adjustment in certain products

- Requirements for buyers and suppliers

Stock finance is integral in trading businesses where there are trades that don’t have a straight match up of the purchase order and supplier and where goods flow directly to the end buyer.

Another reason, is to cover risk in international trade and cash flow. There is a risk to the importer that the exporter may simply take the payment and refuse delivery. Conversely, if the exporter extends a facility to the importer, they may refuse to make payment or unnecessarily delay. To solve this obvious problem, one can use an LC, which is opened in the exporter’s name by the importer through a bank, in their country of business. The LC is a mechanism, whereby the bank guarantees payment to the exporter. As an example, the importer’s bank may provide an LC to the exporter’s bank agreeing to pay upon presentation of certain documents e.g. a bill of lading. The exporter’s bank may provide a finance facility to the exporter on the basis of the export contract.

An LC is the most traditional stock finance mechanism.

Security is of the utmost importance in any stock finance transaction and it will largely depend on verifiable and secure tracking of physical risks and events in the chain between both parties. With various risk mitigation techniques, new tailored products offered and technological advances, this allows reduced risk when advance payment is provided to the exporter, while maintaining the importer’s normal payment credit terms and without burdening the importer’s balance sheet.

Examples of Stock Financing

- Online retailer. An online retailer sells electronics products to the public. In order to have enough buffer stock for a heavy volume-trading period, they need to have at least 6 weeks of stock. Payment is done at the point of sale via a click through on the website so there is no pre-order or purchase. A sales forecast is done and on this basis enough stock is financed and bought. The financier will have security over the stock in warehouse and there is usually a set amount of time, which is usually 90-120 days that stock may be in warehouse.

- Licensed manufacturer. A manufacturer of product was selling product all around the world and buying in from the far-east. This could be on a trade or stock finance basis – it would be trade finance if the purchasers put in an order and there was a corresponding purchase from the suppliers. In the event that there is not a purchase from a credit worthy end purchaser and in fact stock is needed to sell into the market, then stock finance is used.

- Commodity Seller. A trader of commodities was holding a lot of stock with pre-purchase orders that were being sold over a period of time. They required finance against the stock held in warehouse and so a lender agreed to advance funds against this product – this advance amount would change as stock fluctuated and would be measured at different periods throughout the life of the moving commodity. This is sometimes referred to as a borrowing base facility.