Sale and Repo Financing

Trade Finance without Barriers

Informing Today’s Market, Financing tomorrow’s Trade.

Get Trade FinanceContent

Overview

Financial institutions like hedge funds and commodity traders hold a considerable amount of assets. However, they need money to carry out their daily trades smoothly. Repo financing allows them to lend their assets in exchange for money. In other words, repo financing is the sale of securities (or assets) for cash with an agreement to buy them back later at a higher price. This repurchase loan is also known as collateralized loan as the ‘securities’ serve as collateral. A higher price is paid due to the interest applied on the original selling cost of the securities, referred to as the repo rate.

How does it work?

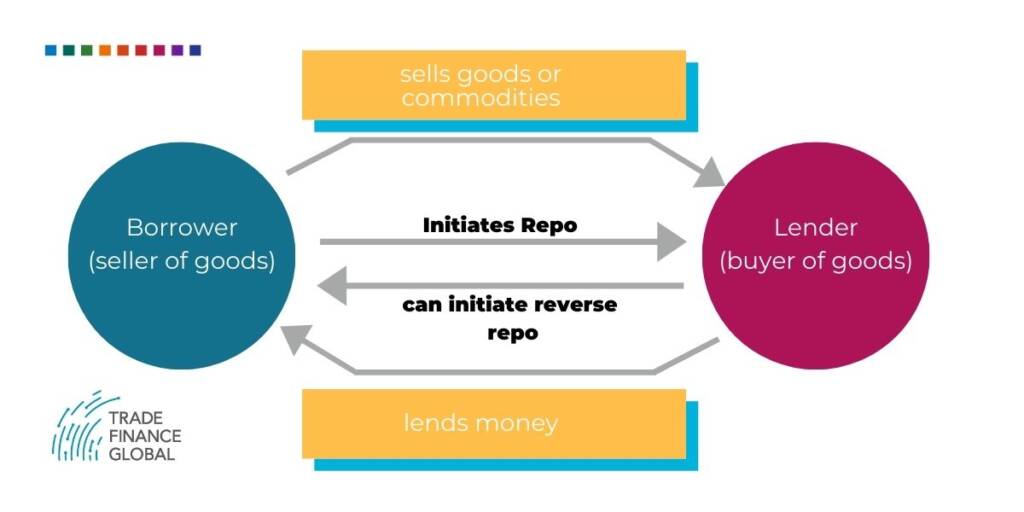

There are two main players in this kind of financing; seller and the buyer. The dealers decide the date on which the deal would be reversed, and the rate of repo is decided on the day when the deal is being finalized. The seller or the lender of the securities remains the owner of the assets. Collateral that is considered legitimate are corporate bonds, treasuries, agencies and mortgage backed securities. When the day of reversing the deal arrives, funds are repaid at the agreed repo rate. The assets are then returned to their owner. This process has been illustrated in the figure 1 below.

Types of Sale and Repo financing

There are three types of sale and repo financing:

- Specialized delivery repo: This transaction needs a guarantee in the form of a bond at the start and the end of the deal. This is not the most common kind of sale and repo financing.

- Third-party repo: In this kind of sale and repo financing, the bank or a clearing agent oversees the deal between the borrower and lender and tries their best to protect the interests of both the parties. The securities are kept by these agents who make sure that the lender receives money; and the securities are returned at the end of the deal, after the repayment with interest has been made to the lender. On top of taking responsibility of keeping assets safely, clearing agents also give importance to the securities and make sure that a stipulated margin is applied. Agents ensure the settlement of transactions on their books, and help dealers in perfecting the collateral. However, it should be kept in mind that banks or such agents don’t help borrowing parties in looking for investors. In other words, they don’t act as brokers or fixers.

- Held-in custody repo: One of the most unpopular types of sale and repo financing, held-in custody repo financing involves the seller keeping the money attained by the sale of securities, in a custodial account. The reason for its unpopularity is that there is high chance of the seller not being able to return the amount of money borrowed, and the borrower may not have access to the collateral. This makes it an unsafe sale and repo financing for the borrower.

Advantages of Repo financing

- The sellers can invest cash overnight, allowing them to manage liquidity effectively. Solid liquidity is maintained by the size of the market and supply of repos.

- Additional yield is provided by repo financing on top of conventional money market instruments, like time deposits and Treasury bills. The maturity date and the quality of the credit decide the yield advantage.

- The principal amount of the repos can be raised or lowered based on the cash flows.

Disadvantages of Sale and repo

- The main challenge involved in sale and repo financing is that of matching two willing contributors. The contracts involved are usually large, which makes it necessary for a suitable investor to have immediate access to a very abundant source of capital. This results in the investing party on the repurchase end being a group of people, rather than an individual. The risks that both participants expose themselves to include many, such as the investor having to pay a higher price than what they paid for their shares.

- A higher risk is that of the buying party not being able to produce the capital needed to repurchase the securities.

Case Study

Bear Stearns Inc

Bear Stearns Companies, Inc. was a global investment bank, securities trading and brokerage firm based in New York. It was shut down in 2008 due to the world-wide financial crisis and. Usually, Bear Stearns borrowed funds on an unsecured basis and utilized equity capital for financing. In 2006, a fall in the short-term unsecured funding was observed. However, at the same time, the funding conditions rose sharply in the first half of 2007. Six-month long repos and additional longer terms were obtained for providing funds for the company’s securities. Yet, restrictions were placed on the use of its short-term Treasury financings.

This resulted in instability in the fixed income repo markets, which continued from 2007 to early 2008. Lenders and borrowers were requested to have better-quality collateral post for having the specified loans maintained. Unfortunately, the company experienced an unexpected loss of confidence by its borrowers and lenders. Market rumours regarding the company’s liquidity position has been cited as one of the reasons for the loss of confidence.