Promissory Notes and Bills of Exchange

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get Started

ADVERTISEMENT

Contents

Bills of Exchange and Promissory Notes are independent payment undertakings (debt obligations) from one person to another. They are codified under the Bills of Exchange Act 1882, which were developed and interpreted by courts

Is a promissory note the same as a bill of exchange?

Historically, both financial instruments were used as a method of financing and to support financing, both domestically and for international (cross-border) trade, although nowadays, Bills of Exchange and Promissory Notes are mainly used for cross-border financing.

Bills of Exchange and Promissory notes are totally independent. This is an important characteristic of these financial instruments. If they are contingent on other instruments such as Purchase Agreements or other underlying transactions, they are generally not accepted.

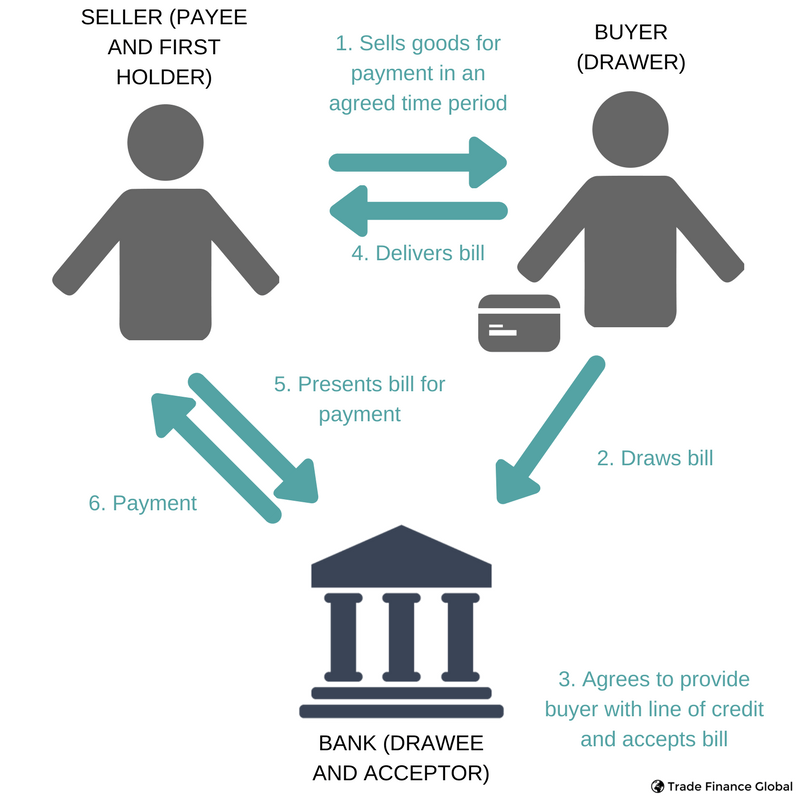

As an example, in the case of a buyer wanting to buy goods from a seller, with the intention of paying in 6 months, the purchase agreement will lie between the buyer and the seller.

- The buyer will agree to payment through a bill of exchange, which can be guaranteed by a bank.

- In this case, a seller would arrange for the goods to be delivered to the buyer, and the buyer would draw a bill on its bank to accept

- By doing so, the bank will incur primary liability of that exchange, which is in favour of the seller

- The bank can also provide the buyer with a line of credit. Alternatively, the seller can agree to have extended payment terms for its buyer (e.g. 6months) knowing that the bank has a better credit rating than the buyer

Example of a promissory note

Can I negotiate or transfer Bills of Exchange or Promissory Notes?

Yes, both instruments could be transferred or negotiable. Parties involved may be able to transfer the rights or title of these instruments to other parties. A holder can receive a bill, providing they become a holder before it’s overdue, if in good faith, and has no idea of defect in the title of that bill. This includes the acceptor (bank), drawer (buyer) or indorser.

How does delivery work?

In order to complete the contract under a Bill of Exchange or Promissory note, delivery must take place. Delivery can mean actual or constructive. An acceptor must accept liability and indorsement of the goods once delivered in order for the contract to remain. Indorsements must be in writing and signed by the indorser, written on the instrument, to the full amount of the product. Indorsement can be with or without recourse (see our article on recourse and non-recourse payments around forfeiting here).

How does payment happen?

Generally the acceptor / maker of Bills of Exchange or Promissory notes respectively are liable to make payment to the seller once presentation of the instrument occurs. Payment can be made to a person acting on behalf of the holder (e.g. a collecting bank) providing the holder treats such payment as discharging the payer’s liability.

Our trade finance partners

- Letters of Credit / Documentary Credit Resources

- All Letters of Credit Topics

- Podcasts

- Videos

- Conferences