Inventory (SIC 52103)

The above Supply Chain Finance techniques have been defined by the Global Supply Chain Finance Forum (BAFT, EBA, FCI, ICC and ITFA)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Our team can work with you to help your cash flow and the working with those in your distribution channel. We assist with sorting out the seasonal fluctuations in your business and help in reducing the associated risks. The inventory financing solutions we assist to create will enable you to focus on the sales and growth of your company.

Inventory Finance

We can assist with the financing of your products from manufacture through to end sale. This flexible financing will assist with taking into account the difficulties and market dynamics in your sector. We understand the pressures that drive your distribution channel and hope to help.

Finding the right funder will allow you to locate the product, in the right quantities, to assist in meeting client demands.

Our funding specialists will help you overcome regulatory difficulties that will be faced when distributing your product across multinational borders.

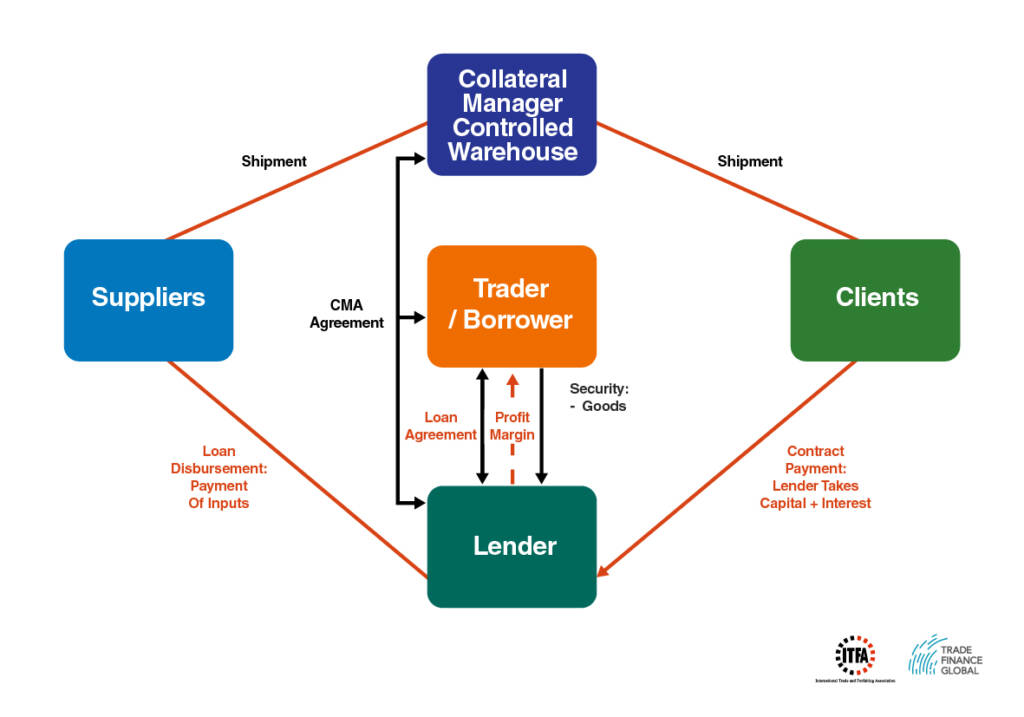

Diagram – Inventory Finance

Products financed

Key inventory includes:

- Raw materials

- Stock

- Work in progress

- Finished goods

- Transit inventory

- Buffer inventory

- Anticipation inventory

- Decoupling inventory

- Cycle inventory

- MRO goods inventory

Inventory Finance Requirements

- Your business is looking for £50k+ trade finance

- You want to purchase stock and have customers/ buyers

- Your business is creditworthy

How the transaction works

When a customer wants to finance inventory, we will assist in creating a tailor-made financing solution at the best rate that is based on your individual circumstances. This is then repaid over time.

What is the SIC Code for Inventory Finance?

SIC Code

52103

Operation of warehousing and storage facilities for land transport activities

Other SIC Codes that could also be used are:

- 51210 Freight air transport

- 51220 Space transport

- 52101 Operation of warehousing and storage facilities for water transport activities

- 52102 Operation of warehousing and storage facilities for air transport activities

Case Study

Screw Manufacturer

A company based in Sunderland that sells screws, nuts and bolts in the UK. The client wanted financing for inventory for their trade. Trade Finance Global assisted with creating a finance solution for them and will help in providing further support as the business expands.

Our trade finance partners

- Invoice Finance Resources

- All Invoice Finance Topics

- Podcasts

- Videos

- Conferences