Electronic data products (SIC 26110)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

What is Electronic Data Finance?

There are various scenarios in which you may need electronic data finance, and you can work with our specialists who understand the requirements of the electronic data industry. We appreciate the substantial influence that electronic data providers and manufacturers make to the UK economy. We work to create innovative funding solutions, whether for the purchase of new equipment or to release cash from products that you currently have. We can also help to facilitate transactions where security is taken over receivables.

Electronic Data Finance

Outside of leasing and hire purchase, we can also work to provide asset refinancing for your current assets.

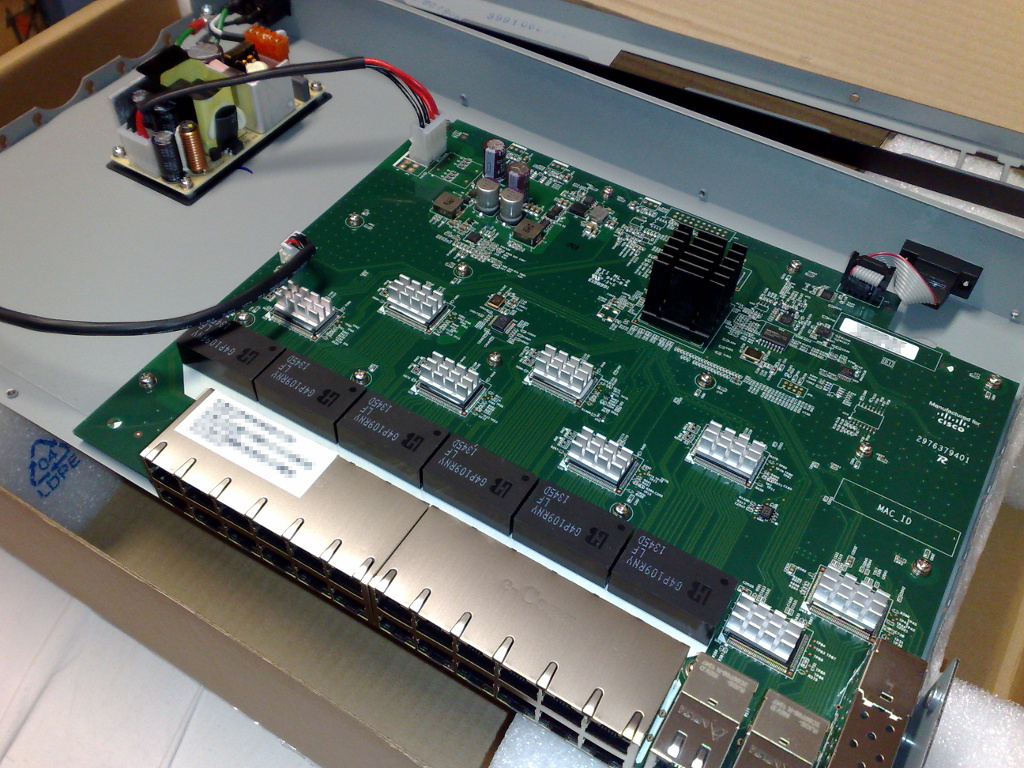

Electronic data products we fund

Key products include:

- Supplier management equipment

- Software management equipment

- Monitoring equipment

- Components

- Devices

- Strip chart recorders

- Data acquisition equipment

- Temperature controllers

- Single-loop controllers

- Servers

- Diagnostic equipment

Trade Finance Requirements

- Your business is looking for £50k+ trade finance

- You want to import or export stock and have suppliers/ buyers

- Your business is creditworthy

How the transaction works

When a business wants to trade internationally, the exporter would typically want to be paid up front by the importer. The bank would issue a Letter of Credit, which guarantees this payment to the exporter upon receipt of documentary proof that the goods have been shipped. This is then repaid once the importer has paid for the goods, which could be anything between 30-180 days later.

What is the SIC Code for Trade Finance for Electronic Data?

SIC Code

26110

Manufacture of electronic components

Other SIC Codes that could also be used are:

- 26511 Manufacture of electronic measuring, testing etc. equipment, not for industrial process control

- 26512 Manufacture of electronic industrial process control equipment

- 26513 Manufacture of non-electronic measuring, testing etc. equipment, not for industrial process control

- 26514 Manufacture of non-electronic industrial process control equipment

- 26520 Manufacture of watches and clocks

- 26600 Manufacture of irradiation, electromedical and electrotherapeutic equipment

Case Study

Global Software Management Company, Glasgow

The business owner required a finance facility so that he could purchase a supplier management equipment and monitoring equipment from China to provide to his end customers (two blue-chip FMCG companies). Trade Finance Global were able to assist with a finance facility which allowed the company to fulfil large orders quickly, alongside existing finance arrangements with their bank.