Exporting to Switzerland

Switzerland Country Profile

Official Name (Local Language) Schweizerische Eidgenossenschaft; Confederation Suisse; Confederazione Svizzera; Confederaziun Svizra

Capital Bern

Population 8,179,294

Currency Swiss Franc

GDP $662.5 billion

Languages French; German; Italian; Romansh

Phone Dial In 41

Switzerland Imports Profile

Imports ($m USD) 267,501

Number of Import Products 4,525

Number of Import Partners 201

Switzerland Economic Statistics

Government Website | https://www.admin.ch/ |

| Sovereign Ratings | https://countryeconomy.com/ratings/switzerland |

| Central Bank | Schweizerische Nationalbank |

| Currency USD Exchange Rate | 0.9992 |

| Unemployment Rate | 3.3% |

| Population below poverty line | 6.6% |

| Inflation Rate | -0.4% |

| Prime Lending Rate | 0.5% |

| GDP | $662.5 billion |

| GDP Pro Capita (PPP) | $59,400 |

| Currency Name | Swiss Franc |

| Currency Code | CHF |

| World Bank Classification | High Income |

| Competitive Industrial Performance | 1/138 |

| Corruption Perceptions Index | 3/180 |

| Ease of Doing Business | 38/190 |

| Enabling Trade Index | 11/136 |

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedExporting to Switzerland

Exports from Switzerland have been increasing year on year and stand at around CHF200 billion yearly with the main export partners being United States, Germany, France and Italy. The exports in Switzerland have averaged around 6000 CHF million from around 1950 until 2015, with a high of around 20000 CHF million at the end of 2014 and a low of around 240 CHF million at the start of 1950. On average, exports in Switzerland account around half of its GDP.

Exporting to Switzerland: What is trade finance?

Exports from Switzerland have been increasing year on year and stand at around CHF200 billion yearly with the main export partners being United States, Germany, France and Italy. The exports in Switzerland have averaged around 6000 CHF million from around 1950 until 2015, with a high of around 20000 CHF million at the end of 2014 and a low of around 240 CHF million at the start of 1950. On average, exports in Switzerland account around half of its GDP.

Switzerland has a total population of around 8 million and an inflation rate running at between 0.2%-0.4% yearly. The main exports of Switzerland are gold (around $95B), packaged medicaments ($30B), animal or human blood (around $17B), precious and base metal watches (around 22B). The main export destinations related to Switzerland, are Hong Kong (around $50B), Germany (under $50B), the United States (around $24B), India (above $20B) and France ($15B). The country of Switzerland borders Germany, France, Italy and Austria. Many see Switzerland as beneficial to export to, as there is an exchange rate which is favourable, the flight time is under 2 hours, English is a widely spoken language, it is a multicultural market which is suitable for testing products, it has the highest per capita income in Europe and there is a similar regulatory and legal environment.

The market in centrally located in Europe with both financial and political stability. The public infrastructure is excellent. The population of the workforce is highly educated with a high productivity level. It is an innovative country with high value spend on research and development including technology and high purchasing power with a reliable legal and regulatory environment. It is important to note that Switzerland is not a member of the EU and is not likely to join in the foreseeable future. Relations are governed by a series of bilateral agreements between countries. There are over 30 free trade agreements, which relax access to markets and are active in trade with Switzerland. They account for over half of Switzerland’s total trade.

Chart Showing GDP Growth Compared to rest of world

GDP Composition for Switzerland

Agriculture

0.7%

Grains, fruits, vegetables; meat, eggs, dairy products

Industry

25.9%

Machinery, chemicals, watches, textiles, precision instruments, tourism, banking, insurance, pharmaceuticals

Services

73.4%

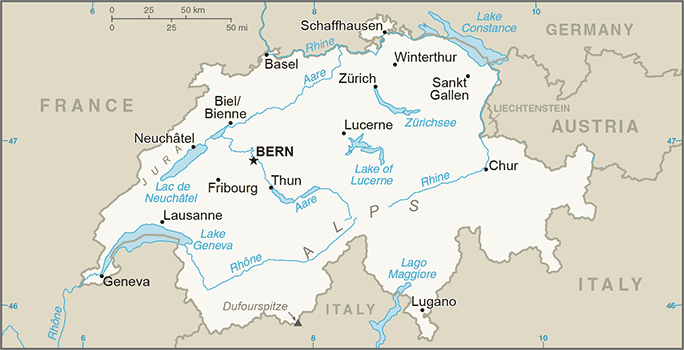

Map

Top 5 Import Partners

| Country | Trade | % Partner Share |

| Germany | 55,322 | 20.68 |

| United States | 21,409 | 8.00 |

| Italy | 20,135 | 7.53 |

| United Kingdom | 19,384 | 7.25 |

| France | 17,393 | 6.50 |

Top 5 Import Products

| Export Product | Number |

| Gold in unwrought forms non-monetary | 26.1% |

| Other medicaments of mixed or unmixed products, | 7.2% |

| Art. of jewellery and pts thereof of/o prec mtl | 4.2% |

| Human and animal blood; microbial cultures; tox | 3.9% |

| Petroleum oils, etc, (excl. crude); preparation | 3.3% |

Local Partners

- All Topics

- Switzerland Trade Resources

- Export Finance and ECA Topics

- Local Conferences