Exporting to Qatar

Qatar Country Profile

Official Name (Local Language) Dawlat Qatar

Capital Doha

Population 2,258,283

Currency Qatari Rial

GDP $156.6 billion

Languages Arabic

Phone Dial In 974

Qatar Imports Profile

Imports ($m USD) 32,06

Number of Import Products 3,865

Number of Import Partners 114

Qatar Economic Statistics

Government Website | https://portal.www.gov.qa/ |

| Sovereign Ratings | https://countryeconomy.com/ratings/qatar |

| Central Bank | Qatar Central Bank |

| Currency USD Exchange Rate | 3.64 |

| Unemployment Rate | 0.7% |

| Population below poverty line | NA |

| Inflation Rate | 3.8% |

| Prime Lending Rate | 4.5% |

| GDP | $156.6 billion |

| GDP Pro Capita (PPP) | $129,700 |

| Currency Name | Qatari Rial |

| Currency Code | QAR |

| World Bank Classification | High Income |

| Competitive Industrial Performance | 18/138 |

| Corruption Perceptions Index | 29/180 |

| Ease of Doing Business | 83/190 |

| Enabling Trade Index | 43/136 |

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedExporting to Qatar

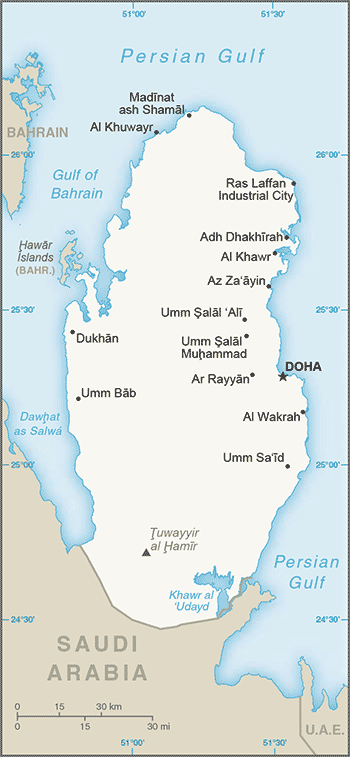

Qatar has a rapidly growing export industry mostly based on oil, and it has a large and steady trade surplus. Qatar’s main imports are machines and transportation equipment, the latter of which it imports mainly from the UK. Other important import sources are the UAE, China, India, and Switzerland. Qatar has a very small agriculture industry due to its size and harsh climate, so it imports most of its food, particularly meat, fruit, and nuts. Qatar’s strategic position on the Persian Gulf and bordering Saudi Arabia and the UAE and the global reach of its national airline, Qatar Airways, make it an important geopolitical player despite its size. It is however vulnerable to naval and aerial blockades, such as the one imposed by Saudi Arabia and the UAE between 2017 and 2021 which temporarily halted much of Qatar’s food imports.

Qatar has had tensions with other countries in the region over its recognition of militant groups such as the Taliban and Hamas; its alliance with the Muslim Brotherhood, which Saudi Arabia considers a terrorist group, has led to the erosion of relations between the two countries. Because of its size, Qatar must rely on foreign allies for security: its most important security partner has historically been the US, and Turkey has recently stepped in to defend it in regional disagreements. Efforts to draw Foreign Direct Investment have led to an easing of restrictions on foreign ownership of companies in the financial and technology sectors, but the traditional route for foreign companies to expand to Qatar involves a 49/51 partnership with a domestic company skewed in Qatar’s favour.

Exporting to Qatar: What is trade finance?

The Economic Complexity Index (ECI) ranked Qatar as the 37th largest export economy in the world and 83rd in terms of the economic complexity. The major exports of Qatar are petroleum gas ($55 billion), crude petroleum ($37 billion), ethylene polymers ($3 billion) and nitrogenous fertilisers ($1.56 billion). Among these export items, petroleum gas represent almost 50% of the total exports while crude petroleum accounts for about 34%.

Qatar’s export commodities are brought to its trading partners: Japan ($33 billion), South Korea ($24 billion), India ($14 billion), China ($7.8 billion) and Singapore ($7.1 billion).

Chart Showing GDP Growth Compared to rest of world

GDP Composition for Qatar

Agriculture

0.1%

fruits, vegetables; poultry, dairy products, beef; fish

Industry

51.1%

liquefied natural gas, crude oil production and refining, ammonia, fertilisers, petrochemicals, steel reinforcing bars, cement, commercial ship repair

Services

48.8%

Map

Top 5 Exports Partners

| Country | Trade | % Partner Share |

| United States | 4,606 | 14.37 |

| China | 3,320 | 10.36 |

| Germany | 2,970 | 2.97 |

| United Arab Emirates | 2,914 | 9.09 |

| Japan | 2,140 | 6.67 |

Top 5 Exports Products

| Export Product | Number |

| Automobiles with reciprocating piston engine di | 7.1% |

| Aircraft parts nes | 3.9% |

| Aircraft nes of an unladen weight exceeding 15, | 3.5% |

| Automobiles with reciprocating piston engine di | 2.4% |

| Transmission apparatus, for radioteleph incorpo | 2.2% |