Exporting to Egypt

Egypt Country Profile

Official Name (Local Language) Jumhuriyat Misr al-Arabiyah

Capital Cairo

Population 94,666,993

Currency Egyptian Pound

GDP $342.8 billion

Languages Arabic

Phone Dial In 20

Egypt Imports Profile

Imports ($m USD) 66,339

Number of Imports Products 4,139

Number of Imports Partners 173

Egypt Economic Statistics

Government Website | https://www.egypt.gov.eg/english/home.aspx |

| Sovereign Ratings | https://countryeconomy.com/ratings/egypt |

| Central Bank | Central Bank of Egypt |

| Currency USD Exchange Rate | 9.71 |

| Unemployment Rate | 13.1% |

| Population below poverty line | 25.2% |

| Inflation Rate | 12.1% |

| Prime Lending Rate | 9.75% |

| GDP | $342.8 billion |

| GDP Pro Capita (PPP) | $12,100 |

| Currency Name | Egyptian Pound |

| Currency Code | EGP |

| World Bank Classification | Lower Middle Income |

| Competitive Industrial Performance | 115/138 |

| Corruption Perceptions Index | 117/180 |

| Ease of Doing Business | 120/190 |

| Enabling Trade Index | 116/136 |

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedExporting to Egypt

Egypt is one of Africa’s largest and most resilient economies, as well as an important trade partner for Southern Europe and the Middle East, with a solid trade deficit. Egypt’s main imports are oil, crops like wheat and corn, iron, and cars; its top import sources are China, Saudi Arabia, the UAE, and Turkey.

Egypt is one of the most important global trading hubs, with the Suez canal serving as one of the busiest maritime passages in the world. Attacks by the Houthi militia in the Red Sea have led crossings through the Suez canal to fall dramatically as ships are diverted to the Cape of Good Hope. Long delays and increased costs caused by this have led to rising prices, which could fuel a further rise in Egypt’s already high inflation and destabilise the domestic economy.

Exporting to Egypt can be cumbersome as bureaucracy is often slow and delayed further by corruption. The domestic economy is turbulent, with high rates of inflation, fast depreciation, and rising poverty and inequality; if this goes on, it could reduce domestic demand and decrease imports. However, the government’s monetary policy is having some success in stabilising the economy, and investment from the UAE among others will help boost demand, stabilising the import industry.

Exporting to Egypt: What is trade finance?

Although Egypt provides a variety of export commodities such as insulated wire ($ 1.1 billion), nitrogenous fertilizers ($1 billion), textiles and chemicals, the core of Egyptian economy is its oil export. Each day, the country produces around 600,000 barrels and exports about 155,000 of them. Crude petroleum comprises $6.70 billion, petroleum gas meanwhile takes a $2.3 billion part while refined petroleum comprises $1.1 billion of the country’s overall export. In the past, about 90% of Egypt’s exports is made up of cotton and cotton textiles continue to grow to 16% in the 1970s. However, cotton was replaced by oil and petroleum products by 1985.

Italy, the United States and India are the primary export destinations of Egyptian goods, which comprises 9.4%, 7.1% and 6.2% if the total volume, respectively. It is also notable to mention that some European countries such as Germany and Spain along with Asian nations such as China and Japan are also considered top exporting markets for Egyptian oil and other products.

Chart Showing GDP Growth Compared to rest of world

GDP Composition for Egypt

Agriculture

11.3%

Cotton, rice, corn, wheat, beans, fruits, vegetables; cattle, water buffalo, sheep, goats

Industry

35.8%

Textiles, food processing, tourism, chemicals, pharmaceuticals, hydrocarbons, construction, cement, metals, light manufactures

Services

80.9%

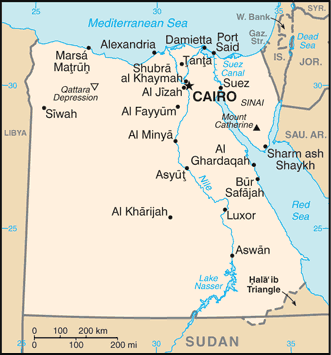

Map

Top 5 import Partners

| Country | Trade | % Partner Share |

| China | 8,105 | 12.22 |

| Germany | 4,515 | 6.81 |

| Italy | 4,192 | 6.32 |

| Saudi Arabia | 4,148 | 6.25 |

| United States | 3,897 | 5.87 |

Top 5 import Products

| Export Product | Number |

| Petroleum oils, etc, (excl. crude); preparation | 8.4% |

| Durum wheat | 5.3% |

| Natural gas, liquefied | 4% |

| Petroleum oils and oils obtained from bituminou | 3% |

| Maize (excl. seed) | 2.6% |

Local Partners

- All Topics

- Egypt Trade Resources

- Export Finance & ECA Topics

- Local Conferences