Infrastructure Finance

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContent

Financing for infrastructure entities and ventures typically refer to the different methodologies ultimately used in paying for infrastructure, this includes the repayment finance from whichever source is chosen. The primary methods of providing finance for publicly owned infrastructure is split into two fundamentally diverse options, public and or private.

What is infrastructure finance?

Public finance concerning publicly owned infrastructure is principally derived from taxation this is not borrowed but rather a planned debt as part of the budget for public spending. On the contrary, private financing for publicly owned infrastructure involves the government borrowing finance to pay for stages or specific projects; this is usually executed when the government ventures beyond the allocated budget for public spending. When the government borrows money from private investors, it is typically performed through project finance where a specific company directly related to the infrastructure project is established to provide the private sector with managerial responsibilities.

This is essentially a transfer of responsibility from public to private where contracts legally shift stages such as designing, construction, engineering, operating and maintenance, private financing initiative and public-private partnerships are formal terms that describe this concept.

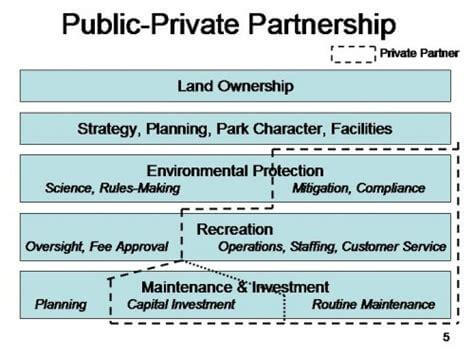

The public-private partnership [PPP] model

Fig. 1.1: Generalized synopsis of a public-private partnership [PPP] model for a larger sized park. Correspondingly, the private sector becomes more involved in the investment, compliance and servicing of the infrastructure project mean whilst the government is more concerned with the planning, regulation and administrative processes of the project.

Who are the key investors in public-private partnerships?

Investors that invest in private financing initiatives range from formal traditional lenders such as banks, and insurers to institutions such as superannuation funds, equity firms and venture capitalists. The advantages of public-private partnership lie in that the risk is essentially shifted to the private sector rather than the public sector, although it remains an argument of disputation and controversy, for the most cases it is a profitable venture for all parties involved in the capital investment.

The private finance initiative [PFI] is strategic in that it is aimed to incorporate the expertise of the private sector in the effective feasible delivery of public service assets, the private sector doesn’t own the asset but can only lease the asset with most contracts ranging between 20 – 50 years. Private finance initiatives are nexus engines for fueling economic growth, employability and higher standards of living. Alternatively there are limits that can constrain the effectiveness of private finance initiatives which include assumptions that financial assessments become less of a priority, reduction in contract flexibility + steep termination costs which makes alterations to the project significantly taxing, public sector paying for the risk transfer and since the financial crisis the red tape and overall complexity of structured financial partnerships have become furthermore complicated. Simultaneously, however, the National Audit Office [NAO] has concluded that most Private finance initiatives are developed and built on time within budget and inclusive of requested specifications and standards.

What are public-private partnerships used for?

Public-private partnerships are typically used for large projects such as mass transportation, highways, airports, bridges and tunnels whereby the investors making the capital investment will keep the large majority of operating revenue as a profit until the contract lease expires.

Although Private Finance Initiatives have become a growing toolkit for development practitioners, non-profits, private and public sector, there remains an imperfect coordination amongst all these parties, but the process is improving. Partnership based approaches offer a significant upside, but many development systems, models and approaches are outdated in terms of measuring impact and managing risk.

Fig 1.2: Publicly owned infrastructure generally uses public finance and privately owned infrastructure generally uses private finance, the below model shows the incorporation of private finance initiatives within publicly owned infrastructure. Although historically speaking, private finance initiatives have been the most common way to privately finance public assets, since 2010 for most developed countries the use of private finance initiatives had declined significantly due to financial crises and controversy over the profitability of the deals.

Partnerships integrate disparate players, it is important to segment and understand the motivations of all parties within the context of the project whereby the most quintessentially effective partnerships strike balances between means and ends subsequently safeguarding both the public-private sensitive nature of the collaboration as well as the ultimate development outcome identified at the outset by all stakeholders. Additionally, managing expectations and risk is critical for successful partnerships. Risk concerning public-private partnerships can be categorized into five main segments, reputational, financial, strategic, operational and compliance. Ensuring that information executed through due diligence travels through the proper channels to influence decision makers is key to success in public-private partnerships. Measurement is a relatively broad notion that can reinforce a diverse amount of important decisions, partnerships must be examined quantitatively to determine the value added from leveraging their resources well as optimizing the parity of tax to loan repayment.

The expanding role of the private sector developing the economic growth has permitted firms such as Trade Finance Global which has been established with the objective to signpost businesses with financial solutions so that their clients can have the most appropriate form of funding. With a rigorously established network of both traditional bank funders and non –bank funders, these companies provide complete assistance in the structuring and formulation for a successful trade transaction.

Note: The terms [Private Finance Initiatives] and [Public – Private Partnerships] have been used interchangeably.

References

Mackworth, [2011], Public Private Partnership Model, https://parkppp.com/, retrieved 24/08/2018.

National Audit Office, Private Finance Projects, October 2009, paragraph 7, retrieved 24/08/2018.

National Audit Office, Choice of finance for capital investment, March 2015, page 36, retrieved 24/08/2018.

National Audit Office, Lessons from Private Finance Initiative, April 2011, page 13, retrieved 24/08/2018.

D.F. Runde, [2013], Future of Public- Private Partnerships: Strengthening a powerful instrument for global development, Center for strategic and international studies. https://www.csis.org/analysis/future-public-private-partnerships-strengthening-powerful-instrument-global-development, retrieved 24/08/2018.

National Infrastructure Delivery Plan, [2016], Institute for Government analysis of Infrastructure and Projects authority – National Infrastructure delivery plan, funding and finance supplement, retrieved 24/08/2018.

Our trade finance partners

- Export Finance Resources

- All Export Finance Topics

- Podcasts

- Videos

- Conferences