Export Finance | The 2025 Ultimate Guide for Exporters | TFG Business Hub

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContent

When companies export products or services, long payment terms can often create working capital challenges.

The upfront cost of producing, shipping, and delivering the goods can be tricky for businesses to manage.

Export finance helps businesses release working capital from cross-border or domestic trade transactions that would otherwise be tied up in invoices or purchase orders (for up to 180 days).

Export finance is a form of specialist trade finance that can help a business grow and sell to a larger market.

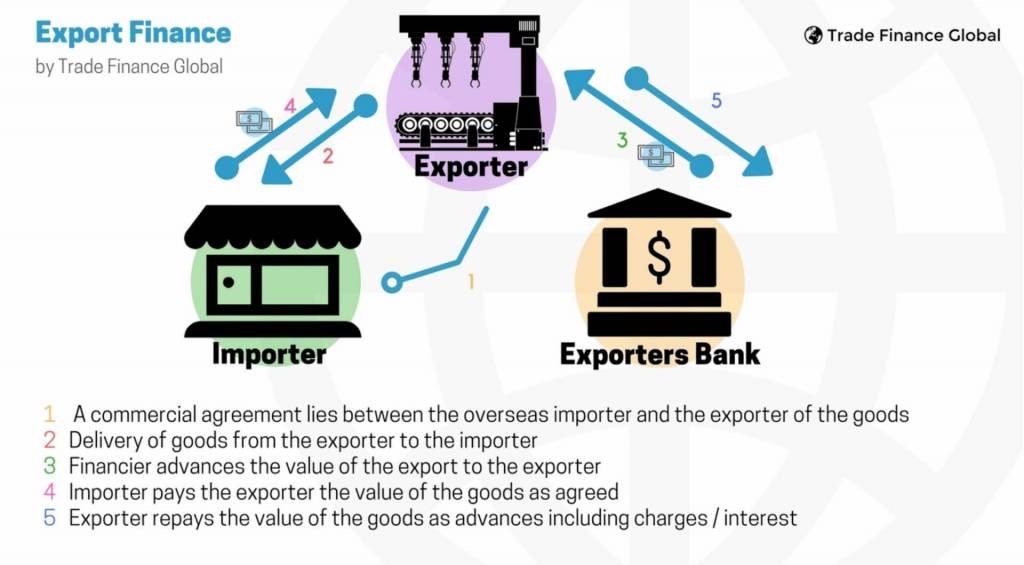

How does Export Finance work?

There are several different types of export finance, so structuring varies, depending on which product is most suitable for your business.

Often the supplier will request a Letter of Credit or a Bank Guarantee, which is the financial security of payment to reduce non-payment risk once they deliver the product or ship the goods.

In other cases, the customer might not pay your company for up to 90 days after the product has been received.

Once the invoice has been issued, receivables or invoice finance can be used to advance payment. The gap until payment is received is bridged by a financier.

Export finance is generally secured, that is, a financier will use the goods or products, the invoices, future cash flow, or the company as security for advancing cash.

FAQ

Our trade finance partners

- Export Finance Resources

- All Export Finance Topics

- Podcasts

- Videos

- Conferences