International Trade Professionals Programme 2021

Content

International Trade Professionals Programme

The ITPP 2021 application is now closed. Keep an eye on this page for updates on ITPP 2022.

Get ahead in Trade Finance, with our highly esteemed International Trade Professionals Programme (ITPP). If you want to be part of the 2021 cohort, apply now.

If you are looking to develop your reputation and knowledge as a leader in trade finance, this programme is for you. In partnership with EBRD, FCI and LIBF, the ITPP enables international trade professionals to write for Trade Finance Global’s award-winning publications.

The top writer of this year’s cohort will be invited to participate in a panel at an LIBF conference and will be enrolled on one of their trade finance courses. The next 5 winners will also be awarded with a trade finance course certified by LIBF. The 10 runners up will receive an FCI course.

Considering the unprecedented year we have all experienced, this programme is also open to those currently unemployed within the trade finance sector.

Key Benefits

- The opportunity to write for Trade Finance Global and have an author profile built for you

- All participants will receive 50% off the LIBF November Annual Trade Finance Compliance Conference and 50% off all FCI education events & FCI Academy 2021/22 ‘Open to All’ courses

- The top writers will receive various industry prizes (panellist, courses)

What’s in it for you?

Reputation

Boost your professional reputation as a leader in trade. You’ll be a published author and part of the ITPP’s 2020 cohort

Learning

Brush up your skills by working with our editorial team to write about a trade niche – shared with our global trade community

Networking

You’ll have a TFG Author Profile built for you, and become a member of ITFA Emerging Leaders, a global network of trade professionals

Training

The top writers (judged externally) will be enrolled onto a trade finance course, certified by either LIBF or FCI

International Trade Professionals Programme 2021

1. Trade Finance Global’s 2021 writer cohort

You’ll be working hand in hand with one of TFG’s editorial team to plan, scope and produce a journalistic piece of content on a pre-agreed topic within international trade and finance. This could be an essay on structured LCs, your own research on trade flows, an opinion piece on blockchain for trade or an educational piece on trade credit insurance.

How does it work?

Once agreed, our editorial team will be on hand to help you edit, improve and refine your article. We will create an author profile for you on Trade Finance Global. Your piece will then be published on Trade Finance Global’s website.

The top articles will also be published in print in Trade Finance Talks (magazine). We have 160k+ monthly readers and 6.2m+ impressions / month on social media and an email database of over 30k database.

Each written piece will be judged by each of the ITPP 2021 Partners (EBRD, FCI, LIBF & TFG) to award the winning prizes.

The winning prizes include:

1.Gold tier

The gold tier winner will receive a panellist position at an LIBF conference, and an LIBF course.

2. Silver tier

The 5 silver tier winners will receive an LIBF course, more details on these courses can be found below.

3. Bronze tier

The 10 bronze tier winners will receive an FCI course, more details on these courses can be found below.

2. Certified trade finance courses by LIBF and FCI

The Gold & Silver-tier winners will receive access to one of the six trade and transaction banking courses provided by The London Institute of Banking & Finance (LIBF). Participants on the programme can choose their preferred course. This includes the study materials, examination and certification.

Each winner will receive access to one of the following courses:

Certificate for Documentary Credit Specialists (CDCS®)

Level 4 Certificate for Documentary Credit Specialists (CDCS®) – 601/1159/8

The Certificate for Documentary Credit Specialists (CDCS) is a professional qualification that is recognised worldwide as a benchmark of competence for international practitioners.

Certificate in International Trade and Finance (CITF)

This is an international trade certification that improves your technical knowledge and teaches you how to apply this knowledge to real situations. LIBF has developed the Level 3 qualification in consultation with trade finance experienced specialists.

Certificate for Specialists in Demand Guarantees (CSDG)

The Certificate for Specialists in Demand Guarantees qualification will develop students’ understanding in the use of guarantees, industry rules, legislation and the challenges relating to demand guarantees and standby credits. CSDG enables students to demonstrate a high level of expertise and improves knowledge and understanding of the complex issues associated with demand guarantee best practice.

Certificate in Trade Finance Compliance (CTFC)

This qualification gives you the technical knowledge to succeed in trade finance compliance and the ability to apply expertise in a professional setting. It is a valuable benchmark for Trade Finance Operations Staff, Relationship Managers, Bank Audit and Compliance Staff, and Risk Managers.

Certificate in Principles of Payments (CertPAY)

CertPAY enables professionals working in the global payments industry to attain an internationally recognised qualification. It will provide you with a comprehensive understanding of payments, from terminology to the mechanics of moving money across the globe, as well as compliance, risk, regulation, and strategy.

Certificate in Supply Chain Finance (CSCF)

The Certificate in Supply Chain Finance is relevant if you work or are aspiring to work within an area dealing with Supply Chain Finance (SCF). You will develop an understanding of the standard definitions for techniques of SCF, how to identify funding gaps as a result of trade cycle analysis, understand clients’ needs and develop your skills in structuring and implementing SCF solutions.

The Bronze tier winners will receive access to a trade and transaction banking courses provided by FCI (Global Representative Body for Factoring and Financing of Open Account Domestic and International Trade Receivables). Participants can choose their preferred course out of the following two options:

FCI Academy’s Introduction to Factoring and Receivables Finance course

The course aims to enhance your skills and enrich your knowledge on this form of finance that shows significant growth during the last decades and

that supports the physical Supply Chain and economic development (FCI &WTO data).

FCI Academy’s Fundamentals on Domestic and International Factoring Course

This online course offers a comprehensive knowledge on Factoring, describing in detail the different variations and their characteristics as well as highlighting the importance of seller selection & management.

Eligibility

You can apply to be part of the International Trade Professionals Programme if you are 18 or over and can demonstrate that you are working in (or have worked in) any of the following fields:

The programme is available if you are working across, or have worked in any of the following domain areas:

- Trade, receivables and supply chain finance (back and front office)

- Trade based financial crime, compliance and regulation

- Trade (research or economics based)

- Shipping, logistics and supply chain

- Trade policy, practitioner or law

- Trade credit insurance, risk, sureties and bonds

- Export credit agency, development finance institution, multilateral development bank (OECD / non-OECD)

- Trade consulting

- Risk: credit, political

- Export finance

- Trade technology / fintech in trade

- Foreign exchange and currency risk

- Sustainable trade

The programme is available at all of the following levels:

- Entry level

- Analyst

- Business Development

- Middle management

- Manager

- Assistant Director

- Director

- Senior Director

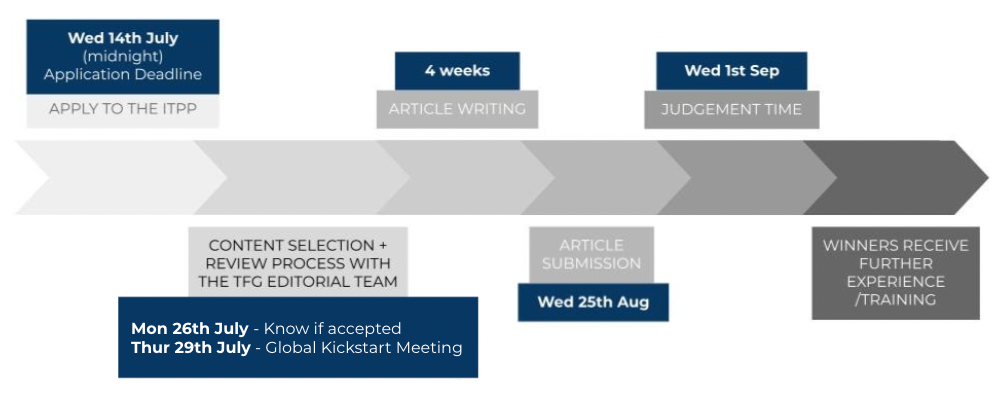

Timeline

Testimonials from last year’s cohort

“The course was helpful and related to my work. I got new knowledge about Supply Chain Finance techniques which would complete my understanding of trade finance tools and for sure will be an added value to my work. For those who believe that they could add new perspectives to the industry and those looking for a channel to deliver their message, the ITPP would be their sincere guide during their journey.”

“I am so grateful for the free LIBF training which led me to be certified as CTFC. Regardless if you are old or new to Trade Finance, the ITPP cohort is a great way to get out of your comfort zone. It provided me with a fresh approach as well as being able to share information in the simplest manner possible.”

“The exposure within the industry is simply invaluable and with that, the ability to connect to other professionals across the world. It gives you a real exposure to international trade and helps put your profile out there. The ITPP was an amazing process of self discovery and provided a real opportunity to learn so much about African Trade. It truly motivated me to get involved in arguments and discussions; pushing me further to engage.”

“ITPP has helped me redefine my personal legacy by merging my passion for trade finance, sailing, polar research and climate change which is much more than I expected. Trade Finance is key to global economic growth post the pandemic, we need all hands on deck for innovative yet sustainable solutions going forward.”

“The best part of ITPP is being a part of a big community with a common interest in International Trade, which otherwise I would never have been introduced to. You will be part of discussions that you would never have the chance to be part of. It is magic to share opinions around the globe with respect and professionalism. The ITPP is a fantastic challenge and journey. I strongly recommend it to everyone who is interested in this field.”

Who are we?

About EBRD

The European Bank for Reconstruction and Development (EBRD) was founded to further progress towards ‘market-oriented economies and the promotion of private and entrepreneurial initiative’. This has been its guiding principle since its creation at the beginning of the 1990s and, new challenges and the welcoming of new countries to the EBRD world notwithstanding, will continue to be its mission in years to come.

Uniquely for a development bank, the EBRD has a political mandate in that it assists only those countries ‘committed to and applying the principles of multi-party democracy [and] pluralism’.

About FCI

FCI is the Global Representative Body for Factoring and Financing of Open Account Domestic and International Trade Receivables. With close to 400 member companies in 90 countries FCI offers a unique network for cooperation in cross-border factoring. Member transactions represent nearly 90% of the world’s international correspondent factoring volume. After 50 years of existence, FCI opened two more business lines: reverse factoring (FCIreverse and EDIreverse) and Islamic International Factoring.

About The London Institute of Banking & Finance

We exist for a very simple reason – to advance banking and finance by providing outstanding education and thinking, tailored to the needs of business, individuals, and society. Our focus is on lifelong learning; equipping individuals with the knowledge, skills and qualifications to achieve what they want throughout their career and life. We provide a balance of experience, insight and thought leadership into today’s financial world, delivered by industry leaders, thinkers and members of our community. And because we’ve been at the heart of the sector since 1879, we create connections and build partnerships between people and business that make banking and finance more accessible and understood, and enhance social inclusion through better financial capability. We are The London Institute of Banking & Finance, lifelong partners for financial education.

About Trade Finance Global

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses. Our award winning educational resources serve an audience of 120k+ monthly readers in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts and videos.

Application Process

To be part of the ITPP 2021 cohort, you will need to write an application letter to answer the following question:

Why would you like to be part of the International Trade Professionals Programme?

Terms and Conditions

Entry Rules

This competition is run by TFG Publishing Limited (“Trade Finance Global”, “TFG”, “we” or “our”) and is open to all residents aged 18+ who submit an application to the TFG competition page. Doing so will give you the opportunity to win the prize as described on the scholarship page.

- Your participation in this competition is at your sole option and risk. No purchase is required to enter.

- By entering this competition you agree to be bound by these terms and conditions.

- You may not participate if you are a TFG employee, agent or employee or agent of a TFG affiliate company, or a family relation of any such employee or agent.

- You may not enter this competition more than once and you are only eligible to win one (1) prize. We reserve the right to disqualify anyone ignoring this rule.

- The competition opens on June 30th 2021 at Midday UK time. You must submit your entry by 23:59am UK time on 14th July 2021.

- Information submitted in this competition must not be abusive, offensive or defamatory. We will put through any relevant photo for voting but reserve the right to refuse irrelevant information as determined at TFG’s sole discretion.

- TFG cannot accept any responsibility for any technical failure or problem which may result in any entry being lost or not being properly registered.

- TFG will only cancel, suspend, or amend the competition if required to do so for legal, regulatory or security reasons.

- All valid entries will be assessed by a panel constituting TFG staff and an independent judge. The panel will award points for originality, inspiration and interest and a winner will be chosen on this basis. The decision of the panel will be final and no correspondence will be entered into regarding that decision.

- We reserve the right to substitute the prize for an appropriate alternative.

- The winner will be contacted by email by Midday UK time in September 2021

- The winner must confirm their acceptance of the prize by replying to our email with their name, email address and telephone number.

- If the prize remains unclaimed after five (5) days, we reserve the right to select an alternative winner.

- The winner will receive their prize within thirty (30) days after claiming their prize.

- TFG will use the winner’s Twitter handle when announcing the winner and you agree that your name may be announced on TFG social media for publicity purposes.

- These terms and conditions are governed by the laws of England and Wales whose courts shall have exclusive jurisdiction.

- You must accept the community guidelines in order to participate in the programme

- You may not enter this competition if you successfully secured a place in last year’s ITPP cohort

The ITPP Objectives

The ITPP cohort aims to be a professional, informative and supportive community where people can share their passion, perspective and insights into global trade, as well as interact, communicate and debate with like minded professionals from all around the world!

We aim to make trade education available to all, removing the barriers of trade finance, by providing insights, thought leadership and great content, showcasing the community across TFG’s platform and beyond.

The ITPP Guidelines

Be Kind and Courteous

We’re all in this together to create a welcoming environment. Let’s treat everyone with respect. Healthy debates are natural, but kindness is required.

No Promotions or Spam

Give more than you take to this group. Self-promotion, spam and irrelevant links aren’t allowed.

No Hate Speech or Bullying

Make sure everyone feels safe. Bullying of any kind isn’t allowed, and degrading comments about things like race, religion, culture, sexual orientation, gender or identity will not be tolerated.

Respect Everyone’s Privacy

Please do not privately communicate, call, message, or ‘add’ other members of ITPP outside of the official groups that TFG have set up, unless you have their express permission and consent in advance. If as a community member you find anyone doing this, please let one of the admins of the group know immediately.

Education Partners

- Partner Courses

- CPD Qualified Content