Accelerate Scholarship Portal | Trade Finance Global

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

Accelerate Scholarship Portal – Trade Finance Global

Congratulations on reaching the next stage of the Accelerate Scholarship competition. We are delighted to have you on board, and look forward to receiving your essay / literature review over the coming weeks as part of the competition.

Next stages

1. Read our guides

We’ve put together a guide for the structure of your essay / literature review. Read the guide, check out our post templates and example posts

2. Choose a topic

We’ll give you the flexibility of choosing your own topic and subject, but we will give you some ideas to get you started

3. Draft your post

We would ask you to confirm the topic and subject

4. Enter Accelerate

You’ll send your final essay / literature review to us for our panel to judge and decide who the winners of Accelerate are

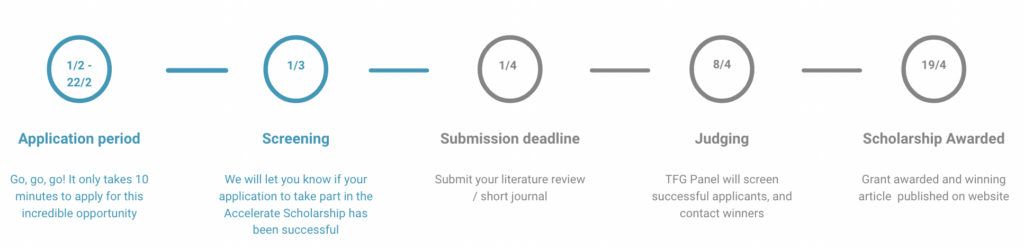

Timelines

Important deadlines

- Confirm the topic and subject you have chosen as soon as possible

- Submit your article by 1st April 2022

What’s in it for you?

Funding

Receive a $1,000 Scholarship Grant towards your academic studies

Reputation

Boost your professional reputation as a recipient of the Accelerate Scholarship

Networking

The opportunity to work with experts in international trade

Development

Guidance from TFG’s editorial team

1. Read our guides

Once you have sent us your final drafts for the posts we will send you feedback before it’s submitted to the panel as part of your entry to Accelerate.

2. Choose your topic

We’ve listed the topics and geographies below, and suggested some possible headlines and subjects as starting points.

Please use these to have a think about the kind of areas you would like to write about, and then let us know over email what is of interest to you.

Sectors

- International Trade

Analysis of free trade agreements and blocs

Up and coming trade agreements

Trade tariffs and trade barriers in certain markets

Customs declarations post-Brexit – what has changed?

A deep dive on certificates of origin

Phytosanitary measures in Australia and how this impacts trade

The changing role of the World Trade Organisation

World Customs Organisation – an overview

Trade deficits and trade surpluses – how trade works

The impact of COVID-19 on global supply chains

- Trade Finance

How trade finance can help facilitate trade growth post-COVID

Export Credit Agencies and their role in international trade

Public-Private Finance Partnerships

Different types of trade finance

Foreign exchange / currency movements – a deep dive into various currencies and pegs

The role of trade credit insurance and reinsurance in global trade

Shariah and Islamic finance explained

Legal reform of trade finance – the acceptance of digital documents in international trade

An explanation of the Model Law on Electronic Transferable Documents (MLETR) and the role of UNCITRAL in trade

Supply chain finance disclosure requirements and how this might change post the collapse of Greensill

- Shipping and Freight

The great freight crisis

Wider impacts of shipping and supply chain disruptions

Offshoring, reshoring and nearshoring – has the US-China trade war had long-lasting consequences on global supply chains?

Port closures as a result of COVID and how this has changed shipping

Innovations in shipping and supply chains

Building sustainable supply chains and recent innovations

A history of the container ship

- Business Finance

Debt versus equity finance for business finance

Deep dive on invoice finance (discounting and factoring)

Overview on different types of business finance and their effectiveness in supporting domestic and international finance

The rise of alternative finance

Fintech innovations / uses of fintech in alternative finance

An overview of stagflation and how it’s impacting economies – monetary and fiscal policy

- Technology

DeFi (decentralized finance) and its role in trade

Central Bank Digital Currencies (CBDC) and impact on monetary policy / trade

The role of blockchain in international trade

Emerging technologies and supply chain (e.g. machine learning, artificial intelligence, automation)

How technology can be used for the automation of manual trade processes such as document checking

Use cases for technology in implementing more sustainable supply chains

Has greenwashing gone too far and how can technology

- Commodities, Softs and Agriculture

An insight on the commodities supercycle

Oil / LNG Macro economic trends

Sustainability and LNG markets

Sustainability and ESG in commodity trade finance

Metals markets overview

Car markets – the new role of EU vs Britain post Brexit and car manufacturers

Agri / grain – Africa overview

The semiconductor (shortage) crisis

Global Food Crisis

How do farmers access finance?

3. Need help?

Send your questions to education@tradefinanceglobal.com

Please note we will be checking your work for plagiarism and duplicate content.

Trade Finance Global are trusted and used by:

Education Partners

- Partner Courses

- CPD Qualified Content