CTRM (Commodity Trading and Risk Management) Software

Content

When it comes to Commodity Trading and Risk Management (CTRM), having the right software can make all the difference, and there are now a plethora of options available in the market. With so many options, choosing the right software can be a daunting task, that’s where TFG can help.

Which CTRM Software is right for you?

Here’s our Top 20 CTRM Systems…

- AEGIS Hedging – Best for comprehensive commodity and rate hedging, offering modern software and expertise for risk mitigation and portfolio valuation.

- Agiboo – Best for physical and derivative trading with high configurability.

- Murex – Best-in-class integrated solution for comprehensive financial technology needs, ideal for capital markets players seeking a global, cross-asset platform with regulatory readiness.

- Amphora – Best for commodity trading with a global presence, committed to customer service and forward-thinking solutions.

- ION Aspect – Best for commodity trading, providing a real-time, web-based interface with quick deployment for integrated insights.

- Arantys (by Cadran Consultancy) – Best for cloud-based ERP in commodity trading, offering end-to-end functionality with real-time insights and quick deployment.

- Balsamo (by Commodities Engineering) – Best for handling the full trade lifecycle of any commodity, providing flexibility as a standalone or integrated solution.

- CMS Trade (by CMS Computer Management System SA) – Best for specialised raw commodity trading software since 1978, offering real-time data synchronisation.

- Comcore (by ComFin Software) – Best for next-gen CTRM, combining cutting-edge technology with decades of experience for comprehensive commodity trading solutions.

- CommodityPro – Best for handling the full trade lifecycle of any commodity, offering high flexibility and a comprehensive package of features.

- CoreTRM – Best for integrated CTRM, standing out with its ability to handle large enterprise user bases and a responsive, cloud-based, API-first platform.

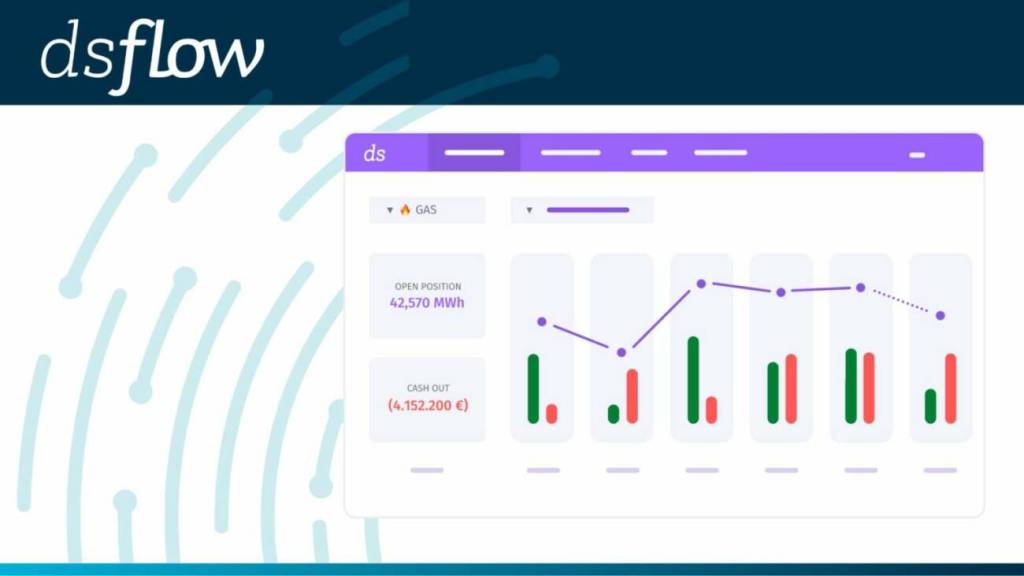

- Dsflow – Best for modern energy trading and risk management, providing real-time visibility for informed decision-making.

- DycoTrade – Best for Commodity ERP embedded in MS Dynamics 365 F&SCM, offering a complete solution for trading operations.

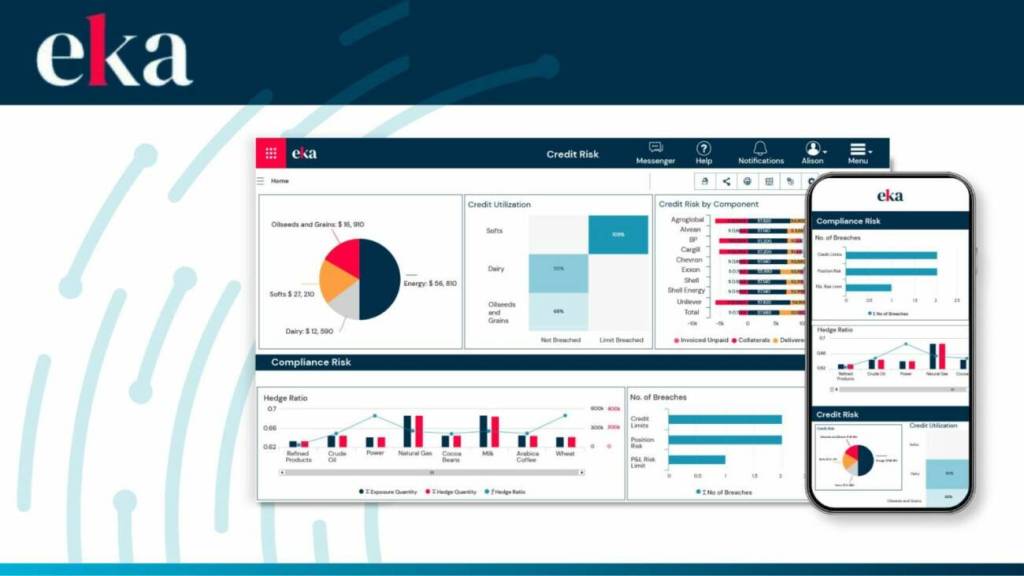

- Eka – Best for cloud-based CTRM, providing real-time data, advanced analytics, and tools for reacting faster in volatile markets.

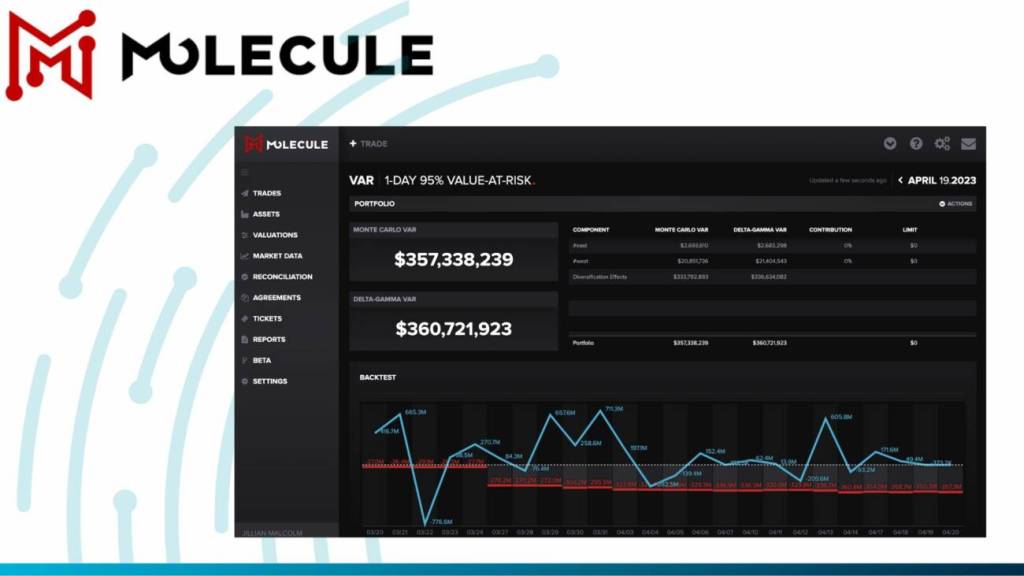

- Molecule – Best for forward-thinking energy and commodities trading companies, offering a modern platform in the cloud, with an intuitive interface.

- Enverus – Best for suite solutions tailored to commodity trading and risk management, focusing on real-time market data and enterprise-level data management.

- Fendahl’s Fusion CTRM – Best for next-gen commodity trading and risk management, with a single, easy-to-use modular platform and high customizability.

- MineMarket (by Datamine) – Best for mining intelligence software, providing a complete mine-to-market solution with broad coverage.

- Partner XM Commodity Management (By Eximware Inc) – Best for intelligence-driven CTRM, offering a complete solution for managing trading operations and power plant performance.

- CoreTRM – Ideal integrated CTRM solution, excelling in managing large enterprise user bases. Responsive, cloud-based, API-first platform for rapid deployment and scalable business growth.

AEGIS Hedging — Premier Choice for Commodity and Rate Hedging

AEGIS Hedging is a top-tier provider in the realm of commodity and rate hedging, offers unmatched technology and expertise to help producers, consumers, manufacturers, and investors mitigate risk and protect their cash flow. The company’s modern software and expertise allow users to research the market, analyse margin exposure, execute hedge transactions, and value portfolios all in one place.

Why AEGIS Hedging Stands Out:

AEGIS Hedging differentiates itself through its comprehensive approach to hedging. The company’s platform allows users to exchange their floating price risk for a fixed price, often at little or no cost. This makes it a valuable tool for any organisation looking to protect its financial stability in volatile markets.

AEGIS Hedging Standout Features & Integrations

AEGIS Hedging covers a wide range of markets, offering solutions for commodity markets, emissions markets, and more. The platform provides users with action-oriented market insights, helping them make informed decisions about their hedging strategies.

AEGIS Hedging also offers carbon and emission solutions, serving as a trusted partner for organisations’ carbon compliance and revenue-generating credit needs. This makes it a versatile tool for organisations operating in industries with significant environmental impacts.

Pros

- Comprehensive approach to hedging

- Covers a wide range of markets

- Provides action-oriented market insights

- Offers carbon and emission solutions

Cons

- May require a certain level of expertise for effective use

- May not be suitable for organizations not involved in commodity or rate hedging

AEGIS Hedging is a robust tool for any organisation involved in commodity or rate hedging. Its comprehensive approach and wide market coverage make it a versatile solution that can adapt to the changing needs of the market. Whether you’re looking to protect your cash flow, comply with carbon regulations, or gain insights into market trends, AEGIS Hedging has the tools you need to achieve your goals.

Agiboo — Top Choice for Commodity Trading and Risk Management

Agiboo is a leading provider in the sphere of commodity trading and risk management (CTRM), caters to the requirements of professionals in commodity trading, merchandising, and risk management. Agiblocks, the company’s flagship product, is a cutting-edge CTRM software offering a comprehensive set of tools to manage the intricacies of physical and derivative trading.

Why Agiboo Stands Out

Agiboo distinguishes itself through its focus on the specific requirements of commodity traders. The software handles the complexities of physical trading, including logistics, contracts, and risk management. It also supports derivative trading, offering tools for hedging, valuation, and compliance. The software boasts high configurability, allowing tailoring to the unique needs of each organisation.

Agiboo Standout Features & Integrations

Agiblocks includes features such as real-time position keeping, risk management, contract management, logistics and operations, and financial management. It also offers advanced analytics and reporting tools, providing users with insights into their trading activities and market trends.

Agiboo integrates seamlessly with a range of other systems, including ERP and accounting systems, market data providers, and logistics and warehouse management systems. This allows users to streamline their workflows and ensure synchronisation of all their data.

Pros

- Specialised for commodity trading

- Comprehensive suite of tools for physical and derivative trading

- Highly configurable to meet the unique needs of each organisation

- Advanced analytics and reporting tools

Cons

- May not be suitable for organisations not involved in commodity trading

- Requires a certain level of expertise for effective use

Agiboo is a robust tool for any organisation involved in commodity trading. Its comprehensive suite of tools and high degree of configurability make it a versatile solution that can adapt to the changing needs of the market. Whether trading physical commodities or derivatives, Agiboo has the tools required to manage activities effectively and stay ahead of the market.

Murex – MX.3 — Integrated Financial Technology Solutions

For over three decades, Murex has been at the forefront of providing enterprise-wide, cross-asset financial technology solutions to capital markets players. With its flagship platform, MX.3, Murex has established itself as a trusted partner for clients globally, offering comprehensive support for trading, treasury, risk, and post-trade operations.

Why Murex Stands Out

Murex distinguishes itself through its commitment to cutting-edge technology, superior customer service, and unique product innovation. With MX.3, Murex provides a cross-function platform that supports market standards out-of-the-box while allowing customisation and applications development. Its continuous delivery approach ensures the safest and quickest way to channel innovation at scale.

Murex Standout Features & Integration

- Cross-Asset Platform: MX.3 covers all asset classes and functions, automating and controlling the entire value chain for the sell side.

- Regulatory Readiness: Murex collaborates with market utilities, industry associations, and clients for regulatory compliance, addressing clearing, collateral, trade reporting, market, counterparty credit, and liquidity risk.

- Global Partnerships: With a unique geographical footprint and three decades of experience, Murex is the solution of choice for handling local specifics globally.

Pros

- Comprehensive Financial Technology Solution: MX.3 offers a holistic solution for trading, treasury, risk, and post-trade operations.

- Regulatory Readiness: Murex’s commitment to regulatory compliance ensures clients can navigate evolving standards with ease.

- Global Presence: With over 50,000 daily users in 60 countries, Murex’s global partnerships make it a reliable choice for diverse financial institutions.

Cons

- Learning Curve: The system’s comprehensive nature may pose a learning curve for new users.

- Potentially not suitable for Smaller Businesses: MX.3 may be more extensive than needed for smaller businesses that don’t require such a comprehensive solution.

Conclusion: Murex’s MX.3 stands as a best-in-class integrated solution, offering a comprehensive, adaptable, and globally recognised platform for capital markets players. While it may have a learning curve and be more suitable for larger enterprises, its commitment to innovation and regulatory readiness makes it a strategic choice for those seeking advanced financial technology solutions.

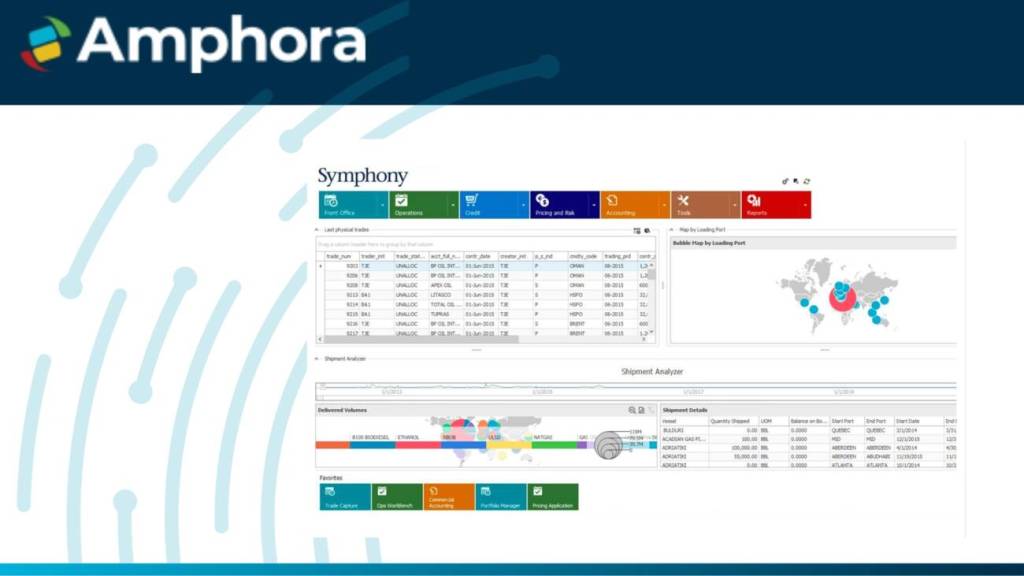

Amphora — Specialised Solution for Commodity Trading and Risk Management

Amphora is a distinguished provider in the commodity trading and risk management (CTRM) sector, offering a range of products tailored to meet the unique needs of various trading businesses. These include Symphony, a versatile multi-commodity platform, and Alchemy, a platform specifically designed for metals concentrates trading.

Why Amphora Stands Out

Amphora sets itself apart through its commitment to delivering exceptional service to its customers and partners. With development and service centres located in the UK, USA, India, Switzerland, and Singapore, Amphora provides localised knowledge on a global scale. The company maintains a forward-thinking approach, anticipating shifts in technology and customer demands to ensure its solutions remain relevant and effective.

Amphora Standout Features & Integrations

Amphora’s suite of products each offer unique features. Symphony, their primary product, is a commodity trading and risk management solution that provides a scalable multi-commodity platform. Alchemy, on the other hand, is a dedicated platform for metals concentrates trading, designed to cater to the complexities of this specific trading business.

Additional products include the Trade Confirmations Manager for efficient creation of trade documents, the Freight Manager for advanced freight trading, and the Claims Manager, which offers full integration with Symphony and is based on the Microsoft workflow engine.

Amphora also provides Symphony Credit, a pioneering tool for real-time credit exposure calculation in the commodities industry, offering high-performance reporting and exposure monitoring.

Pros

- Offers a diverse range of products for various trading needs

- Provides exceptional support with a global reach

- Maintains a forward-thinking approach to adapt to market changes

- Prioritises investment in its team, ensuring high-quality service

Cons

- May require a certain level of expertise for effective use

- May not be suitable for organisations not involved in energy trading or risk management

Amphora is a comprehensive solution for organisations involved in commodity trading or risk management. Its diverse suite of products and commitment to customer service make it a reliable choice for businesses seeking to streamline operations, ensure regulatory compliance, and gain insights into market trends.

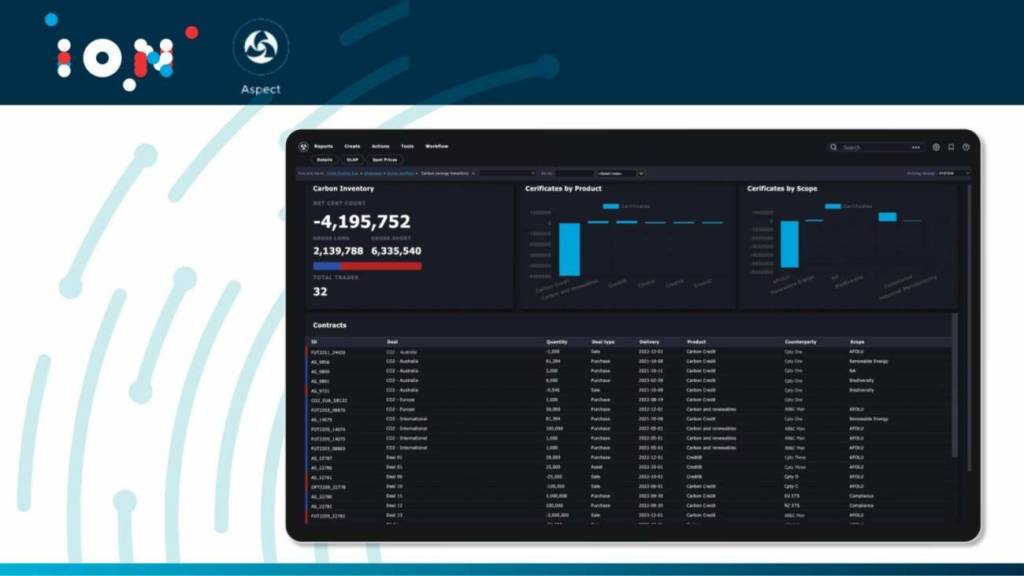

ION Aspect — Specialised Solution for Commodity Trading

ION Aspect is a distinguished provider in the commodity trading sector, offers a multi-tenant SaaS solution designed specifically for traders, refiners, producers, and marketers of crude oil, refined petroleum products, petrochemicals, metals, as well as carbon traders. The system provides integrated insights into trading, logistics, financial, and risk management processes, helping businesses capitalise on new opportunities faster.

Why ION Aspect Stands Out

ION Aspect sets itself apart through its comprehensive, web-based user interface that provides real-time insights across an organisation. The system is designed to offer recommendations on choices to make for maximum profitability. With rapid deployment times, ION Aspect provides a quick return on investment.

ION Aspect Standout Features & Integrations

ION Aspect offers several key features that help transform businesses. These include real-time calculations and reporting, standard exchange connectivity with seamless continuity of service, and integrated data feeds.

The system is enhanced with market data from leading exchanges and news sources, empowering decision-making. It also includes a Decision Support Center (DSC) that supports traders globally by providing access to a market data and news aggregation platform, available on all devices.

ION Aspect also offers a Carbon Zero module to manage energy transition with a simple, fast trading and inventory solution that covers the full carbon and renewable certificate lifecycle.

Pros

- Offers a cloud-based SaaS system for commodity traders

- Provides real-time insights across an organisation

- Features automated workflows for financial and treasury management

- Supports optimal logistics planning and risk management

Cons

- May require a certain level of expertise for effective use

- May not be suitable for organisations not involved in commodity trading

ION Aspect is a comprehensive solution for organisations involved in commodity trading. Its cloud-based SaaS system and commitment to providing real-time insights make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

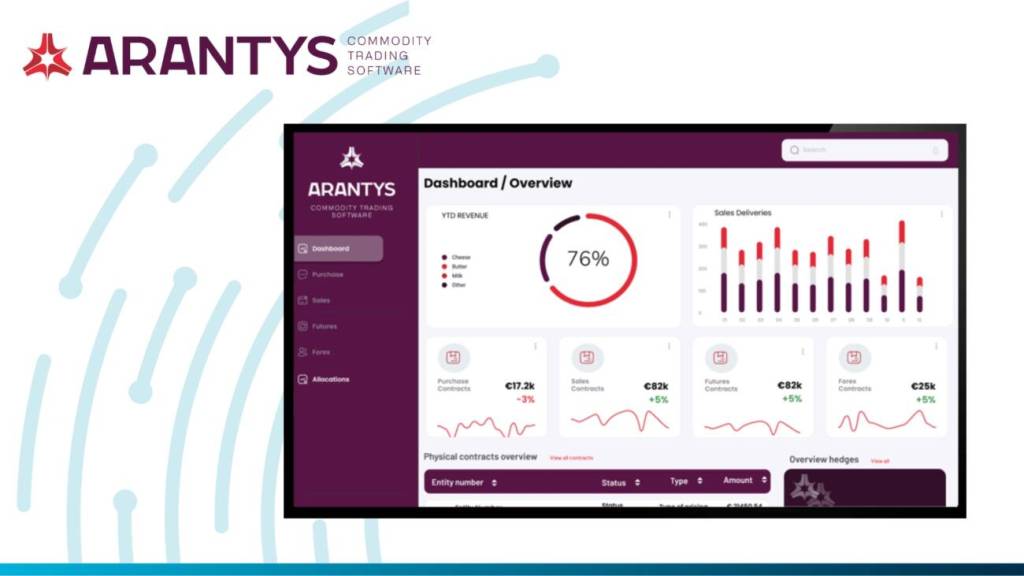

Arantys (by Cadran Consultancy) — Specialised ERP Solution for Commodity Trading & Risk Management

Arantys is a product offered by Cadran Consultancy, is a cloud-based ERP solution specifically developed for commodity traders. The system provides end-to-end functionality to manage commodity trading processes from contract to cash. This integrated CTRM ERP solution enables businesses to control their processes and manage risks effectively.

Why Arantys Stands Out

Arantys sets itself apart through its comprehensive, cloud-based user interface that provides real-time insights across an organisation. The system is designed to offer recommendations on choices to make for maximum profitability. With rapid deployment times, Arantys provides a quick return on investment.

Arantys Standout Features & Integrations

Arantys offers several key features that help transform businesses. These include real-time position insight, risk management, logistic planning, allocation and execution, hedging functionality, future and forex settlement, and mark-to-market.

The system is enhanced with analytics & reporting capabilities, document handling, sample and quality management, transportation management, and borrowing base reporting.

Arantys is fully integrated with Oracle JD Edwards ERP, providing one version of the truth. It also features workflow management and is fully deployed in the cloud.

Pros

- Offers a cloud-based ERP system for commodity traders

- Provides real-time insights across an organisation

- Features automated workflows for financial and treasury management

- Supports optimal logistics planning and risk management

Cons

- May require a certain level of expertise for effective use

- May not be suitable for organisations not involved in commodity trading or risk management

Arantys is provided by Cadran Consultancy, is a comprehensive solution for organisations involved in commodity trading. Its cloud-based ERP system and commitment to providing real-time insights make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

Balsamo (by Commodities Engineering) — Comprehensive CTRM Solution

Balsamo, a product developed by Commodities Engineering, is a unique Commodity Trading and Risk Management (CTRM) software platform. This platform is designed to handle the full trade lifecycle of any commodity and is unrivalled for simplifying complex management of raw materials, refined, scrap, concentrates, and precious metals.

Why Balsamo Stands Out

Balsamo sets itself apart with its capability to handle the full trade lifecycle of any commodity, making it a unique CTRM solution. The platform is highly flexible, allowing it to be used as a standalone solution or integrated into existing software infrastructure. It offers a comprehensive package of front, middle, and back-office features, providing straight-through processing from trade capture to invoice generation.

Balsamo Standout Features & Integrations

Balsamo offers several key features that help transform businesses. These include quick and easy physical and paper deal entry, accurate capture of complex trades, and powerful functionality for managing operations, logistics, and storage.

The platform’s risk management functionality is built upon international best practices, allowing companies to monitor, report, and manage various types of risk in real time. Back-office tools include an Invoice Manager for direct generation of invoices and account statements, and the system can be connected to a company’s existing ERP system or accounting software.

For top management, Balsamo provides real-time data, analytics dashboards, and profitability reports, allowing informed decisions based on accurate and up-to-date information.

Pros

- Offers a comprehensive CTRM solution

- Provides real-time insights across an organisation

- Features automated workflows for financial and treasury management

- Supports optimal logistics planning and risk management

Cons

- The system’s complexity may require a steep learning curve for new users.

- The platform may be overkill for smaller businesses that don’t require such a comprehensive solution.

- As it’s designed for commodity trading, it may not be suitable for businesses outside of this sector.

- The cost of the software and potential implementation services may be prohibitive for some businesses.

Balsamo, provided by Commodities Engineering, is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing real-time insights and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

CMStrade — Comprehensive Solution for Commodity Trading & Risk Management

CMStrade is a pioneer in software specialised for raw commodity trading companies, offers a comprehensive solution that handles all trade and business operations. This software, implemented in 1978, is designed to synchronise data across all departments in real-time, optimising efficiency, regulatory compliance, and safety.

Why CMStrade Stands Out

CMStrade sets itself apart through its comprehensive, real-time synchronisation of data across all departments. The system is designed to offer recommendations on choices to make for maximum profitability. With rapid deployment times, CMStrade provides a quick return on investment.

CMStrade Standout Features & Integrations

CMStrade offers several key features that help transform businesses. These include real-time position insight, risk management, logistic planning, allocation and execution, hedging functionality, future and forex settlement, and mark-to-market.

The system is enhanced with analytics & reporting capabilities, document handling, sample and quality management, transportation management, and borrowing base reporting.

CMStrade also offers credit lines and cash management tracking physicals and accounting, industrial-strength cost accounting, transaction tracing across departments up to the original voucher, efficient audits, regulatory compliance, and truer risk control.

Pros

- Offers a comprehensive solution for commodity traders

- Provides real-time insights across an organisation

- Features automated workflows for financial and treasury management

- Supports optimal logistics planning and risk management

Cons

- May require a certain level of expertise for effective use

- May not be suitable for organisations not involved in commodity trading or risk management

CMStrade is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing real-time insights and synchronising data across all departments make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

Comcore by ComFin Software — Next-Generation CTRM Solution

Comcore is a product developed by ComFin Software, is a next-generation Commodity Trading and Risk Management (CTRM) software platform. This platform is designed to provide a comprehensive solution for managing the complex and multifaceted processes involved in commodity trading.

Why Comcore Stands Out

Comcore sets itself apart with its combination of cutting-edge technology and decades of experience in the field. The platform is highly flexible, allowing it to be used as a standalone solution or integrated into existing software infrastructure. It offers a complete package of front, middle, and back-office features, providing straight-through processing from trade capture to invoice generation.

Comcore Standout Features & Integrations

Comcore offers several key features that help transform businesses. These include quick and easy physical and paper deal entry, accurate capture of complex trades, and powerful functionality for managing operations, logistics, and storage.

The platform’s risk management functionality is built upon international best practices, allowing companies to monitor, report, and manage various types of risk in real time. Back-office tools include an Invoice Manager for direct generation of invoices and account statements, and the system can be connected to a company’s existing ERP system or accounting software.

For top management, Comcore provides real-time data, analytics dashboards, and profitability reports, allowing informed decisions based on accurate and up-to-date information.

Pros

- Offers a comprehensive CTRM solution

- Provides real-time insights across an organisation

- Features automated workflows for financial and treasury management

- Supports optimal logistics planning and risk management

Cons

- May require a certain level of expertise for effective use

- May not be suitable for organisations not involved in commodity trading or risk management

Comcore is provided by ComFin Software, is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing real-time insights and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

CommodityPro — Streamlined CTRM Solution

CommodityPro is a unique Commodity Trading and Risk Management (CTRM) software platform that provides a comprehensive solution for managing the full trade lifecycle of any commodity. It is designed to simplify the complex management of raw materials, refined, scrap, concentrates, and precious metals.

Why CommodityPro Stands Out

CommodityPro sets itself apart with its capability to handle the full trade lifecycle of any commodity, making it a unique CTRM solution. The platform is highly flexible, allowing it to be used as a standalone solution or integrated into existing software infrastructure. It offers a comprehensive package of front, middle, and back-office features, providing straight-through processing from trade capture to invoice generation.

CommodityPro Standout Features & Integrations

CommodityPro offers several key features that help transform businesses. These include quick and easy physical and paper deal entry, accurate capture of complex trades, and powerful functionality for managing operations, logistics, and storage.

The platform’s risk management functionality is built upon international best practices, allowing companies to monitor, report, and manage various types of risk in real time. Back-office tools include an Invoice Manager for direct generation of invoices and account statements, and the system can be connected to a company’s existing ERP system or accounting software.

For top management, CommodityPro provides real-time data, analytics dashboards, and profitability reports, allowing informed decisions based on accurate and up-to-date information.

Pros

- Offers a comprehensive CTRM solution

- Provides real-time insights across an organisation

- Features automated workflows for financial and treasury management

- Supports optimal logistics planning and risk management

Cons

- The system’s complexity may require a steep learning curve for new users

- As it’s designed for commodity trading, it may not be suitable for businesses outside of this sector

CommodityPro is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing real-time insights and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

CoreTRM — Integrated CTRM Solution

CoreTRM is an innovative Commodity Trading and Risk Management (CTRM) software platform that integrates front, middle, and back-office activities for multiple commodities. Designed with a best-in-class commodity trading and risk management business process mindset, CoreTRM offers state-of-the-art software deployment and seamless version control.

Why CoreTRM Stands Out

CoreTRM stands out with its ability to handle even the largest of enterprise user bases, allowing businesses to start small and expand at their own pace. It offers a responsive, cloud-based, API-first platform that is fast to roll out, easy to configure, and extendable.

CoreTRM Standout Features & Integrations

CoreTRM offers several key features that help transform businesses. These include complex deal capture and price modelling, a multi-dimensional view of exposure and trade profitability, and a ‘Deadline and Alert’ system for cargo operations management.

The platform’s risk management functionality allows for multi-level interrogation of profit and loss, exposure, and activity by audit trail. It also provides approved customer controls and full control on the price import function.

For top management, CoreTRM provides a multi-dimensional view of profit and loss, exposure, deal changes, and new commitments. It also allows an overlay of exposure limits and other control mechanisms to flag exceptional activity.

Pros

- Offers a comprehensive CTRM solution

- Provides real-time insights across an organisation

- Features a ‘Deadline and Alert’ system for cargo operations management

- Supports complex deal capture and price modelling

Cons

- The platform may be overkill for smaller businesses that don’t require such a comprehensive solution.

- The cost of the software and potential implementation services may be prohibitive for some businesses

CoreTRM is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing real-time insights and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

Dsflow — Modern Energy Portfolio Management

Dsflow is a modern energy trading and risk management solution designed to manage your entire deal flow. It provides real-time visibility into positions and risks, enabling energy traders, buyers, and producers to make informed decisions.

Why Dsflow Stands Out

Dsflow stands out for its ability to ingest the entire deal flow, providing instant visibility into positions and risks. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

Dsflow Standout Features

Dsflow stands out for its ability to ingest the entire deal flow, providing instant visibility into positions and risks. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

Dsflow provides several key features:

- Secure Trade Capture: Traders can securely capture their trade flow, ensuring the integrity and confidentiality of their trading data.

- Consumption Forecasts: Buyers can get their consumption forecasts and open-positions, enabling them to plan their energy purchases effectively.

- Power Plant Performance Audit: Producers can audit their power plants’ performance, allowing them to identify and address operational inefficiencies.

- Real-Time Visibility: Dsflow provides real-time visibility into positions and risks, enabling users to make informed decisions.

Pros

- Offers a modern energy trading and risk management solution

- Provides real-time visibility into positions and risks

- Supports secure trade capture, consumption forecasts, and power plant performance audits

- Designed for energy traders, buyers, and producers

Cons

- Smaller businesses might not fully utilise the extensive features offered by the platform

Dsflow is a comprehensive solution for organisations involved in energy trading. Its commitment to providing real-time insights and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

DycoTrade Commodity ERP Solution — Integrated CTRM Software

DycoTrade is a state-of-the-art Commodity ERP Solution, fully embedded in MS Dynamics 365 F&SCM. It provides a complete solution for managing the entire trading operations, optimising logistics, mitigating risks, and integrating with accounting.

Why DycoTrade Stands Out

DycoTrade stands out for its ability to provide a complete solution for managing the entire trading operations. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

DycoTrade Standout Features

DycoTrade provides several key features:

- Risk Management: Real-time overview of your positions. Within DycoTrade, you can evaluate your trade risks to a significant extent. You can access a real-time overview of your commodities and currency position.

- Position Management: In DycoTrade, your commodity and forex position is always up to date. It is a real-time system. In the position, you can have the physical-, future- and option contracts. It is up to you if you want to see the position per month or week.

- Trade Results: Using the Trading module in DycoTrade, you can manage all your trading activities, from items and delivery to prices and cash flow. All trades generated by DycoTrade are attuned to the actual market and market-to-market prices.

- Mark to Market: Calculate all contracts to one parity. Run Mark to market as often as required, Mark to market for different contracts, Mark to market on Purchase, Inventory, Sales, Futures and FX.

Pros

- Offers a modern energy trading and risk management solution

- Provides real-time visibility into positions and risks

- Supports secure trade capture, consumption forecasts, and power plant performance audits

- Designed for commodity traders, buyers, and producers

Cons

- The cost of implementation may be prohibitive for MSME/SMEs

- The time needed to learn the intricacies of the system

DycoTrade is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing a complete solution for managing the entire trading operations and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

Eka — Cloud-Based Commodity Trading and Risk Management Software

Eka is a comprehensive, cloud-based commodity trading and risk management (CTRM) solution. It provides real-time data and advanced analytics, enabling traders and risk managers to react faster and smarter in volatile markets.

Why Eka Stands Out

Eka stands out for its ability to provide a complete solution for managing trading operations. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

Eka Standout Features

Eka provides several key features:

- Physical Trade: Get end-to-end coverage of physical commodity trading with contract management, pricing, scheduling, workflow management, real-time views of position, exposure, and P&L, discounts and premiums, and procurement.

- Derivative Trades: Manage commodity derivative trading in one system with hedging and speculation, margins and brokerage, and mark to market computations.

- MTM and Position: View your real-time position exposure for physicals, derivatives, and Forex trading. Analyze the potential impact of dynamic market prices.

- P&L Explained: Identify critical factors for profit and loss change over time. Allocate P&L into more than 50 attribution buckets, spot anomalies, identify factors for P&L change, and view position change.

- VAR Calculation: Mitigate value at risks through informed decisions. Compute VAR on portfolio/scenario combinations, calculate component VAR, simulate market scenarios, and identify correlations between different market curves, interest, and exchange rates.

- Settlement: Manage real-time logistics and trade settlement, track goods movement, analyze KPIs by managing settlements and inventory, calculate accrual adjustments, manage costs, settlements, taxes, levies, and cash flow.

- Risk and Monitoring: Analyze global risk and track breaches. Define risk limit policies against position, P&L and VAR, create alerts for breaches, analyze breaches to assess the impact on P&L, and analyze trades by user-defined specifications.

Pros

- Offers a comprehensive solution for managing trading operations

- Provides real-time visibility into positions and risks

- Supports secure trade capture, consumption forecasts, and power plant performance audits

- Designed for commodity traders, buyers, and producers

Cons

- The platform’s focus on energy trading may not be suitable for businesses outside of this sector

- Smaller businesses may not need the range of features

Eka is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing a complete solution for managing the entire trading operations and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

Molecule — ETRM CTRM Software in the Cloud

Molecule is a modern and intuitive solution designed to revolutionise energy and commodities trading. Positioned as the alternative to outdated ETRM/CTRM systems, Molecule offers a cloud-based platform that prioritises innovation over constraints, providing a seamless trade risk management experience.

Why Molecule Stands Out

Molecule stands out as a contemporary ETRM/CTRM platform built in the cloud, replacing convoluted systems of the past. With an emphasis on an easy-to-use experience, near real-time reporting, and 30+ integrations, Molecule aims to streamline trade risk management and propel businesses into the future.

Molecule Standout Features & Integration

- Effortless Integrations + Automation: Molecule’s cloud-based ETRM/CTRM integrates with 30+ data sources, automates routine tasks, and acts as a natural extension of your risk management team.

- Near-Real-Time Trade Data Insights: Providing analytics on risk exposure, positions, and P&L, Molecule empowers users with instant access to accurate data and timely insights.

- Intuitive User Experience: Molecule’s cloud-based system offers a sleek, intuitive interface designed to simplify complex tasks, boost productivity, and enhance trade risk management efficiency.

- Rapid, Fixed-Fee Deployment: The platform offers fast, fixed-fee deployment, eliminating the complexity of traditional setups with flexibility and no hidden costs.

- Agile, Low-Maintenance Solution: Molecule’s agile SaaS platform minimizes maintenance demands, allowing users to focus on critical business operations.

Pros

- Efficiency and Productivity: Molecule streamlines trade risk management, saving time and providing greater visibility into positions.

- Responsive Customer Support: Customers appreciate Molecule’s responsive and attentive customer support, aligned with the company’s value of doing what’s best for its customers.

Cons

- Cost: The cost of the software and potential implementation services may be prohibitive for some businesses.

Molecule is not just a replacement for outdated ETRM/CTRM systems; it’s a catalyst for positive change in trade risk management. With its modern approach, user-friendly interface, and responsive support, Molecule empowers businesses to make better decisions, avoid risks, and achieve success.

Enverus Trading & Risk Solutions — Comprehensive Suite for CTRM

Enverus is a suite of solutions tailored to the needs of commodity trading and risk management. With a focus on real-time market data, forward curve building, and enterprise-level data management, Enverus provides a robust set of tools for trading across various markets and commodities.

Why Enverus Stands Out

Enverus distinguishes itself with its suite of solutions that cater to different aspects of commodity trading and risk management. It offers a browser-based interface that is user-friendly, with carefully designed screens and intuitive one-click actions.

Enverus Standout Features & Integrations

Enverus provides a range of solutions including:

- Enverus Foundations™: An essential set of oil & gas data analytics.

- Enverus Core™: High-value, cross-department workflows designed for rapid time-to-value realization impacting your top and bottom lines.

- Enverus Intelligence™: Technical research, publications, and direct access to industry experts that leverage today’s most advanced analytics and technology.

- Enverus Fusion™: Securely blend your internal, high-resolution data with Enverus analytics-ready data sets and models.

- MarketView: Bridges the front, middle, and back offices of your trading and risk organization, allowing you to view and analyze data in real time across multiple platforms.

Pros

- Offers a suite of solutions, providing flexibility and comprehensive coverage for different trading and risk management needs.

- Real-time market data and forward curve-building capabilities enhance decision-making processes

- User-friendly interface with intuitive one-click actions improves user experience.

- Integration with ecosystem partners extends the platform’s capabilities, offering more value to users.

Cons

- The wide range of solutions and features might be overwhelming for new users

- Businesses outside of commodity trading might find the platform less suitable for their needs

Enverus offers a comprehensive suite of solutions for organisations involved in commodity trading. Its commitment to providing real-time insights and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

Fusion CTRM by Fendahl

Fendahl’s Fusion CTRM is a next-generation commodity trading and risk management software solution that offers a single, easy-to-use modular platform. With a modern architecture and Fendahl’s 100% built-in-house philosophy, Fusion CTRM is highly customisable and can be easily adapted to meet your business processes.

Why Fendahl’s Fusion Stands Out

With a modern architecture and Fendahl’s 100% built-in-house philosophy, Fusion CTRM is highly customisable and can be easily adapted to meet your business processes.

Key Features

- Multi-Commodity Intelligent System: Fusion CTRM supports the requirements of front office, operations, and back office while providing powerful in-built reporting tools.

- Customizable and Flexible: Fusion CTRM can be easily modified to meet the unique business processes of each client.

- Fast Implementation: Fusion can be implemented much faster than legacy CTRM solutions, allowing you to get up and running quickly.

- Seamless Integration: Fusion CTRM can be easily integrated with third-party systems such as ERPs, providing you with a seamless and efficient solution for your commodity trading and risk management needs.

Pros

- Fusion CTRM offers a comprehensive solution for all your commodity trading and risk management needs.

- The software is highly customizable, allowing it to adapt to your specific needs.

- Fusion CTRM can be implemented quickly, reducing the time it takes to get up and running.

- The software can be easily integrated with third-party systems, providing a seamless and efficient solution.

Cons

- As with any software, there may be a learning curve for users unfamiliar with the system.

- The cost may be prohibitive for smaller businesses.

MineMarket by Datamine — Comprehensive Mining Intelligence Software

MineMarket by Datamine is a comprehensive mining intelligence software solution that provides a complete mine-to-market solution. It offers a broad coverage for managing the mining value chain by combining comprehensive material tracking, logistics management, and complex sales and marketing capability into a single solution.

Why MineMarket Stands Out

MineMarket stands out for its ability to provide a complete mine-to-market solution. It offers a broad coverage for managing the mining value chain by combining comprehensive material tracking, logistics management, and complex sales and marketing capability into a single solution. This allows for maximised commercial outcomes by optimising logistics, charting the impact of sales, and tracking and identifying operational bottlenecks.

MineMarket Standout Features & Integrations

MineMarket provides several key features:

- Increased supply chain visibility: MineMarket replaces the need for disparate technical and commercial systems, providing stakeholders with real-time access to key performance indicators such as production, inventory, quality, delays, and contract information.

- Standardised business processes: MineMarket enforces the standardisation of business processes by providing common data collection mechanisms throughout the entire supply chain.

- Improved control of production: The blending and planning functionality provides both the ability to consistently blend as well as visibility of stock shortages and quality problems well into the future.

- Supports complex commercial planning & operations: MineMarket supports and automates marketing desk processes, providing sophisticated tools to allow companies to compete efficiently in a global market.

- Enables regulatory compliance: MineMarket ensures that all generated data is traceable to and complies with the corresponding contractual arrangements, as well as maintaining complete audit details of every transaction.

Pros

- Offers a comprehensive mine-to-market solution

- Provides real-time access to key performance indicators

- Supports complex commercial planning & operations

- Ensures regulatory compliance

Cons

- The system’s complexity may require a steep learning curve for new users.

- The platform may be overkill for smaller businesses that don’t require such a comprehensive solution.

- As it’s designed for mining intelligence, it may not be suitable for businesses outside of this sector.

- The cost of the software and potential implementation services may be prohibitive for some businesses.

MineMarket is a comprehensive solution for organisations involved in mining. Its commitment to providing a complete mine-to-market solution and managing complex mining processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

Partner XM Commodity Management by Eximware — Intelligence Driven CTRM Solution

Partner XM Commodity Management by Eximware is an intelligence-driven CTRM solution that provides a complete solution for managing trading operations. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

Why Partner XM Stands Out

Partner XM stands out for its intelligence-driven approach to commodity management. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

Partner XM Standout Features

Partner XM provides several key features:

- Trade Life Cycle Management: Partner XM provides comprehensive management of the trade life cycle, from purchase/sale and forwards to allocations. It supports fixed and differentially priced trades and shipment spreads.

- Real-Time Access to Trade Data: Partner XM provides real-time access to trade data, enabling traders to make informed decisions.

- Transparency and Traceability: Partner XM provides transparency and traceability in trading operations, ensuring accountability and compliance.

- Forecasting & Demand Management: Partner XM supports forecasting and demand management, enabling effective planning and resource allocation.

- Position & Risk Management: Partner XM provides comprehensive position and risk management capabilities, helping traders manage their exposure and mitigate risks.

- Inventory Location & Delivery Status: Partner XM tracks inventory location and delivery status, providing real-time insights into stock levels.

- Title Documents: Partner XM manages title documents, ensuring the integrity and legality of trades.

- Shipping Instructions/Advices: Partner XM manages shipping instructions and advices, ensuring effective logistics management.

- Delivery Instructions/Orders: Partner XM manages delivery instructions and orders, ensuring timely and accurate delivery of commodities.

- Sample Management: Partner XM manages pre-shipment, arrival, and offer samples, and allows them to be assignable to contacts. It also supports configurable scoring and testing attributes.

Pros

- Intelligence-driven approach enhances decision-making capabilities.

- Real-time access to trade data supports informed decision-making.

- Transparency and traceability features ensure accountability and compliance.

- Advanced forecasting and demand management tools facilitate effective planning and resource allocation.

Cons

- The comprehensive nature of the platform may be overwhelming for smaller businesses or those with simpler needs

- The cost of the software and potential implementation services may be prohibitive for some businesses

Partner XM is a comprehensive solution for organisations involved in commodity trading. Its intelligence-driven approach and commitment to providing a complete solution for managing trading operations make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.

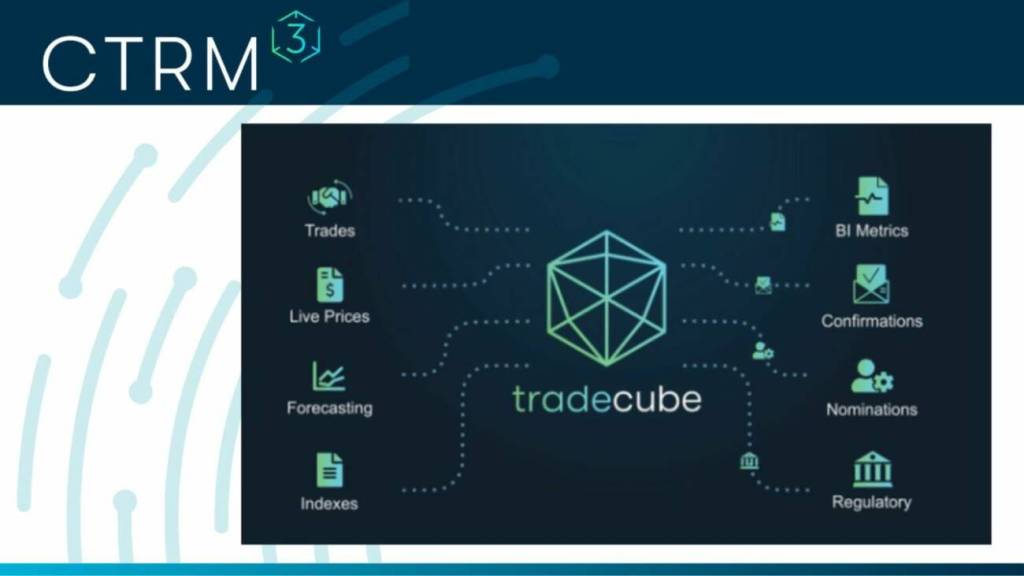

TradeCube by CTRM Cubed — Innovative CTRM Solution

CoreTRM — Integrated CTRM Solution

CoreTRM is an innovative Commodity Trading and Risk Management (CTRM) software platform that integrates front, middle, and back-office activities for multiple commodities. Designed with a best-in-class commodity trading and risk management business process mindset, CoreTRM offers state-of-the-art software deployment and seamless version control.

Why CoreTRM Stands Out

CoreTRM stands out with its ability to handle even the largest of enterprise user bases, allowing businesses to start small and expand at their own pace. It offers a responsive, cloud-based, API-first platform that is fast to roll out, easy to configure, and extendable.

CoreTRM Standout Features & Integrations

CoreTRM offers several key features that help transform businesses. These include complex deal capture and price modelling, a multi-dimensional view of exposure and trade profitability, and a ‘Deadline and Alert’ system for cargo operations management.

The platform’s risk management functionality allows for multi-level interrogation of profit and loss, exposure, and activity by audit trail. It also provides approved customer controls and full control on the price import function.

For top management, CoreTRM provides a multi-dimensional view of profit and loss, exposure, deal changes, and new commitments. It also allows an overlay of exposure limits and other control mechanisms to flag exceptional activity.

Pros

- Offers a comprehensive CTRM solution

- Provides real-time insights across an organisation

- Features a ‘Deadline and Alert’ system for cargo operations management

- Supports complex deal capture and price modelling

Cons

- The system’s complexity may require a steep learning curve for new users

- The cost of the software may be prohibitive for some businesses

CoreTRM is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing real-time insights and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.