Digital Ecosystems in Trade Finance

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

Global trade continues to recover following the dip caused by the financial crisis. Of course, trade volumes are currently threatened by a slowing global economy, trade tensions between the US and China, and the real possibility of a no-deal Brexit. But the long-term outlook remains positive. Supply chains are continuing to become more international, drawing on many parties from around the world.

TFG reports exclusively on the white paper: Digital Ecosystems in Trade Finance, from Boston Consulting Group (BCG), SWIFT and the International Chamber of Commerce (ICC).

Introduction

1.1. Trade at a glance

Global trade continues to recover following the dip caused by the financial crisis. Of course, trade volumes are currently threatened by a slowing global economy, trade tensions between the US and China, and the real possibility of a no-deal Brexit. But the long-term outlook remains positive. Supply chains are continuing to become more international, drawing on many parties from around the world.

This ought to be good news for the banks that supply trade finance. However, at the same time as trade volumes are increasing, other forces are reducing banks’ margins. Transactions continue to shift from documentary trade, typically involving letters of credit issued by banks, to open account trade. Costs are also proving stubbornly high. This is partly a consequence of increased regulatory burdens. But it also results from a failure to digitise and automate operations. Trade finance remains a largely paper-based and laborious business. A single transaction often requires the interaction of more than 20 entities, and involves between 10 and 20 paper documents and 5,000 data field exchanges.

Several attempts to digitise trade finance have been made over recent years, but they gained insufficient take-up to materially reduce the role of paper and manual data entry across the industry. The latest initiative in this area is the idea of “digital trade ecosystems” – a digital platform that connects entities within the trade finance network and facilitates the flow of data between them. Consortia of banks and other large players in trade finance are investing heavily in their development.

Will these ecosystems succeed where other attempts to digitise trade finance have failed? To help evaluate their prospects, BCG and SWIFT (with support from the ICC), surveyed banks and corporates to discover their attitudes towards digital ecosystems: what are they looking for, where do they expect ecosystems to be valuable, and what would it take for them to adopt the technology?

1.2. State of the international trade market

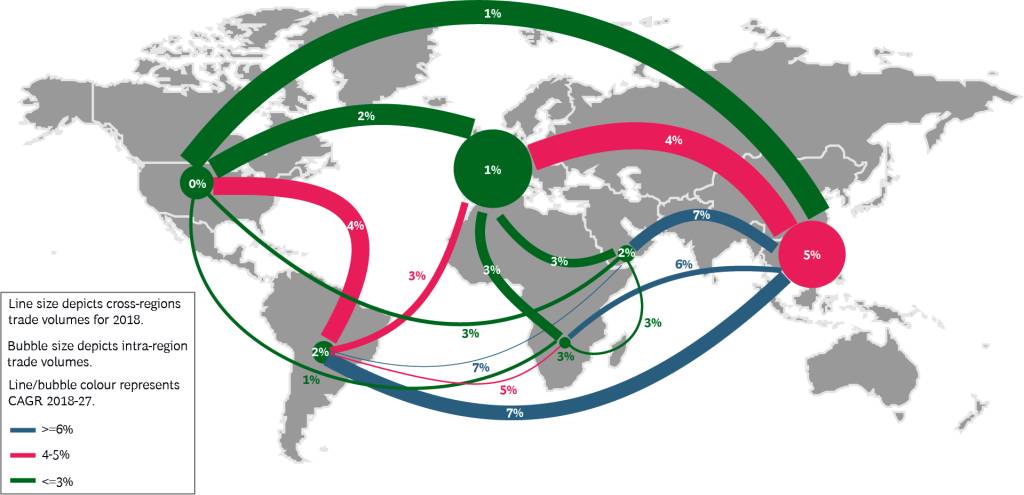

In 2018 international trade returned to its historical 2014 peak of $18.5 trillion. But current political uncertainties mean that we forecast trade flows to decline by 1% annually until the end of 2020. In the longer term, however, trade is likely to recover. According to the BCG Trade Finance Model, global trade should hit a new high of $25 trillion by 2027, growing at a CAGR of 3.3%. This growth will not be evenly distributed. India and Vietnam, for examples, are expected to become the 7th and 11th largest exporters respectively.

More generally, Asia as is expected to account for 40% of global trade flows by 2027, up from its 34% share in 2010. Asia-based corridors are expected to grow by between 1% and 7% annually from 2018-2027, while North America-based corridors are expected to grow by only 0% to 4% (see Exhibit 1).

Exhibit 1 – Global trade flows are expected to grow from 2018 to 2027, reaching US$25T

A slowdown in trade flows, combined with an expected margin squeeze of 1% to 2%, will likely lead to flat or slightly declining trade finance revenue pools in the short term. As flows recover, however, we expect revenues to climb from $47 billion today to $57 billion by 2027 – that is, at CAGR of 2.6% across the period.

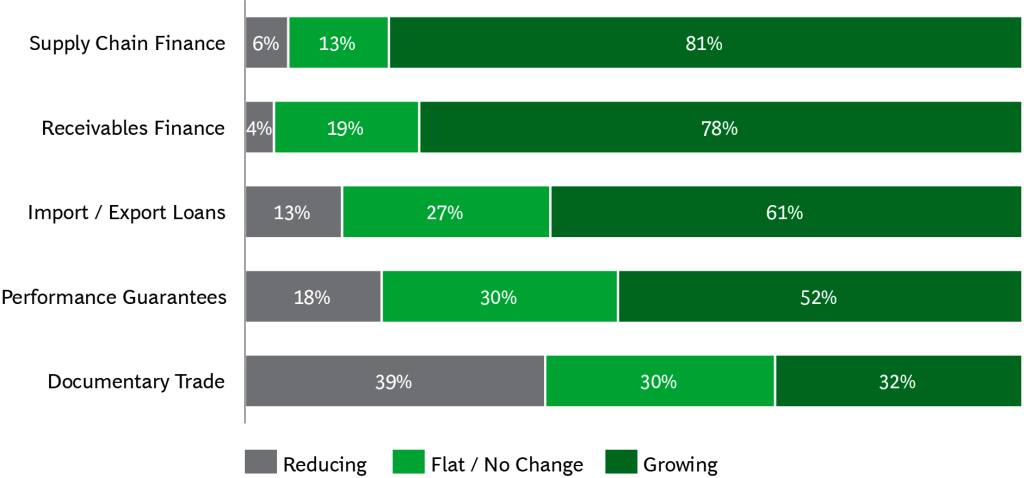

Because of the continuing shift in trade finance from documentary trade to lower- margin open account transactions, the growth in trade finance revenues will lag the recovery in trade flows. Today, open account trade accounts for 45% of trade finance revenues. BCG forecasts that by 2027, this figure will have increased to 60%. Trust amongst trading parties is increasing, and so is the demand for fast, frictionless business, as in the consumer world.

This forecast was corroborated by the results of our survey. More than 80% of respondents saw Supply Chain Finance and Receivables Finance as the trade products with the fastest growth. And 38% of respondents believe that demand for documentary trade will continue to decline (see Exhibit 2). Despite its decline, however, documentary trade does still have a role to play in the foreseeable future. Open account trade is not a like-for-like alternative, and a number of businesses – particularly SMEs with less established supply chains – will continue to need this form of risk mitigation when trading overseas, particularly in times of economic and political uncertainty.

1.3. How is demand for trade finance products changing?

Exhibit 2 – How is demand for trade finance products changing?

The willingness of traders to shift to new products has presented both opportunities and pressure for banks and non-banks to innovate in the trade finance space. The hype around new technologies, such as smart contracts, AI and Distributed Ledger Technology (DLT), has also transformed trade finance into a hotbed of innovation, attracting sustained investment in digital trade ecosystems.

Digital Ecosystems

2.1. Digitising trade – What are digital ecosystems?

Efforts to digitise trade have been going on for more than 10 years, with innovations such as BPO, and even early platforms such as Bolero. But they have gained little traction – as there is a vast number of participants in the trade ecosystem that lack the scale or sophistication to use these platforms, they fail to build the scale required for such network-based products. Recently, the ongoing shift to open account trade, coupled with increased appetite for digitisation and bank / investor ‘hype’ from technologies such as blockchain, has driven a new generation of innovation, with multiple digital ecosystems appearing over recent years. These ecosystems are often the products of consortia of cross- industry partners or sponsors collaborating to establish digital platforms that connect entities within the broader trade finance network and facilitate the flow of data between them. They typically aim to provide:

- Harmonisation – the ability for most parties involved in a transaction to interact via a single platform

- Efficiency – the automation and simplification of processes, including real-time data exchange, reducing costs for participants

- Transparency – the secure sharing of data directly between the relevant parties

- Security – the ability to authenticate parties and record transactions to reduce the chance of against fraud, with or without DLT

Many transactions using such technology have been announced recently. But they have typically been no more than test transactions, involving clients such as Cargill, Rio Tinto, wool exporter Fox & Lillie, and China’s state-owned Sinochem Energy Technology. They do not represent a systemic move to the new platforms for business-as-usual. Nor is there any “single winner”. Many platforms now compete, variously focused on specific regions, on kinds of goods, or on legal arrangements (such as documentary vs. open account trade).

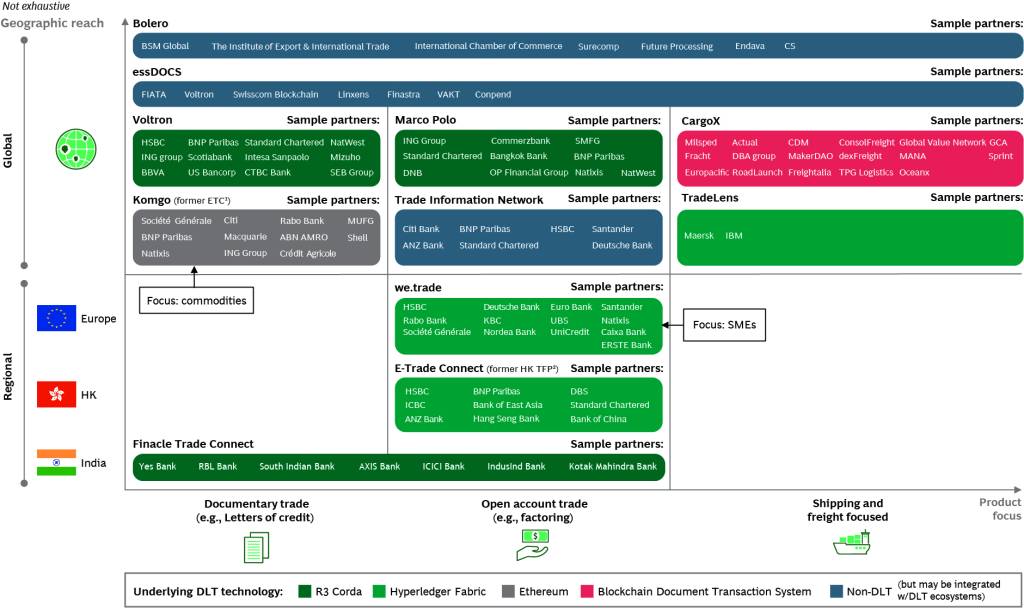

These digital ecosystems are also built on a variety of underlying technologies. Many use DLT plaforms such as R3’s Corda and Hyperledger. Others, such as Bolero, use more traditional infrastructure (see Exhibit 3).

2.2. Digital ecosystems: A map

Exhibit 3 – Digital ecosystems have a wide range of key partners and vary by geographic reach, product and client focus, and underlying technology

Despite all the innovation and investment, there seems to be no overarching narrative on the value propositions of this new wave of digital ecosystems. Many highlight the opportunities presented by interconnected trade, but the more pessimistic feel these claims are aimed at “finding a purpose for DLT”. Yet others consider this enthusiasm to be justified as a catalyst for wider digitisation in trade.

To get a clearer view of the matter, we surveyed a small number of banks and corporates to compare their starting positions and what they are seeking from digital trade finance ecosystems.

Current Pain Points in Trade Finance

3.1. What needs to change?

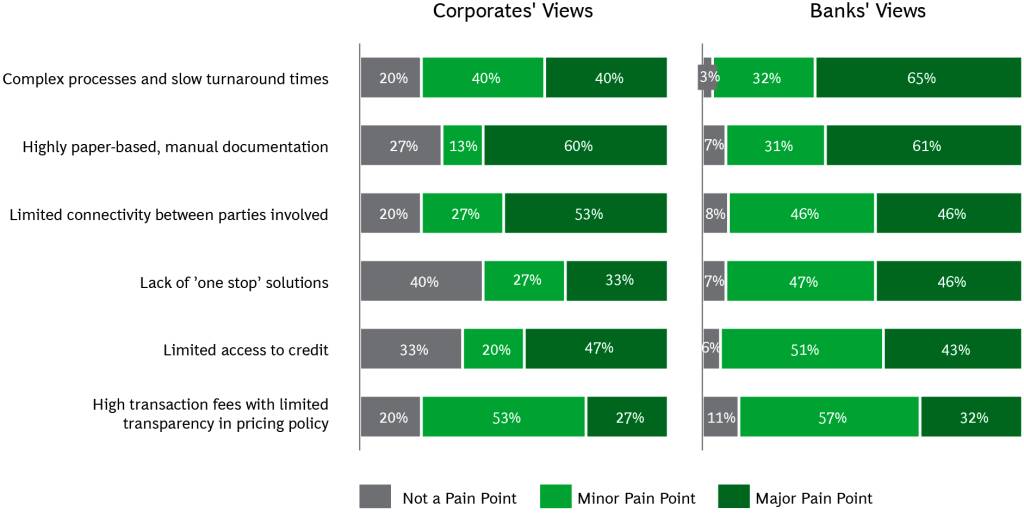

Banks and corporates have similar views on the pain points in trade finance. Transaction documentation remains largely paper-based and requires considerable manual data entry, driving up costs and complexity and damaging the customer experience. They also agree that there is too little connectivity between various parties in the trade landscape.

For corporates, the lack of one-stop solutions and high fees are generally considered to be minor pain points, with banks apparently over-estimating how much their customers care about these issues (see Exhibit 4).

3.2. What are the biggest ‘pain points’ for corporates?

Exhibit 4 – What are the biggest ‘pain points’ for corporates?

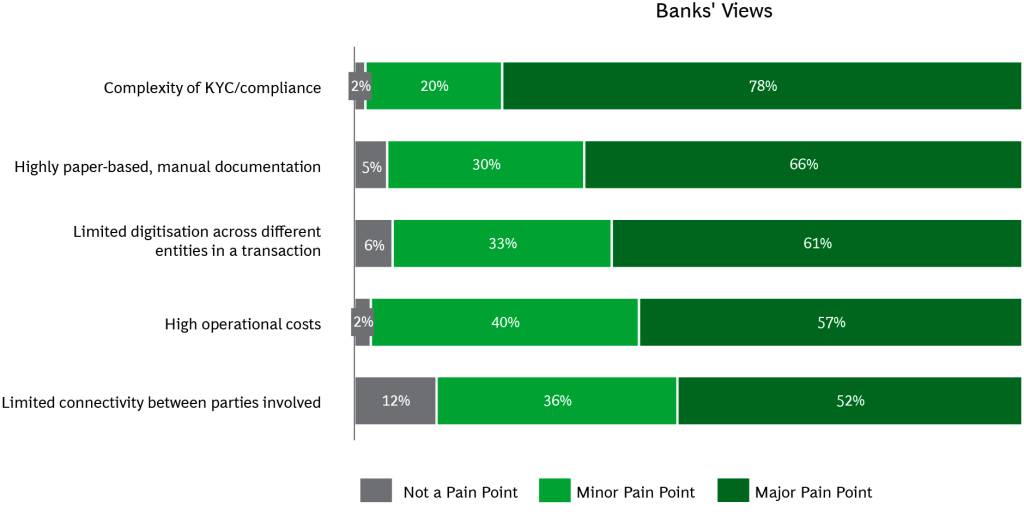

Besides the excessive use of paper documentation, the greatest pain points for banks are the burden of “Know Your Customer” (KYC) and other compliance requirements, especially when importers or exporters are from countries where data is difficult to obtain or trust (see Exhibit 5).

3.3. What are the biggest ‘pain points’ for banks?

Exhibit 5 – What are the biggest ‘pain points’ for banks?

Opportunities for Digital Ecosystems

4.1. What do banks and corporates want?

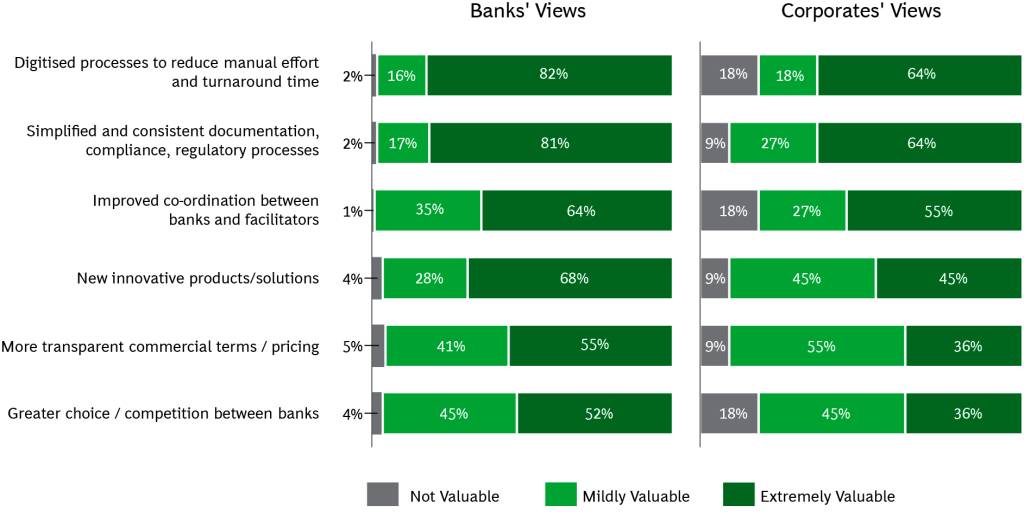

The above pain points can be significantly eased by digital trade ecosystems. Corporates are most looking forward to automated digital trade processes that will reduce manual effort while ensuring consistency and reducing error rates. They also seek the increased connectivity that digital ecosystems can provide within the fragmented trade community of importers, exporters, shipping companies, customs agencies and banks.

Interestingly, corporates are less concerned with gaining access to new, innovative products, improved commercial terms, or greater choice between competing banks. They seek the operational benefits of digital ecosystems rather than their potential to revolutionise the trade finance marketplace (see Exhibit 6).

4.2. What will corporates find valuable from trade finance ecosystems?

Exhibit 6 – What will corporates find valuable from trade finance ecosystems?

We also asked banks what they believe corporates will find valuable. It turns out that that banks are generally more optimistic about the value of trade ecosystems for corporates than corporates themselves are. For example, banks are much more bullish about the potential of innovative products. More than two-thirds of banks believed new products and solutions would be highly valued by corporates, while less than half of corporates thought so. This mismatch probably reflects the different perspective of the two groups. The transformational potential of digital ecosystems excites the insiders developing the technology. Importers and exporters, by contrast, just want trade made easier and cheaper.

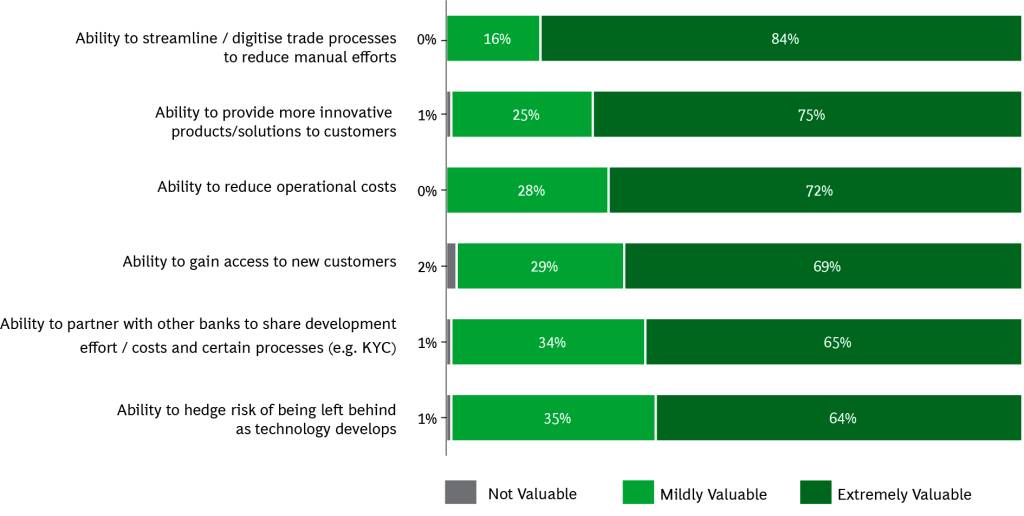

Banks seek the same thing, of course. As one banker responding to our survey put it, banks want to be able to “focus on financing rather than paper pushing”. HSBC, named the market leader in trade finance by Euromoney, has stated that, while approving trade loan applications typically takes one-and-a-half days, effective use of ecosystems could bring this down to a matter of hours.

More than two-thirds of banks felt that digital ecosystems would give them access to new customers and would allow them to partner with other banks to share development costs and certain processes, such as KYC (see Exhibit 7). A similar proportion of banks felt that investing in digital trade ecosystems also enables them to hedge the risk of being left behind as technology advances, without the need to invest heavily in proprietary blockchain solutions of their own. Some larger banks are investing in multiple ecosystems, to avoid putting all their eggs in one basket. To the best of our knowledge, BNP Paribas is involved in at least five ecosystems,

and HSBC and Standard Chartered in at least four.

4.3. What will banks find valuable from trade finance ecosystems?

Exhibit 7 – What will your banks find valuable from trade finance ecosystems?

Risk & Ins

Digital ecosystems also have the potential to promote the sustainability agenda of many participants in international trade. For example, BCG has partnered with WWF-Australia to launch OpenSC, a global blockchain platform that lets suppliers and stakeholders track goods, such as sustainable fish, along the supply chain. Consumers can learn more about the sustainability credentials of the products they purchase by simply scanning a QR code. Similarly, R3 and Ripe.IO are partnering to bring more trust and transparency to the agricultural food chain.

Similar platforms exist for other goods. IBM is working with Ford on a platform to verify the origin of ethically-sourced minerals; Provenance seeks to track consumer products more broadly; and BlockVerify focuses on combatting counterfeiting.

In the logistics space, TradeLens (a project by Maersk and IBM) is an ecosystem of players across the global shipping supply chain. It is intended to reduce waste and

Outlook for Adoption

5.1. What is the outlook for adoption?

Banks and Corporates are generally positive about the future of trade ecosystems (see Exhibit 8). Most banks we surveyed either already partner with one or more trade ecosystems or plan to. More than 75% of banks and corporates surveyed were confident that they would conduct most trade finance via ecosystems in 3-5 years.

Despite this rapidly growing interest and investment, however, trade ecosystems now capture only a tiny fraction of trade flows. Indeed, many platforms have not yet moved beyond the proof-of-concept stage to wider “go live” commercially. While this is, in part, simply a consequence of their novelty, there are still obstacles that need to be overcome before the use of trade ecosystems becomes the new normal.

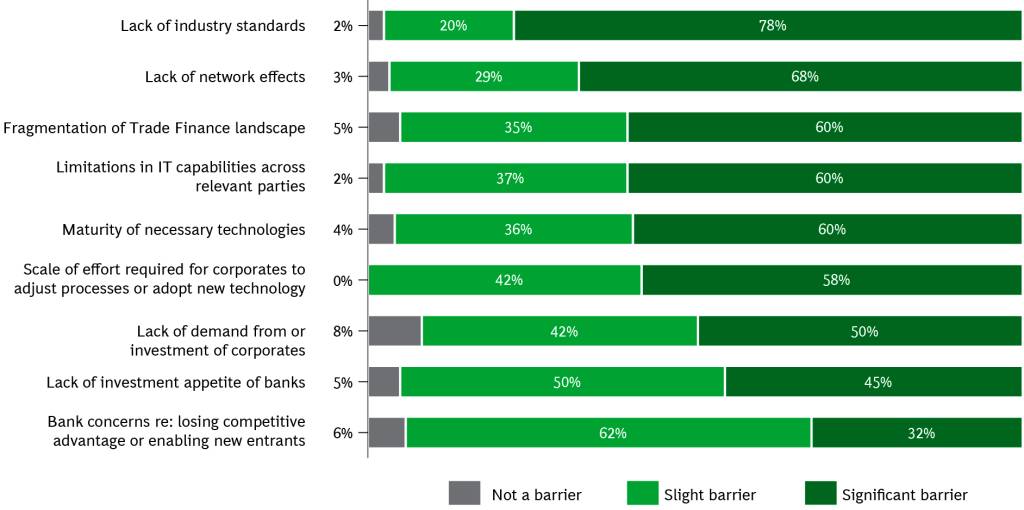

Exhibit 8 – What do you think are the biggest barriers to the development & adoption of these ecosystems?

5.2. Fragmentation and the need for network effects

The trade finance landscape is fragmented, with any one transaction involving at least 20+ actors across at least two countries, but often more. A trade ecosystem will effectively digitise trade only if most of these actors adopt it. Players are unlikely to bear the cost of adopting the technology unless they have some guarantee that they will be able to connect with their counterparties. Because a wide network is required to make the technology worthwhile for users, it is difficult to achieve the necessary scale.

As one corporate respondent put it, “digitising trade finance is not a technology issue. The issue is mainly (if not only) about all participants of a global trade transaction being [accessible from] the very same digital platform. The technology to digitise trade has been available for 20 years. It need not be blockchain-based”.

The need for network effects is not a new challenge; it has been an obstacle to the adoption of BPO. And now there are even more platforms and solutions competing for partners.

We are starting to see some ecosystems react to the need for network effects by seeking cross-platform partnerships. For example, we.trade has been collaborating with eTradeConnect in Hong Kong to extend its geographical reach and bring connectivity to 12 banks and 18 corporates in Asia. Similarly, Voltron are partnering with essDOCS to bring together Voltron’s blockchain-based trade finance solution with essDOCS’ e-documentation and provide a more complete offering to customers.

Until such cooperation becomes more widespread, smaller or more cautious banks and corporates are likely to “wait it out” rather than betting on a platform that may not be a winner. One corporate surveyed said that it plans to “wait for the ecosystems to consolidate until [they] commit to any of them”.

5.3. Lack of standards

Trade finance products must allow multiple parties to trade easily, securely and legally across borders. This requires common operational and legal standards. By introducing new and technologically diverse platforms and shifting from paper- based contracts and other documentation to “digital equivalents”, digital eco-systems create new challenges with regard to standards. Eighty percent of bank respondents considered the lack of standards a “significant barrier” to digitisation.

Various industry players and bodies are responding to the challenge.On the technology front, Marco Polo, R3, and TradeIX are spearheading the Universal Trade Network (UTN) initiative to harmonise the diverging technology landscape created by these new trade finance ecosystems: for example, by developingcommonly agreed message structures, standards, and codes. The InternationalChamber of Commerce (ICC) plans to further build on the above industry efforts through what will become the Digital Standards Initiative (DSI). This takes advantage of the ICC’s position as a neutral party to develop standards and protocols that will enable the next digital era in trade.

As part of their overarching work, the ICC has launched a number of initiatives. Earlier this year, the ICC released a set of eRules – its revised eUCP and eURC –that act as annexes to the existing ICC rules for Documentary Credits and Collections, specifically to accommodate the presentation of electronic records (either alone or in combination with paper documents). In addition, the ICC has set up a working group to develop a ‘blank sheet’ set of rules for digital trade, known as Uniform Rules for Digital Trade, as well as a broader digital trade roadmap, that articulates how different groups of stakeholders (e.g. governments, industry, and the ICC, etc.) need to collaborate on the overall trade digitisation journey.

Another project on the horizon is Alibaba’s Electronic World Trading Platform (eWTP). Partnering with the WTO and World Economic Forum, the nascent initiative aims to build rules and standards and to provide logistics, financing, and technological infrastructure that make it easier for SMEs to trade internationally. Big tech firms have not yet established a place for themselves in the trade finance space, and it will be interesting to see what role Alibaba, Tencent and Amazon may play in the future.

5.4. Technology capabilities and maturity

In the short-term, the growth of digital ecosystems will be limited by technology. Distributed ledger technology (DLT), which underpins many of these platforms, still has few commercial applications at scale and is constantly developing. More than two thirds of bank respondents felt that technology maturity is a material barrier. However, the removal of this obstacle, unlike the others, is probably just a matter of time.

From conversations, several banks feel that they have made large investments in DLT that have not yet paid out – there is a risk that the industry may suffer “blockchain fatigue”. As the industry becomes increasingly agile, the tolerance for projects with 3+ year returns will likely decrease further. Indeed, it may turn out that DLT is not an essential ingredient of digital trade ecosystems and they can advance without it – similar to how SWIFT GPI reinvented cross-border payments through mostly behavioural and relatively modest technology changes. The same approach could potentially be applied to documentary trade as a ‘quick win’.

Beyond technology, the maturity of the ecosystem itself is also a challenge. As explained in the BCG report “The Emerging Art of Ecosystem Management” (2019), ecosystems can exist in three forms: digitiser networks, platforms, and super platforms. Bolero, in its original form, is reminiscent of a digitiser network, while the next generation of ecosystems (Marco Polo, we.trade, Voltron) resemble platforms. The question is when we will see the first trade super platforms, and how financially and politically viable they will be.

5.5. Uncertain demand

Adopting digital trade ecosystems requires material financial and human capital commitments from banks, and – to a lesser degree – corporates. Almost half of bank respondents felt that the lack of demand or investment from banks and corporates was a significant barrier to adoption (see Exhibit 8). Even more bank respondents felt that the scale of effort required by corporates to move to ecosystem-based trade was a barrier. Corporates seemed to have similar views.

The challenge here is proving value. Many trade ecosystems have successfully developed technology and onboarded partners, but few have truly demonstrated that they are the silver bullet to simplify trade. As one banker commented, their strategy is to wait until trade ecosystems have “been proven to be of necessity and cost-effective”.

Conclusion

6.1. How should banks and ecosystems respond?

We have seen rapid progress in digital trade ecosystems over the past three years, and the outlook remains positive. The banks and corporates we surveyed agree that conducting trade via ecosystems will eventually become standard practice.

However, while many trade ecosystems were initially sold on the premise of revolutionising trade, the standout “ask” from the industry and, especially, corporates is simply to make trade simpler, faster, and easier. To overcome the barriers that have hindered previous attempts to digitise trade, ecosystems and their bank investors with need to do three things.

First, they must promote the development of more universal technological, regulatory, and legal standards. The undisputed legal standing of a Letter of Credit is one the reasons it has changed so little over the decades. Banks, ecosystems, governments, and other bodies need to work together to build digital standards for the future.

Second, they must cooperate to enable interoperability. Trade is too fragmented and politically important for there to ever be one “winning” trade finance ecosystem globally. Rather than competing for customers and locking out actors on other platforms, ecosystems will need to be able to cross-communicate. While large global banks may be happy to hedge their bets and invest in a multitude of ecosystems, smaller banks and corporates may not. Building yet more isolated platforms will simply fragment trade further, hinder the ability to gain network effects and critical mass, and delay the overall digitisation of trade. Instead, the trade finance community should embrace ecosystems as an opportunity to cooperate and finally crack the conundrum of reinventing trade for the digital generation.

Finally, they should focus on the basics. The goal is to deliver functionality, not technology. The development agenda should be based on removing pain points and listening to customers, not on building hype.

6.2. About the Authors

Sukand Ramachandran is a Managing Director and Senior Partner in BCG’s London office. He is a core member of the Financial Institutions practice and a topic leader in trade finance.

Ravi Hanspal is a Project Leader in BCG’s London office. He is a core member of the Financial Institutions practice and experienced in wholesale and transaction banking.

Laura Fisher is an Associate in BCG’s London office. She is experienced in Financial Institutions.

Huny Garg (External Contributor) is the Head of Trade & Supply Chain at SWIFT, based in the UAE.

Acknowledgments

We would like to thank Huny Garg and colleagues from SWIFT, and David Bischof and colleagues from the Banking Commission of the International Chamber of Commerce for their support and contributions in preparing this paper. We would also like to thank the roughly 120 survey respondents from various financial institutions and corporates for their valuable insights.

For Further Contact

If you would like to discuss this report, please contact one of the authors.

6.3. About the Companies

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we help clients with total transformation—inspiring complex change, enabling organizations to grow, building competitive advantage, and driving bottom-line impact.

To succeed, organizations must blend digital and human capabilities. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consulting along with technology and design, corporate and digital ventures— and business purpose. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow our clients to thrive.

SWIFT and the International Chamber of Commerce (ICC) also provided significant input to this paper.

Headquartered in Belgium, SWIFT is a global member- owned cooperative and the world’s leading provider of secure financial messaging services. We provide our community with a platform for messaging and standards for communicating, and we offer products and services to facilitate access and integration, identification, analysis, and financial crime compliance. Our messaging platform, products, and services connect more than 11,000 banking and securities organisations, market infrastructures, and corporate customers in more than 200 countries and territories, enabling them to communicate securely and exchange standardised financial messages in a reliable way. As their trusted provider, we facilitate global and local financial flows and support trade and commerce all around the world; we relentlessly pursue operational excellence and continually seek ways to lower costs, reduce risks, and eliminate operational inefficiencies. SWIFT’s international governance and oversight reinforces the neutral, global character of its cooperative structure, and our global office network ensures an active presence in all the major financial centers. For more information, please visit swift.com.

The International Chamber of Commerce (ICC) is the world’s largest business organisation with a network of over 6 million members in more than 100 countries. We work to promote international trade, responsible business conduct and a global approach to regulation through a unique mix of advocacy and standard setting activities—together with market-leading dispute resolution services. Our members include many of the world’s largest companies, SMEs, business associations and local chambers of commerce.

Publishing Partners

- Blockchain & DLT Resources

- Cryptocurrency Resources

- All Topics

- Podcasts

- Videos

- Resources

- Conferences