International Trade has been the engine behind much of the world’s economic growth over the past half a century, and was highlighted by Trump early in the campaign season as a large focus for his administration.

Lets not forget the main focus of globalisation is specialisation – meaning countries are able to produce more of the good they are relatively better at without suffering because the goods they need but now cannot produce, can be imported.

The question on many people’s minds is, what will Trump’s presidency mean for global trade?

So, what has Trump said?

It is no secret the business mogul is somewhat radical. However, his positions on trade have already had large effects. Firstly, Donald Trump held a speech June 28th, 2016 in which he stated he would change the “failed trade policy”. He would do this, by rejecting the Trans Pacific Partnership (more on this to come), appoint better trade negotiators, and renegotiate or possibly withdraw from the North American Free Trade Agreement.

During an interview on July 24, 2016, Trump said he would raise a tariff of between 15% and 35% on companies who move their operations to Mexico. He went on to argued the loss of jobs from the initial move will be compensated for by the tax.

As reported in The Washington Times, Trump held a rally in Ohio in which he echoed to the crowd “The Trans-Pacific Partnership is another disaster done and pushed by special interests who want to rape our country — just a continuing rape of our country”.

During the Fox news/ Wall Street Journal Republican Debate, Trump went further to say “I’d rather make individual deals with individual countries” as opposed to trade deals that incorporate a pool of countries.

Trump also accused the Chinese of currency manipulation, and pledged to officially label them as such when he made office. The term ‘currency manipulation’ explains how an economy purposefully devalues their currency, in order to make their prices more internationally competitive and thus, increase exports. When a country is labelled as a manipulator, large import tariffs can be placed on the country in attempt to counteract the effect of the low value currency.

What is the Trans-Pacific Partnership, and why did Trump reject it?

The Trans-Pacific Partnership is a free trade agreement that was held between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam and before January 23rd 2017, The United States of America.

The agreement saw the above 12 nations accounting for a GDP of nearly $28trillion, a 40% of global GDP as reported in Trade Finance Global’s Trans-Pacific Trade Agreement which is a third of global trade.

The trade agreement came through years of negotiations, and was one of Barack Obama’s highest achievements. The aim of the agreement was to combine economic forces with the countries surrounding the pacific rim through low tariffs, and also help to work together against China’s rising economic power.

By creating a form of single market between the U.S and the Asian region, the Obama Administration’s idea was to increase market demand by expanding the accessible market, which will lead to higher domestic jobs, and higher domestic real wages.

Trumps main issue with the agreement was that U.S jobs are suffering from the trade agreement, not prospering. Trump argued that many corporations set up in America have and will continue to take their factories to other TPP countries, where wages and other such operating costs are lower. And of course, American jobs were Trump’s number 1 campaign factor.

The issue of jobs arises where there is no mandate in the agreement for job security or wage regulation past the standard minimum wage for US workers. This meant the companies enjoying higher profits from an increase in their exports to these countries weren’t spending the newly won profit on their workers.

Possibility of Trade Wars

Trade wars are situations where countries impose high tariffs on imports from other countries, increasing the price for these goods domestically, greatly reducing the amount imported. The last trade war America was involved in was in 1930, coined the Smoot-Hawley Act named after two republican congressmen.

The trade war saw America raise import tariffs on all countries exporting to America, in an effort to protect domestic employment levels. Sounds rather similar, no?

The rise of tariffs in 1930 saw imports fall 40% over the following two years, causing European countries to increase tariffs against American produce, resulting in a trade war.

Because of the increase of tariffs against America, their exports fell dramatically, causing employment to fall with it.

How have the Financial Markets Reacted?

Given the fact that the financial markets are a way for companies to increase their capital, allowing business expansion, and higher profits, how have they reacted to Trump and his policies on trade.

- S&P 500 performance 8th nov 2016 – March 2017.

- Source: Financialtimes/markets.

- https://markets.ft.com/data/indices/tearsheet/charts?s=INX:IOM

Above we see the performance of the S&P 500 from 8th November 2016 (the day Trump’s victory was announced) through until March of 2017.

The Standard and Poor’s 500 is one of America’s largest index’s, and it has reacted well since Trump’s presidential victory.

The index rose from 2,139 on November 8th 2016, to 2,361 on March 31st 2017 – a 10.38% improvement.

It is important to note that Trump’s stance on banking and general business regulation is largely responsible for the stock’s performance. With fewer regulations, corporations and banks have more freedom, both financially and generally and this boosts investor confidence, which then increases the value of the stock.

To see the effect movements in trade dimensions has, we shall analyse the performance of the S&P 500 surrounding the departure from the Trans-Pacific agreement on January 23rd 2017.

The index sat at 2,265 on January 23rd, and rose to a high of 2,299.55 two days later, showing the index welcoming a TPP-exit.

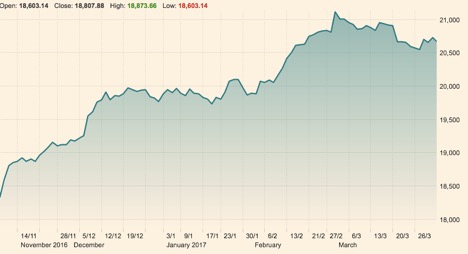

Looking at another large index of the American stock market – the Dow Jones, we see a similar upward trend for the same period.

- Dow Jones – 8th November 2016 to March 2017.

- Financialtimes/markets

- https://markets.ft.com/data/indices/tearsheet/charts?s=DJI:DJI

Again, analysing the 10 days surrounding the departure from TPP, we see the Dow Jones index rise with the S&P. The index held at 19,790 on January 20th 2017, and had risen to a high of 20,028.62 by 30th January 2017.

From the above information, Trump’s stance on trade appears to be effecting the markets positively.

This was also reflected by a recent survey on SMEs by Fit Small Business, – although most respondents felt positive and optimistic about the economy, over 54% of them felt that he should be voted out of office.

What happens to Output with Trump?

This topic is again, rather controversial. The controversy arises with financial indices such as the two above, react to trade agreement departures well in spite of the potential supply side shock the economy may experience as a result of Trump’s migration plans.

According to the National Bureau of Labour Statistics, as of 2015 there were 26.3 million foreign born individuals in the U.S Labour force. A 16.7% of total labour force. These 26.3 million people were most likely to work in areas including service occupations, natural resources, construction, maintenance occupations, transportation, and material moving occupations.

Given Trump’s desire to block migrant entrance into America, along with the removal of migrants currently living in America, the output levels for the economy are sure to suffer from such a reduction in the labour supply.

Moving Forward

Although markets have reacted well to President Trump’s trade movements, the long term effects and possible trade war erections are concerning.

It is now a case of waiting. There have been no case filings from the U.S to the World Trade Organisation this year and with the Chinese Yuan Renminbi performing well, claims of currency manipulation have faded. Both of these factors are reassuring, however, how long they hold is a different matter.

It really can go one of two ways. It will either result in higher American jobs and a diversification of their production, or a trade war which will result in lower American jobs. The effect a trade war would have on the U.K, whether we are directly involved or not, will impact you greatly, so keep an eye on Trade Finance Global for updates.

Exporting to the US?