Estimated reading time: 7 minutes

Following on from our first predictions article, the incremental gains for credit insurance, trade and supply chain finance, TFG surveyed 9 more industry experts looking at what we might expect for technology for trade, treasury and payments in 2024.

As we ring in the new year, the trade, treasury, and payments is indeed poised for another year of significant evolution.

At Trade Finance Global (TFG), we have gathered insights from industry experts to forecast the developments and challenges these sectors will face in the coming year. Their collective wisdom sheds light on the overarching trends and expected transformations across several key areas.

Perhaps some of these predictions can help to navigate the changes and opportunities that 2024 is likely to bring.

Solving complex issues will be key to fintech survival

In 2024, experts anticipate significant advancements and shifts in the fintech landscape across trade, treasury, and payments, focusing on streamlining cross-border transactions. This will be achieved by expanding instant payment systems by major infrastructures like Visa, Mastercard, SWIFT, and new technologies such as Ripple.

Enno-Burghard Weitzel, SVP Strategy, Digitization & Business Development, Surecomp, said, “We expect 2024 will see an increased use of APIs as standards are put in place and technology providers expand their portfolios.”

Other technologies, like artificial intelligence and machine learning, will automate complex processes, improve risk assessments, and enable the creation of personalised financial solutions while also helping to combat trade-based fraud and support supply chain resilience.

While opportunities abound in the fintech space, they will not be shared equally by all firms, with fierce competition expected to drive several out of business as the industry continues to consolidate.

Andre Casterman, Founder, Casterman Advisory, said, “Those fintechs that succeed in solving the most complex issues will survive and become key partners to financial institutions in trade, in payments and in ESG. Many other fintechs won’t deliver sufficient value and will therefore continue to lose money and disappear over time.”

2024 is poised to be a year where fintech significantly evolves to meet the complex demands of cross-border trade, with a strong emphasis on efficiency, compliance, security, and the integration of emerging technologies like AI.

An infrastructure revolution for payments

If some of the speculation is to come true in the year ahead, 2024 may be remembered as the year of payment’s infrastructure revolution.

2023 marked the beginning of the multi-year transition to ISO 20022, a structured and global data standard for financial information, that is expected to gain momentum this year.

Barry Rodrigues, EVP, Payments, Finastra, said, “Banks are required to transition to the new messaging standard before November 2025, but many will implement the necessary changes ahead of time for a competitive advantage.”

These changes will complement others across the payments infrastructure base, such as a growing embrace of cloud technology, that will lay the groundwork for a revised and digitally driven approach to payments.

Darren Parslow, Global Head, Visa Commercial Solutions, said, “We expect formerly closed-loop and proprietary technologies will become more open source, generic solutions will become increasingly tailored and once-siloed networks will become even more interoperable.”

Transaction banks will continue to explore new growth avenues, such as request-to-pay solutions for SMEs and digital procurement platforms, which are expected to drive continued demand for supply chain finance and open account instruments.

On a national level, considerable digital change may also be in the works, but it is tough to say when its full impact will be felt.

Stan Cole, Advisor, Unite Global AS, said, “We will see a relentless push forward by governments and central banks towards introducing retail CBDC in the payments mix.”

Avanee Gokhale, Global Lead Trade Strategy, SWIFT, added, “Central bank digital currencies (CBDCs) are on the horizon with significant impacts on the payments ecosystem… but these remain some years away for full impact.”

Overall, the payments sector in 2024 will be shaped by continuous technological innovation and a push towards real-time, transparent, and cheaper payment solutions, amidst a backdrop of geopolitical tensions and market fragmentation.

Technology will aid decision-making in treasury

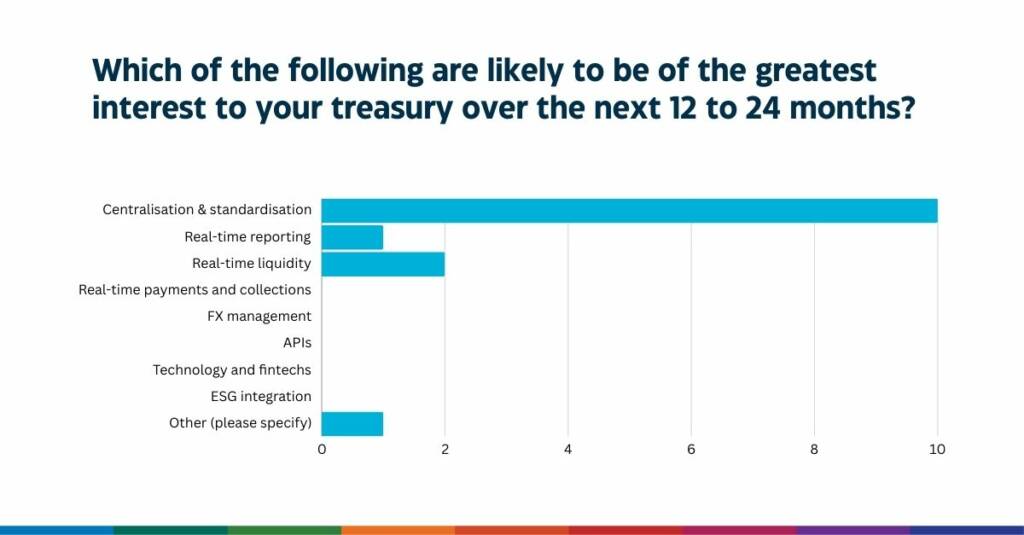

With the integration of advanced technologies and a shift towards real-time liquidity management at the forefront of the industry, treasury is in store for a transformational 2024.

With the onset of rich data sets, there will be a deeper integration across companies, enabling automation and eliminating inefficiencies. This degree of data availability, when augmented with modern technologies, will allow treasury departments to swiftly make decisions and adapt to changing market conditions.

Moez Thameur, VP Product Working Capital, Kyriba, said: “APIs and Artificial intelligence will be the CFO’s co-pilot in making the right decisions, at the right time, with the right information.”

Moreover, digitising treasury functions will make a broader range of instruments available for optimising working capital intra-day. Treasuries will have greater access to tools and resources that allow for more precise and efficient management of resources.

Thameur added, “In 2024, the CFO role will evolve into more of a ‘Chief Liquidity Officer’, having accurate and immediate visibility on where the company’s current and future liquidity needs stand and being able to action different liquidity scenarios at a fingertip.”

The progression towards digital integration and informed decision-making will be of great benefit to organisations, allowing them to stay ahead of the curve and respond effectively to the challenges of a rapidly evolving business landscape.

ESG is here to stay

The role that sustainability and ESG play in business strategies and operations will become more critical in 2024, yet the journey towards effective implementation and standardisation will remain challenging.

Enno-Burghard Weitzel said: “2024 will only see wide adoption of ESG reporting across the industry if regulators make ESG transparency mandatory based on an agreed-upon framework or standard.”

Johanna Wissing, Board Member, ITFA, added, “There is an urgent need to harmonise reporting standards and develop common audit requirements. This will take time. It was a multiyear process to implement similar standards for financial accounting, so efforts will need to continue past 2024.”

The push for greater focus on ESG will come not only from regulators but also from activist investors who are looking for greater transparency and disclosure from companies. Such investors increasingly seek assurance that the companies they invest in manage their ESG risks and avoid greenwashing.

A significant aspect of the conversation around ESG in 2024 will involve the role of emerging markets in the context of trade finance, highlighting the need to understand and integrate ESG considerations in diverse economic and geopolitical landscapes.

One of the key challenges identified for ESG implementation is the potential widening of the SME trade finance gap. As funding smaller businesses becomes more complex, there is a risk that ESG could be perceived as too difficult to implement effectively.

Such a challenge underscores the need for cooperative efforts across industries to maintain momentum and ensure an inclusive transition towards sustainable trade.

This will open opportunities for technology companies in the ESG space, particularly when it comes to developing solutions for tracking and managing sustainable supply chains. The intersection of technology and sustainability is expected to drive innovation and offer new tools for companies to meet their ESG objectives.

Rebecca Harding, Managing Director, Rebeccanomics, said, “ESG isn’t going to go away, but there will need to be a concerted cross-industry effort in 2024 to keep the momentum going behind this issue.”

—–

These predictions and insights from industry experts attempt to see through the fog of the future and provide a sense of what the next year might bring.

Should they prove to be true, then 2024 will be a year of significant evolution driven by technological advancements and a deepening commitment to ESG principles.

As we navigate these changes, the insights shared by our experts may prove to be invaluable in guiding strategies and decision-making processes, ensuring readiness for the dynamic landscape of 2024 and beyond.

Read the first part of the article here.