ETRM (Energy Trading and Risk Management) Software

Content

An ETRM system is a crucial software tool used by traders, suppliers, distributors, and wholesalers to automate processes related to the supply and trading of diverse energy commodities and financial derivatives.

Which Energy Trading and Risk Management Software is right for you?

- Reuters Trading for Exchanges: Eikon – Best for unparalleled access to financial data, insights, and collaboration with a focus on comprehensive market data.

- Igloo ETRM by Brady – Best for quick implementation and adaptability to new markets for both financial and physical energy trading instruments.

- EOT by EnergyOne – Best for comprehensive energy trading in the Asia-Pacific region, featuring market flexibility, advanced time intervals, and daily price capabilities.

- Allegro by Ion – Best for utilities and energy companies, with a multi-commodity approach and integrated advanced analytics.

- FIS Global ETRM – Best for versatile capabilities beyond traditional systems, streamlining trading, risk management, and operations for global energy commodities.

- Brady ETRM by Brady – Best for European energy trading, known for extensive functionality, risk modelling, connectivity, live-price feeds, and real-time regulatory reporting.

- Trader Suite by Navitasoft – Best for energy trading in Eastern Europe, featuring multi-commodity support and flexible data management

- MX.3 by Murex – Best for a market-leading front-to-back ETRM solution with integrated features across asset classes, known for resilience, scalability, and comprehensive risk-based pricing.

- Openlink (Endur) – Best for global ETRM use, offering advanced risk management, workflow automation, and multi-commodity trading support with real-time streaming data capabilities.

- Enverus – Best for Midstream Operations Managers, providing advanced analytic and forecasting capabilities, financial modelling, competitor activity analysis, and infrastructure optimisation for navigating the energy market.

- ION Allegro – Best for energy trading and risk management (ETRM), focusing on power, natural gas, and renewables markets with industry-standard workflows.

- Entrade by Enuit – Best for ETRM/CTRM, offering a complete solution for managing trading operations, consumption forecasts, and power plant performance.

Key Benefits:

- Enables rapid, profitable, and data-driven decision-making by assessing market insights

- Tailored features and functionalities based on the specific energy commodity being traded

- A valuable asset for businesses, even with limited resources, offering unparalleled functionality

- Addresses top challenges in the commodity market, including managing price volatility and ensuring regulatory compliance

- Unifies businesses of all sizes, providing transparency to essential information precisely when needed

Why would you use an ETRM solution?

Energy Trading Risk Management (ETRM) software automates tasks, fostering strategic growth by enhancing value creation and operational efficiency. With streamlined workflows, it handles trading, hedging, credit, cash flow, operations, and inventory management, making it a cost-effective choice for energy trading companies.

Whether specialised for a specific energy commodity or versatile for multiple types, ETRM ensures accuracy, eliminates errors and bias, and addresses regulatory complexities, surpassing legacy systems or spreadsheets. Tracking the entire deal lifecycle, providing market insights, ensuring risk control, and facilitating regulatory compliance, ETRM promotes seamless communication and workflow management.

How to choose an ETRM software that is right for you?

When selecting an ETRM system, ensure it serves as an end-to-end platform, offering a comprehensive view of front, middle, and back-office operations, tailored to your business objectives. Look for functionality covering trade and operations, hedging and risk management, inventory management, financial accounting, reporting, and seamless integration with third-party applications.

Eikon by Reuters Trading for Exchanges

Eikon is a cutting-edge open-technology solution designed for financial markets professionals, providing unparalleled access to industry-leading data, insights, and exclusive news. It goes beyond being a data platform, offering a comprehensive suite of apps, collaboration tools, and a flexible open technology platform.

Why Eikon Stands Out

Eikon stands out as a powerful tool that seamlessly integrates data, insights, and collaboration, empowering financial professionals to make informed decisions. Its open technology platform, high-performance apps, and extensive market data make it a go-to solution for those seeking a competitive advantage.

Key Features & Integrations

- Comprehensive Market Data – Real-time and historical insights from thousands of sources and expert partners worldwide.

- Applications Across Industries – Insights and data in Commodities Trading, Equities Trading and Corporate Treasury.

- Customisable Tools and Interoperability – Customised alerts for price changes, research, news releases, and economic/company events.

- Integration with Trade Execution – Execution management tools for fast and efficient multi-asset global execution.

- Flexible Data API with Python Interface – Access Eikon’s high-value financial data through a flexible data API with a native Python interface to gain unique and deeper insights beyond traditional spreadsheets.

Pros

- Total freedom of access with standalone applications like Messenger.

- Eikon Web access for a seamless online experience.

- Mobile Eikon for iPhone and Android, keeping you connected on the go.

Cons

- The training and support to use effectively could be time consuming.

Eikon is a revolutionary platform offering financial professionals unparalleled access to data, insights, and collaboration tools. Its standout features include comprehensive market data, industry-specific applications, customisable tools, and integration with trade execution. With total freedom of access and a flexible data API, Eikon is designed to empower users in making informed decisions in dynamic financial markets.

Igloo ETRM by Brady

Brady IGLOO is a cutting-edge, Software as a Service (SaaS) Energy Trading and Risk Management (ETRM) solution developed in collaboration with one of the world’s largest financial energy traders. Designed for maximum performance, Igloo offers a state-of-the-art user experience to empower energy trading desks in navigating the dynamic and volatile energy commodities markets efficiently.

Why Brady IGLOO Stands Out

Brady IGLOO stands out with real-time position monitoring for both physical and financial energy trading, hourly/sub-hourly pricing flexibility, automated trading curve creation from price feeds, comprehensive risk exposure analysis, risk control through applied limits, and detailed historical Value at Risk (VaR) analysis at the component level.

Key Features and Capabilities

- Rapid Implementation – Igloo can be implemented within weeks, with pre-configured core functionality for quick and easy setup.

- Market Expansion – Easily adds new markets and exchanges, ensuring adaptability to evolving trading landscapes.

- Versatile Delivery – Accessible via web, desktop, mobile, or API to accommodate various user preferences and needs.

- Comprehensive Instrument Support – Supports a wide range of contracts and instruments for both financial and physical energy trading participants.

Pros

- Quick Implementation

- Comprehensive Instrument Coverage

- Certified Solutions Provider

- Supports Algorithmic Trading

Cons

- The platform may be complex in learning curve, required significant training and support to use effectively.

Brady IGLOO ETRM is a modern and versatile solution that stands out for its speed of implementation, adaptability to evolving markets, and comprehensive support for both financial and physical energy trading instruments. It offers a robust set of features for risk management and decision support in today’s dynamic energy trading landscape.

EOT by Energy One

EOT (Energy One Trading) is a comprehensive front, middle, and back-office energy trading solution catering to electricity, environmental, carbon, gas, oil, and other energy commodities in the Asia-Pacific region.

Why EOT Stands Out

Energy One’s EOT stands out as a comprehensive energy trading solution, encompassing front, middle, and back-office functionalities for a diverse range of energy commodities. It exhibits market flexibility, addressing electricity, environmental, carbon, gas, oil, and other commodities in Australia, New Zealand, and Asia. Additionally, EOT provides advanced time interval support and daily prices, enhancing flexibility and precision in trading strategies.

Key Features and Capabilities

- Market Coverage – Supports various energy commodities for Australia, New Zealand, and Asia.

- Time Intervals – Accommodates markets with time intervals, including 5-minute, 30-minute, hourly, and daily prices.

- Contract Lifecycle Management – Offers full contract lifecycle management for enterprise-grade power and complex gas market trading.

Pros

- Full Contract Lifecycle Management

- Multi-Year Performance

- Cloud-Based Managed Services

Cons

- Not global, only for selected markets

EOT by Energy One is a robust solution designed for diverse energy commodities, offering advanced features like contract lifecycle management and support for various time intervals. Its cloud-based managed services and additional solutions further enhance its appeal for energy traders in the Asia-Pacific region.

Allegro by ION

Allegro is a distinguished energy trading and risk management (ETRM) solution, specially crafted for utilities and energy companies involved in trading diverse commodities such as power, renewables, natural gas, liquid hydrocarbons, and environmental products.

Why Allegro Stands Out

Allegro stands out due to its exceptional industry reputation, serving as one of the leading solutions for power trading and renewable energy management. Its front-to-back, multi-commodity approach, integrated advanced analytics, and extensible framework for customisations contribute to its prominence.

Key Features & Integrations

- Real-time Position Visibility – Providing immediate insight into positions for enhanced monitoring.

- Robust Risk Management – Equipped with robust risk management capabilities crucial for navigating industry complexities.

- Regulatory Compliance – Assisting businesses in meeting compliance obligations through comprehensive reporting.

- Flexible Deal Capture – Adaptable deal capture functionality to accommodate dynamic energy pricing and transactions.

- Allegro University – A unique resource offering technical training for Allegro customers and partners.

- Customer Support – Providing personalised assistance, including troubleshooting and hands-on support.

Pros

- Comprehensive front-to-back, multi-commodity solution.

- Integrated advanced analytics for accurate position and exposure views.

- Extensible framework for customisations tailored to specific business needs.

- Real-time position visibility enhances monitoring and decision-making.

- Robust risk management capabilities for industry complexities.

- Allegro University offers technical training for skill acquisition and optimisation.

Cons

- For larger business with more intricate procedures, implementing the software could be time-consuming and expensive.

Allegro is an industry-leading ETRM solution renowned for its versatility, from power trading to renewable energy management. Its comprehensive features, integrated analytics, and support for customisations make it a powerful choice for businesses navigating the evolving energy landscape. Allegro University and customer support further enhance its appeal, ensuring users optimise their investment and stay ahead in the dynamic energy markets.

FIS Global ETRM

FIS® Energy Trading, Risk and Logistics Platform, redefines the traditional Energy Trading and Risk Management (ETRM) system, offering a comprehensive solution for energy companies engaged in trading physical energy commodities and their associated financial instruments. This cloud-native platform operates within a customisable HTML 5 user interface, enhancing flexibility and functionality.

Why FIS Stands Out

FIS stands out by providing more than a conventional ETRM system. It streamlines trading, risk management, and operations for a wide range of energy commodities, supporting gas and power, weather, emissions, coal, fuels, refined products, LNG, FX, and derivatives worldwide. Key features that distinguish FIS include its cloud-native architecture, straight-through processing (STP) capabilities, and a customisable HTML 5 interface for end-to-end functionality.

Key Features & Integrations:

- Cover All Deal Types – Access one system for all deal types for energy commodities in multiple currencies.

- Streamline Processes – Manage natural gas and pipeline operations seamlessly, providing real-time profit reporting.

- Strengthen the User Experience and Reporting – Leverage HTML 5 for customised, end-to-end functionality across the front, middle, and back office.

Pros

- Cloud-native platform for streamlined trading, risk management, and operations.

- Fully customisable HTML5 user interface for a user-friendly experience.

- Support for a wide range of energy commodities and deal types.

- Real-time position visibility and profit reporting.

- Comprehensive tools for managing positions, P&L, and risk reporting.

- Ability to calculate mark-to-market positions in real-time.

Cons

- More useful for mid-large sized trading companies.

FIS Energy Trading, Risk and Logistics Platform stands out as a versatile and advanced ETRM solution, offering unparalleled capabilities for energy companies. Its cloud-native design, real-time functionality, and extensive support for various energy commodities make it a powerful choice for those navigating volatile and regulated markets. The platform’s commitment to user experience, advanced analytics, and compliance with regulatory requirements positions it as a leader in the energy trading and risk management landscape.

Brady ETRM by Brady

Brady ETRM is a comprehensive enterprise-wide European Energy Trading and Risk Management (ETRM) platform Catering to regional power trading leaders, Brady ETRM offers a robust solution for multi-national energy organisations involved in trading complex portfolios encompassing both physical assets and financial contracts.

Why Brady ETRM Stands Out

Brady ETRM distinguishes itself through its extensive front, mid, and back-office functionality, addressing the specific needs of organisations engaged in multi-national energy trading. The platform excels in areas such as risk modelling and valuation of structured deals, covering both physical assets and Power Purchase Agreements (PPAs). The inclusion of robust connectivity to major energy trading platforms, live-price feeds, automatic deal capture, reconciliation support for exchange trades, and real-time regulatory reporting further solidifies Brady ETRM as a comprehensive and forward-looking solution for enterprises in the dynamic energy trading landscape.

Key Features & Integrations

- Trade Management – Offers intuitive monitors for showcasing critical business results and ensures easy import and management of derivatives and settlement prices.

- Risk Management – Features include mark-to-market functionality for real-time valuation, providing comprehensive risk and currency exposure reporting and includes stress test reporting for simulating adverse market conditions.

- Connectivity & Regulatory Compliance – Connectivity to popular price sources and platforms across power, gas, and emissions markets, integrates live-price feeds and ensures real-time EMIR & REMIT regulatory reporting.

- Energy Reporting Service – The platform integrates with popular business intelligence (BI) tools, facilitates the export of real-time entity and transaction data and enables business-critical reporting to regulate database growth.

Pros

- Enterprise-wide platform with a 30-year heritage, serving regional power trading leaders.

- Extensive front, mid, and back-office functionality tailored for multi-national energy organisations.

- Specialised focus on risk modelling and valuation of structured deals, including physical assets and Power Purchase Agreements (PPAs).

- Intuitive monitors, automatic generation of essential financial data, and robust connectivity to major energy trading platforms.

Cons

- Not global, solely focused on European markets.

Brady ETRM not only excels in comprehensive trade and risk management but also stands out with its robust connectivity and regulatory compliance features. The platform’s ability to seamlessly connect with popular price sources, major energy trading exchanges, and support real-time regulatory reporting underlines its commitment to staying at the forefront of the evolving energy trading landscape. Additionally, the Energy Reporting Service integrates with popular business intelligence tools, providing users with the flexibility to export and analyse real-time entity and transaction data efficiently. Overall, Brady ETRM remains a versatile and reliable choice for enterprises navigating the complexities of energy trading.

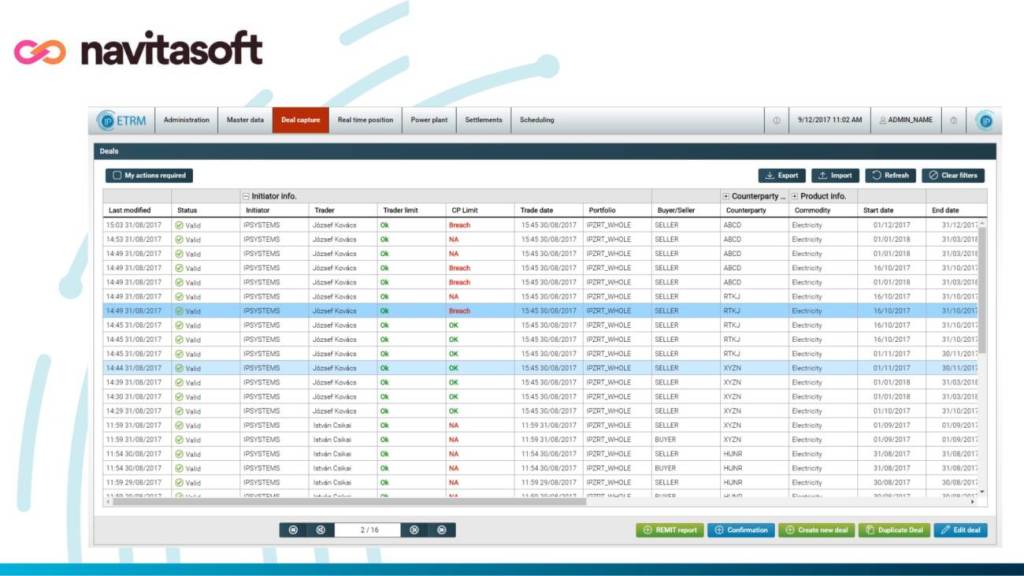

Trader Suite by Navitasoft

Trader Suite is a robust software solution for energy trading, specialising in wholesale and retail operations within the Eastern European region. Designed with a focus on prompt, flawless, and resource-efficient execution of energy trading strategies, Trader Suite caters to a diverse range of market segments, offering comprehensive support for power and gas trading.

Why Trader Suite Stands Out

Trader Suite distinguishes itself as a versatile Energy Trading and Risk Management (ETRM) system with key features tailored to meet the unique needs of energy trading businesses. The platform excels in the following areas.

Key Features & Integrations

- Multi-commodity Trading – Handles diverse commodities such as gas, power, coal, CO2, FX, and others.

- Flexible Basic Data & Topology Management – Ensures well-structured data for efficient processes.

- Customisable User Screens & Deal Capture Templates – Allows users to tailor the interface and deal entry templates.

- Unlimited Custom Workflows – Enables businesses to set up unique workflows for deal management.

- Real-time Position-keeping – Provides instant position calculations for responsive decision-making.

Pros

- Real-time Access: Provides instant visibility into energy portfolio positions.

- Integrated Solution: Covers all trading functions with robust risk management support.

- Customisation: Highly adaptable and customisable to meet specific business requirements.

- User-friendly: Designed for ease of use, ensuring trader comfort and efficiency.

- Adaptive: Future-proof solution capable of adapting to evolving energy market dynamics.

Cons

- A learning curve for users unfamiliar with highly customisable systems and the need for ongoing updates to stay abreast of market changes.

Trader Suite emerges as a leading ETRM system, providing a comprehensive and adaptable solution for energy trading businesses. Its standout features, real-time capabilities, and focus on user-friendly customisation make it a valuable asset in the dynamic and fast-paced energy market. While users may need time to fully harness its customisable features, Trader Suite stands out as a reliable and future-proof choice for energy trading operations in the Eastern European region.

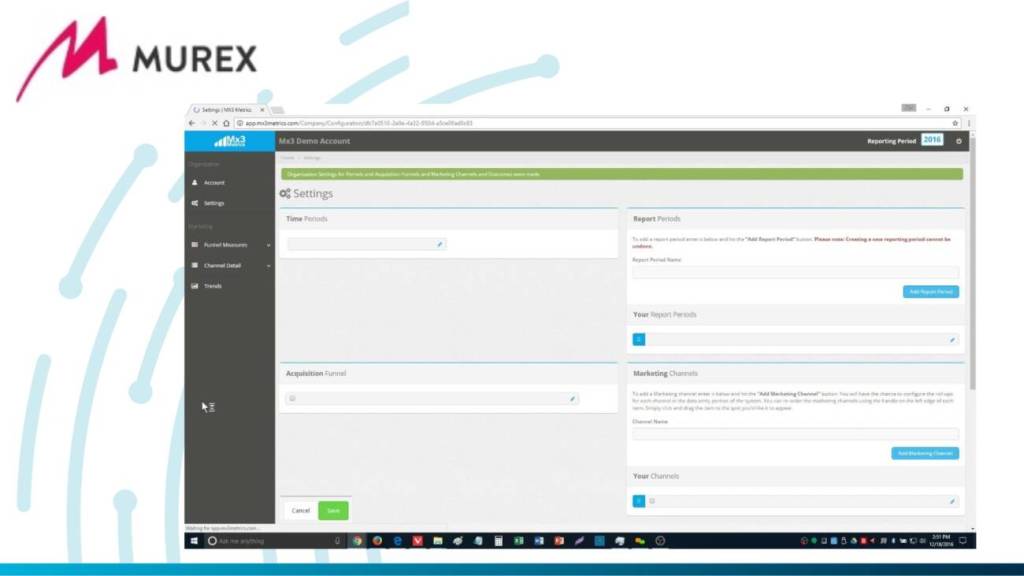

Murex

Murex’s MX.3 for Sales and Trading is designed to provide accurate, real-time data, ensuring agility, simplicity, and control for salespeople, traders, and senior management in times of high market volatility.

Why MX.3 Stands Out

MX.3 stands out as a robust, reliable, and integrated platform covering best-in-class features across all asset classes. It addresses the need for real-time insights, efficient workflows, and risk control, making it a market-leading solution for cash and derivatives trading.

Key Features & Integrations

- Integrated Platform – Transaction, counterparty, book, desk, entity, and company-wide insights are embedded into a single platform.

- Connected Solutions – Connected to affirmation and execution platforms, integrated to the bank, and the wider market and regulatory ecosystem to help automate business processes

- Software Development Kit (SDK) – Best-in-class SDK for swift extension of analytics and quick app development for end users and institution’s customers.

- Resilient Architecture – Resilient and scalable architecture supporting predictable response times, avoiding downtime in volatile markets.

- Risk Control and Collaboration – Enforces close risk control to prevent unauthorised usages, track changes, quantify their impact on P&L, and check against limits in real-time, facilitating collaboration between front & back-office, risk, and collateral teams.

Pros

- Comprehensive functional coverage for risk-based pricing, structuring, real-time portfolio, and P&L analysis.

- Robust and modular solutions for trading, risk management, and processing across all asset classes.

- Flexibility of deployment on-premises or in the cloud, with the option for Murex’s SaaS offering.

- Openness of MX.3 enables innovation through a REST API library.

Cons

- Larger businesses with complex procedures may find the implementation of the software to be time-consuming and costly.

MX.3 for Sales and Trading by Murex is a market-leading front-to-back-to-risk solution that excels in providing integrated features across asset classes. Its resilience, scalability, and comprehensive functional coverage make it a go-to choice for institutions aiming to accelerate their technology transformation and reduce the total cost of ownership. The platform’s openness allows for innovation through additional bespoke services, making it adaptable to the evolving demands of the challenging regulatory environment.

Openlink (Endur)

Openlink is a comprehensive solution designed for companies engaged in multiple commodities markets globally, offering advanced risk management, workflow automation, and customisation capabilities. With a front-to-back approach, Openlink supports all commodity asset classes, providing scalability and adaptability as businesses expand.

Why Openlink Stands Out

Openlink distinguishes itself with unparalleled capabilities in risk management, high-performance operations, and real-time streaming data. It offers a complete portfolio view and sophisticated risk analysis tools, empowering businesses to thrive in diverse commodities markets.

Key Features & Integrations

- Workflow Automation – Automates energy trading workflows from front to back office, enhancing efficiency and enabling teams to focus on growth initiatives.

- Risk Management Excellence – Offers sophisticated risk management tools, providing real-time exposure analysis for effective risk mitigation.

- Streamlined Operations – Streamlines energy trading processes, including trade and operations management, hedging, credit control, and delivery, boosting operational efficiency.

- Unified Data Ecosystem – Ensures a connected data ecosystem, offering a comprehensive view of business and financial portfolios for informed decision-making.

- Multi-Commodity Trading – Supports versatile multi-commodity trading, accommodating diverse energy commodities to meet specific business needs.

- Efficient Reconciliation – Significantly reduces reconciliation times through automated processes, enhancing operational efficiency and accuracy.

Pros

- Comprehensive risk management tools

- Workflow automation for efficient business processes

- Real-time streaming data for informed decision-making

- Multi-commodity trading support

- Scalability to accommodate business growth

- Trusted by major commodity-intensive corporations

Cons

- The platform necessitates substantial training and support for effective use.

Openlink is a robust, multi-commodity, and multi-currency ETRM solution with advanced capabilities in risk management, operations, and real-time data. It stands out for its scalability, workflow automation, and comprehensive features, making it a trusted choice for globally operating companies in complex commodities markets. The solution’s key features include workflow automation, risk management, streamlined processes, connected data, and support for multi-commodity trading. Additionally, Openlink offers value-added modules like ION Cloud, reconciliation and document management, scheduling and logistics, credit and risk management, and trading and analytics.

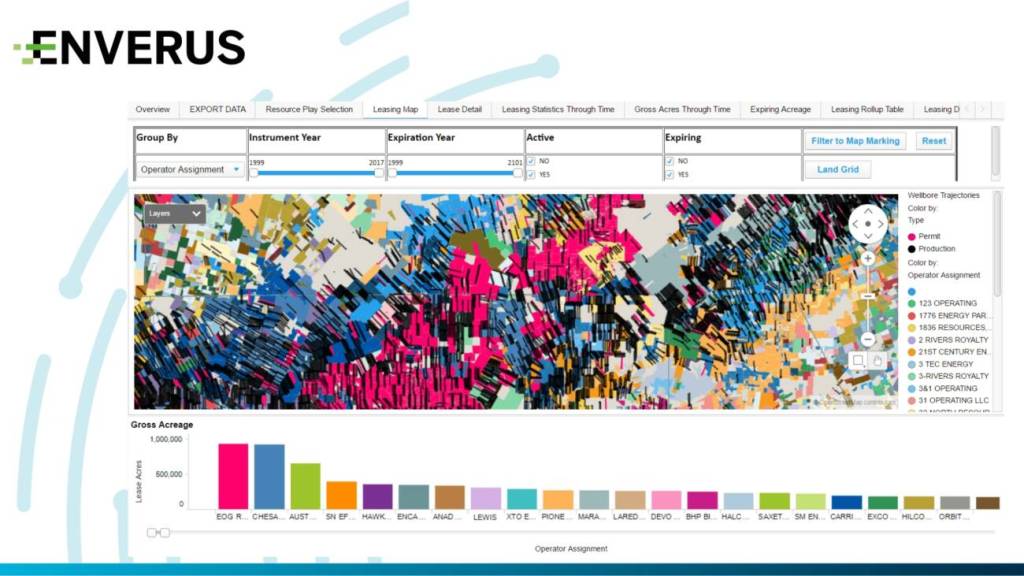

Enverus

Enverus presents a comprehensive suite of decision-making tools tailored for Midstream Operations Managers. This sophisticated platform combines analytic and forecasting capabilities to empower strategic investment decisions, production goal attainment, and deal optimisation within the dynamic energy market. The Enverus solution is a Software-as-a-Service (SaaS) offering, providing reliable data streams and analytical tools to enhance planning, buying, selling, and overall operational and financial performance in the Midstream sector.

Why Enverus Stands Out

Enverus stands out for its advanced analytic and forecasting capabilities, enabling Midstream operators to navigate the complexities of the energy market. Key features and integrations include:

Enverus’ Key Features & Integrations

- Financial Modelling – Encompasses natural gas and oil prices for buying and selling, along with comprehensive considerations of gathering and processing, transportation, and storage costs.

- Upstream Production and Forecasts – Delivers current upstream production levels, driller activity, breakevens, and future production forecasts by geographic region.

- Competitor Activity Analysis – Provides insights into competitor midstream activities, including current data, analytics, and forecasting.

- Midstream Operations Management – Offers tools for managing oil and gas purchases, optimising margins, and forecasting supply and demand dynamics.

- Infrastructure Optimisation – Assists in optimising transportation, refining, and storage by analysing trends, operator activities, and leasehold quality.

- Market Intelligence – Enables midstream operators to set prices, manage transportation costs, and schedule deliveries based on solid market intelligence.

Pros

- Real-time Decision-Making: Leverages near real-time data streams for prompt decision-making in upstream purchasing and downstream sales.

- Comprehensive Market Analysis: Provides in-depth analysis of Midstream market dynamics, well production, and competitor activity.

- Custom Alert Notifications: Allows users to set custom alerts for specific areas of interest, enhancing lead identification.

- Forecasting Capabilities: Utilises state-of-the-art decline curve technology for assessing potential in a matter of minutes.

- Optimisation of Midstream Operations: Supports comprehensive optimisation of operations, partnerships, and transactions.

Cons

- The need for ongoing updates to stay aligned with market changes.

Enverus emerges as a leading solution for Midstream Operations Managers, providing a sophisticated platform for data-driven decision-making, competitor analysis, and operational optimisation. Its standout features, including financial modelling, competitor activity analysis, and infrastructure optimisation, make it a valuable asset in navigating the complexities of the energy market. While users may need time to fully harness its customisable features, Enverus stands out as a reliable and comprehensive choice for enhancing operational and financial performance in the Midstream sector.

ION Allegro — Top-tier Solution for Energy Trading and Risk Management

ION Allegro is a leading solution in the realm of energy trading and risk management (ETRM), is designed specifically for utilities and energy companies who market, trade, or consume power, natural gas, or renewables. The solution offers a front-to-back, multi-commodity platform that deploys with industry-standard workflows and provides an extensible framework for customisations.

Why ION Allegro Stands Out

ION Allegro distinguishes itself through its focus on energy markets. Built from the ground up for these markets, Allegro is recognised globally as a top-class solution for power and natural gas. It streamlines energy trading operations, risk management processes, and regulatory compliance reporting, freeing up resources to focus on business growth. The solution is designed with extensibility, enabling businesses to customise the solution to their unique needs.

ION Allegro Standout Features & Integrations

ION Allegro offers a suite of integrated advanced analytics, empowering businesses to derive insights and improve decision making. Key features include the ability to centralise physical and financial trading, connect the front-, middle-, and back-office, and unlock insights to optimise decision making.

The solution also offers advanced analytics, providing decision support with asset optimisation insights, sophisticated models for measuring portfolio risk, and the ability to value complex and esoteric contracts. Logistics are streamlined with automated scheduling activities and seamless connections to external operational systems.

Pros

- Designed specifically for energy commodities

- Streamlines business processes

- Provides visibility into your business

- Offers multi-commodity trading and advanced analytics

Cons

- May require a certain level of expertise for effective use

- May not be suitable for organisations not involved in energy trading or risk management

ION Allegro is a robust tool for any organisation involved in energy trading or risk management. Its comprehensive approach and focus on energy markets make it a versatile solution that can adapt to the changing needs of the market. Whether you’re looking to streamline your operations, comply with regulations, or gain insights into market trends, ION Allegro has the tools you need to achieve your goals.

ENTRADE by Enuit — Comprehensive ETRM/CTRM Solution

Entrade by Enuit is a comprehensive ETRM/CTRM solution that provides a complete solution for managing trading operations. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

Why Entrade Stands Out

Entrade stands out for its ability to provide a complete solution for managing trading operations. It offers a secure platform for traders to capture their trade flow, buyers to get their consumption forecasts and open-positions, and producers to audit their power plants’ performance.

Entrade Standout Features

Entrade provides several key features:

- Deal Capture: Entrade allows for the capturing and recording of deals, ensuring the integrity and confidentiality of trading data.

- Physical Commodity Movements: Entrade provides the ability to schedule physical commodity movements, enabling effective logistics management.

- Cost Tracking: Entrade tracks primary and secondary costs, providing a clear overview of the financial aspects of trading operations.

- Inventory Monitoring: Entrade monitors inventory levels and costs, providing real-time insights into stock levels.

- Deal Valuation: Entrade calculates the valuation of deals, providing a clear understanding of the financial value of trading operations.

- Settlement Calculation: Entrade calculates settlement amounts, ensuring accurate financial reconciliation.

- Invoice Generation: Entrade generates invoices, streamlining the billing process.

- Risk Monitoring: Entrade monitors all business and market-related risks, providing a comprehensive overview of potential risks.

- Reporting: Entrade provides useful reports and a data warehouse, enabling effective data analysis and decision making.

Pros

- Offers a comprehensive solution for managing trading operations

- Provides real-time visibility into positions and risks

- Supports secure trade capture, consumption forecasts, and power plant performance audits

- Designed for commodity traders, buyers, and producers

Cons

- The platform’s focus on energy trading may not be suitable for businesses outside of this sector.

- The cost of the software and potential implementation services may be prohibitive for some businesses.

- The system’s complexity may require a steep learning curve for new users.

- Smaller businesses might not fully utilize the extensive features offered by the platform.

Entrade is a comprehensive solution for organisations involved in commodity trading. Its commitment to providing a complete solution for managing trading operations and managing complex trading processes make it a reliable choice for businesses seeking to streamline operations and capitalise on new opportunities faster.