Estimated reading time: 2 minutes

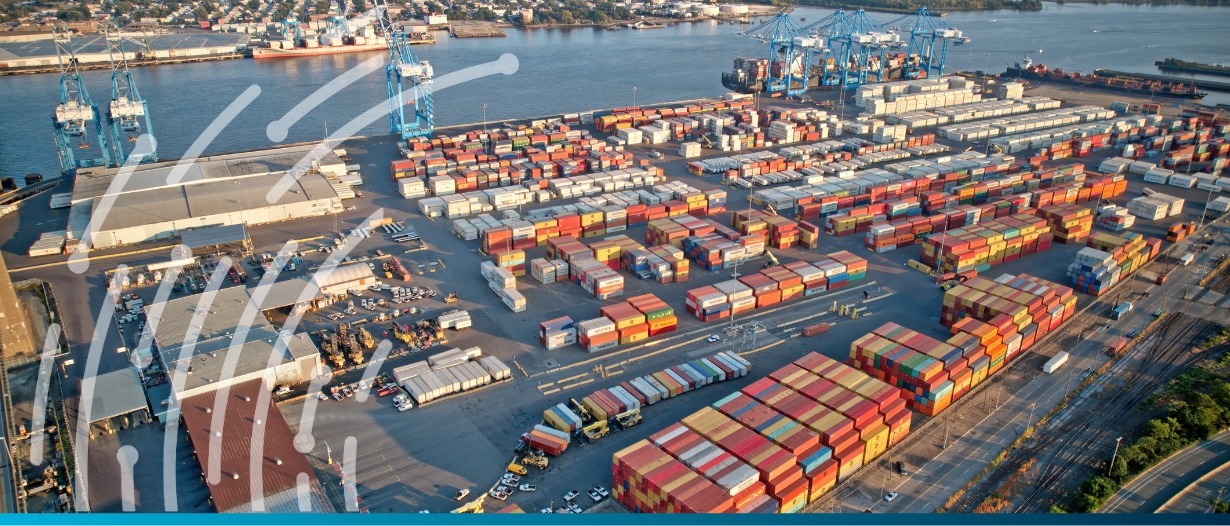

The US trade deficit contracted to $58.3 billion in August, marking its lowest level since late 2020, according to data released by the Commerce Department on Thursday.

This represents a nearly 10% decrease from July’s revised figure of $64.7 billion. The contraction exceeded analysts’ expectations, who had forecast the trade deficit to shrink to $62.3 billion.

“Trade flows have slowed overall,” economist Rubeela Farooqi of High Frequency Economics told AFP. “But quarter-to-date, exports are up and imports are down, suggesting some softening in domestic demand,” she added.

Exports rose by $4.1 billion to reach $256 billion in August, with goods exports specifically increasing by 1.8% to $171.5 billion. Shipments of capital goods hit a record high, while exports of foods, feeds, and beverages were the lowest since August 2020. At $84.5 billion, exports of services were the highest on record.

Conversely, imports slipped by $2.3 billion to $314.3 billion, with goods imports dropping by 0.9% to $256.0 billion. This decline in imports potentially signals a softening in domestic demand, which has been attributed to steep interest rate hikes by the Federal Reserve aimed at lowering inflation and cooling demand.

The services surplus stood at $26.2 billion, the highest since March 2018. Despite the narrowing trade gap, trade made no contribution to the economy’s 2.1% annualized growth rate in the second quarter.

The goods deficit with China dipped by $1.3 billion to $22.7 billion in August, with imports from the country dropping more than exports to it. This comes amid warnings that global growth is weakening, including among the United States’ major trading partners, which could impact exports.

Farooqi also warned of a potential slowdown in growth later this year if the job market cools “more materially,” which would weigh on demand for goods and services.

The data suggests that while consumer spending has been a key driver in boosting US trade, analysts caution that this could weaken following the central bank’s interest rate hikes over the past year.