The European Bank for Reconstruction and Development (EBRD) has recently unveiled its latest Regional Economic Prospects report.

The report provides a comprehensive overview of economic trends across various regions for the year 2023, revealing a diverging pattern of growth.

While Central Asia and parts of the Caucasus are expected to see robust economic growth, emerging Europe is set to face a series of challenges.

Key highlights

- Central Asia and the Caucasus to benefit from strong trade and high remittance levels from Russia.

- Emerging Europe to experience economic deceleration due to high energy prices and persistent inflation.

- Overall growth in EBRD regions to slow to 2.4% in 2023 but pick up to 3.2% in 2024.

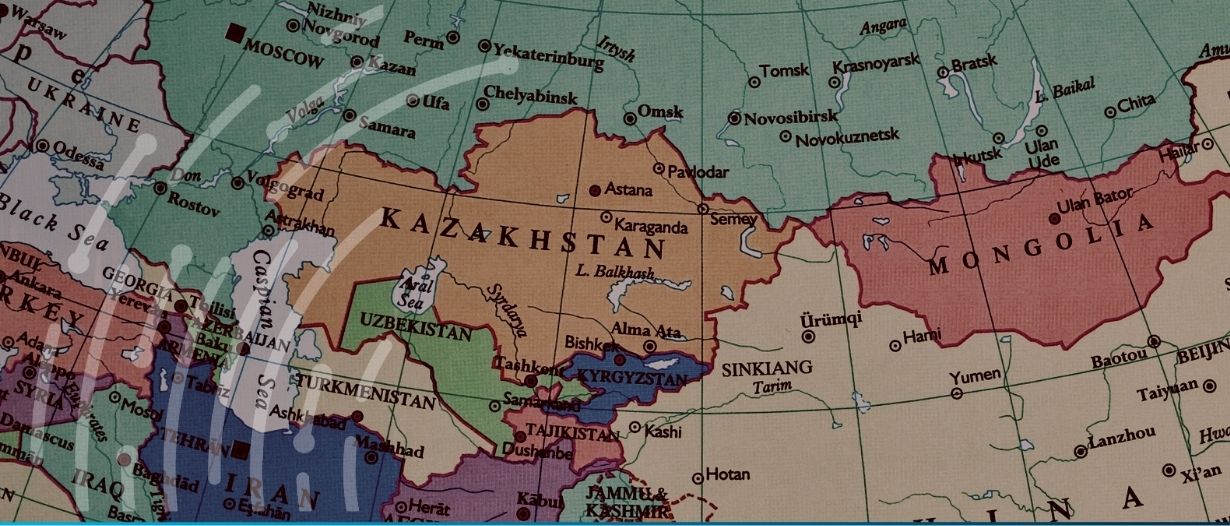

Central Asia and the Caucasus

According to the EBRD report, Central Asia and certain areas of the Caucasus are poised for strong economic performance. This growth is largely attributed to solid trade relations and high levels of remittances from Russia. These factors have underpinned robust real wage growth in these regions, making them stand out in the EBRD’s overall economic landscape.

Emerging Europe

On the other hand, emerging Europe is grappling with economic deceleration. The region is burdened by high energy prices and an average inflation rate of 9.7% as of July 2023. These factors have led to a weaker economic performance, affecting both households and businesses.

Beata Javorcik, EBRD Chief Economist, said, “Our economists see a diverging pattern of growth among the EBRD regions. The robust growth of the economies of Central Asia and the weaker performance of those in central Europe and the Baltic states reflect the different consequences of energy prices, inflation and shifting patterns of trade.”

Significant trends influencing the forecast

Energy prices and consumption

One of the most notable trends is the significant drop in gas consumption in emerging Europe, which fell by over 20% during the winter of 2022-23. This was primarily due to a reduced supply of gas from Russia, leading to much higher energy prices in the region.

Industry shifts

European industries are undergoing a transformation, moving away from gas-intensive sectors like construction materials and chemicals to less carbon-intensive sectors such as electrical equipment and pharmaceuticals. This shift is evident in countries like Poland, where basic metals production declined by 18% year on year, while electrical equipment production surged by 21%.

Labour market resilience

Despite the challenges, the labour market across Europe has shown remarkable resilience. Companies have managed to retain jobs even amidst large structural changes in industrial output. Moreover, nominal wages have increased rapidly in many economies, although this has led to reduced competitiveness in some cases.

Regional projections for 2023 and beyond

- Central Europe and the Baltic states are expected to see an average growth of 0.5% in 2023, rising to 2.5% in 2024.

- South-eastern European Union economies are projected to grow by 2% in 2023, picking up to 2.8% in 2024.

- The Western Balkans could experience a GDP growth of 2% in 2023, rising to 3.4% in 2024.

- Central Asia is forecasted to maintain strong growth rates of 5.7% in 2023 and 5.9% in 2024.

The EBRD’s latest economic report provides a nuanced view of the economic landscape for 2023. While Central Asia and the Caucasus are set to enjoy robust growth, emerging Europe faces a more complex set of challenges. These diverging trends underscore the need for targeted policy measures to navigate the economic complexities of the coming year.

Read the full report here.