Clearing House

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

What is a Clearing House?

A clearing house is a financial institution that acts as an intermediary between buyers and sellers of financial instruments to settle trades and ensure that both parties fulfil their obligations.

In the financial industry, there are many types of clearing houses that serve a variety of markets and instruments, and they can either be owned by market participants or be independent entities regulated by financial authorities.

Since they can help reduce systemic risk by providing a centralised and standardised mechanism for settling trades, they are most commonly associated with the derivatives market, where trades can involve complex financial instruments and high levels of risk.

But there are many different types of clearing houses, each with its own specific function and application. Some will specialise in trades of stocks and other equity instruments, while others focus on trades in fixed-income instruments, such as bonds and other debt securities.

Commodity clearing houses, for example, handle trades in commodities, such as agricultural products, energy products, and metals, while foreign exchange clearing houses take on trades in foreign currencies.

There are also multi-asset class clearing houses that can handle trades across different markets and asset classes.

In addition to facilitating settlement, clearing houses may provide other services, such as trade matching, netting, and margining.

How does a Clearing House work?

A clearing house acts as an intermediary between buyers and sellers of financial instruments and facilitates the settlement of trades by ensuring that both parties adhere to their agreed-upon contract terms.

When a trade is executed, the clearing house becomes the counterparty to both the buyer and the seller. This process – known as novation – allows the clearing house to assume the risk that one party may fail to fulfil their obligations under the contract.

The clearing house reduces this risk of default by requiring both parties to deposit collateral which the clearing house can use to cover the loss if one party fails to fulfil their obligation.

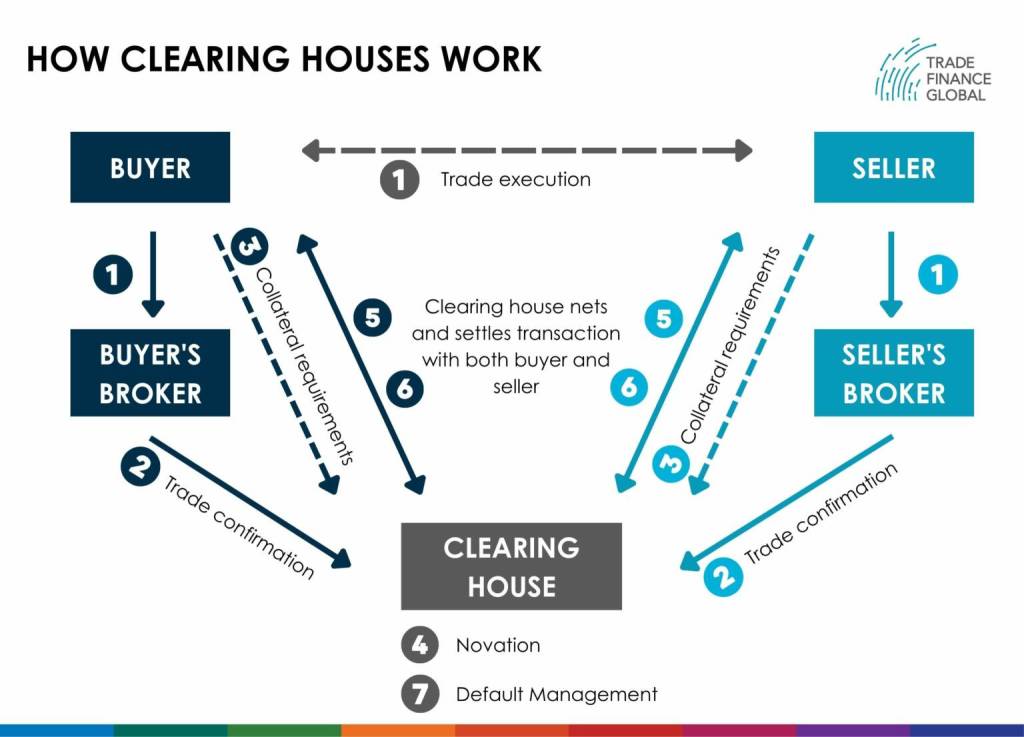

Here’s a simplified overview of how a clearing house works:

- Trade Execution: A buyer and seller enter into a trade and submit their respective orders to their broker.

- Trade Confirmation: The broker sends the trade details to the clearing house, which confirms the trade details with both parties.

- Collateral Requirements: The clearing house requires both the buyer and the seller to deposit collateral, such as cash or securities, with the clearing house to cover potential losses in the event of default.

- Novation: The clearing house becomes the buyer to the seller and the seller to the buyer, becoming the counterparty to both parties. This process is known as novation.

- Netting: The clearing house nets the obligations of all parties to the trade, which can reduce the amount of collateral required.

- Settlement: The clearing house ensures that both parties fulfil their obligations to deliver the financial instrument or make the payment by settling the trade.

- Default Management: If one party fails to fulfil their obligation, the clearing house uses the collateral deposited by both parties to cover the loss. If the loss exceeds the amount of collateral deposited, the clearing house may use other resources (such as a default fund or insurance) to cover the loss.

By acting as a central counterparty, the clearing house helps to reduce counterparty risk and promote market stability; however, it cannot eliminate the risks of a transaction entirely.

Any firm looking to leverage the services of a clearing house needs to carefully weigh the associated risks and benefits to fully understand what they are getting into.

Clearing Houses Work Diagram

The Risks and Benefits of Clearing Houses

While clearing houses operate largely as a means of reducing the credit, counterparty, and settlement risks involved in a transaction, that does not mean that risks can be ignored when using one.

Clearing houses have the potential to become a single point of failure for the financial system, creating a degree of concentration risk that is compounded by the fact that they are complex institutions vulnerable to operational risk, such as system failures or cyber-attacks.

They must also be well governed to ensure they operate effectively and efficiently, particularly given the complex legal and regulatory environment they operate in, which itself creates certain legal risks.

Furthermore, clearinghouses can also create liquidity risk since they require participants to post collateral that must be made inaccessible for some period of time.

On the flip side, requiring participants to post collateral certainly helps to promote financial stability, reduce credit risk, and inject confidence into a transaction.

Clearing houses also provide standardised processes, procedures, and contracts in a transparent manner which can help to reduce complexity, promote efficiency in financial markets, and improve market integrity.

On aggregate, the benefits of clearing houses in promoting financial stability and reducing risk generally outweigh the risks, but it is important to be aware of the potential risks to manage them effectively.

Examples of Clearing Houses

Many clearing houses are operating in various financial markets around the world.

The Depository Trust & Clearing Corporation (DTCC) is a USA-based clearing house that provides clearing and settlement services for a range of financial instruments, including equities, bonds, and derivatives.

In Europe, Euroclear and Clearstream provide many of these same clearing and settlement services for the EU, while the Hong Kong Exchanges and Clearing Limited (HKEX) serves that function in the Asian markets.

LCH.Clearnet out of the UK is one of the largest clearing houses in the world. It provides clearing and settlement services for various financial instruments, including interest rate swaps, credit default swaps, and commodities.

CME Group, another USA-based clearing house, is one of the largest futures exchanges in the world and provides clearing and settlement services for futures and options contracts on commodities, currencies, and interest rates.

How to access Clearing House services

Access to clearing house services typically requires membership in the clearing house, and the requirements for membership can vary significantly depending on the clearing house and the type of financial instrument being cleared.

Typically, however, becoming a member of a clearing house requires a financial institution to meet certain criteria, such as having sufficient financial resources, demonstrating operational capabilities, and meeting certain regulatory requirements.

The process can be complex and time-consuming and may involve a detailed application process, due diligence checks, and ongoing compliance requirements.

Access to these services is generally limited to regulated financial institutions, such as banks, brokers, and other financial intermediaries approved for membership in the clearing house. However, some clearing houses may also offer services to non-financial firms or individuals, depending on the nature of the financial instrument being cleared and settled.

Once a financial institution is a member of a clearing house, it can access the clearing house’s services for clearing and settling financial transactions.

This may involve submitting trades to the clearing house for clearance and settlement, posting collateral to meet margin requirements, and complying with other operational and regulatory requirements.

Clearing House Regulations and oversight

Regulatory oversight of clearing houses typically involves regular monitoring and assessment of the clearing house’s financial resources, risk management procedures, and operational capabilities. Authorities may also conduct stress tests and other assessments to evaluate its ability to withstand market disruptions.

These regulations and oversight are designed to ensure that clearing houses operate safely and have adequate resources and risk management procedures to protect the financial system if something were to go wrong.

Like all internationally operating organisations, clearing houses are subject to regulations and oversight by regulatory bodies both in their home jurisdictions and in the jurisdictions where they operate.

In the United States, clearing houses are overseen by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), depending on the type of financial instrument being cleared. The CFTC is responsible for clearing houses that clear futures and options contracts, while the SEC looks at clearing houses that clear securities.

In Europe, the European Securities and Markets Authority (ESMA) shares this role with the various national regulatory authorities, such as the Financial Conduct Authority (FCA) in the UK and the Autorité des Marchés Financiers (AMF) in France.

In Asia, the regulation tends to be more regional, with clearing houses overseen by different regulatory bodies depending on the jurisdiction. For example, in Hong Kong, they are regulated by the Hong Kong Monetary Authority (HKMA), while in Singapore, it is the Monetary Authority of Singapore (MAS).

Regardless of the nuances, these systems are all designed to promote the safety and stability of the financial system by ensuring that clearing houses are adequately capitalised, have robust risk management procedures, and can manage potential losses and market disruptions.

Publishing Partners

- Payments Resources

- All Payments Topics

- Podcasts

- Videos

- Conferences