Estimated reading time: 10 minutes

Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn

In an increasingly interconnected global economy, the fight against financial crimes has become more complex and critical than ever.

One form of illicit activity that poses considerable challenges to regulators, law enforcement agencies, and financial institutions is trade-based money laundering (TBML). In its simplest form, TBML is a covert technique that allows criminals to conceal illicit proceeds by exploiting the very systems of legitimate trade, making it a potent tool in illicit financial operations.

In this episode of Trade Finance Talks, Brian Canup, assistant editor at TFG, was joined by Channing Mavrellis, director of the Illicit Trade Program at Global Financial Integrity, to delve into the world of TBML. Together, they explored the latest developments and insights surrounding trade-based money laundering (TBML) practices.

Transnational crime and illicit financial flows: Connecting the dots

The UN Convention on Transnational Organised Crime deliberately refrains from providing a precise definition of transnational crime. This flexibility allows the convention to accommodate the emergence of new types of crimes on a global, regional, and local scale.

However, an official definition does exist for organised criminal groups, which involve three or more individuals collaborating to commit at least one crime to attain a direct or indirect tangible benefit.

The range of criminal activities conducted by transnational criminal organisations can include human trafficking, arms trafficking, drug trafficking, mineral trafficking, wildlife trafficking, counterfeiting and trading of counterfeit goods, fraud, extortion, money laundering, and cybercrime. Furthermore, transnational crime does not necessarily require the involvement of a group but can be characterised by its transnational nature.

The connection to illicit financial flows (IFFs) is highly significant. IFFs refer to the movement of illegally earned, transferred, and/or utilised funds between different countries. Illegally earned funds can originate from activities like drug trafficking, while illegally transferred funds may result from customs fraud or capital flight. Illegally utilised funds can be associated with terrorism financing.

The main hurdle for criminal groups lies in the process of laundering criminal proceeds to make them appear legitimate, and this is where TBML becomes particularly relevant in the context of transnational crime. Criminal groups perceive the utilisation of the international trade system as an immensely advantageous method for money laundering, capitalising on the opportunities that arise from global trade.

As Mavrellis said, “Having a method of laundering the funds that involve international trade can be very beneficial.”

Unveiling the methods of TBML

Mavrellis explained that TBML involves various methods, which she categorises as document-based and non-document-based techniques.

Document-based TBML often depends on trade misinvoicing, which is a type of customs fraud. This method entails purposefully altering the value of a trade transaction by falsifying details such as price, quantity, quality, or country of origin of the commodity. By overvaluing or undervaluing goods during import or export processes, criminal organisations can facilitate the movement of funds into or out of a country while presenting falsified documentation to justify the additional funds being transferred.

On the other hand, non-document-based TBML is quite challenging to detect. One prevalent example is the black market peso exchange (BMPE). The BMPE originated in Colombia and is often associated with drug trafficking, but the method is not exclusive to that country or to a particular criminal activity.

The BMPE mechanism relies on repatriating the proceeds of crime from one country to another by using the proceeds to purchase legitimate trade goods, which are then exported, most frequently, to the source country. The goods are then sold and the funds are received by the criminal organisation. This method helps to avoid detection as well as allows for the exchange of funds from one currency to another.

For instance, if criminal organisations generate cash from selling narcotics in the United States, they need to transfer the funds back to Colombia and convert them to Colombian pesos. In the BMPE, the cartel may purchase legitimate trade goods in the U.S. with the cash proceeds and export them to Colombia. The goods, which represent the criminal proceeds, are then sold, thereby laundering the proceeds and transforming them into accessible funds, all the while bypassing the formal financial system.

Alternatively, the cartel may engage a peso broker, who charges a certain rate (i.e. commission) to purchase the narcotics proceeds. The broker can then provide the cartel with “clean” money or facilitate the integration of the criminal proceeds into the formal financial system through different means, such as individual deposits or cash-intensive businesses.

Mavrellis reported that law enforcement has previously reported peso brokers charging commissions of 10% to 15% for laundering dirty money, with the fee charged to the account for the risk that the broker is taking. For example, a broker would charge a cartel $50,000 to $75,000 to launder $500,000 cash.

Over the last several years, there have been increasing reports of Chinese money laundering organisations (CMLOs) entering the narcotics money laundering scene, motivated by getting access to US dollars due to strict currency controls in China. These organisations offer to purchase unlawful proceeds at lower commissions compared to traditional peso brokers.

Mavrellis emphasised, “With the involvement of Chinese money laundering organisations, it gets a little bit more complicated.”

In regards to TBML, this creates a three-party transaction:

- Cartels looking to launder money,

- Chinese money laundering organisations wanting to profit from currency exchange,

- Chinese nationals wanting to acquire US dollars/move money out of China.

The CMLO accepts the dirty US dollars, and then makes an equivalent amount of money (e.g. Mexican pesos) available to the cartel in Mexico, less a commission. The CMLO then sells the US dollars to a Chinese national, who then transfers an equivalent amount of Chinese Renminbi (plus a fee) from their Chinese bank account to the CMLO’s Chinese bank account.

Another option is for the CMLO to accept the US dollars and make an equivalent amount of Chinese Renminbi available that can then be used by the cartel to purchase goods in China for export to Mexico, for example, completing the money laundering process.

On another note, traditional methods of money laundering face heightened scrutiny, leading criminals and other illicit actors to resort to trade-based methods to hide their illicit financial flows. This shift raises the stakes, as trade-based methods not only facilitate the laundering of proceeds from activities like narcotics trafficking and human trafficking, it can also enable terrorist financing as well as serve as a means to disguise logistical support for terrorist activities, such as the transportation of weapons.

“I think this is in large part to the fact that so much of our [anti-money laundering/countering the financing of terrorism] AML/CFT framework that’s out there globally is really focused on financial institutions”, Mavrellis explained, noting that this “backdoor” of trade is often overlooked.

Ostensibly, TBML presents numerous challenges for law enforcement and policymakers as it capitalises on the fact that AML/CFT frameworks primarily focus on financial institutions rather than trade.

Trade-based money laundering: Dominant industries & countries revealed

Criminals exploit various trade transactions to conceal and launder illicit funds. “Any commodity that you can think of, they’ve done,” Mavrellis revealed.

This versatility creates market threats for legitimate businesses, as illicit activities can disrupt fair competition. Hair extensions, used cars, and even cattle are just a few examples of seemingly unrelated trade items that have been exploited in TBML schemes.

Criminal groups may under-price the commodities used in TBML schemes in order to sell the goods quicker, thus accessing the criminal proceeds faster. Legitimate businesses often struggle to keep up with the pricing strategies and quick liquidation methods employed by those engaged in TBML.

“It can be very difficult for legitimate businesses to compete with some of these illicit activities.” Mavrellis highlighted.

When discussing the vulnerability of countries to TBML, Mavrellis expressed an inclusive viewpoint, adding “Which countries are most vulnerable? Again, it’s all of them.”

The effective screening of each global trade transaction is a daunting task for customs departments due to the sheer volume involved. Authorities are confronted with the delicate responsibility of striking a balance between facilitating trade and combating illicit activities, ensuring both business continuity and national security are safeguarded.

China has emerged as a particular area of concern due to its extensive involvement in transnational crime and illicit financial flows. The massive volume of goods entering and leaving the country provides ample opportunities for the camouflage of illicit activities.

Mavrellis said, “When you think about just the volume of goods coming in and out of the country, it’s very easy to disguise any kind of illicit activity.”

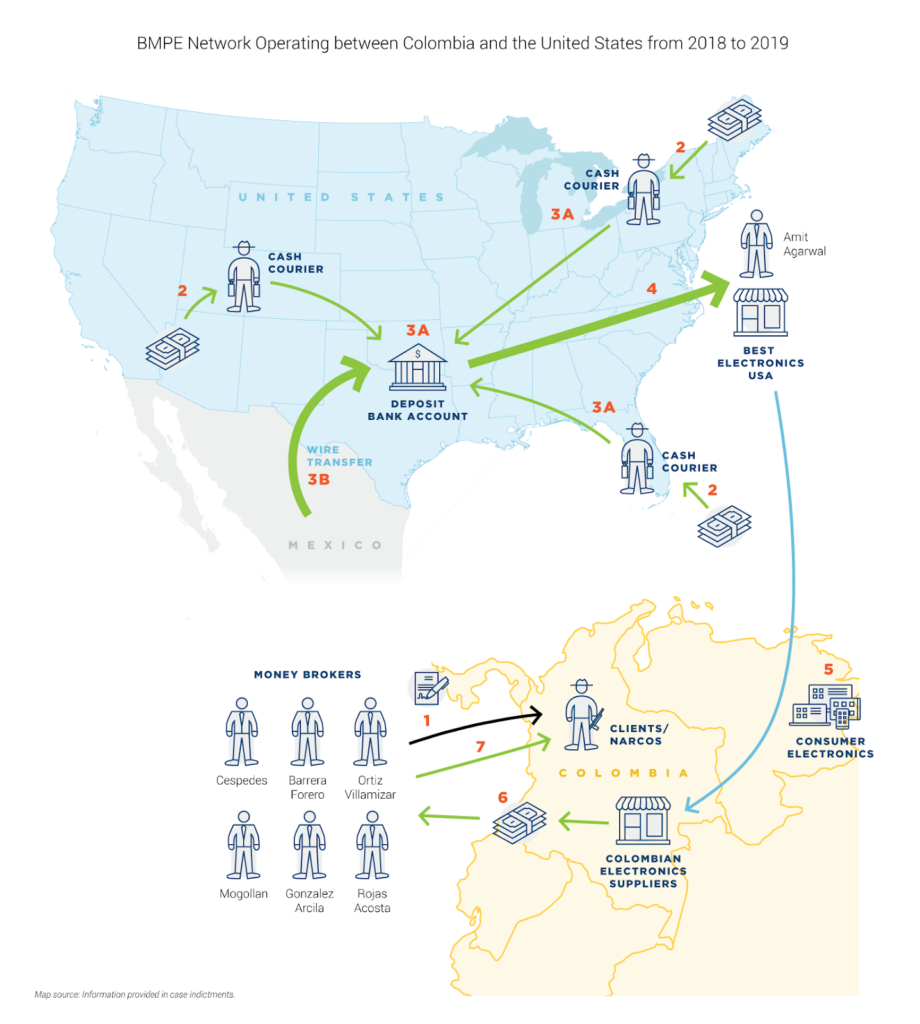

Black Market Peso Exchange

Source: Global Financial Integrity, Financial Crime in Latin America and the Caribbean: Understanding Country Challenges and Designing Effective Technical Responses.

To demonstrate the intricacy and extent of trade-based money laundering (TBML) operations, Mavrellis shared a compelling case study from Global Financial Integrity’s 2021 report, Financial Crime in Latin America and the Caribbean. The study centred on a black market peso exchange (BMPE) scheme, showcasing the sophistication of such illegitimate schemes.

According to Mavrellis, in 2019, a BMPE network operating between Colombia and the United States was dismantled by the US authorities. Money brokers, also known as peso brokers, acted as intermediaries between individuals, businesses, and criminal organisations, facilitating the laundering of criminal proceeds.

The US Department of Justice alleged that six money brokers based in Colombia were involved in laundering and repatriating narcotics proceeds, specifically cash from the US back to Colombia.

Narco-traffickers would contact these brokers to inform them about the cash in the United States requiring laundering. The brokers would then create contracts detailing the conditions of the transaction, in particular the commission rate. Once the contract was signed, the brokers arranged for the pickup of cash using a network of couriers located across the United States.

This particular case was part of a US Drug Enforcement Administration investigation, and the couriers would then deposit the collected funds into a DEA-controlled bank account, which also received wire transfers of illicit proceeds from other countries, including Mexico. Amit Agarwal, an Indian national and owner of Best Electronics USA, played a pivotal role in this network. After receiving the funds in his business account, Agarwal would export electronic goods of similar value to Colombian electronics importers, using a code name on the commercial invoice to link the transactions to the corresponding money broker.

Rather than paying Agarwal directly as the exporter, the Colombian businesses would pay the appropriate amount in Colombian pesos to the peso brokers in Colombia, who would then deliver the funds to their clients, the narco-traffickers. The money brokers retained a commission for themselves and the couriers.

The case study underscores the importance of conducting thorough customer due diligence and profiling to uncover instances of trade-based money laundering. Unusual behaviour, such as businesses depositing large amounts of cash outside their standard patterns or payments received from third parties, can raise red flags for financial institutions and businesses.

Strengthening the global defence mechanism: How governments can fight against financial crime

Amid the ever-changing landscape of criminal activities, governments play an imperative role in combating these illicit practices. As policymakers seek strategic measures to address these evolving issues, Mavrellis has put forth several key messages.

- Trade and customs records to be freely accessible to the public. While some trade information is available, for free as well as for a fee, through sources like the United Nations Comtrade database and S&P Global Market Intelligence’s Panjiva database, countries should automatically provide timely, comprehensive trade data to the public free of charge in order to adequately verify trade transactions, among other benefits.

- Continuous and dynamic information exchange between countries. An ideal scenario would involve countries automatically sharing trade data to allow customs authorities to track and verify transactions accurately and in real-time, enhancing overall transparency and security. As Mavrellis pointed out, “It’s all about data. It’s all about sharing data. Everybody needs to know what’s going on. That’s our point of view.”

- The establishment of robust legislation and registries for beneficial ownership. Beneficial ownership refers to the identification of the individuals that ultimately own and/or control a company. Anonymous, shell, and front companies are often used to facilitate criminal activity, and law enforcement needs to know the ultimate beneficial owners of these companies in order to hold the responsible individual(s) accountable.

- Implement targeted economic and financial sanctions. Directing attention towards individuals, entities, and countries involved in financial crimes and money laundering can. By denying access to the financial system, it becomes possible to disrupt the operations of these networks and diminish their influence. As Mavrellis stated, “We should focus on targeting individuals, entities, and countries that facilitate financial crimes and money laundering, and consider the application of economic and other targeted financial sanctions against those engaged in such illicit activities.”