Estimated reading time: 6 minutes

Brexit was one of the major triggers that pushed the UK government to take action and further facilitate trade. As part of trade facilitation, the UK government introduced the Electronic Trade Documents Bill, which is currently undergoing legal stages before being fully enforced. It’s a great step forward, however, industries need more than that.

The majority of industry actors are waiting for the Single Trade Window (STW) implementation with anticipation.

What is STW and how does it link with the new customs system – Customs Declaration Service (CDS)? How can British importers and exporters keep up and stay customs compliant to ensure stable supply chains? Here at Brose Limited, we would like to share some insights and talk about some common challenges within the automotive industry. To give you a brief introduction – the Brose Group is the world’s fourth-largest family-owned automotive supplier, and every second new car worldwide has at least one of our products.

The company’s intelligent solutions for vehicle access and interiors provide greater comfort and flexibility whilst innovative concepts for thermal management increase efficiency and contribute to environmental and climate protection. As one of the 44 production plants in the group, Brose Limited produces car seat structures and window regulators with the potential for further expansion.

CDS and ‘mountains of considerations’

In September last year, UK Customs introduced CDS for the whole UK on imports (CDS was available before for Northern Ireland movements only). Brose Limited went through the process rather smoothly but not without challenges. Hard work and existing customs knowledge within Brose’s Logistics Team played a key role, as well as cooperation with our customs software provider (MIC) – which led to a successful transition before the actual deadline. We have pulled out most typical ‘technicalities’ taken into consideration in our case:

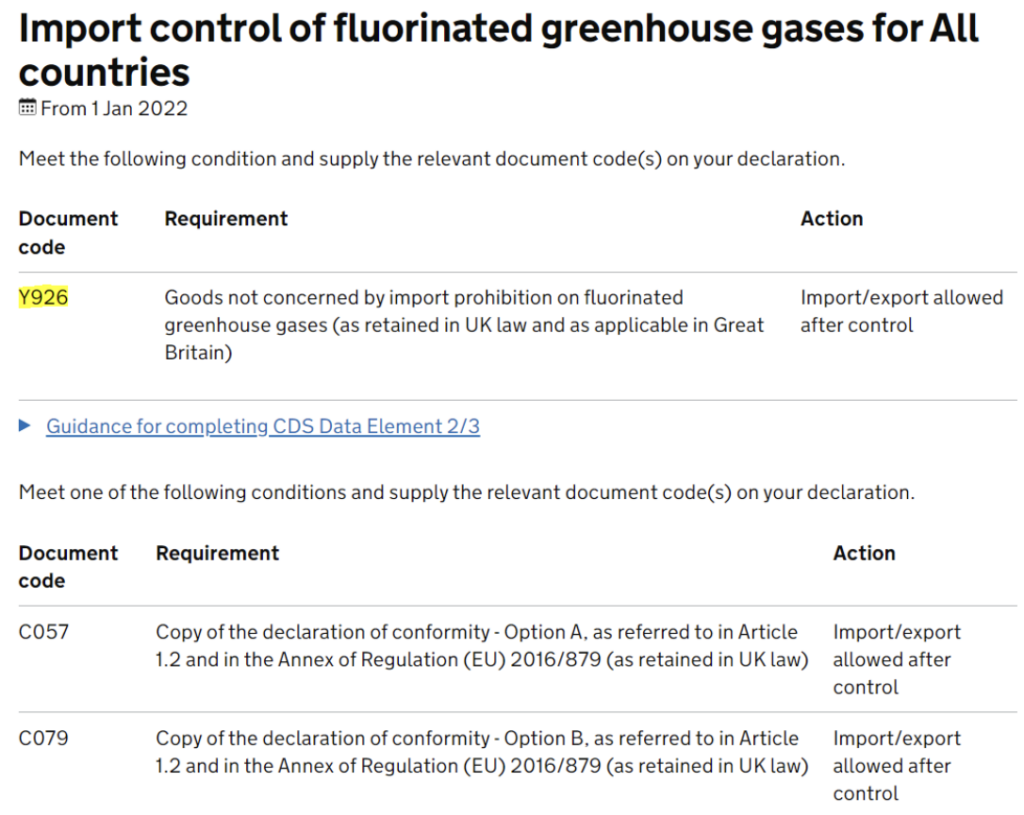

- HTS codes review and selection of document/union codes (nicknamed ‘Y’ codes) to eliminate 999L waiver code usage

- Incoterms reviews (supplier contracts, shipping paperwork and our database)

- Valuation methods reviews & financial considerations

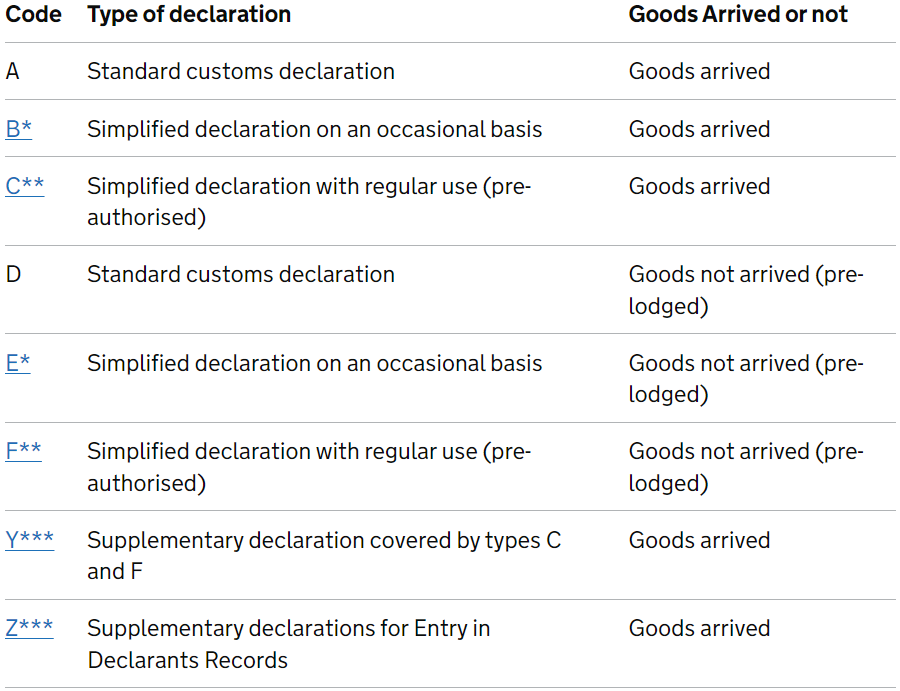

- Declaration types, message information and process reviews for Customs Special Procedures

- Data automatisation (for minimal manual input)

- Ports, shipping routes considerations and coding

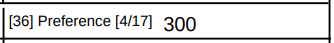

We also had to ensure existing regimes were applied and automated, such as status codes (‘AE’) assigned to the document code (‘U110’) if the preference code was manually selected to 300. We input preference codes after compliance checks, and as per TCA Annex 7, in addition to obtaining LTSD’s (Long Term Supplier Declarations) and other evidence from our suppliers – we check the correctness of the Statement on Origin (aka invoice declaration) text, validity and REX. Always striving for best practice!

Preference code can be found in data element 4/17 in the import declaration, but each software provider can display information in a different format(s)

Carrying out a number of tests with the Consolidated CDS Workaround Document kept readily available prepared us for the worst-case scenarios. For example, upon ‘Party ID Unknown’ error, it turned out there were issues with our government gateway ID account (resolved at the end).

Another example is when other error codes appeared during live declarations (some related to mentioned ‘Y’ codes, some linked to CDS issues) that proved challenging and time-consuming, especially when getting support via official channels.

Nevertheless, most of the time digging deeper into ‘gov.uk’ proved successful and no goods were stuck at the border. While successful in this instance, it is not the case with businesses where response times would have been much more critical (i.e. when a driver is stuck at the border).

As the system is constantly updated and improved, there are constant changes within CDS, whether permanent (e.g. extra representation type codes) or temporary (U116 needed on goods from EU and back to normal, e.g. U110 code after few days).

It’s reassuring to know CDS is under constant development, yet the UK importers must expect the unexpected (account for e.g. unplanned GVMS and/or CDS system outages), plan/declare ahead where possible and adapt dynamically.

However, there are two sides of the coin here – the system must be fully capable of handling a high volume of declarations and must fulfil all requirements to become a ‘reliable ground’, and a link to the STW – yet UK traders need faster responses, more clarity on intended system changes and no unknown system errors.

Single Trade Window: UK setting an example for the world?

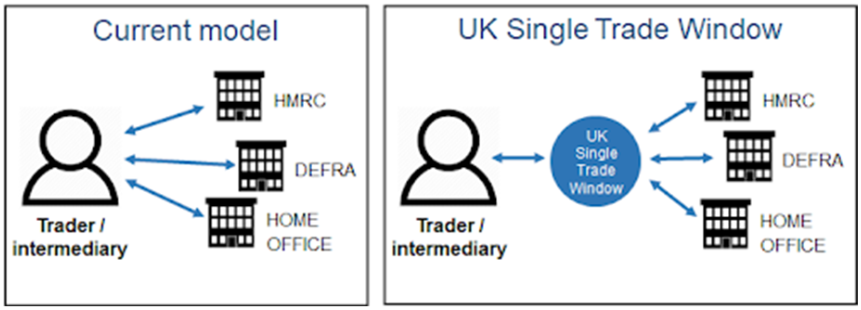

It is assumed the STW platform will be linked or will contain CDS data elements as part of the self-declaration of border data. But it is expected to offer much more than that.

The aim of STW, as part of UK’s Border Strategy 2025, is to make customs formalities quicker and easier and for border agencies to share a single platform. Presumably, this will improve border agencies’ internal communication, as well as communication and data requests to/from traders themselves.

In addition, potential data visibility at any time will be hugely beneficial to companies like Brose Limited. One of the other key principles, as stated within STW policy discussion paper, will be simplification around multiple shipments and submitting the same data. Moreover, the paper further explores the pre-population of data and multi-filing. Such potential gives huge hopes for customs digitalisation – we all transfer data digitally on a daily basis. Now it’s time for trade!

Three countries have already implemented trade digitalisation, Singapore (TradeNet), the United States (ACE) and New Zealand (TSW). With the UK hopefully implementing STW in the near future, it would set an example for other countries to follow. As the WTO reports in the ‘The promise of TradeTech Policy approaches to harness trade digitalisation’ – as more countries adopt customs digitalisation, it will ease the burden of trade and encourage a higher level of export activity.