The big event for Sterling this week, and arguably for the remainder of 2016, could well prove to be the Bank of England’s August policy decision.

Money markets are now pricing in a near-100% chance that an interest rate cut will be delivered by policy makers at Threadneedle Street.

At present, we are seeing markets favouring a 25 basis point cut while question marks hang over whether a greater cut will be delivered.

There are also varied opinions on whether the quantitative easing programme will be extended.

If a cut greater than 25 basis points, and a good dose of quantitative easing is introduced, then expect GBP to slip back towards post-referendum lows.

This is because such actions would increase the supply of Sterling to the market and devalue the Pound on a unit basis.

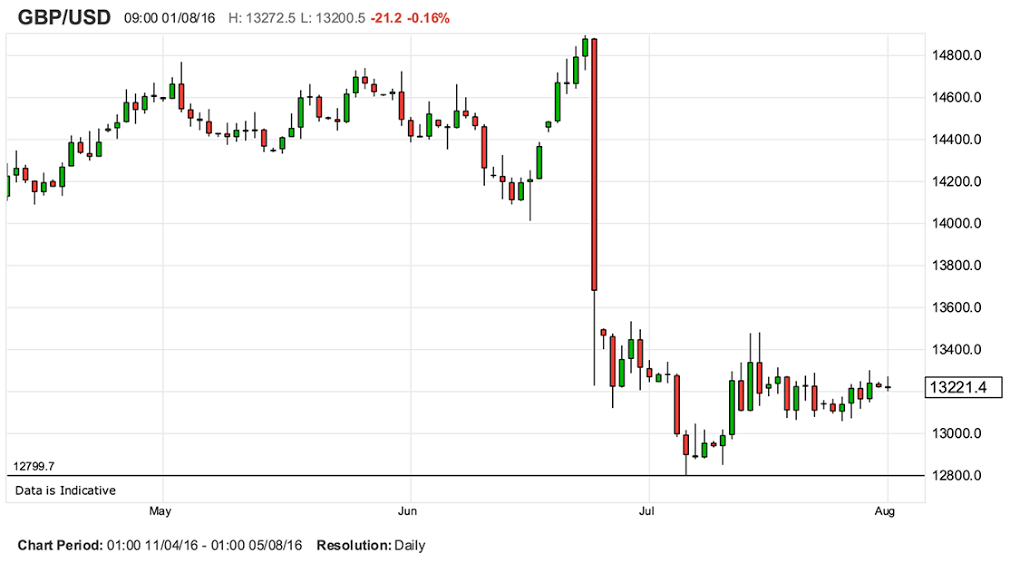

As can be seen on the charts we could therefore potential witness the GBP/USD back at 1.28:

There is however a risk to this GBP-negative view.

With markets clearly positioned for a rate cut, what would happen if the Bank of England didn’t change policy?

The shock would certainly play into the hands of GBP bulls and we could see the July recovery extend into April as markets are caught wrong-footed.

A frantic bout of short-covering would, as traders close out their GBP-negative bets, would likely aid Sterling sharply higher.

This is the risk that we would be most wary of.

But, why would the Bank opt to leave policy unchanged you may ask?

The reason for such caution is the observation that the Bank of England is a ‘data-dependent’ bank, i.e it only acts on solid data.

There is therefore the chance that the Bank will want to wait a little longer to gauge the impacts of the referendum on the real economy.

There is good reason to wait as the most recent confidence surveys from Lloyds Bank and the ICAEW show business confidence has rebounded in July.

Both note that the slump in confidence following the vote could be fleeting.

Add to this the better-than-forecast GDP data from the ONS, released last week, which showed the economy grew at a rude 0.6% quarter-on-quarter rate in the second quarter.

This gives some good cushioning heading into the final half of 2016.

We have heard a number of analysts reflect that there is “good reason not to bother” with a cut.

“Many believe a rate cut is also on the cards but we see good reasons not to bother,” says Mike van Dulken, Head of Research at Accendo Markets.

van Dulken questions whether a rate cut would really help, given how low rates have been since the FTSE bottomed in March 2009. Will it make anyone more likely to spend/invest?

“Secondly, why inflict more pain on the banks, especially the bailed out Lloyds which the government still holds a 10% in and is desperate to unload but unable to while the shares languish 20p offside?” asks van Dulken.

A rate cut won’t help the share price, its profitability is dented by further squeezing still depressed Net Interest Margins.

In agreement is Arnaud Masset at Swissquote Bank, in Gland, Switzerland:

“The BoE has limited room for manoeuvre before switching to negative interest rates. Therefore, we expect the central bank to leave its benchmark rate unchanged at its next meeting on August 4th, waiting for further information about the implication of Brexit for the UK economy.”

We don’t yet know precisely how much the UK’s Brexit vote has hurt demand and we won’t know for probably many months yet.

Hard data for July will be available only by late August and a first pass of 3Q GDP not until late October.

That first pass will have nothing to say about business investment or household saving behaviour.

The question is then, can the BoE wait that long?