Estimated reading time: 9 minutes

Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn

There is little doubt that 2022 has been an unprecedented year and for better or for worse, a lot has happened in the trade, treasury, payments and supply chain spaces.

As we make plans to wrap up this year and head into the next, TFG wanted to take a look back at all that has happened and the major themes discussed in each of the last 12 months.

January: sustainability and COP 26

2022 began positively, with the afterglow of COP26 and the Glasgow Climate Pact sowing the seed for important sustainability discourse. Signatories pledged to make the 2020’s a decade for climate action and support.

While trade may not have been prominent on the agenda, there were several key developments in the space, such as defining sustainable trade finance and exploring how development banks can accelerate a green transition for developing economies.

The four key areas of climate action lie around:

- Mitigation – reducing emissions.

- Adaptation – helping those already impacted by climate change.

- Finance – enabling countries to deliver on their climate goals.

- Collaboration – working together to deliver on those goals.

Watch TFG’s editor, Deepesh Patel, talk to industry leaders about the impact of the landmark climate conference on the commodities sector.

Hear from David Thambiratnam, CEO of Veridapt, about how to manage net-zero goals.

February: Russian invasion alters global landscape

In February, Russia invaded Ukraine – sparking the humanitarian and economic crises that would underpin the rest of 2022.

Many Western nations imposed sanctions – including trade and commodity finance restrictions – against Russia, and the invading nation was barred from using the SWIFT global payment network.

These actions continue to impact shipping logistics, trade, and supply chain finance.

China’s State Bank, the Industrial and Commercial Bank of China, also ceased issuing confirmation letters of credit for the purchase of Russian commodities.

The events in February have certainly had persisting and continually evolving implications.

Read more about how the Russia-Ukraine war is creating a global food crisis.

Learn about Trade Data Monitor’s chief economic analyst John W. Miller’s analysis on the war’s impact on global trade.

March: changing digital standards

In March, the World Trade Organization (WTO) and the International Chamber of Commerce (ICC) published their first-ever standards toolkit for paperless trade.

Rather than devising a new set of standards, this toolkit highlighted the fact that there are already several different standards for digital trade, but many practitioners are either not aware that they exist or don’t know how to use them.

The toolkit provides an overview of these existing standards for trade digitalisation and was launched with the intent to help drive adoption, identify potential gaps, and promote interoperability.

This is a first step towards making trade paperless and has helped practitioners become aware of the different standards for digital trade, and how best to use them.

Learn more about the ICC and WTO’s standards toolkit and see how it could help you.

Emmanuelle Ganne, Senior Analyst, Economic Research Department at WTO and Hannah Nguyen, Director – Digital Ecosystems, ICC Digital Standard Initiative, help us better understand the standards toolkit.

April: rapid oil and gas price increases

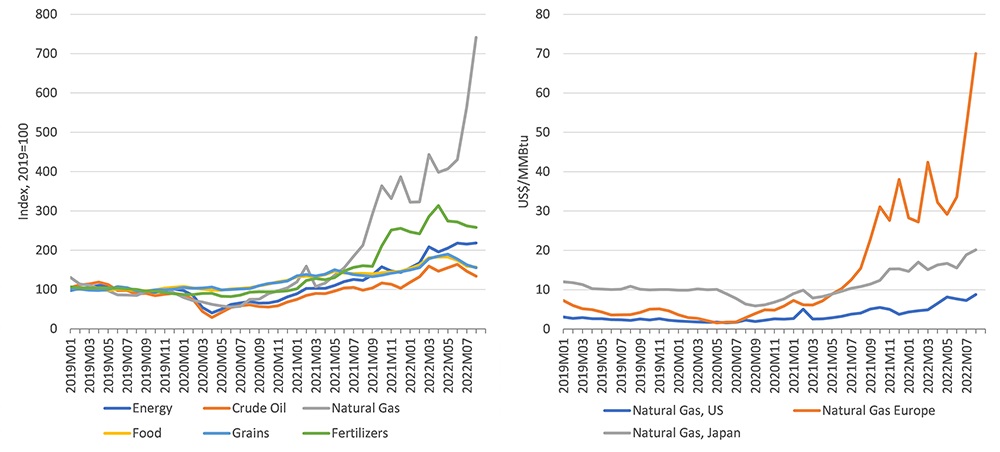

In April, the ongoing conflict in Ukraine led to an increase in financial sanctions against Russia, causing a spike in global oil and energy prices.

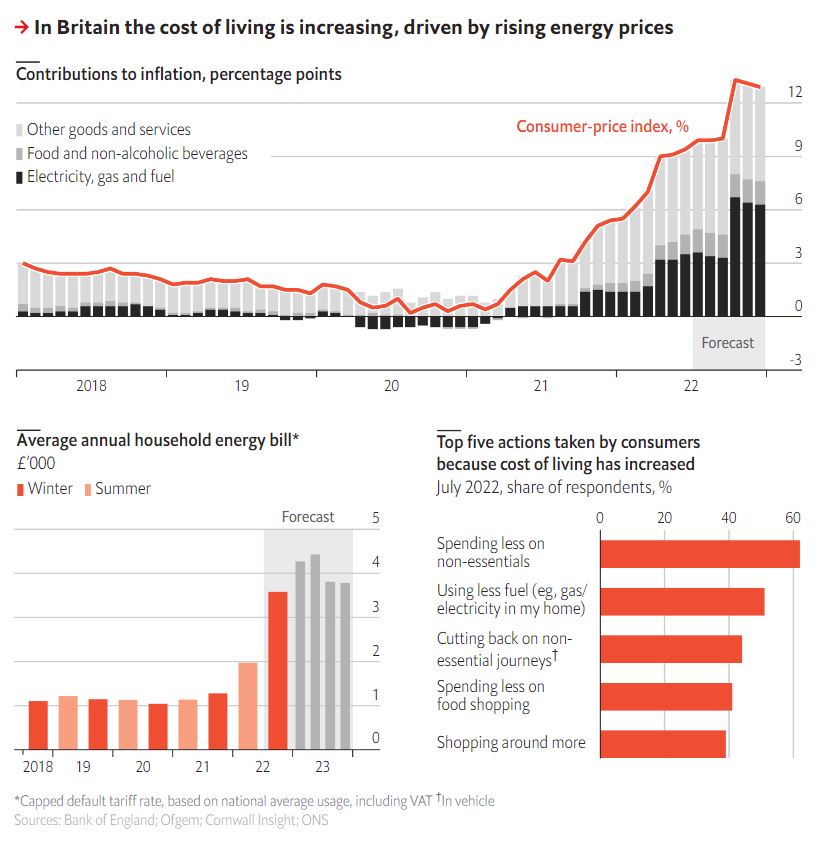

This had a significant impact on countries throughout Europe and the world, with some estimates showing an 85% increase in energy prices in the UK alone.

These rising prices contributed to growing inflation and began making headlines throughout the month.

Starting in April, inflation made it seem like trade had returned to pre-pandemic levels, but the volumes had not. Only the dollar values returned to those levels, as the high commodity prices skewed the data.

See TFG’s summary on the topics discussed at the Centre for Strategic and International Studies conference on United States’ response to the global energy crisis.

May: we.trade collapses

In May, the economic uncertainty began creating real challenges for unprofitable technology companies. Several tech companies struggled to raise capital, causing them to lay off employees, or shutting down altogether.

Blockchain-based trade finance platform we.trade was among these companies.

Events such as this shocked some in the industry who anticipated that the pandemic would completely digitalise trade.

Despite the reality check, there were several positive developments in the trade tech sphere with several key mergers, acquisitions, and partnerships forming to address issues across multiple verticals.

Read TFG’s take on the implications of we.trade’s collapse on the trade finance industry.

Listen to Komgo’s CEO, Souleïma Baddi, and TFG’s Deepesh Patel talk about the upside of blockchain technology.

June: trade finance as an asset class

In June 2022, the topic of trade finance as an asset class gained attention.

The key to developing trade finance as an asset class lies in education and providing the technology, legal framework, and tools that allow funds and individuals to invest.

However, there are still many challenges ahead, including the complexity and the difficulty of comparing different types of trade finance assets.

Trade finance has traditionally offered high single-digit or low double-digit returns, but this may be a struggle in the current high-interest rate environment.

Learn more about trade finance as an asset class from Jason Barrass, chief commercial officer at ARC Ratings.

July: focus on trade for small and medium businesses

July was an exciting month for TFG as we released our research on the trade finance landscape in Europe for small and medium-sized businesses (SMEs).

We learned that despite high inflation, record energy prices, and geopolitical uncertainty, SME demand for trade finance was indeed on the rise.

But – as has been a repeating chorus for SME financing – that demand was not being met.

Many of the companies that want trade finance need help getting it, with SME applications disproportionately rejected due to stringent regulations and large manual processing costs.

Read more about trade finance’s role in SME growth in Trade Finance Talks Issue 11.

TFG surveyed SMEs across Europe to understand their trade finance habits, needs, and wants. Download our guide to see the results.

August: governments grapple with rising inflation

We started to hear more about inflation in April, but the discussions really emerged in August – when it reached a 40-year high in the UK – with theories that rising inflation was a major driver for declines in economic activity and consumer confidence.

The rhetoric, however, was not all negative, with many commenters putting forward ideas – many of them trade-related – for how to fight inflation to keep the cogs of the economy going.

Allianz Trade, as an example, released a report showing that reducing non-tariff barriers to trade could help to lower inflation by 4.5% in the EU.

September: credit insurance gains importance

Continuing macroeconomic uncertainty brought trade credit insurance into the spotlight in September, prompting TFG and Tinubu to host a webinar to speak with veterans of the industry.

The experts were adamant about dispelling the sentiment held by many that trade credit insurance is like an umbrella that does not open when it rains.

The data shows that trade credit insurance has indeed been a tool that banks and corporates use effectively for both credit risk mitigation and capital relief.

TFG spoke with Gordon Cessford, president of Atradius US to understand how trade credit insurance protects against political risks and macroeconomic instability.

To help companies navigate the risks of international trade, TFG published a “Trade & Export Finance Guide” in partnership with UKEF and DIT.

October: growth of electronic bills of lading

October brought the conversation back around to trade digitalisation.

The UK introduced an electronic trade documents bill into parliament. While the bill is not yet law – it is expected to pass in early 2023 and may set a strong precedent for other commonwealth nations to soon follow suit.

There was also much discussion around electronic bills of lading (eBLs) and their use in the industry.

While they are not a new concept, they are largely underutilised.

Many advocates are urging practitioners to take steps to integrate eBLs into their workflows rather than waiting for others to do it first.

Read more TFG’s analysis of the UK’s Electronic Trade Documents Bill.

While at Sibos, TFG spoke with Niels Nuyens, program director at DCSA to learn more about digitisation and eBLs.

November: payments and digitisation gain steam

Following the Sibos conference in October, TFG spent a lot of time discussing the payments landscape and the impact that COVID-19 has had on digitalising payment processes.

The industry is often forced to contend with a divide between high-value and low-value payments, which particularly impacts small businesses in emerging markets.

Perhaps more important than the actual content of these discussions, however, was the overarching consensus that these conversations need to continue and need to foster a collaborative environment for all stakeholders involved.

Download Issue 13 of Trade Finance Talks to learn more about the evolving landscape of payments in the trade finance industry.

Watch Ben Ellis, global head of Visa B2B Connect, discuss the highs and lows of B2B payments.

December: future outlook, surviving the uncertainty and embracing the opportunities

As we look ahead to 2023, there are some repeating themes on the horizon.

Sustainability will continue to be a vital area for global business.

We expect many key partnerships to form and discussions to take place throughout 2023 and beyond.

Trade digitalisation will continue to grab headlines. Much of the work that the trade finance community has done for digitalisation will begin to have a tangible impact next year.

Of course, none of this can be done alone, which will make partnerships even more important as we look towards driving further change in the months to come.

In the end, there is plenty of space for cautious optimism in 2023.

TFG spoke to ITFA’s Sean Edwards about his predictions for the trade finance industry in 2023.

Listen to TFG’s yearly wrap-up podcast, ‘22 in 22 minutes!