Estimated reading time: 6 minutes

The ITFA Middle East Regional Committee hosted its fourth Trade Finance Forum (TFF) in collaboration with the DIFC Academy on 29 September 2022.

This was the first in-person TFF event held since May 2019 and was attended by over 80 participants from financial institutions, insurance companies, corporates, fintechs, and others.

The forum was structured into two-panel events. The first focused on the macro-trends in the world of trade finance, and the second on digitisation.

The event opened with a keynote speech by Baris Kalay, EMEA head of corporate sales, global transaction services at Bank of America.

Kalay touched on hot topics in the treasury sector at the moment. This includes: working capital management and efficiency, the impact of the rising rate environment on liquidity management, digitisation, and supply chain sustainability, highlighting that the GCC region has been slightly more sheltered from macro events, with anticipated gross domestic product (GDP) growth rates which are substantially ahead of their more developed peers.

Kalay also spoke about data and digitisation, defining it as not only the change from paper to electronic, but as a way to connect data points to make more informed and real-time decisions, thereby managing risk and creating opportunities more effectively.

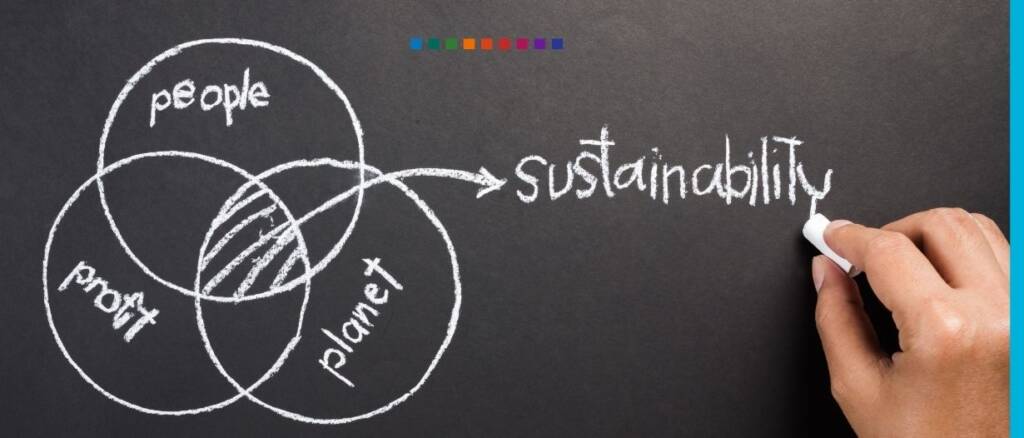

He went even further, pinpointing how the industry must move to unlock balance sheet inefficiencies and progress towards a better, more sustainable (focusing on environment, social, governance (ESG)), and data-driven trade finance ecosystem.

Macroeconomic outlook on the trade finance ecosystem

The first panel explored all relevant topics surrounding the global economic environment. The panel included; Maninder Bhandari from GTR MENA as moderator; Motasim Iqbal, managing director, Standard Chartered; Meriam Charraji, regional head of GTRF legal for MENA, HSBC; Stanley Pullolickel commercial treasury executive, GE; and Dan Georgescu, business restructuring, PWC, shared their insight on the overarching theme of treasury transformation being tackled in the GCC.

Pullolickel said, “Banks must come up with value-added solutions addressing the entire trade ecosystem”.

Banks should work with fintechs to provide a holistic overview of the trade transaction end-to-end to enable treasurers to find efficiencies in addressing their cash conversion cycles and focus on liquidity management. Given the impending global economic slowdown, it is at the forefront of any treasurer’s agenda today.

With that comes an increased focus as well on the monetisation of receivables and payables.

Georgescu said, “Corporates have moved from bilateral self-focused discussions with funders to looking at financing their trade ecosystem more holistically”.

However, Georgescu stressed that the determining factor for a successful Supply Chain Finance (SCF) program is the engagement with the corporate client’s procurement team, a conversation which is often overlooked or left too late.

The speakers also addressed sustainability within the supply chain.

Iqbal said, “The focus is on nearshoring and onshoring as much as possible.

“The conversation we are having with our corporates is that, while they may have to pay more warehousing cost, at least we don’t see a stoppage in the production cycle.”

Resilience is also being achieved via diversification of the supplier base, moving from single-source to multiple-source suppliers.

All panellists agreed that underlying all aspects within the working capital space is the topic of ESG.

Charraji said, “The evidence to me suggests that ESG is here to stay, it’s something that the market is asking for, and thus, ultimately, the industry will have to agree on a cohesive set of standards eventually.”

While a lot of work has been carried out, financial providers and regulators are all working together to build that framework.

Trade and technology

The second panel, focused on trade digitisation in the MENA region, was moderated by Naura Hussain head of FI, United Bank Ltd, and attended by Andre Casterman from Casterman Advisory, chair of fintech committee, ITFA; Sinan Ozcan, senior executive officer and board director for DP World Financial Services, Cargoes Finance; Mrityunjay ‘Jay’ Singh, ADCB; and Vishnu Purohit group head trade product management, ENBD.

Ozcan said, “Trade transformation requires not only innovation but also collaboration simply because the scale and the complexity of global trade is huge given the involvement of the various funders, third-party providers, regulators, data security and complexity of the underlying transactions.”

Scalability is necessary for digitisation to be successful, but while many advents have been made with the introduction of; Model Law on Electronic Transferable Records (MLETR), e-Bills of Lading (eBL), Uniform Rules for Digital Trade Transactions (URDTT) to name a few, standardisation and consolidation are far from being achieved.

Casterman stressed that while standards are very important (MT 700, MT 100, the ISO 20022, the Uniform Customs and Practice for Documentary Credit (UCP) 600 MLETR), they are not sufficient to achieve the full internal operability requirements.

The latter is being addressed by initiatives on the fintech side, such as the digital negotiable instruments (DNI) initiative and trade finance distribution (TFD) initiative.

The TFD initiative attempts to create a bridge between the trade finance space and the originators, the funders, and the institutional investors with; a multi-bank, multi-investor, or repackaging entity.

The appetite for trade assets globally has grown, with non-traditional players such as insurance companies, non-banked financial institutions, and others entering the trade distribution market. There has been a rise in interest, particularly following the increase of securitisation in the trade space.

Tokenisation was also underscored as a tool to widen the investor base and allow for a larger segment of the corporate population to be banked and address the trade finance gap: inherently however, the issue of transparency, market-to-market and secure data sharing have yet to be fully resolved.

Singh emphasised the added compliance angle needing to be tackled as well. He sighted that UTC is one such example where banks are collaborating via blockchain to control double financing of invoices.

While trade remains an attractive, short-term self-liquidating asset, a substantial amount of work must be carried out to ensure control of fraud risks.

The future of trade finance transactions

The panel concluded by assessing the various proof of concepts currently being tested and agreeing that in a utopian world, stakeholders involved in a trade finance transaction would use a public network underpinned by blockchain technology to carry out the execution end to end.

This process would address the fragmented world of trade finance as we know it today.

Achieving that ultimately comes down to one critical ingredient: collaboration.