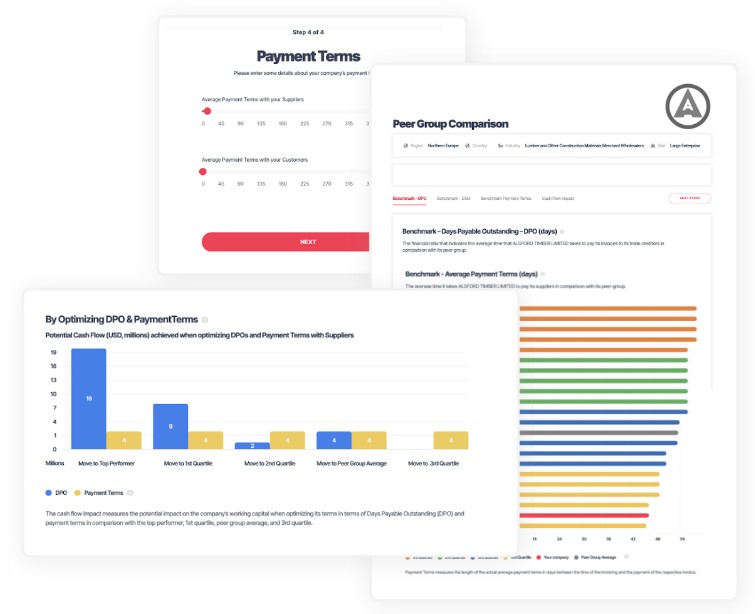

Artificial intelligence-based (AI) Fintech company Calculum releases a software as a service (SaaS) working capital metrics and payment terms peer comparison calculator, aiding companies worldwide to negotiate better payment terms and leading them to unlock millions in cash flow.

Calculum, a Miami-based data as a service (DaaS) provider, has announced the launch of an interactive web-based calculator. This tool will assist companies in calculating and negotiating optimal payment terms with their trading partners, thus improving working capital for businesses worldwide.

According to a recent working capital study, net working capital (NWC) days reached a five-year-high, brought about by uncertainty over the last few years.

While many of the spikes in working capital had unwound by mid-2021, the ending of government support, elevated levels of debt, and ongoing supply chain disruptions all mean that capital efficiency has to be a priority moving forward.

Eugene Buckley, chief revenue officer of Calculum Inc, said, “Currently, we see that corporates are shifting their focus from navigating from COVID slowdown to growth.

“That said, volatility in supply chains is increasing the pressure on working capital. We see that cash flow is on the management’s top priority list this year.”

Calculum’s research and experience with corporates in all key sectors in Europe, the Americas, and Asia show that on average over 5% of annual costs of sales (COGS) can be freed up in cash flow.

CEO of Calculum Inc., Oliver Belin, said, “AI represents the next frontier in applying data science to help companies unlock working capital.”