What Are HTS (Harmonized Tariff Schedule) Codes?

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

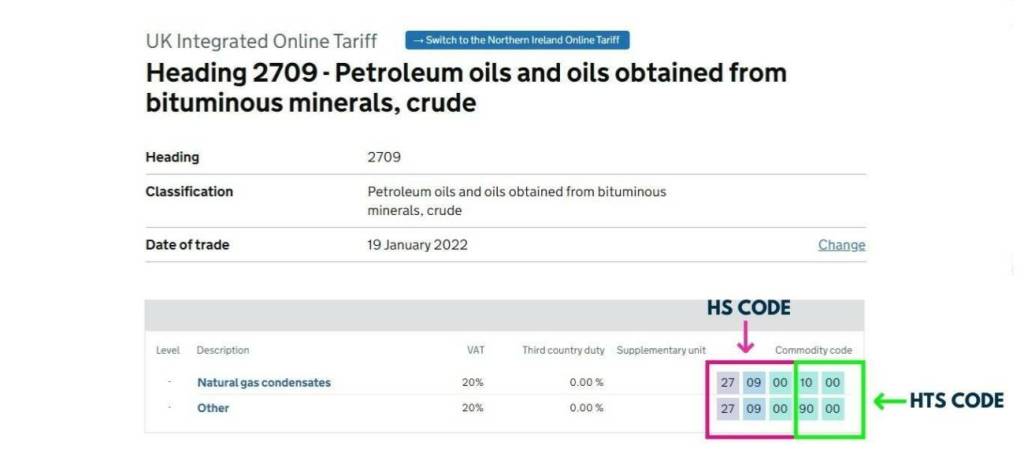

When declaring goods to a customs authority, HTS codes are used alongside HS codes.

In this article, we explain how and why HS codes are paired with HTS codes, both for goods classification and tax purposes.

What are HTS codes?

‘HTS’ stands for Harmonized Tariff Schedule, and HTS codes help importers and exporters to easily find and calculate the duty or tax to be paid on their products.

HTS codes are unique, 10-digit numbers that are used universally in international trade, but their tax implications will differ in individual jurisdictions.

In the US, for example, the HTS codes are administered by the US International Trade Commission (USITC), which links the codes to the relevant duty and tax legislation in that jurisdiction.

In the US, this system is known as the Harmonized Tariff Schedule of the United States (HTSUS).

What does an HTS code look like?

The first six digits are an HS code, and then the next two digits link to the sub-heading of the HS code, which establishes duty or tax rates for the product being shipped.

The final two digits are a statistical entry that is used to collect trade data, and thus has no bearing on duty or tax implications.

If required, this ‘statistical suffix’ must be correct, and if not required, it must be replaced with ‘00’.

In the UK, HTS codes are referred to as ‘commodity codes’, and are administered by Her Majesty’s Revenue & Customs (HMRC).

Our team at Trade Finance Global (TFG) can help you on your import or export journey, and you can get in touch with us by clicking the link below.

- Customs Resources

- All Customs Topics

- Podcasts

- Videos

- Conferences