What is HS Code? HS Code Explained

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

Harmonized System (HS) codes

HS codes, accepted by the majority of nations around the world, are identification codes given to goods for use in international trade. The HS codes are administered by the World Customs Organization (WCO) and are internationally accepted for use by customs authorities and companies to identify goods.

Key features of HS codes:

- Six digit code to classify the goods

- Defined rules that classify the goods

- Act as a uniform standard for classification of goods worldwide

- Covers 98% of goods in international trade and over 5000 commodities

Why you need your HS codes

The correct HS code for your goods will be required for use in legal and commercial documents when undertaking trade.

Some examples of use are in sales contracts, bills of lading, letters of credit, and certificates of origin.

Some of these legal and commercial documents are needed when applying for trade finance.

HS codes are also used by customs authorities to apply tariffs and taxes to goods and keep track of imports and exports.

HS general rules

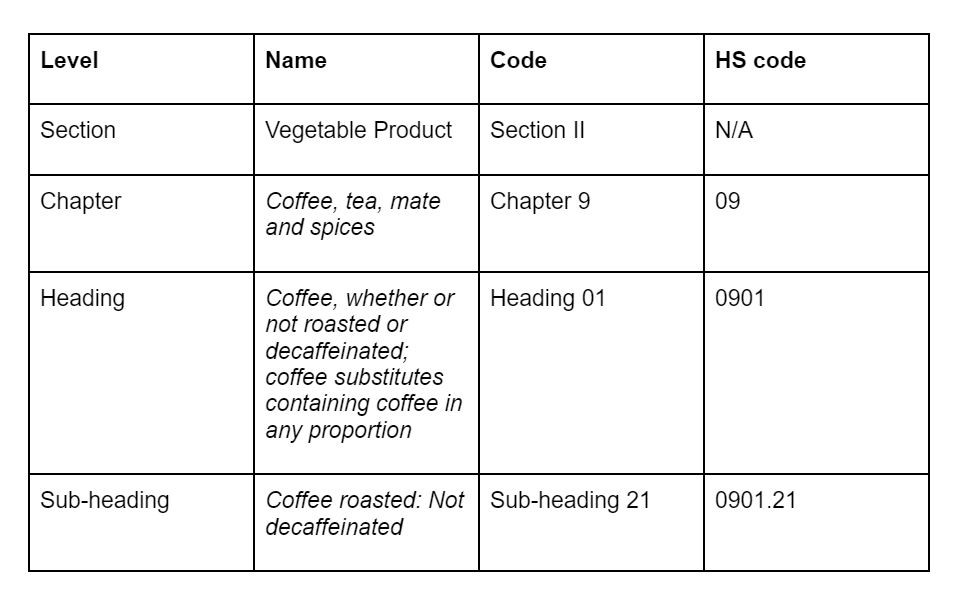

The WCO has a comprehensive classification system for HS codes. The goods will fall under a section and follow onto chapters, headings, and sub-headings, each step increasing in specificity.

There are 21 sections, 99 chapters, 1,244 headings, and 5,224 sub-headings.

The anatomy of an HS Code:

- First two digits: Chapter

- Second two digits: Heading

- Final two digits: Sub-heading

Classifying your goods

Using the WCO Harmonized System webpage you can identify the HS code for your goods with their classification key.

Example: HS code for roasted caffeinated coffee

The HS code for ‘roasted caffeinated coffee’ would be (0901.21).

The general rules

The general rules will guide traders in classifying their goods which will give them the most appropriate HS code.

There are six general rules that guide traders to classify their goods.

- GR1

- GR2

- GR3

- GR4

- GR5

- GR6

For more information visit WCO trade tools

2022 updates to the HS codes

The WCO updates its HS code system every five years. The purpose of this is to adapt to the evolving needs of the global trade environment.

In January 2022, the WCO published the 7th edition of the HS, with slight amendments to the HS code rules.

The speed of uptake between countries has varied, however large trading blocs such as the EU updated their systems on January 1, 2022.

Before exporting or importing check that your goods are correctly classified and that they meet the requirements of the customs authorities along your trade route as well as when using the codes in your relevant legal and commercial documentation.

Practical use of HS codes

You may have seen product codes that are longer than the 6 codes used in the HS. This is because different countries will have different additions to HS codes to convey important information about the good.

For most customs authorities, the first 6 codes of their goods classification will be the HS code, with any following digits based on their own coded system.

Example of HS codes use in international trade

The United States’ classification (Schedule B), has a total of 10 digits; the first 6 are the HS codes and the following 4 are decided by the US Census Bureau.

The US Department of Commerce advises that you need the HS code, the US Schedule B code, and the export destination country’s product code before you can export your goods successfully.

Originating and non-originating goods

HS codes are an important part of multiple challenges in international trade.

One key challenge is identifying whether a good is originating or non-originating, which can affect the tariff given to a product.

Here’s why it’s important: If you want to make the most of a free trade area (FTA) your goods may need to meet the rules of origin standards for the FTA.

For example, for your good to be tariff-free, it might need to be ‘wholly obtained’ giving it origination status from within your FTA.

Originating status can be classified by a changed commodity code from the imported inputs to final exported goods. This would mean that the inputs used to produce the good you’re exporting can be of non-originating status, so long as the final good being exported is classified under a different commodity code.

This can be applied to different levels of HS codes including at the chapter, heading, and sub-headings levels.

Change of chapter (CC):

One example of this, would be the Change of chapter.

If you import a wristwatch (chapter 91 Clocks and watches and parts thereof) from another country outside of the FTA (a non-originating good), but your value-added does not change the original HS Chapter in the goods HS Code, your watch may not meet origination standards and therefore will not gain access to preferential tariffs.

However, you can import goods outside of the FTA (non-originating goods) that are under different chapters such as aluminium (chapter 76 Aluminium and articles thereof) and use this to produce a watch that meets the HS Chapters classification for watch (chapter 91 Clocks and watches and parts thereof).

The change in chapter means that your goods can be classified as originating, despite using non-originating goods. They would therefore be eligible for the preferential tariffs.

Key points to remember with HS codes and Originating status

To meet these requirements you need to know the HS code of the good you’re exporting, the inputs used in producing the good as well as their countries of origin.

To get the correct coding for your goods and originating status it is best to check the rules of your local customs authority as well as the customs authority of the destination for the export.

Tools

To get your classification codes correct here are some tools to help.

The WCO offers trade tools, which act as a central database that includes HS and the Rules of Origin, including updates of HS codes.

The importance of HS codes in international trade

The acceptance and versatility of the HS code as a universal economic language and code for goods has made it an indispensable tool for international trade, incorporated into many customs clearance systems around the world.

Customs procedures

Using the correct HS code and the right interpretation is of utmost importance, as usage of incorrect code may be considered by customs as non-compliance, misleading or misdeclaration – each of which comes with its associated penalties.

Using the correct HS code can be quite tricky in specific instances, as an interpretation of the codes may vary between countries and customs authorities.

Improper usage of the HS code could result in an improper tariff being applied by customs, which can increase the cost of imports to the customer exponentially.

Trade statistics

The uniform codes also allow for use in tracking trade statistics. In addition to governments, the code is also used by private-sector firms and international organizations.

It is utilized to monitor, update, and optimize controlled goods, internal taxes, rules of origin, trade policies, transport statistics, freight tariffs, a compilation of national accounts, quota controls, price monitoring, traffic statistics, and economic research and analysis.

Transferring trade information

HS codes are used extensively in electronic messages like the United Nations rules for Electronic Data Interchange for Administration Commerce and Transport (UN/EDIFACT).

This has made it easier for the system to become a worldwide standard for describing a good across various platforms. Its nearly universal usage allows authorities such as port and customs departments to identify the products.

Other product standards

Depending on your type of goods and business, you made need other product codes when trading.

The GS1 Standards is a database that includes the Global Trade Item Number (GTIN). This can be encoded into barcodes for use in commerce to easily identify goods.

For e-commerce traders, Google now prefers the use of GTIN product identifiers when using ‘Google for Retail’.

Testimonials

HSN Codes were required by a distributor of chemicals from Mumbai in order to check tax information and pay the correct amounts in accordance with local regulations.

Case Study

Chemical Distributor

TFG put us in touch with expert HS experts so that we could ship our chemical goods across the state and also pay the appropriate taxes to the government.

- Customs Resources

- All Customs Topics

- Podcasts

- Videos

- Conferences