The UN’s World Food Programme has warned that the failure to open Black Sea ports is a declaration of war on global food insecurity and will lead to famine, destabilisation of nations, and mass migration by necessity.

Not a comfortable backdrop for writing a dispassionate article on how changes in global agribulk trade will impact bulk shipping, but here goes.

The United States Department of Agriculture (USDA) has released its first pass at the 2022/23 season crop and trade forecasts, generating some negative headlines.

Both the US and global wheat outlooks signalled reduced supplies and exports.

Global coarse grain production is set to fall with corn production dropping from a previous record high, while the global rice outlook was more favourable with 2022/23 production and trade hitting record highs.

Soya bean trade in 2022/23 is also set to bounce back.

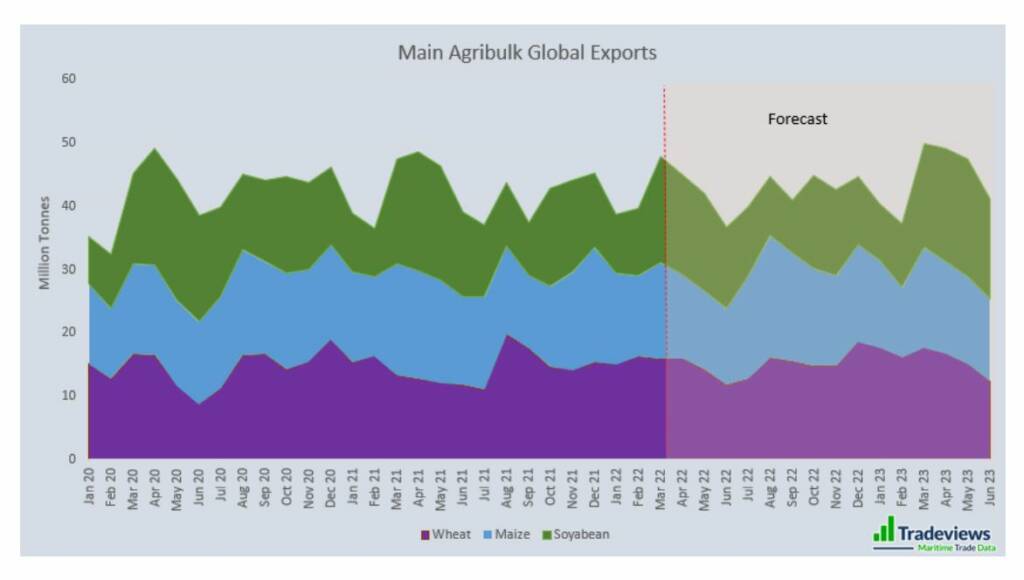

Tradeviews has dug deeper into the USDA analysis to see what implications can be drawn for trade over the coming months.

Reinterpreting USDA grain forecasts

USDA data can be difficult to understand for those unfamiliar with it since it uses a variety of marketing years and some forecasts are published in marketing years while others are published in trading years.

The term ‘marketing year’ refers to a 12-month period at the onset of the main harvest when a crop is marketed for consumption, trade, or storage.

At Tradeviews, we analyse each country-commodity combination and apply historical monthly seasonal trade analysis, generating monthly forecasts from both outstanding 2021/22 and new 2022/23 USDA export trade forecasts.

We also look at annual seasonal growth patterns and other longer-range analyses to estimate trade growth beyond the 2022/23 forecasts.

The blockade of Ukrainian Black Sea ports

As a working assumption, we have restricted our estimates of Ukrainian grain export trade between April and September 2022 to one million metric tons (mt)/month and assumed that exports resume thereafter in line with USDA 2022/23 estimates.

Ukraine is reporting progress in rail shipments of grain across its western borders with EU states, suggesting that limited flows of wheat, maize, and barley will get to outside markets.

However, Ukraine’s grain transportation infrastructure remains heavily geared to shipping out of its Black Sea ports and the USDA has already sharply downgraded its Ukrainian grain export forecasts.

At best, if an export shipping supply route is instigated, then postponed shipments could increase later this year.

With the conflict continuing to rage, there is a threat that grain shipments will continue to be heavily constrained, potentially forcing the USDA to trim its forecasts even further.

Wheat trade

Ukraine is a major exporter of wheat accounting for around 11% of global trade in 2021.

Our analysis shows strong growth in global wheat export trade in the first half of 2022, a levelling off in the second half of 2022 and further growth of around 7% year-on-year in the first half of 2023.

The fact that wheat trade holds up this year is primarily due to a strong recovery in Canadian and Russian exports, which offset declines in Argentinian and US shipments.

The USDA expected India to export 8.5 million mt of wheat over the 12 months starting in April, but this is now threatened by a surprise wheat export ban due to heat-curtailed production and record domestic wheat prices.

Also worthy of note is that half of the Ukrainian exports in 2021 were short-sea shipments.

Our data shows 37% going to Turkey, East Mediterranean, and North Africa and a further 13% to East Africa and the Middle East.

The loss of this trade will inevitably suck in longer-haul shipments from other exporting nations.

Maize/corn trade

Ukraine is also a major exporter of maize, accounting for 13.5% of global trade in 2021.

The first half of 2022 is expected to register a 13% year-on-year drop in global maize trade, stemming from record shipments in the first half of 2021, but also the conflict in Ukraine.

Volumes are expected to recover in the second half of the year, up by just under 13% year-on-year and global exports are forecast to fall back in the first half of 2023 primarily due to the seasonal impact of South American maize exports.

This should still register a growth of just under 3% year-on-year.

Ukraine’s pattern of maize export trade in 2021 was more diverse compared to wheat, with its main customer, China, taking nearly one-third of shipments.

Barley trade

The global trade in barley is relatively small compared to wheat and maize.

Ukraine accounted for 15% of global barley export shipments in 2021, just over half of which went to China while one-third comprised short-sea shipments to Turkey, East Mediterranean, and North Africa.

Overall trade is expected to shrink particularly in the second half of 2022.

Shipments from Australia and the EU are expected to decline from previous years, partly driven by China’s import ban on Australian barley.

Soya bean trade

Turning to agribulk trade commodities that have been less directly impacted by the conflict in Ukraine, soya bean export trade is set to track lower this year due to the impact of droughts in South America, following record shipments in 2021.

However, trade is projected to bounce back in the first half of 2023.

The USDA forecasts solid growth in production and exports in South America’s 2022/23 soya bean seasons, while US soya bean exports are expected to continue to grow.

Volumes are expected to rise 4% year on year in the second half of 2022 and up 5.5% year on year in the first half of 2023.

China remains the dominant importer of soya beans accounting for just under 60% of global trade.

Soya bean meal trade

The outlook for the soya bean meal export trade is positive with steady year-on-year growth in 2022 and into the first half of 2023.

The USDA has production gains in both Brazil and the US outpacing domestic demand growth.

After dipping slightly in the first half of 2022, Argentina’s soya bean meal shipments are also expected to grow over the next 12 months.

Rice trade

The global trade in rice is also expanding with the USDA forecasting record production and export trade in 2022/23.

India is leading the way as the largest rice exporting nation and we also expect strong growth in export trade in Thailand and Vietnam.

Sugar trade

The global sugar trade is expected to see strong growth this year.

Thailand’s sugar exports are rebounding following previously reduced output due to drought and Brazil’s sugar exports are expected to grow over the next 12 months based on higher yields and a stable percentage diversion of sugar into ethanol production.

However, India’s sugar exports are set to fall after the Indian government introduced measures to curb sugar exports in late May.

This was an effort to check domestic inflation and push more sugarcane into ethanol production.

Overall agribulk trade picture

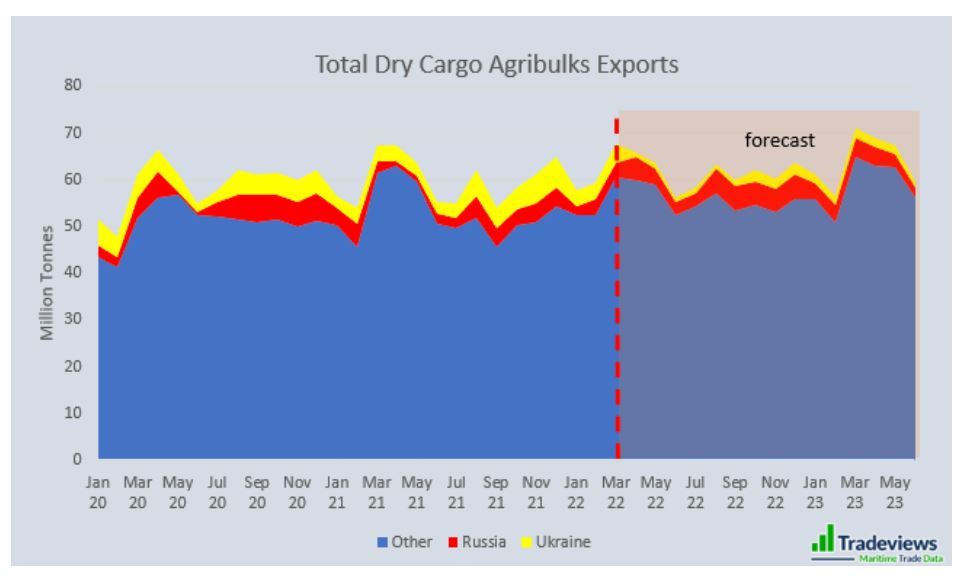

Finally, we focus on aggregate global agribulk export trade (wheat, coarse grains, soya beans, soya bean meal, rice, and sugar), split between Ukraine, Russia, and the rest of the world.

Despite the conflict, our analysis shows global agribulk trade export holding up with 1.5% year-on-year growth in the first half of 2022, 3.4% year-on-year growth in the second half of 2022 and 4.0% year-on-year growth in the first half of 2023.

The bottom line is that the overall grain trade outlook is still healthy.

The USDA forecasts result in growth in export trade outside Russia and Ukraine, particularly in the second half of 2022.

In addition, Russian grain exports are set to rise sharply with the USDA forecasting jumps in Russian shipments of both wheat and barley.

We also expect some gains in average voyage distances due to the disruption in traditional shipping patterns.

However, we are mindful of the risks that sanctions could have for constraining Russian grain export volumes or that Russia could decide to restrict grain exports in reaction to sanctions.

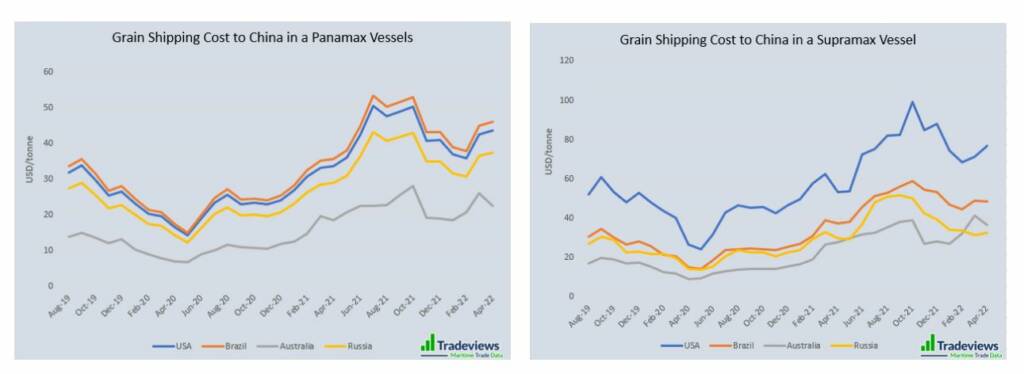

Shipping costs

There has been high volatility in the dry freight market of late, particularly in the Capesize sector.

Our Shipping Cost Comparison tool shows the cost of hiring a Supramax or Panamax vessel on major grain routes has more than doubled since April 2020.

We expect these rates to remain firm for the remainder of the year given our final thoughts.

Final thoughts

The resilience of agribulk trade continues to support freight rate levels, however, there are other factors at play.

Dry bulk carrier fleet growth remains benign as shipowners and shipyards concentrate on building containerships and LNG carriers.

Problems with containership logistics have pushed more agribulk cargo over into dry bulk shipments.

The conflict in Ukraine has provided at least a short-term boost to the international coal trade as Europe struggles to replace Russian gas supplies.

The conflict has also led to a surge in oil prices with low-sulphur fuel oil in Singapore pushing over $1,000/mt in late May, providing further incentive for shipowners and charterers to slow steamships.

Another major factor is congestion, particularly at Chinese ports impacted by recent COVID-19 lockdowns.

There are many push-pull factors driving trade and freight.

We hope that Tradeviews can help you navigate a path through these choppy waters.

Read the latest issue of Trade Finance Talks, June 2022