TFG interviewed Steven Beck, head of trade and supply chain finance at Asian Development Bank (ADB), to discuss how the trade and supply chain finance landscape has changed as a result of the COVID-19 pandemic.

TFG’s Lewis Evans (LE) interviewed Steven Beck (SB), head of trade and supply chain finance at Asian Development Bank (ADB), to discuss how the trade and supply chain finance landscape has changed as a result of the COVID-19 pandemic, and how the ADB is assisting businesses in their transition to a digital and sustainable economy.

The ADB is a multilateral development bank responsible for providing loans, guarantees, technical assistance, grants, and equity investments to promote social and economic development in Asia and the Pacific.

Steven is the head of ADB’s Trade and Supply Chain Finance Program (SCFP) and is credited for implementing its first supply chain finance business.

Pandemic alters ADB’s focus

LE: How has the ADB adjusted to the changes in international trade and global supply chains caused by the COVID-19 pandemic?

SB: Pre-COVID, the way we would position our role in global trade was around reducing market gaps.

We focused heavily on providing guarantees and loans to close those market gaps to generate the trade-led growth that leads to job creation and people’s lives improving, including being lifted out of poverty.

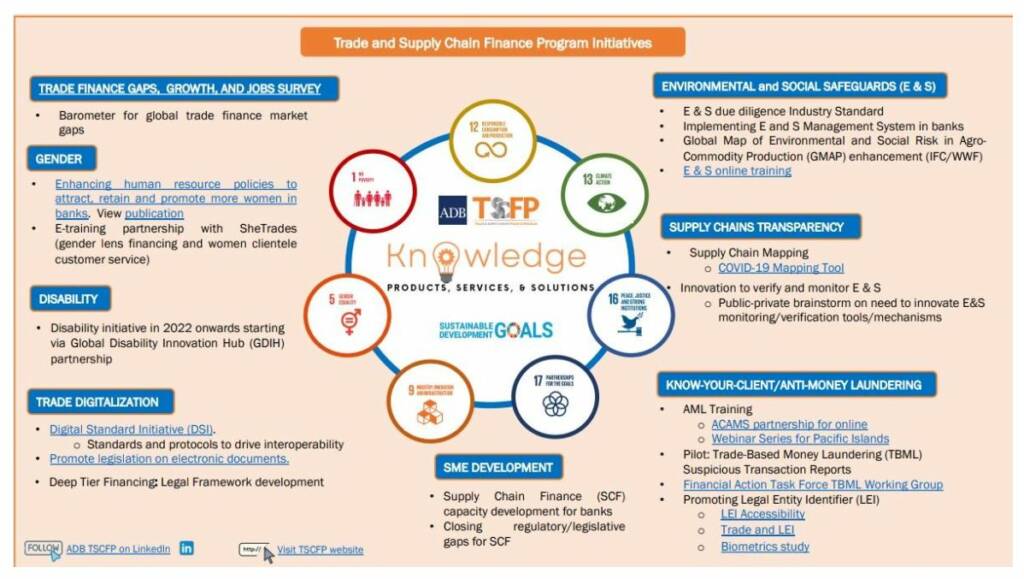

We also created knowledge products, including our Trade Finance Gaps, Growth and Jobs Survey and the ICC trade finance register, that help us understand and address that gap.

However, it’s not just about closing market gaps anymore; It’s also about ensuring that global supply chains are resilient and robust so that they can deliver what people need when and where they need it.

Pre-COVID no one talked about supply chains, but now everyone recognises how important they are, especially when it comes to providing things like medicine or ventilators.

We are now diversifying away from a sole focus on closing market gaps and concentrating on making global trade and supply chains green, resilient, inclusive, socially responsible, and transparent.

In November 2016, McKinsey reported that 80% of the global carbon footprint can be traced back to supply chains.

The industry needs to ensure throughout the entire global supply chain that production is being made in such a way that aligns with the COP 26 and Paris Agreement objectives.

This need to be vigilant also extends to social issues throughout the supply chain, like labour standards.

This is how ADB’s thinking has shifted over the last couple of years and how we are approaching different initiatives to fit into our specific objectives.

Widening trade finance gap

LE: In the 2021 Trade Finance Gaps, Growth and Jobs Survey, ADB reported the trade finance gap at $1.7 trillion, up from $1.5 trillion in 2018. Could you explain why you think the gap has widened?

SB: With the heightened perception of risk right around the world, the private sector has retrenched and has looked to multilateral development banks to step up. And so we’ve seen a 40% increase in both the number and value of transactions supported each year by ADB’s trade and supply chain business.

Last year, ADB supported nearly 7,000 transactions valued at over $8 billion, an unprecedented level.

Given the significance of the macroeconomic events that have occurred in the meantime, we do not doubt that the gap today is indeed much higher than $1.7 trillion.

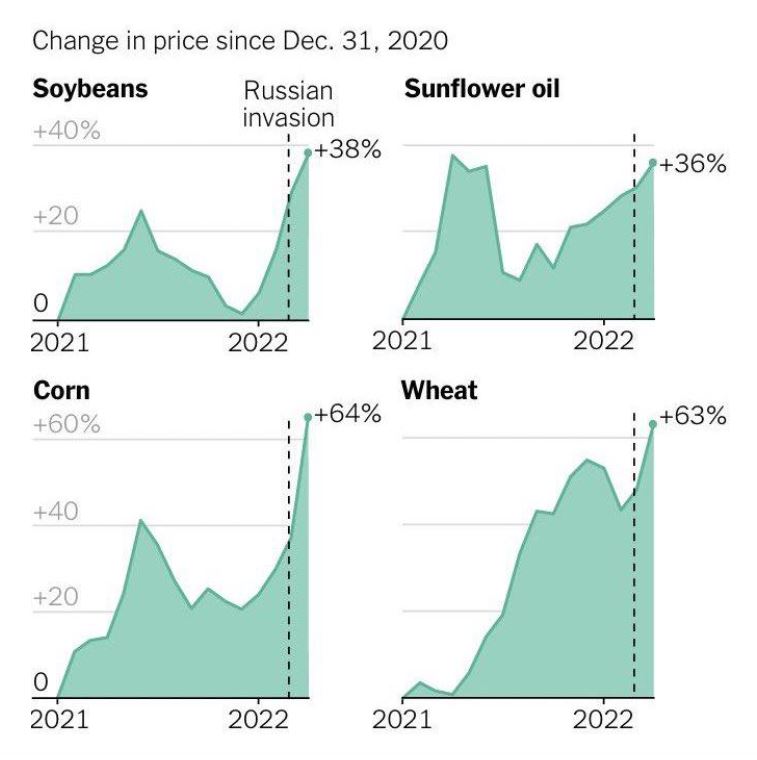

When ADB collect data for its Trade Finance Gaps, Growth and Jobs study, inflation had yet to take hold in the energy and food markets, and Russia had not yet invaded Ukraine.

Inflation-induced increases in prices are going to eat into both country and counterparty limits, sharply curtailing the volume of real goods that can be financed.

Challenges are interconnected

LE: You mentioned that the ADB is diversifying from the focus of closing market gaps, and adapting your remit to be more socially and environmentally aligned. Are any areas proving to be difficult to make progress in?

SB: All areas are difficult to a degree.

Take greening the supply chain as an example – this does not exist in a vacuum.

We would see a substantial impact if each of the companies involved in that whole chain were online.

By connecting everyone through a digital system, we will be able to collect a lot more information that allows us to better layer on mechanisms to monitor sustainability.

The big challenge is, as we go further down the supply chain, we start dealing with companies that are smaller and may not have the same capacity for a digital transition as larger firms, but we can’t exclude them.

We’re talking with industry and tech to find some potential solutions. There’s a lot of exciting work going on in this space and good collaboration. I’m confident we’ll crack this nut. We have no choice.

As you can see a lot of these focus areas are intertwined so a challenge that is experienced in one, tends to leak into the next one as well. And the reverse is true. Digitalization is a glue that can address a lot of challenges to making global trade and supply chains green, resilient, transparent, and socially responsible.

The energy transition tightrope

LE: There is a need to balance the economic needs of many developing nations with the green energy transitions of the world so that we avoid making progress in one at the expense of the other. How is the ADB approaching this transition?

SB: It’s a difficult balance.

Some countries are going to be able to make that transition more quickly but some of our developing members are going to need more time.

The Paris Agreement and COP26 both explore this idea of a “just transition”.

What’s important is for us to work with developing economies to ensure that there is a transition, but to do that in such a way that it’s calibrated with what they’re capable of doing within certain time frames.

Pushing for MLETR adoption

LE: What role does the digitisation of the supply chain have in achieving this transition?

SB: Digitisation is a core part of trying to ensure environmental and social standards throughout global trade and supply chains.

The ADB has been very active on that front, creating the Digital Standards Initiative (DSI) with the Government of Singapore, and housing it in the International Chamber of Commerce (ICC).

We’re working very closely with the DSI to have governments implement model legislation that was created by the United Nations (UN) called Model Law on Electronic Transferable Records (MLETR), which is legislation that recognises a digital trade document.

In addition to this initiative, we are creating protocols and standards that are going to drive the interoperability between those different parts of the trade ecosystem.

Without that digitisation, you’re not going to be able to drive the transparency that’s going to help us move up the curve on things like trade-based money laundering (TBML), sustainability, resilience, and social responsibility.

Governments are keen on introducing this sort of legislation because they know it’s going to drive productivity and help achieve all those goals that we have talked about.

Today, the vast majority of countries have no legislation in place that recognises a digital document.

We are providing technical assistance and actively encouraging governments to take those model laws that have been created by the UN and put them into a form that makes sense for the context of a particular legislative jurisdiction.

This will help SMEs and others plug into the new digital era of global trade and supply chains that we need to move towards.

Steven Beck won the 2022 Outstanding Contribution to Trade Finance award

Read the latest issue of Trade Finance Talks, June 2022